The Great Wealth Transfer: A New Era of Opportunity

In recent years, there’s been a significant shift in how wealth is distributed among generations. It’s called the Great Wealth Transfer.

Historically, the transfer of wealth from one generation to the next was a more gradual process, often limited to smaller amounts of inheritance or family savings. But today, the scale has increased in a big way. As a recent article from Bankrate says:

“The biggest wave of wealth in history is about to pass from Baby Boomers over the next 20 years, and it’s going to have major impacts on many facets of life. Called The Great Wealth Transfer, $84 trillion is poised to move from older Americans to Gen X and millennials. If it’s managed smartly, Americans will be able to grow their wealth and ensure their financial security.”

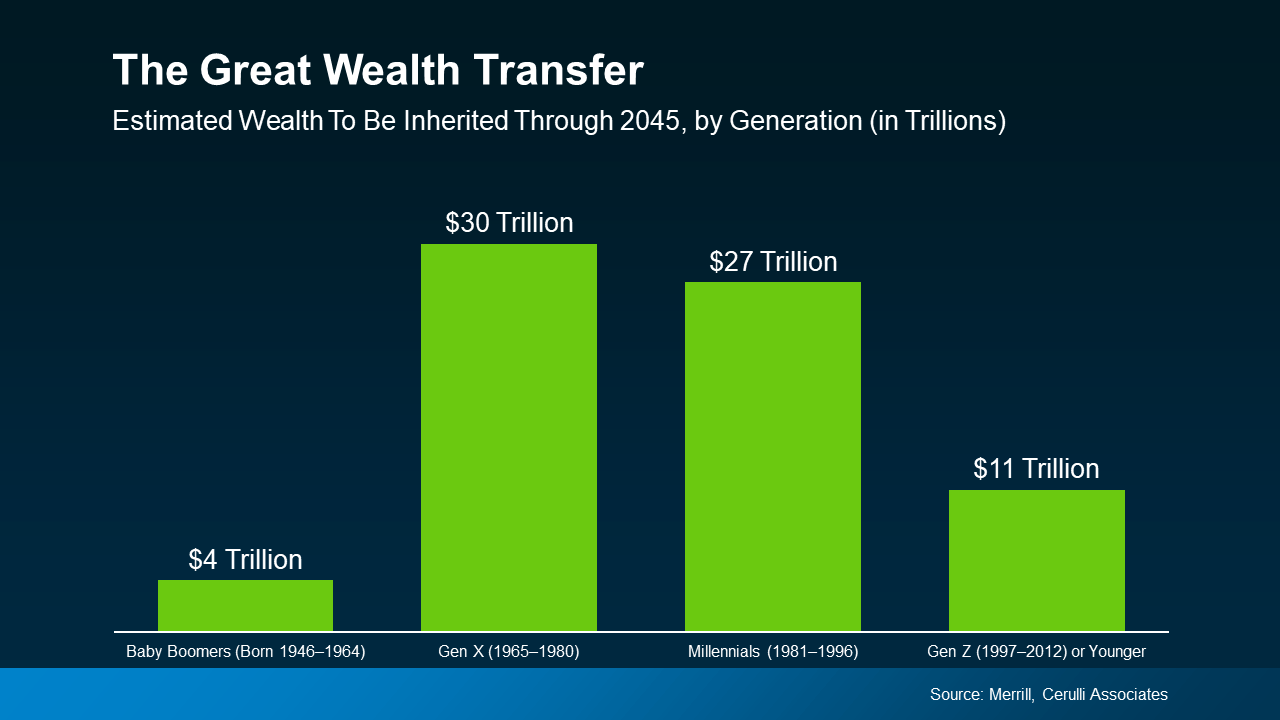

Basically, as more Baby Boomers retire, sell businesses, or downsize their homes, more substantial assets are being passed down to younger generations. And this creates a powerful ripple effect that’ll continue over the next few decades. The graph below uses data from Merrill and Cerulli Associates to give you an idea of how much inherited money is set to change hands through 2045:

Impact on the Housing Market

Impact on the Housing Market

One of the most immediate effects of this wealth transfer is on the housing market. Home affordability has been a concern for many aspiring buyers, especially in high-demand areas. The increase in generational wealth is expected to ease some of these challenges by providing future homeowners with greater financial resources. As assets are passed down through generations, buyers may find themselves in a better position to afford homes. Merrill talks about that benefit in a recent article:

“While millennials face steep barriers . . . to buying a first home in many markets, ‘that’s a for-now story, not a forever story’ . . . The Great Wealth Transfer should enable more of them to become homeowners — or trade up or add a second home — either through inherited property or the funds for a down payment.”

Impact on the Economy

But the Great Wealth Transfer doesn’t just impact housing. It’s also going to provide a new avenue for entrepreneurial spirits to fuel economic growth. If someone is looking to start a business and they’re receiving funds like this, that money can used as the necessary capital to start a new company. This helps the next generation of innovators and business owners bring their ideas to life.

While affordability remains a challenge in today’s housing market, the ongoing Great Wealth Transfer is poised to unlock new opportunities. As wealth is passed down and put to use, it’s expected to ease some of the barriers to homeownership and fuel other entrepreneurial endeavors.

