Homeowners Today Have Options To Avoid Foreclosure

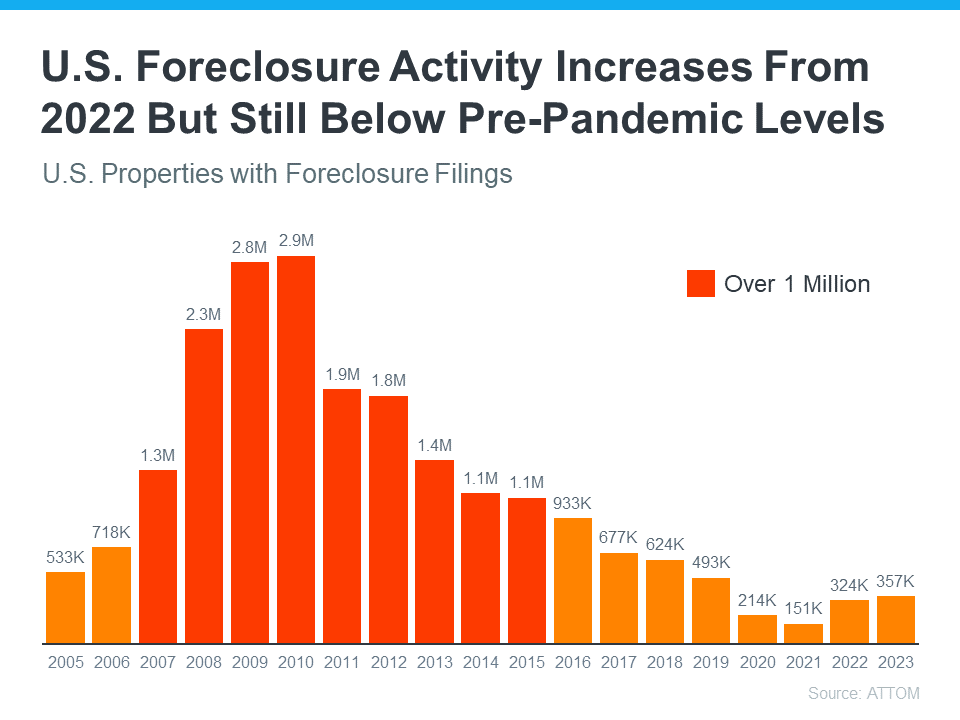

Even with the latest data coming in, the experts agree there’s no chance of a large-scale foreclosure crisis like the one we saw back in 2008. While headlines may be calling attention to a slight uptick in foreclosure filings recently, the bigger picture is that we’re still well below the number we’d see in a more normal year for the housing market. As a report from BlackKnight explains:

“The prospect of any kind of near-term surge in foreclosure activity remains low, with start volumes still nearly 40% below pre-pandemic levels.”

That’s good news. It means the number of homeowners at risk is very low compared to the norm.

But, there’s a small percentage who may be coming face to face with foreclosure as a possibility. That’s because some homeowners may have an unexpected hardship in their life, which unfortunately can happen in any market.

For those homeowners, there are still options that could help them avoid having to go through the foreclosure process. If you’re facing difficulties yourself, an article from Bankrate breaks down some things to explore:

- Look into Forbearance Programs: If you have a loan from Fannie Mae or Freddie Mac, you may be able to apply for this type of program.

- Ask for a loan modification: Your lender may be willing to adjust your loan terms to help bring down your monthly payment to something more achievable.

- Get a repayment plan in place: A lender may be able to set up a deferral or a payment plan if you’re not in a place where you’re able to make your payment.

And there’s something else you may want to consider. That’s whether you have enough equity in your home to sell it and protect your investment.

