3 Key Factors Affecting Home Affordability

Over the past year, a lot of people have been talking about housing affordability and how tight it’s gotten. But just recently, there’s been a little bit of relief on that front. Mortgage rates have gone down since their most recent peak in October. But there’s more to being able to afford a home than just mortgage rates.

To really understand home affordability, you need to look at the combination of three important factors: mortgage rates, home prices, and wages. Let’s dive into the latest data on each one to see why affordability is improving.

1. Mortgage Rates

Mortgage rates have come down in recent months. And looking forward, most experts expect them to decline further over the course of the year. Jiayi Xu, an economist at Realtor.com, explains:

“While there could be some fluctuations in the path forward … the general expectation is that mortgage rateswill continue to trend downward, as long as the economy continues to see progress on inflation.”

And even a small change in mortgage rates can have a big impact on your purchasing power, making it easier for you to afford the home you want by reducing your monthly mortgage payment.

2. Home Prices

The second important factor is home prices. After going up at a relatively normal pace last year, they’re expected to continue rising moderately in 2024. That’s because even with inventory projected to grow slightly this year, there still aren’t enough homes for sale for all the people who want to buy them. According to Lisa Sturtevant, Chief Economist at Bright MLS:

“More inventory will be generally offset by more buyers in the market. As a result, it is expected that, overall, the medianhome price in the U.S. will grow modestly . . .”

That’s great news for you because it means prices aren’t likely to skyrocket like they did during the pandemic. But it also means it’ll probably cost you more to wait. So, if you’re ready, willing, and able to buy, and you can find the right home, purchasing before more buyers enter the market and prices rise further might be in your best interest.

3. Wages

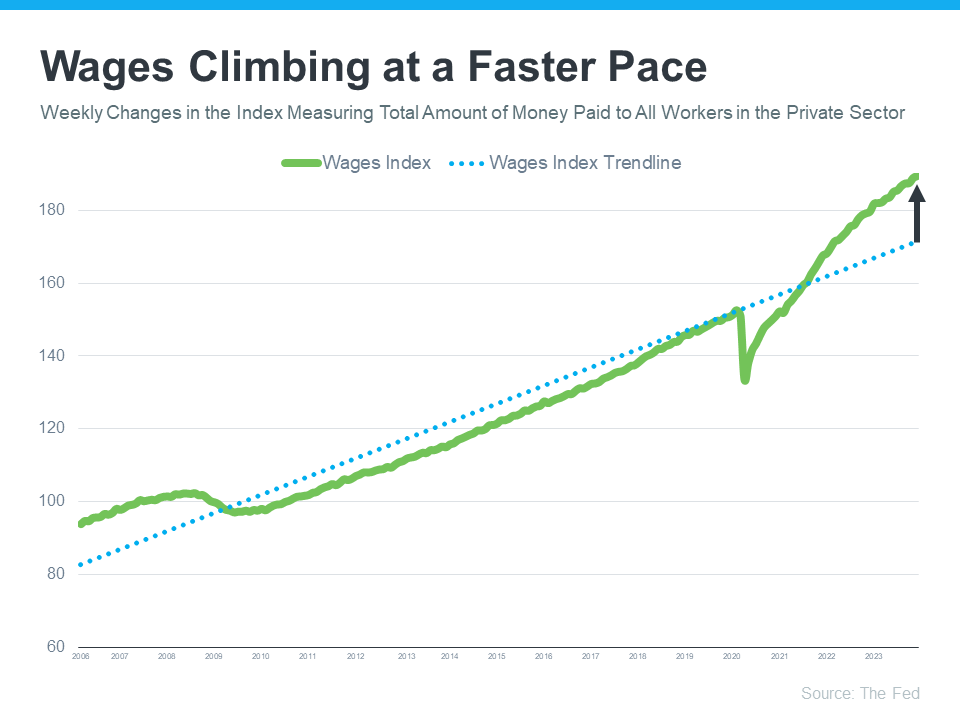

Another positive factor in affordability right now is rising income. The graph below uses data from the Federal Reserve to show how wages have grown over time:

If you look at the blue dotted trendline, you can see the rate at which wages typically rise. But on the right side of the graph, wages are above the trend line today, meaning they’re going up at a higher rate than normal.

Higher wages improve affordability because they reduce the percentage of your income it takes to pay your mortgage. That’s because you don’t have to put as much of your paycheck toward your monthly housing cost.