The Great Wealth Transfer: A New Era of Opportunity

The Seismic Shift in Homeownership

A tectonic shift is rumbling beneath the foundations of the housing market: The Great Wealth Transfer. As the Baby Boomer generation, custodians of a staggering amount of wealth, prepares to pass the torch, a new era of opportunity is dawning for future homeowners. This generational handover promises to reshape the landscape of homeownership, injecting unprecedented liquidity into the market and potentially easing the longstanding affordability crisis.

The Inheritance Effect: A Double-Edged Sword

For many, the prospect of inherited property or a substantial windfall from an aging relative is a dream come true. It’s a financial lifeline that can catapult them from renters to homeowners, providing the much-needed funds for a down payment or even outright purchase. This influx of generational wealth can significantly impact home affordability, particularly in regions where housing prices have skyrocketed.

However, the inheritance effect is a double-edged sword. While it can empower individuals to become homeowners sooner rather than later, it can also exacerbate existing inequalities. Those fortunate enough to inherit substantial sums may find themselves with a significant advantage in the competitive housing market, potentially leaving others further behind.

The Ripple Effect: Economic Implications

The implications of the Great Wealth Transfer extend far beyond the housing market. As younger generations receive a windfall, they are likely to increase their spending, stimulating economic growth and creating new opportunities. This increased consumer demand can lead to job creation, business expansion, and a general uptick in economic activity.

Moreover, the influx of wealth can fuel entrepreneurial endeavors, as individuals may use their inheritance to start businesses, invest in new ventures, or pursue other ambitious projects. This entrepreneurial spirit can drive innovation, create jobs, and contribute to a more dynamic and resilient economy.

Navigating the New Landscape: Tips for Future Homeowners

For those hoping to capitalize on the opportunities presented by the Great Wealth Transfer, it’s essential to have a well-thought-out plan. Here are some tips to help you navigate the new landscape:

- Educate Yourself: Stay informed about the latest trends in the housing market, mortgage rates, and economic conditions. This knowledge will empower you to make informed decisions and seize opportunities when they arise.

- Set Clear Goals: Define your long-term financial objectives and create a roadmap to achieve them. Whether you’re aiming to buy a first home, invest in real estate, or start a business, having a clear plan will help you stay focused and motivated.

- Seek Professional Advice: Consult with financial advisors, real estate agents, and other experts to get personalized guidance. They can help you assess your financial situation, identify potential risks, and develop strategies to maximize your wealth.

- Consider Your Options: Explore various financing options, including conventional mortgages, FHA loans, VA loans, and USDA loans. Each option has its own advantages and disadvantages, so it’s important to compare and contrast to find the best fit for your needs.

- Be Patient and Persistent: The housing market can be volatile, and it may take time to find the right property at the right price. Be patient, persistent, and willing to compromise when necessary.

West Palm Beach: A Prime Example

As a vibrant and growing city, West Palm Beach offers a unique blend of urban amenities and coastal charm. With its thriving economy, excellent schools, and beautiful beaches, it’s no wonder that many people are drawn to this desirable location.

If you’re considering buying a home in West Palm Beach, you’ll want to work with a knowledgeable and experienced West Palm Beach mortgage broker. They can help you navigate the complex world of home financing, find the best mortgage rates, and ensure a smooth and stress-free closing process.

Conclusion

The Great Wealth Transfer represents a once-in-a-generation opportunity for individuals to achieve their financial goals and unlock new possibilities. By understanding the trends, setting clear objectives, and seeking professional advice, you can position yourself to take advantage of this seismic shift and create a brighter future for yourself and your loved ones.

The Philanthropic Impulse: A Force for Good

As the Great Wealth Transfer unfolds, many individuals are driven by a desire to give back to their communities and make a positive impact on the world. This philanthropic impulse can take many forms, from supporting charitable causes to investing in social enterprises.

By donating a portion of their inheritance or wealth to charitable organizations, individuals can help address pressing social and environmental issues, such as poverty, education, healthcare, and climate change. Philanthropy can also foster innovation and entrepreneurship by providing funding for research, development, and new ventures.

West Palm Beach: A Hub of Philanthropy

West Palm Beach has a rich history of philanthropy, and the city continues to attract generous donors from around the world. With its vibrant arts scene, world-class healthcare institutions, and thriving non-profit sector, there are countless opportunities to make a difference.

If you’re interested in getting involved in philanthropic activities in West Palm Beach, consider:

- Volunteering: Donate your time and skills to local organizations that are working to improve the lives of others.

- Donating: Make financial contributions to charitable causes that align with your values and interests.

- Starting a Foundation: Establish your own foundation to support specific causes or organizations.

The Ethical Implications of Wealth Transfer

While the Great Wealth Transfer presents many opportunities, it also raises important ethical questions. How should inherited wealth be used? What responsibilities do the wealthy have to society? These are complex issues that require careful consideration.

As individuals inherit wealth, they may feel a sense of obligation to use it wisely and responsibly. This can lead to a renewed focus on social justice, environmental sustainability, and intergenerational equity. By using their resources to create a better world, the wealthy can leave a lasting legacy that benefits future generations.

