Down Payment Assistance Programs Can Help Pave the Way to Homeownership

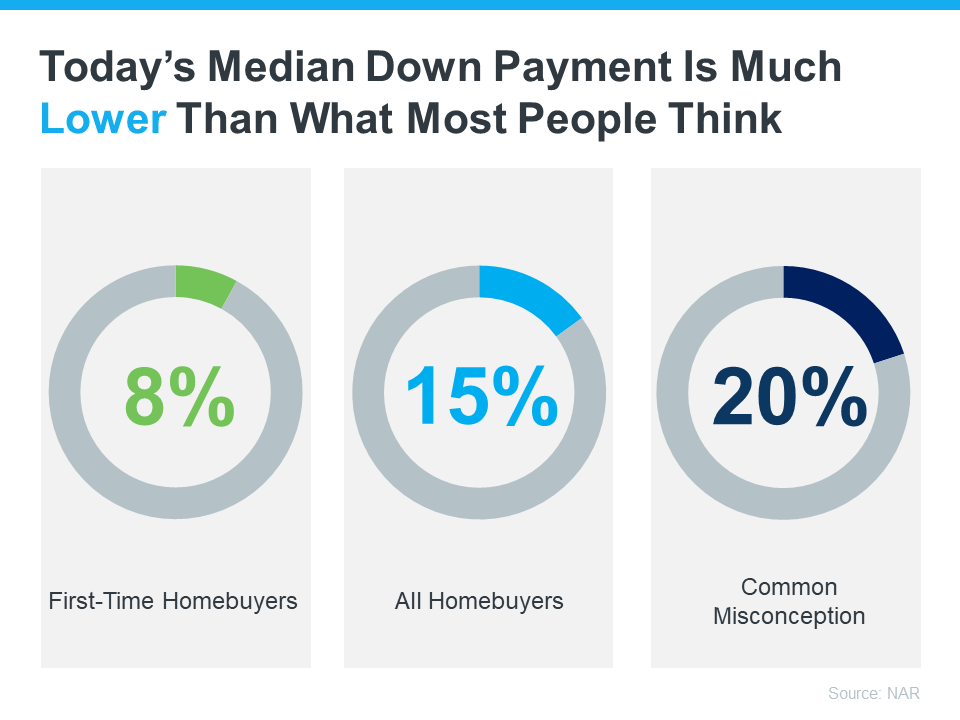

If you’re looking to buy a home, your down payment doesn’t have to be a big hurdle. According to the National Association of Realtors (NAR), 38% of first-time homebuyers find saving for a down payment the most challenging step. But the reality is, you probably don’t need to put down as much as you think:

Data from NAR shows the median down payment hasn’t been over 20% since 2005. In fact, the median down payment for all homebuyers today is only 15%. And it’s even lower for first-time homebuyers at 8%. But just because that’s the median, it doesn’t mean you have to put that much down. Some qualified buyers put down even less.

For example, there are loan types, like FHA loans, with down payments as low as 3.5%, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants. But let’s focus in on another valuable resource that may be able to help with your down payment: down payment assistance programs.

First-Time and Repeat Buyers Are Often Eligible

According to Down Payment Resource, there are thousands of programs available for homebuyers – and 75% of these are down payment assistance programs.

And it’s not just first-time homebuyers that are eligible. That means no matter where you are in your homebuying journey, there could be an option available for you. As Down Payment Resource notes:

“You don’t have to be a first-time buyer. Over 39% of all [homeownership] programs are for repeat homebuyers who have owned a home in the last 3 years.”

The best place to start as you search for more information is with a trusted real estate professional. They’ll be able to share more information about what may be available, including additional programs for specific professions or communities.

Additional Down Payment Resources That Can Help

Here are a few down payment assistance programs that are helping many of today’s buyers achieve the dream of homeownership:

- Teacher Next Door is designed to help teachers, first responders, health providers, government employees, active-duty military personnel, and veterans reach their down payment goals.

- Fannie Mae provides down-payment assistance to eligible first-time homebuyers living in majority-Latino communities.