What This Means for You

Home affordability depends on three things: mortgage rates, home prices, and wages. The good news is, they’re moving in a positive direction for buyers overall.

If you’re thinking about buying a home, it’s important to know the main factors impacting affordability are improving. To get the latest updates on each, let’s connect.

Unveiling the Tapestry of Home Affordability: Navigating the Nexus of Finances and Dreams

In the labyrinth of real estate, where dreams converge with fiscal realities, the ability to afford a home isn’t merely a financial milestone; it’s a narrative of aspirations and feasibility. As we embark on this expedition, three paramount factors emerge, each weaving its thread into the intricate fabric of homeownership: Home Affordability, home prices, and the ever-fluctuating pulse of Mortgage Rates.

1. Decoding the Quandary of Home Affordability

At the crossroads of ambition and pragmatism lies the pivotal notion of Home Affordability. This isn’t just about the ability to buy a house; it’s about ensuring that the investment aligns harmoniously with your financial compass. The question isn’t merely “Can you afford the home?” but rather, “Can you sustain and thrive within the financial ecosystem this home introduces?”

The Dance of Finances: Balancing Act in Homeownership

Embarking on the journey to afford a home requires a meticulous dance with financial variables. It extends beyond the down payment and considers the intricate choreography of ongoing costs – property taxes, maintenance, and unforeseen financial gusts. The mantra isn’t just to buy but to secure a homestead without compromising your financial equilibrium.

Crafting a Vision: Buying A Home versus Finding the Right Home

In the grand tapestry of homeownership, the distinction between merely Buying A Home and unearthing the right home is profound. The latter encapsulates the essence of aligning your aspirations with pragmatic choices. It’s about finding a dwelling that resonates with your lifestyle, values, and future plans—a place where dreams can find both roots and wings.

2. Navigating the Ebb and Flow of Home Prices

As the sun sets on one horizon, the value of a home rises or falls on another. Home prices form the kaleidoscope through which the economic landscape is perceived, influencing decisions and sculpting possibilities.

Unraveling the Enigma of Home Valuation

Home prices, akin to the stock market, experience undulating shifts. The appraisal of a property isn’t merely a numeric revelation but a complex amalgamation of location, amenities, market trends, and the zeitgeist of the neighborhood. The challenge, therefore, lies in understanding this enigma to make informed decisions.

Economic Oscillations: The Ripple Effect on Home Affordability

The economy dances to its own rhythm, and this choreography reverberates in the real estate realm. Economic upswings inflate home prices, often rendering the pursuit to afford the home a formidable task. Conversely, during economic downturns, the real estate market becomes a realm of opportunity, with lowered prices inviting prospective homeowners to the banquet of affordability.

3. The Symphony of Mortgage Rates: Conducting Financial Harmony

In the symphony of homeownership, Mortgage Rates emerge as the conductor, orchestrating the financial harmony that defines your journey. The cadence of these rates dictates the financial tenor of your monthly mortgage payment.

The Dance of Interest Rates: An Overture to Homeownership

Securing a mortgage isn’t merely about the principal amount; it’s about the melody of interest rates that accompanies it. Fluctuating like a musical crescendo, Mortgage Rates can either compose a soothing serenade or an unsettling dissonance in your financial portfolio.

Monthly Mortgage Payment: Deciphering the Financial Sonata

Your monthly mortgage payment is the echo of your homeownership journey. Calculated based on the loan amount, interest rate, and loan term, it is the fiscal commitment that accompanies the joy of possessing a home. Understanding this financial sonata is crucial in ensuring that the melody aligns seamlessly with your budgetary symphony.

A Tapestry Woven with Care: Home Affordability Unveiled

In the realm of homeownership, the convergence of afford a home, home prices, and Mortgage Rates creates a tapestry that encapsulates dreams, fiscal prudence, and the ebb and flow of economic tides. Navigating this labyrinth demands a nuanced understanding of these factors, transforming the pursuit of homeownership from a mere transaction to a symphony of financial prudence and aspirational fulfillment.

As you embark on this odyssey, remember – it’s not just about Buying A Home; it’s about crafting a narrative where the echoes of affordability resonate harmoniously with your aspirations. Find the right home, not just for today but for the symphony of tomorrows that await.