You May Be Able To Use Your Equity To Sell Your House

In today’s real estate market, many homeowners have far more equity in their homes than they realize due to the rapid home price appreciation we’ve seen over the past few years. That means, if you’ve lived in your house for a while, chances are your home’s value has gone up. Plus, the mortgage payments you’ve made during that time have chipped away at the balance of your loan. That combo may have given your equity a boost. And if your home’s current value is higher than what you still owe on your loan, you may be able to use that increase to your advantage. Freddie Mac explains how this can help:

“If you have enough equity, you can use the proceeds from the sale of your home to pay off your remaining mortgage debt, including any missed mortgage payments or other debts secured by your home.”

Lean on Experts To Explore Your Options

To find out how much equity you have, partner with a local real estate agent. They can give you an estimate of what your house could sell for based on recent sales of similar homes in your area. You may be able to sell your house to avoid foreclosure.

If you’re a homeowner facing hardship, lean on a real estate professional to explore your options or see if you can sell your house to avoid foreclosure.

Homeowners Today Have Options To Avoid Foreclosure

In today’s dynamic Real Estate Market, homeowners facing financial hardships no longer feel trapped by the looming threat of Foreclosure. With innovative solutions and proactive measures, there are numerous options to avoid foreclosure and secure financial stability. Whether you’re struggling with Mortgage Payments or facing the daunting foreclosure process, there are avenues to explore before relinquishing your home.

Understanding Foreclosure

Foreclosure is a legal process that a lender initiates when a homeowner fails to make their Mortgage Payments. This process can be stressful and confusing, but understanding the foreclosure process can help homeowners prepare and potentially avoid it.

Equity: Your Secret Weapon

One of the most powerful tools at a homeowner’s disposal is their home’s equity. Equity is the difference between your home’s current value and what you owe on your mortgage. If you have enough equity, you might be able to use it to your advantage.

How Much Equity Do You Have?

To find out how much equity you have, you’ll need to determine your home’s value. This can be done by getting an appraisal or by speaking with a local real estate agent. Once you know your home’s value, subtract what you owe on your mortgage. The remaining amount is your equity.

Using Your Equity To Sell Your House

If you have enough equity, you might be able to sell your house and use the profits to pay off your mortgage. This can be a great option for homeowners who are looking to avoid foreclosure and start fresh.

Loan Modification and Forbearance Programs

If selling your home isn’t an option, there are other options to avoid foreclosure. One such option is a loan modification. This involves working with your lender to adjust your loan terms, making your payments more manageable.

Forbearance Programs are another option. These programs allow homeowners to temporarily stop making mortgage payments while they get back on their feet.

Leaning on a Real Estate Professional

In these trying times, it can be beneficial to lean on a real estate professional. They can provide valuable advice, help you understand your options, and guide you through the process of avoiding foreclosure.

Foreclosure Activity and the Housing Market

It’s also important to understand the broader context of Foreclosure Activity and the Housing Market. Foreclosure activity can have a significant impact on the housing market, affecting home prices, inventory levels, and the overall health of the real estate market. By staying informed about foreclosure activity, you can better understand the market conditions and make smarter decisions about buying or selling a home.

West Palm Beach Mortgage Broker

If you’re in the West Palm Beach area, consider reaching out to a West Palm Beach mortgage broker. They can provide Affordable West Palm Beach home loans, help you find the Best mortgage rates in West Palm Beach, and guide you through West Palm Beach refinancing options.

Whether you’re a First time home buyer in West Palm Beach or looking for Local mortgage lenders in West Palm Beach, a mortgage broker can be an invaluable resource. They can even provide Property loan advice in West Palm Beach and help with Mortgage pre-approval in West Palm Beach.

In conclusion, homeowners today have more options than ever to avoid foreclosure. By understanding your situation, exploring your options, and seeking professional help, you can navigate this challenging situation and secure a brighter financial future.

Understanding Your Situation

The first step in navigating away from Foreclosure is to assess your current financial standing and explore potential solutions. Take the time to find out how much equity you have in your home and evaluate your loan terms. Understanding your home’s value and equity position is crucial in determining the best course of action. Fortunately, there are various resources available to homeowners to accurately gauge their home’s current value.

Leveraging Equity to Mitigate Risk

For homeowners fortunate enough to have enough equity in their homes, leveraging this equity can be a viable strategy. One option is to sell your house and utilize the proceeds to satisfy your lender. Through this approach, homeowners can avoid Foreclosure while preserving their credit score and financial well-being. Using Your Equity To Sell Your House can be a proactive step towards financial recovery.

Exploring Loan Modification and Forbearance Programs

If you’re struggling to meet your Mortgage Payments, it’s essential to explore alternative arrangements with your lender. Loan modification and Forbearance Programs offer temporary relief by adjusting loan terms or temporarily suspending payments. These programs provide breathing room for homeowners facing temporary financial setbacks and can help prevent Foreclosure.

Seek Professional Guidance

Navigating the complexities of Foreclosure and exploring options to avoid foreclosure can be overwhelming. This is where the expertise of a local real estate agent or West Palm Beach mortgage broker becomes invaluable. These professionals can provide personalized guidance based on your unique circumstances and help you make informed decisions.

Working with a Real Estate Professional

When considering options to avoid foreclosure, it’s crucial to lean on a real estate professional who understands the nuances of the Housing Market. Whether you’re exploring selling your house or seeking loan modification, a knowledgeable agent can provide invaluable insights and advocate on your behalf.

Evaluating Alternative Solutions

In some cases, homeowners may not have sufficient equity to sell their house or qualify for loan modification. In such situations, creative solutions may be necessary. This could involve exploring refinancing options or seeking assistance from local mortgage lenders specializing in Affordable West Palm Beach home loans.

Proactive Financial Planning

Ultimately, avoiding Foreclosure requires proactive financial planning and a willingness to explore alternative solutions. By assessing your home’s value, understanding your loan terms, and seeking guidance from real estate professionals, you can navigate challenging financial situations with confidence.

Conclusion

While facing Foreclosure can be daunting, homeowners today have more options to avoid foreclosure than ever before. From leveraging equity to exploring Forbearance Programs, proactive measures can help mitigate the risk and preserve financial stability. By collaborating with local real estate agents and mortgage brokers, homeowners can chart a course towards financial recovery in the ever-evolving Real Estate Market.

Embracing Financial Empowerment

In the face of Foreclosure Activity, it’s essential for homeowners to recognize their agency and explore available resources. Rather than succumbing to despair, empower yourself by researching Property loan advice and Commercial mortgage brokers in West Palm Beach. These professionals specialize in providing tailored solutions to help homeowners navigate complex financial landscapes.

First-Time Homebuyer Assistance

For individuals experiencing financial strain, particularly first-time homebuyers, there are resources available to ease the burden. First-time homebuyer loans in West Palm Beach offer accessible financing options with favorable terms, empowering individuals to achieve homeownership without undue financial stress. By leveraging these programs, prospective buyers can fulfill their homeownership dreams while mitigating the risk of Foreclosure.

Planning for Long-Term Stability

While addressing immediate financial challenges is crucial, it’s equally important to strategize for long-term stability. This entails not only avoiding Foreclosure but also safeguarding against future financial uncertainties. Commercial mortgage brokers in West Palm Beach can provide invaluable guidance on structuring mortgage arrangements that align with your long-term financial goals.

Utilizing Mortgage Calculators

In the digital age, homeowners have access to an array of tools to aid in financial planning. West Palm Beach mortgage calculators allow homeowners to estimate monthly payments, evaluate refinancing options, and assess the potential impact of loan modifications. By leveraging these tools, homeowners can make informed decisions that align with their financial objectives.

Collaborating with Community Resources

In addition to seeking guidance from real estate professionals and mortgage brokers, homeowners can tap into community resources for additional support. Non-profit organizations and government agencies often offer counseling services and financial assistance programs aimed at preventing Foreclosure and promoting housing stability. By leveraging these resources, homeowners can access a wealth of support tailored to their specific needs.

