Breaking Into the Market: Smart Moves for First-Time Buyers

If you’re like a lot of aspiring homebuyers, there’s a major hurdle standing in your way — the cost of living. From groceries to gas, eggs, and just about everything else, prices have gone up. And that rings true for home prices, too.

But even when everything feels expensive, there are still ways to make homeownership more than an item on your wish list. You may just need to think about where you plan to buy a bit differently.

Think of Your First Home as a Stepping Stone

One of the biggest misconceptions among buyers is that their first home has to be their forever home – or that it has to check all the boxes of what they want right out of the gate. In reality, it’s just a starting point.

Once you own a home, you start to build equity, which grows over time as home prices rise. Down the road, if you want to move — whether to a larger space, a better location, or both — the equity you’ve gained can help you do just that.

So rather than waiting until you can afford your dream home in your ideal neighborhood, consider starting with something that works for now.

Expand Your Search To Find More Affordable Options

If high home prices in your favorite area are holding you back, it’s time to cast a wider net. By keeping an open mind and being flexible with location, you may be surprised at what’s possible within your budget. Many buyers find success by looking in surrounding areas – and some even choose to move out of state.

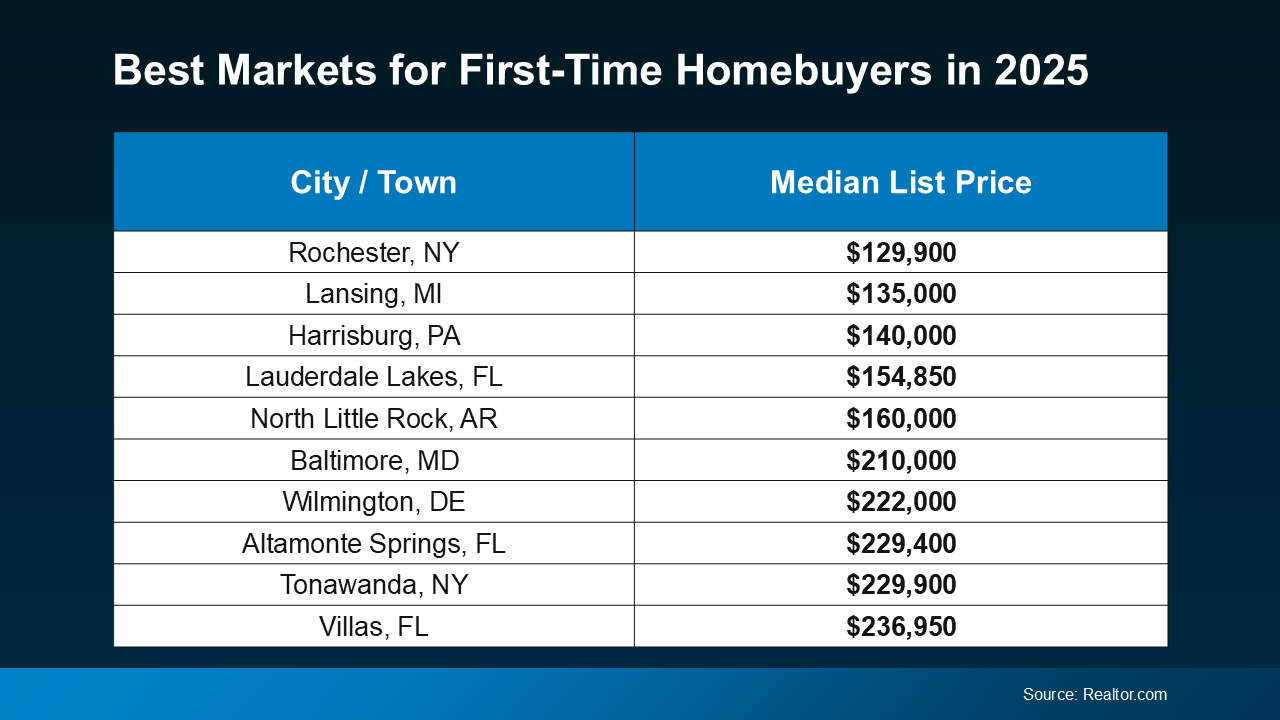

According to a report from Realtor.com, these are some of the best markets for first-time homebuyers this year (see chart below):

Of course, moving to a different state isn’t for everyone – and isn’t a necessity. The right agent can help you find more cost-effective options wherever you are.

Of course, moving to a different state isn’t for everyone – and isn’t a necessity. The right agent can help you find more cost-effective options wherever you are.

If you want to stay local, looking just outside your preferred neighborhood could help you find something you can afford that’s still pretty close to your favorite restaurants, shops, and activities. Sometimes, moving as little as 10 minutes away makes a big difference.

And the best way to see what’s available is to work with a real estate agent who understands the local market and can help you identify hidden gems nearby. An agent can point you to communities you may not have considered that have lower price tags now and are steadily gaining value and appeal. That way you can buy your first home and be set up to gain equity through the years.

Today’s cost of living is a challenge for many homebuyers. But by exploring different areas and working with a knowledgeable agent, you can take that first step toward owning a home — and building equity for your future.

How far outside of your area would you look to make homeownership happen? Let’s connect to chat through your options.

Breaking Into the Market: Smart Moves for First-Time Buyers

The Journey to Owning a Home Starts Here

The dream of homeownership is alive and well, but for many first-time buyers, the path to getting the keys to their own place can feel like an uphill battle. Between the rising cost of living, increasing home prices, and competitive bidding wars, stepping into the real estate market may seem overwhelming. However, with the right approach, you can turn that dream into reality and finally own a home without breaking the bank.