Paving the Path Forward: Strategies for Achieving Home Affordability

As we delve deeper into the fabric of homeownership, it becomes evident that achieving Home Affordability is an art as much as it is a financial transaction. Let’s explore pragmatic strategies and insights that can serve as the compass guiding you through the labyrinth of real estate intricacies.

4. Financial Literacy: Empowering the Homebuyer

At the nucleus of achieving Home Affordability is a foundation built on financial literacy. Understanding the nuances of credit scores, debt-to-income ratios, and the intricacies of loan structures empowers the prospective homeowner. It’s not merely about the ability to afford the home at present, but also about nurturing financial acumen for the journey ahead.

Mortgage Rates Decoded: Locking in Favorable Terms

In the volatile landscape of financial markets, timing is often pivotal. Keep a vigilant eye on the trajectory of Mortgage Rates. Securing a mortgage when rates are favorable can substantially impact the affordability of your home over the long term. Consider consulting with financial experts to gauge the opportune moment for this significant financial commitment.

5. Strategic Location: The Geographical Cadence of Affordability

The old adage “location, location, location” reverberates with renewed significance when contemplating homeownership. Home prices are deeply entwined with the geography of your prospective homestead. While urban allure may beckon, suburban or emerging neighborhoods often present more affordable alternatives. Balancing proximity to amenities with regional affordability can be a game-changer.

Future-Proofing Investments: Anticipating Market Trends

Peering into the crystal ball of real estate is a daunting task, yet understanding and anticipating market trends can fortify your quest to afford a home. Investigate planned developments, infrastructure projects, and the overall economic health of the region. A well-informed investment is not only a testament to financial prudence but a shield against the uncertainties of the market.

6. Financial Planning: Orchestrating Your Budgetary Symphony

Achieving Home Affordability requires a symphony where every note is meticulously composed – and this begins with your budget. Scrutinize your expenses, delineate priorities, and create a financial roadmap that doesn’t merely facilitate the ability to afford the home but ensures sustained financial well-being.

Emergency Funds: Shielding Your Homeownership Dreams

In the unpredictable theater of life, unforeseen circumstances can take center stage. Establishing and maintaining an emergency fund serves as a protective shield for your homeownership dreams. This financial buffer not only safeguards against the unexpected but also ensures the continuity of your homeownership journey.

The Epitome of Affordability: A Harmonious Homestead

As the symphony of homeownership unfolds, the confluence of strategic decisions, financial literacy, and a nuanced understanding of market dynamics creates the epitome of Home Affordability. It’s not merely about conquering the immediate challenge of Buying A Home; it’s about sculpting a harmonious homestead where aspirations find a sanctuary within the realms of fiscal prudence.

In this intricate dance between dreams and financial realities, remember that achieving Home Affordability is not a solitary act but a collaborative endeavor. Leverage the expertise of financial advisors, stay attuned to market dynamics, and let your journey towards homeownership resonate with the melody of financial empowerment and aspirational fulfillment. May your homestead be not just a house but a testament to the symphony of well-crafted dreams and financial acumen.

In Conclusion: Crafting Your Homeownership Symphony

As we draw the curtain on this exploration of Home Affordability, let’s distill the essence into a resounding crescendo. Achieving the dream of homeownership is not a solo act; it’s a symphony where each note—each decision—contributes to the harmony of your fiscal and aspirational narrative.

In the realm where the threads of afford a home, home prices, and Mortgage Rates intertwine, strategic choices become the conductor of your financial orchestra. Navigate the landscape with financial literacy as your compass, timing your moves in tandem with the rhythm of Mortgage Rates.

Remember, the right home is not merely a structure; it’s a reflection of your values and aspirations. Balance the allure of urban landscapes with the economic cadence of emerging neighborhoods, orchestrating a geographical symphony that resonates with both your heart and your budget.

Financial planning is the sheet music that guides your budgetary symphony. Establish emergency funds as the protective shield, ensuring your homeownership dreams endure the unpredictable acts of life. This journey isn’t just about Buying A Home; it’s about creating a harmonious homestead where every note of affordability aligns with your long-term financial well-being.

As you step onto this stage of homeownership, may your symphony be one of prudence, empowerment, and fulfillment. Let your home echo not just with the sounds of everyday life but with the resounding melody of a well-crafted dream—a testament to the harmonious union of aspirations and financial acumen. Your homeownership symphony awaits, ready to be composed with the precision and grace of a life well lived.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today