- Freddie Mac also has options designed specifically for homebuyers with modest credit scores and limited funds for a down payment.

- The 3By30 program lays out actionable strategies to add 3 million new Black homeowners by 2030. These programs offer valuable resources for potential buyers, making it easier for them to secure down payments and realize their dream of homeownership.

- For Native Americans, Down Payment Resource highlights 42 U.S. homebuyer assistance programs across 14 states that ease the path to homeownership by providing support with down payments and other associated costs.

Even if you don’t qualify for these types of programs, there are many other federal, state, and local options available to look into. And a real estate professional can help you find the ones that meet your needs as you explore what’s available.

Bottom Line

Achieving the dream of having a home may be more within reach than you think, especially when you know where to find the right support. To learn more about your options, let’s connect.

Down Payment Assistance Programs Can Help Pave the Way to Homeownership

Embarking on the journey to homeownership is an exciting chapter in one’s life. The allure of having a place to call your own is a dream that many aspire to fulfill. However, the path to homeownership often comes with hurdles, particularly the financial challenge of making a median down payment for all homebuyers.

For those who find themselves looking to buy a home, the prospect of scraping together a substantial down payment can be a daunting task. This is where Down Payment Assistance Programs come into play, offering a lifeline to individuals who dream of homeownership but face financial constraints.

The Landscape of Down Payment Assistance Programs

In the realm of home financing, various programs are available to assist first-time homebuyers and those with modest credit scores. These initiatives aim to make the dream of having a home a tangible reality for a broader demographic.

One such program making waves is the 3By30 program. This initiative, backed by entities like Fannie Mae and Freddie Mac, strives to provide accessible financing options for aspiring homeowners. These programs go beyond the conventional FHA loans and cater to the diverse needs of individuals on their homebuying journey.

Navigating the Terrain of Homeownership

Understanding the intricacies of these programs is crucial for those who aspire to qualify for these types of programs. While it might seem like a labyrinth, having a trusted real estate professional by your side can illuminate the way forward.

A real estate professional well-versed in the nuances of these assistance programs can be an invaluable asset. They can guide you through the eligibility criteria, helping you comprehend if you qualify for programs like VA loans, USDA loans, or other specialized initiatives tailored for homebuyers with modest credit scores.

Decoding the Terminology

Before delving into the specifics, let’s decode some of the terminology associated with these programs. FHA loans, for instance, are government-backed loans that facilitate lower down payments, making them attractive for those with limited financial resources. On the other hand, VA loans cater specifically to veterans, offering them favorable terms to ease their entry into homeownership.

The 3By30 program is a relatively novel concept designed to address the evolving needs of the modern homebuyer. It signifies a commitment to facilitating homeownership for three million individuals by the year 2030.

Unlocking the Door to Homeownership

For first-time homebuyers, the prospect of unraveling the mysteries of these programs may seem overwhelming. However, the key lies in breaking down the process into manageable steps.

- Connect with a Real Estate Professional: The guidance of a trusted real estate professional is akin to having a seasoned navigator on your journey. They can help you explore the array of programs available for homebuyers and identify the ones aligning with your unique circumstances.

- Understand Eligibility Criteria: Each program comes with its set of eligibility criteria. For example, USDA loans are tailored for individuals purchasing homes in rural areas. Understanding whether you meet the criteria is fundamental to unlocking the doors to these assistance programs.

- Financial Preparedness: While these programs aim to alleviate financial barriers, it’s essential to be financially prepared. This includes understanding the costs associated with homeownership beyond the down payment, such as closing costs and ongoing expenses.

Bridging the Gap

One of the primary advantages of Down Payment Assistance Programs is their ability to bridge the financial gap for those who dream of homeownership but lack the means for a substantial down payment. These initiatives act as a beacon of hope, making the prospect of having a home more accessible than ever before.

Even for those with modest credit scores, these programs provide a glimmer of optimism. Traditional financing options may have stringent credit requirements, but certain programs extend a helping hand to individuals who are earnestly working towards their homeownership goals.