Strategic planning, an open mind, and guidance from a knowledgeable real estate agent can unlock doors you never thought possible. From finding budget-friendly homes to tapping into affordable options, here’s your ultimate guide to making smart moves in today’s housing market.

Think of Your First Home as a Stepping Stone Home

A common misconception among first-time buyers is that their first purchase must be their forever home. The reality? Your first home is more of a launchpad—a stepping stone home that allows you to start to build equity while providing a solid foundation for future investments.

Why Equity Matters

When you own a home, every mortgage payment you make is an investment in your future. Over time, as home prices rise, your property’s value increases, and you start to build equity. This equity can later be used to upgrade to a larger home, relocate to a more desirable neighborhood, or even invest in rental properties.

By focusing on a stepping stone home rather than a dream home right away, you’re creating financial leverage that will serve you well down the road.

Moreover, many first-time buyers underestimate the power of building wealth through homeownership. Real estate has historically been one of the most stable long-term investments, allowing homeowners to accumulate wealth while enjoying the benefits of having a place to call their own. Even a modest starter home can yield significant financial returns in the long run, especially if you choose a location with strong market trends and future growth potential.

Expand Your Search to Find Affordable Options

Many homebuyers set their sights on a specific neighborhood, only to find that prices exceed their budget. Rather than giving up, consider broadening your search to surrounding areas where homes may be more attainable.

- Location Flexibility: Looking just 10–15 minutes outside your ideal area can uncover hidden gems—neighborhoods that offer lower home prices while still providing great amenities.

- Best Markets for First-Time Homebuyers: Certain cities and suburbs offer more budget-friendly homes and better opportunities to set up to gain equity.

- Work With a Local Market Expert: A real estate agent with a deep understanding of the local market can help you identify undervalued areas poised for growth.

Additionally, many metropolitan areas have emerging suburbs with new developments that offer modern amenities at a fraction of the cost of established neighborhoods. These growing communities often come with added benefits such as improved infrastructure, better schools, and increased job opportunities, making them excellent choices for first-time buyers looking to maximize their investment.

The Power of Working With a Knowledgeable Agent

Navigating the real estate market on your own can be daunting. This is where an agent becomes your secret weapon. A skilled real estate agent will:

- Provide insight into market trends

- Identify affordable options

- Negotiate on your behalf

- Help you find budget-friendly homes in up-and-coming areas

With the right guidance, you can buy your first home without the stress of going it alone.

Beyond simply finding listings, a great real estate agent will help you understand the intricacies of financing, market conditions, and future resale potential. They can also connect you with trusted professionals such as home inspectors, mortgage brokers, and attorneys to ensure a smooth transaction from start to finish.

Financing Your First Home: Smart Mortgage Moves

Securing a mortgage is one of the most important steps in the homebuying process. If you’re looking in Florida, consulting with a West Palm Beach mortgage broker can help you find the best financing options. Here’s what you need to know:

Best Mortgage Rates in West Palm Beach

Mortgage rates fluctuate based on market trends, credit scores, and loan types. To get the best mortgage rates in West Palm Beach, it’s crucial to shop around and compare lenders.

Affordable West Palm Beach Home Loans

For those looking for affordable West Palm Beach home loans, government-backed programs like FHA and VA loans can make owning a home more accessible.

First-Time Home Buyer Loans in West Palm Beach

There are special programs designed for first-time buyers, offering lower down payments and reduced interest rates. Checking out first-time home buyer loans in West Palm Beach can provide significant savings.

Mortgage Preapproval in West Palm Beach

Before you start house hunting, getting a mortgage preapproval in West Palm Beach strengthens your position as a buyer and helps you understand how much house you can afford.

Local Mortgage Lenders in West Palm Beach

Working with local mortgage lenders in West Palm Beach can provide personalized service and potentially better loan terms than larger national banks.

West Palm Beach Refinancing Options

If you already own a home, exploring West Palm Beach refinancing options can help lower your interest rate or provide cash for home improvements.

Additionally, using West Palm Beach mortgage calculators can help you estimate your monthly payments and understand different financing scenarios before making a commitment.

Finding the Way You Can Buy Your First Home

You can buy your first home with confidence when you take strategic steps and leverage the resources available to you. Here’s a roadmap to making homeownership happen:

- Get Financially Prepared

- Check your credit score and improve it if needed.

- Save for a down payment and closing costs.

- Get preapproved for a mortgage.

- Expand Your Search

- Consider location flexibility to find affordable options.

- Explore surrounding areas that offer better value.

- Work With the Right Professionals

- A real estate agent with local market expertise.

- A West Palm Beach mortgage broker to secure financing.

- Make a Smart Purchase

- Buy a stepping stone home to start to build equity.

- Look for hidden gems that will appreciate over time.

- Plan for the Future

- As your equity grows, you’ll have more opportunities for future investments.

The Bottom Line

Buying your first home doesn’t have to feel impossible. With strategic planning, working with a knowledgeable agent, and securing the right financing, you can buy your first home without compromising on quality or affordability. Whether you’re searching for budget-friendly homes, exploring West Palm Beach mortgage calculators, or seeking property loan advice in West Palm Beach, there are countless resources available to help you achieve homeownership.

Your journey to owning a home starts today. Take the first step, explore affordable options, and make your dream of homeownership a reality!

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice