Foreclosure Activity Is Still Lower than the Norm

Have you seen headlines talking about the increase in foreclosures in today’s housing market? If so, they may leave you feeling a bit uneasy about what’s ahead. But remember, these clickbait titles don’t always give you the full story.

The truth is, if you compare the current numbers with what usually happens in the market, you’ll see there’s no need to worry.

Putting the Headlines into Perspective

The increase the media is calling attention to is misleading. That’s because they’re only comparing the most recent numbers to a time where foreclosures were at historic lows. And that’s making it sound like a bigger deal than it is.

In 2020 and 2021, the moratorium and forbearance program helped millions of homeowners stay in their homes, allowing them to get back on their feet during a very challenging period.

When the moratorium came to an end, there was an expected rise in foreclosures. But just because foreclosures are up doesn’t mean the housing market is in trouble.

Historical Data Shows There Isn’t a Wave of Foreclosures

Instead of comparing today’s numbers with the last few abnormal years, it’s better to compare to long-term trends – specifically to the housing crash – since that’s what people worry may happen again.

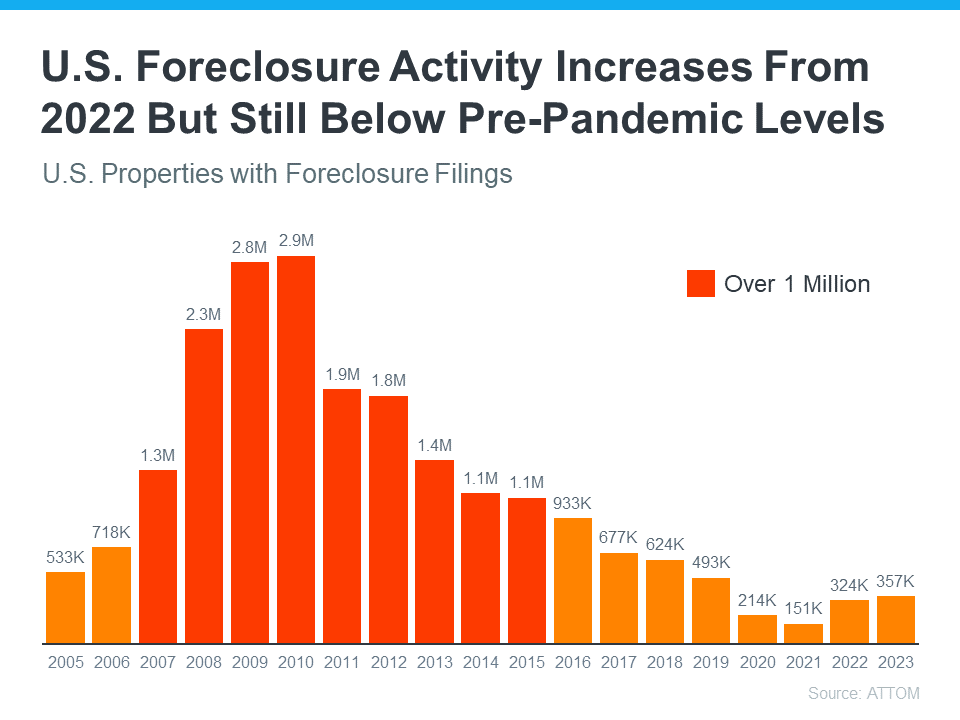

Take a look at the graph below. It uses foreclosure data from ATTOM, a property data provider, to show foreclosure activity has been consistently lower (shown in orange) since the crash in 2008 (shown in red):

So, while foreclosure filings are up in the latest report, it’s clear this is nothing like it was back then.

In fact, we’re not even back at the levels we’d see in more normal years, like 2019. As Rick Sharga, Founder and CEO of the CJ Patrick Company, explains:

“Foreclosure activity is still only at about 60% of pre-pandemic levels. . .”

That’s largely because buyers today are more qualified and less likely to default on their loans. Delinquency rates are still low and most homeowners have enough equity to keep them from going into foreclosure. As Molly Boesel, Principal Economist at CoreLogic, says:

“U.S. mortgage delinquency rates remained healthy in October, with the overall delinquency rate unchanged from a year earlier and the serious delinquency rate remaining at a historic low… borrowers in later stages of delinquencies are finding alternatives to defaulting on their home loans.”

The reality is, while increasing, the data shows a foreclosure crisis is not where the market is today, or where it’s headed.

Even though the housing market is experiencing an expected rise in foreclosures, it’s nowhere near the crisis levels seen when the housing bubble burst. If you have questions about what you’re hearing or reading about the housing market, let’s connect.