Diverse Programs, Diverse Solutions

The landscape of assistance programs is diverse, mirroring the diversity of aspiring homeowners. While FHA loans and VA loans cater to specific demographics, initiatives like the 3By30 program reflect a broader commitment to inclusivity.

As a potential homebuyer, being aware of the array of programs available empowers you to make informed decisions. It’s not just about finding a house; it’s about finding the right program that aligns with your aspirations and financial capabilities.

Overcoming Common Misconceptions

In the realm of homeownership, misconceptions abound. Some individuals may be under the impression that these assistance programs are exclusively for those with dire financial constraints. However, the reality is more nuanced.

Down Payment Assistance Programs cater to a spectrum of individuals, recognizing that the barriers to homeownership extend beyond financial limitations. Whether you’re a young professional navigating the complexities of a competitive housing market or a seasoned individual seeking a new chapter, these programs can be a catalyst for fulfilling your dream of having a home.

The Role of Education in Empowering Homebuyers

Education is a cornerstone in the realm of homeownership. Being well-informed about the programs available for homebuyers equips you to make decisions aligned with your long-term goals. It also dispels myths and misconceptions that may deter individuals from exploring these valuable initiatives.

Your journey to homeownership is not just a transaction; it’s a transformative experience. With the right knowledge and a proactive approach, you can navigate the complexities of the real estate landscape and find the program that sets you on the way to homeownership.

Conclusion

In conclusion, the dream of homeownership is within reach for those who dare to explore the diverse landscape of Down Payment Assistance Programs. Whether you’re a first-time homebuyer, someone with modest credit scores, or a veteran seeking specialized financing options like VA loans, these programs cater to a spectrum of needs.

The 3By30 program and others represent a commitment to making homeownership a reality for millions. As you embark on your homebuying journey, remember that having a trusted real estate professional by your side can be the key to unlocking doors and navigating the terrain with confidence.

So, as you envision the walls adorned with memories and the sound of your footsteps echoing through the halls of your own home, know that Down Payment Assistance Programs are here to pave the way, making your dream of homeownership a tangible and achievable reality.

Sailing Through the Seas of Homeownership

As you sail through the seas of homeownership, it’s essential to appreciate the multifaceted nature of these programs. The commitment of entities like Fannie Mae and Freddie Mac to fostering accessible financing underscores the transformative power of homeownership. It’s not merely about acquiring a property; it’s about establishing roots and creating a haven that resonates with your aspirations.

Unveiling the Layers of Support

Down Payment Assistance Programs extend beyond the financial realm. They embody a layered support system, acknowledging that the journey to homeownership involves more than just monetary considerations. From educational resources that demystify the intricacies of the homebuying process to counseling services that provide emotional support, these programs strive to be comprehensive in their approach.

In the quest to qualify for these programs, it’s imperative to tap into the wealth of resources at your disposal. While the monetary assistance is undoubtedly pivotal, the additional layers of support contribute to a holistic and empowering homebuying experience.

Tailoring Solutions to Diverse Needs

The beauty of these programs lies in their ability to tailor solutions to diverse needs. For instance, if you’re a veteran, exploring the benefits of VA loans can open doors to homeownership with favorable terms. On the other hand, if you’re eyeing a property in a rural area, USDA loans might be the key to unlocking your dream home.

This tailored approach reflects a nuanced understanding of the varied circumstances individuals face on their journey to homeownership. It’s about recognizing that the dream of having a home is a universal aspiration, and the path to realizing that dream should be adaptable to individual realities.

Embracing Innovation in Home Financing

The landscape of home financing is dynamic, evolving to meet the changing needs of society. The 3By30 program is a testament to this spirit of innovation. By setting a goal to facilitate homeownership for three million individuals by 2030, it signals a commitment to staying ahead of the curve and addressing the evolving challenges of the real estate landscape.

As a prospective homebuyer, being aware of these innovative programs positions you at the forefront of possibilities. It’s an acknowledgment that the journey to homeownership is not static; it’s a dynamic process that requires staying informed and embracing the opportunities presented by evolving initiatives.