The Importance of Proactive Communication

Effective communication with your lender is paramount when facing financial challenges. Rather than avoiding conversations about Foreclosure or missed payments, proactively engage with your lender to explore potential solutions. Many lenders are willing to work with homeowners to find mutually beneficial arrangements, including loan modifications and Forbearance Programs.

Embracing Financial Education

In addition to exploring immediate solutions to avoid Foreclosure, homeowners can benefit from ongoing financial education. Understanding the intricacies of mortgage agreements, the Real Estate Market, and personal finance empowers individuals to make informed decisions and navigate financial challenges with confidence. Online resources, workshops, and seminars offer valuable insights into budgeting, credit management, and long-term financial planning.

Engaging Legal Assistance

In complex Foreclosure cases where legal intervention may be necessary, homeowners can seek assistance from experienced real estate attorneys. These professionals specialize in navigating legal proceedings, negotiating with lenders, and advocating for homeowners’ rights. By enlisting legal support, homeowners can access expert guidance and protect their interests throughout the foreclosure process.

Exploring Government Assistance Programs

Government agencies at the federal, state, and local levels offer a range of assistance programs designed to support homeowners facing financial hardship. From Foreclosure Prevention Counseling to Loan Modification Initiatives, these programs provide invaluable resources and guidance to struggling homeowners. By exploring available government assistance programs, homeowners can access additional support to navigate challenging financial circumstances.

Leveraging Community Support Networks

Communities often rally around homeowners facing Foreclosure, offering support networks and resources to mitigate financial strain. Local churches, non-profit organizations, and community groups may provide assistance with housing expenses, food insecurity, and other essential needs. By tapping into these support networks, homeowners can access a wealth of resources and find solace in community solidarity.

Embracing Financial Resilience

In conclusion, while the prospect of Foreclosure can be daunting, homeowners today have a myriad of options to avoid foreclosure and secure their financial well-being. By leveraging equity, exploring alternative financing options, and seeking guidance from real estate professionals and mortgage brokers, homeowners can navigate challenging financial circumstances with confidence.

Through proactive financial planning, collaboration with community resources, and effective communication with lenders, homeowners can safeguard against Foreclosure and pave the way for long-term stability. By embracing financial empowerment and resilience, individuals can overcome adversity and thrive in the ever-evolving Real Estate Market.

Leveraging Equity for Stability

One of the most powerful tools at a homeowner’s disposal is the equity in their property. By understanding the value of their home and assessing their equity position, individuals can make informed decisions about their financial future. Whether through selling your house to satisfy outstanding debts or exploring loan modification options, leveraging equity provides a pathway to stability.

Exploring Alternative Financing Options

For homeowners facing challenges with Mortgage Payments or loan terms, alternative financing options offer potential solutions. Refinancing your mortgage, seeking First Time Home Buyer Loans, or engaging with Local Mortgage Lenders in West Palm Beach can provide avenues to alleviate financial strain and avoid Foreclosure.

Seeking Guidance from Real Estate Professionals

Navigating the complexities of the Foreclosure Process requires expertise and guidance. Partnering with a knowledgeable local real estate agent or West Palm Beach mortgage broker can provide invaluable support. These professionals offer insights into market trends, negotiation strategies, and available resources to help homeowners make informed decisions.

Understanding Government Assistance Programs

Government assistance programs play a crucial role in supporting homeowners facing financial hardship. From Forbearance Programs to Foreclosure Prevention Counseling, these initiatives offer lifelines to individuals navigating uncertain financial waters. By exploring available programs and resources, homeowners can access the support needed to weather financial storms.