Navigating the Current Landscape: Foreclosure Activity Is Still Lower than the Norm

In the ever-shifting terrain of the real estate market, the phrase “expected rise in foreclosures” has become a recurrent note of concern for many homeowners and industry observers alike. As we delve into the intricate web of factors influencing the housing market, it’s essential to cast a discerning eye on the dynamics surrounding foreclosure activity.

The Unprecedented Forbearance Program: A Shield Against the Storm

Amidst the turbulence caused by economic uncertainties, the forbearance program emerges as a beacon of hope for homeowners grappling with financial instability. This novel initiative has played a pivotal role in mitigating the anticipated surge in foreclosures, offering a temporary respite to those facing the daunting prospect of losing their homes.

In scrutinizing the current foreclosure data, a noteworthy trend comes to the forefront: Foreclosure activity remains surprisingly subdued. The strategic implementation of the forbearance program has acted as a buffer, creating a temporary safeguard against the anticipated wave of foreclosures.

The Pulse of Home Loans: A Vital Metric in Assessing Foreclosure Risk

To comprehend the nuances of the current scenario, it’s imperative to gauge the health of the home loans landscape. The ebb and flow of this financial tide provide valuable insights into the broader dynamics of the housing market.

Despite initial apprehensions surrounding the pandemic’s economic aftermath, the resilience of the housing market is evident. The meticulously crafted forbearance program has not only protected homeowners but has also served as a stabilizing force, preventing a seismic shift in foreclosure activity that many had feared.

A Detailed Exploration of Foreclosure Data

Let’s delve into the realm of foreclosure data to dissect the trends and anomalies shaping the current narrative. The numbers paint a fascinating picture, one that defies the gloomy projections that loomed large on the horizon not so long ago.

In parsing the intricate details, a pattern emerges: the much-anticipated surge in foreclosures has yet to materialize. This defies conventional expectations and underscores the effectiveness of the forbearance program in providing a crucial safety net for homeowners navigating financial uncertainties.

Unraveling the Myth of an Imminent Wave of Foreclosures

The narrative of an impending wave of foreclosures has been a specter haunting the housing market, instilling fear and uncertainty. However, a closer inspection of the prevailing conditions reveals a more nuanced reality.

The expected rise in foreclosures, while a valid concern given the economic landscape, is not an imminent cataclysm. The foresighted implementation of the forbearance program has mitigated the immediate threat, allowing homeowners breathing room to recalibrate their financial compass.

The Housing Market Symphony: Harmonizing Stability Amidst Turbulence

As we navigate the intricate symphony of the housing market, the interplay of various instruments creates a melodic composition that defies the discordant notes of an anticipated crisis. The forbearance program, akin to a conductor guiding the orchestra, orchestrates a harmonious balance, ensuring that the crescendo of foreclosures remains muted, at least for the time being.

Future Projections: Anticipating the Unseen

While the current scenario paints a picture of stability, it’s prudent to acknowledge the unpredictable nature of economic landscapes. The efficacy of the forbearance program, while commendable, is not a permanent panacea.

As we peer into the future, industry experts and economists are cautiously optimistic but mindful of potential shifts. The anticipated rise in foreclosures might still materialize, albeit at a delayed pace. The key lies in vigilance and adaptability, traits that will serve both homeowners and industry stakeholders well in navigating the uncharted waters that lie ahead.

In Conclusion: Navigating Uncertainties with Resilience

In the labyrinth of economic uncertainties, the current state of foreclosure activity stands as a testament to the efficacy of strategic interventions. The forbearance program, a linchpin in this narrative, has provided a crucial lifeline to homeowners facing financial headwinds.

As we move forward, the housing market remains a dynamic entity, susceptible to the unpredictable winds of change. Yet, the current data and trends offer a glimmer of optimism, reassuring homeowners that the anticipated wave of foreclosures is, for now, held at bay by the proactive measures in place.

In this intricate dance between stability and uncertainty, the housing market continues to evolve. The resounding message is clear: adaptability and foresight will be the guiding stars in navigating the labyrinth of the real estate landscape.

Navigating the Current Landscape: Foreclosure Activity Is Still Lower than the Norm (Continued)

The Resilience of Homeownership in the Face of Challenges

In contemplating the resilience of homeownership amidst economic challenges, it becomes evident that the symbiotic relationship between the forbearance program and homeowners has been pivotal. The forbearance initiative has not only provided financial relief but has also underscored the fundamental belief in the enduring value of homeownership.

The journey from the initial shockwaves of the pandemic to the current landscape of tempered foreclosure activity has been marked by collective efforts. Homeowners, financial institutions, and policymakers have collaboratively weathered the storm, illustrating the intrinsic value placed on stable housing environments.

Shifting Perspectives: From Anticipation to Adaptation

The narrative surrounding the expected rise in foreclosures has undergone a subtle transformation. What was once a foreboding specter has evolved into a narrative of cautious optimism. This shift in perspective is not born out of complacency but rather from a collective acknowledgment of the effectiveness of measures taken to date.

Adaptation remains the watchword for homeowners and industry stakeholders alike. The housing market, akin to a dynamic ecosystem, requires constant recalibration in response to external stimuli. The forbearance program, while a stalwart defender against the immediate threat of foreclosures, is a testament to the adaptive spirit ingrained in the real estate landscape.

The Interconnected Threads of the Housing Market Tapestry

To comprehend the full tapestry of the housing market, one must acknowledge the interconnected threads that weave its fabric. The forbearance program acts not in isolation but as part of a complex network of influences that collectively shape the destiny of the real estate sector.

Home loans, a linchpin in this narrative, play a pivotal role in determining the trajectory of foreclosure activity. As the financial heartbeat of the housing market, the health of home loans provides valuable insights into the overall robustness of the sector. The current landscape, with its subdued foreclosures, signals a degree of financial vitality not easily dismissed.

Uncommon Terminology: Illuminating the Lexicon of Real Estate

In our exploration of the housing market intricacies, it’s prudent to introduce some uncommon terminology that adds depth to the conversation. The concept of “foreclosure resilience” encapsulates the ability of the housing market to withstand external pressures, emerging stronger and more adaptive in the face of challenges.

Moreover, the term “forbearance equilibrium” can be used to describe the delicate balance achieved by the forbearance program, ensuring that it serves as a temporary safety net without creating an environment of prolonged financial dependency.

Embracing Data: A Pragmatic Approach to Understanding Foreclosure Trends

As we continue our journey through the layers of foreclosure data, it’s imperative to approach the numbers with a discerning eye. Data, when wielded effectively, becomes a powerful tool in unraveling the complexities of the real estate landscape.

The unexpected juxtaposition of a stabilizing housing market and the specter of an anticipated rise in foreclosures necessitates a nuanced interpretation of the available data. Industry analysts and policymakers, armed with a comprehensive understanding of the numbers, can craft strategies that bolster the resilience of the housing market.

Future-proofing Homeownership: A Collaborative Endeavor

Looking ahead, the path to ensuring the sustained well-being of homeownership involves a collaborative endeavor. Industry stakeholders, policymakers, and homeowners themselves must work in tandem to fortify the foundations of the housing market.

The lessons learned from navigating the uncertainties of the recent past are invaluable. They emphasize the importance of proactive measures, adaptable strategies, and a collective commitment to the principles that underpin stable homeownership.

Final Thoughts: A Call to Vigilance and Proactivity

In the symphony of the housing market, the current movement reveals a harmonious interplay between stability and adaptability. The anticipated rise in foreclosures, once a crescendo of concern, has been tempered by the foresighted measures in place.

As we conclude this exploration, a call to vigilance resounds. The real estate landscape, while currently navigating a period of relative calm, remains susceptible to the unpredictable currents of the economic tide. Proactivity, adaptability, and a steadfast commitment to the well-being of homeownership are the guiding principles that will shape the future chapters of this intricate narrative.

In the labyrinth of uncertainties, the resilience of the housing market stands as a testament to the collective spirit of those committed to fostering a landscape where homeownership remains a steadfast anchor in the ever-changing sea of economic dynamics.

Bottom Line: A Tapestry of Resilience in the Housing Market

In the grand tapestry of the housing market, the current thread woven into the narrative is one of resilience and adaptability. Despite initial concerns surrounding an expected rise in foreclosures, the forbearance program has emerged as a stalwart defender, creating a temporary equilibrium that has kept foreclosure activity lower than the norm.

The unexpected juxtaposition of economic uncertainties and a subdued wave of foreclosures underscores the effectiveness of strategic interventions. Homeownership, once under the looming shadow of an imminent crisis, now stands as a testament to the collective efforts of homeowners, policymakers, and industry stakeholders.

As we peer into the future, the key takeaway is one of vigilance and proactivity. The housing market, a dynamic ecosystem, requires ongoing recalibration to navigate the unpredictable economic currents. Industry participants must remain committed to the principles of stability and adaptability, ensuring that the foundations of homeownership remain robust in the face of potential challenges.

In conclusion, the current state of foreclosure activity is a reflection of the resilience ingrained in the housing market. While challenges persist, the collaborative spirit that has guided us through recent uncertainties provides a roadmap for future endeavors. The bottom line is clear: by embracing adaptability, leveraging data-driven insights, and fostering a collective commitment to homeownership, we can navigate the ever-evolving landscape and build a future where stability and prosperity in real estate are not just aspirations but enduring realities.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today