A Symphony of Support: Trusted Real Estate Professionals

Amidst the myriad options and programs, the role of a trusted real estate professional emerges as a guiding force. Picture them as the conductor of a symphony, orchestrating the various elements of the homebuying journey to create a harmonious experience.

These professionals are more than mere intermediaries; they are partners invested in your success. They bring a wealth of knowledge about the programs available for homebuyers, steering you away from potential pitfalls and towards opportunities that align with your vision.

Weathering the Storms: Addressing Concerns

While the allure of homeownership is undeniable, it’s crucial to address common concerns that may act as storms on your journey. Some individuals may worry about the complexities of the application process for these programs, while others may be concerned about hidden costs.

Here’s where education and transparency play pivotal roles. Understanding the nuances of the application process, clarifying any misconceptions, and having a clear picture of the financial commitments involved can help you weather these storms with confidence.

Future-proofing Your Investment

As you stand on the cusp of homeownership, it’s wise to consider the long-term implications of your investment. Beyond the initial excitement of acquiring a property, what measures can you take to future-proof your investment?

This is where your choice of financing and the programs available for homebuyers come into play. Forward-thinking initiatives, such as the 3By30 program, not only pave the way for immediate homeownership but also position you for a future where your investment stands the test of time.

A Tapestry of Homeownership

In weaving the tapestry of homeownership, each thread represents a unique aspect of your journey. From the choice of financing to the selection of a trusted real estate professional, each decision contributes to the rich fabric of your homeownership story.

The dream of having a home is not a one-size-fits-all aspiration. It’s a personalized vision that reflects your values, aspirations, and lifestyle. As you explore the multitude of programs available for homebuyers, remember that the tapestry you create is as unique as you are.

Final Thoughts: The Resonance of Homeownership

In the symphony of life, the resonance of homeownership is a profound chord. It signifies stability, growth, and the fulfillment of a timeless dream. Down Payment Assistance Programs are not just financial tools; they are instruments that harmonize with your journey, making the dream of homeownership a melody that echoes through the corridors of your life.

So, as you navigate the seas of homeownership, guided by the wind of innovative programs and the compass of a trusted real estate professional, let the vision of your own home be the North Star that lights your way. In this grand journey, every step forward is a note in the symphony of your life, composing a melody that is uniquely yours.

Bottom Line: Down Payment Assistance Programs Illuminate the Path to Homeownership

In the grand tapestry of homeownership, Down Payment Assistance Programs emerge as guiding stars, illuminating the path for those who dream of having a home. From the innovative strides of the 3By30 program to the tailored solutions offered by FHA loans, VA loans, and USDA loans, these initiatives represent a commitment to inclusivity and empowerment.

The journey to homeownership is not a solitary walk but a collaborative symphony. A trusted real estate professional stands as a conductor, harmonizing the elements of education, financial support, and emotional guidance. Together, they create a melody that resonates with the diverse aspirations and circumstances of aspiring homeowners.

As you navigate the seas of homeownership, it’s crucial to recognize that these programs extend beyond financial aid. They encompass a comprehensive support system, addressing concerns, dispelling misconceptions, and fostering an environment where your dream of homeownership can flourish.

In embracing the dynamic landscape of home financing, individuals are not merely purchasing properties; they are investing in a future where their homeownership story withstands the test of time. The bottom line is this: Down Payment Assistance Programs are not just about acquiring homes; they are about sculpting a life, creating a haven, and composing a symphony that echoes the timeless dream of having a home.

Read from source: “Click Me”

Down Payment Assistance Programs Can Help Pave the Way to Homeownership

– “Down Payment Assistance Programs Can Help Pave the Way to Homeownership” –

The Christian Penner Mortgage Team | Cell/Text: (561) 316-6800

|

|

|

|

|

|

|

|

|

|

HomeBot: Build more wealth with your home

-

Homeowners👉https://hmbt.co/nwCdmG

-

Homebuyers👉 https://hmbt.co/G8fMT

-

Realtors 👉 https://youtu.be/wXROJXQWgug

-

Join here Realtors 👉 https://join.homebot.ai/sponsor/368289?type=real-estate-agent

Check Our Reviews:

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today