Proactive Communication with Lenders

Open and proactive communication with lenders is essential when facing financial challenges. Rather than ignoring Mortgage Payments or falling behind on obligations, reach out to your lender to discuss potential solutions. Many lenders are willing to work with homeowners to find mutually beneficial arrangements that avoid Foreclosure and preserve homeownership.

Embracing a Holistic Approach to Financial Stability

Achieving financial stability goes beyond avoiding Foreclosure; it requires a holistic approach to managing finances and planning for the future. By embracing financial literacy, seeking professional guidance, and leveraging available resources, homeowners can navigate challenges with confidence and resilience.

Conclusion: Navigating Financial Turbulence with Confidence

In the intricate landscape of homeownership, the specter of Foreclosure can cast a daunting shadow. However, armed with knowledge, resources, and determination, homeowners today have an array of options to avoid foreclosure and secure their financial well-being.

From leveraging equity to exploring alternative financing options, proactive measures can help mitigate the risk of Foreclosure and preserve homeownership. By collaborating with real estate professionals, mortgage brokers, and legal experts, individuals can navigate complex financial challenges with confidence and resilience.

Furthermore, community support networks, government assistance programs, and ongoing financial education offer invaluable resources to homeowners facing financial hardship. By tapping into these resources and embracing financial empowerment, individuals can chart a course towards stability and prosperity in the ever-evolving Real Estate Market.

While the road ahead may be challenging, it is also brimming with opportunities for growth and resilience. By embracing proactive planning, engaging in open communication with lenders, and seeking support from trusted professionals, homeowners can navigate financial turbulence with confidence and emerge stronger on the other side.

In the journey towards financial stability, remember that you are not alone. Whether you’re exploring loan modification, considering selling your house, or seeking assistance from community resources, there are people and organizations ready to support you every step of the way.

So, take heart, stay informed, and embrace the journey towards financial resilience with confidence. With perseverance and determination, you can overcome adversity and secure a brighter future for yourself and your loved ones in the realm of homeownership.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

|

|

|

|

|

|

|

|

|

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

|

We Specialize in All Types of Financing, Mortgage Loans and Real Estate Deals.

We have been in the Mortgage and Real Estate Business since 1997!

Personal Profiles:

American Dream TV Show | Mortgage Process Steps | Homebot Videos | Traditional Loan Programs | NON-QM & Portfolio Loan Programs

HomeBot: Build more wealth with your home

Our goal for you is to help you to minimize your tax liability and maximize your cash flow. In today’s market, a mortgage loan is more than ever a financial instrument that must be tied into your long and short-term personal financial plan. This will allow you to create a debt strategy that will help you to build long-term wealth for you and your family.

Check Our Reviews:Residential Financing Options:

Most all loan options are available in just about every state in the country : VA | FHA | USDA | Fannie/Freddie Conventional Loans |Reverse Mortgages | Jumbo Reverse Mortgages | Self Employed Loans | Bank Statement Loans | Investor DSCR Loans | Private Hard Money Loans | Fix & Flip Loans | Bridge Loans | No Ratio | No Income Primary Residence Loans | Jumbo & Super Jumbo loans to $50M.

Temporary Interest Rate Buy-downs on a fixed-rate conventional | FHA | VA loans: 3-2-1, 2/1 or 1/0.

Luxury Sales & Epic Loan Options:

We work with all types of Real Estate Sales & Financing options for Residential & Commercial Real Estate | Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Real Estate Closings | Residential & Commercial Insurance.

Commercial Financing Options:

Our commercial division and can do business in any state in the country for all types of Commercial Loans for owner occupied properties or for business purposes from $50k to $500M | bridge loans | new construction loans for both owner occupied & for investors for individual single family Developer or Builder Spec Homes Loans | Townhomes | Condos | Real Estate Projects for Single Family Home Communities | Townhome Communities | Ground up new construction condominium buildings | Commercial Buildings | Apartment Complex’s | Mixed-Use Projects | SBA loans for new businesses | new construction | acquisition | Refinancing an exciting Loan | business purpose loans for A/R | inventory or cash flow | Doctor Loans for Business Acquisition & Commercial Real Estate with LTV’s as high as 100% LTV

We are your One-Stop Brokerage for all your Personal Residential Mortgage Financing & Sales | Commercial Real Estate Mortgage Financing & Sales | Commercial Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Homeowners insurance | Business Purpose personal and commercial needs.

Keep in mind we shop more than 250 residential and over 10K Commercial banks, lenders & mortgage companies to give you amazingly low rates and the largest product line in the country!

If you have any questions or if you have friends, family or clients, that are buying a home & need a mortgage or want to chat about a scenario just contact us right away:

1) 📅To schedule a time to talk with me just click here: 🔗 Schedule an Appointment with me: Click Here (pick the calendar that fits your specific situation)

2) 🏦 Apply for a mortgage now at www.ChristianPennersLoanApp.com

If you apply, please text me your full name and email address 📱561-373-0987 or

3) 📞Call me directly ☎️561-373-0987

Helping You Achieve The American Dream Of Home Ownership.

#AmericasMortgageSolutions #christianpenner #onestopbrokershop #mortgagebrokerwestpalmbeach #epicrealeststedeals #luxuryhomes #LuxurySales&EpicLoanOptions #TheChristianPennerMortgageTeam #buildwealth #mortgagebrokerflorida #theamericandream #finacingtheamericandream #realestate #mortgage #mortgagebroker #thanks #mortgagetips #mortgageadvice #RealEstateJourney #realtor #realestateexpert #realestatelife #realestategoals #realestatetips #realtorlifestyle #realtorsoffacebook #realtorforlife #businesspupose #mortgageloans #HouseHunting #DreamHome #homeownership #vacationhome #secondhome #homebuyer #interestrates #HousingMarket #stoprenting #commercialloans #ResidentialRealEstateDevelopments #CommercialRealEstateDevelopments #Yachts #Aircrafts #RVs #CollectorCars #ExoticCars #roofsolar #solar #roofSolarFinancingPackages #buildequity #planforyourfuture #buildyoufuture #television #host #tvproduction #streaming #travel #amazon #motivational #Agentmastermindclass #HorseFarms #EquestrianCenters #Vineyards #FruitandVegetableFarms #HobbyFarms #RealEstateInvestment #LuxuryRealEstate #PropertyManagement #RealEstateDevelopment #RealEstateAdvice #HomeStaging #RealEstateGoals #PropertyListing #EcoFriendlyHomes #RealEstatePhotography #UrbanRealEstate #SuburbanHomes #RuralProperties #RealEstateMarket #RealEstateForSale #RealEstateBrokerage #HomeRenovation #RealEstateTech #SmartHomeTechnology #GreenRealEstate #RealEstateNetworking #RealEstateSeminars #RealEstateLaw #RealEstateFinance #LuxuryApartments #CommercialProperties #RealEstateAuctions #HistoricHomes #WaterfrontProperties #CondoLiving

🔍 Whether you’re looking for financing 💰 or to BUY 🏡, SELL 🔄, LEASE 📝, INVEST 💹 or BUILD YOUR DREAM HOME 🏗️ or OFFICE 🏢 on Residential Properties 🏘️, Commercial Real Estate 🏬, or Development Commercial Real Estate 🏗️, Yachts 🛥️, Aircrafts ✈️, RVs 🚐, or Exotic Cars 🚗 – call us TODAY 📞. No matter the NEED 🎯 or GOAL 🏆 – let’s make CONFIDENT decisions together 👥💼.

Christian Penner, CMA

President | CEO | Mortgage Broker

NMLS#368289

America’s Mortgage Solutions, Inc NMLS#2009420

Cell/SMS: 561-373-0987

Direct/efax/SMS: 561-316-6800

Christian Penner712 U.S. Highway 1 North #300, North Palm Beach, FL 33408 |