Conclusion: A Brighter Future

The Great Wealth Transfer is a transformative event that has the potential to reshape our society in profound ways. By understanding the opportunities and challenges associated with this generational shift, we can work together to create a brighter future for all.

Whether you’re a future homeowner looking to capitalize on the rising housing market, an entrepreneur seeking to launch a new venture, or a philanthropist committed to making a difference, the Great Wealth Transfer offers a wealth of possibilities. By embracing this new era with optimism and purpose, we can build a more just, equitable, and sustainable world for generations to come.

The Role of Financial Advisors: A Guide to Navigating the Great Wealth Transfer

As the Great Wealth Transfer unfolds, the role of financial advisors becomes increasingly crucial. These professionals can provide invaluable guidance to individuals who are inheriting significant sums of money, helping them to make informed decisions and achieve their financial goals.

A skilled financial advisor can assist with a variety of tasks, including:

- Estate Planning: Helping to develop a comprehensive estate plan that addresses issues such as asset distribution, tax implications, and guardianship.

- Investment Management: Providing guidance on how to invest inherited funds to achieve long-term growth and income.

- Retirement Planning: Assisting with retirement planning strategies, including determining retirement income needs, selecting appropriate investment vehicles, and managing tax implications.

- Risk Management: Identifying and mitigating potential risks, such as market volatility, inflation, and longevity.

- Charitable Giving: Advising on philanthropic strategies and helping to establish charitable foundations.

Choosing the Right Financial Advisor

When selecting a financial advisor, it’s important to consider several factors:

- Credentials: Look for advisors who have the appropriate credentials, such as the Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) designations.

- Experience: Choose an advisor with experience in working with clients who have inherited wealth.

- Philosophy: Ensure that the advisor’s investment philosophy aligns with your own risk tolerance and long-term goals.

- Fees: Understand the advisor’s fee structure and make sure it is transparent and reasonable.

Building a Strong Relationship

Once you have chosen a financial advisor, it’s important to build a strong and trusting relationship. This involves open communication, regular reviews, and a willingness to adapt your financial plan as needed.

By working closely with a qualified financial advisor, individuals can make the most of the opportunities presented by the Great Wealth Transfer and create a secure financial future for themselves and their loved ones.

Conclusion: A Time of Transformation

The Great Wealth Transfer is a pivotal moment in history, with the potential to reshape our economy and society. By understanding the trends, seizing the opportunities, and addressing the challenges, we can create a brighter future for generations to come.

Whether you’re a future homeowner looking to unlock your financial potential, an entrepreneur seeking to launch a new venture, or a philanthropist committed to making a difference, the Great Wealth Transfer offers a wealth of possibilities. By working together and embracing this new era with optimism and purpose, we can build a more just, equitable, and sustainable world for all.

The Impact of the Great Wealth Transfer on the Housing Market

One of the most significant impacts of the Great Wealth Transfer is likely to be felt in the housing market. As younger generations inherit wealth, they may have more purchasing power, driving up demand for homes and potentially pushing prices higher.

However, the effect on the housing market may vary depending on several factors:

- Geographic Location: The impact may be more pronounced in certain regions, such as high-cost areas where housing prices are already elevated.

- Inventory Levels: If there is a limited supply of homes available for sale, increased demand could lead to more competition and higher prices.

- Economic Conditions: The overall health of the economy will also play a role. If the economy is strong, job growth and rising incomes may further boost demand for housing.

West Palm Beach: A Case Study

As a popular destination for retirees and affluent individuals, West Palm Beach has experienced significant growth in recent years. The influx of wealthy residents has contributed to rising home prices and a competitive housing market.

The Great Wealth Transfer could further fuel this trend, as younger generations inherit wealth and seek to purchase homes in this desirable location. However, the impact will also depend on factors such as interest rates, economic conditions, and the availability of affordable housing options.

Strategies for Homebuyers in a Competitive Market

For individuals looking to buy a first home in a competitive market, several strategies may be helpful:

- Save for a Larger Down Payment: A larger down payment can improve your chances of getting approved for a mortgage and may help you negotiate a better interest rate.

- Consider Alternative Financing Options: Explore options such as FHA loans, VA loans, and USDA loans, which may have lower down payment requirements or more flexible eligibility criteria.

- Be Flexible: Be willing to consider different neighborhoods, property types, or price ranges to increase your chances of finding a suitable home.

- Work with a Real Estate Agent: A knowledgeable real estate agent can help you navigate the market, negotiate offers, and find hidden gems.

Conclusion: A New Era of Opportunity

The Great Wealth Transfer is a complex phenomenon with far-reaching implications. While it presents significant opportunities for individuals and communities, it also raises important questions about equity, sustainability, and the future of our society.

By understanding the trends, challenges, and potential benefits of this generational shift, we can work together to create a more just, prosperous, and sustainable world for all.

The Impact of the Great Wealth Transfer on Small Businesses

The Great Wealth Transfer is not only reshaping the housing market but also has the potential to significantly impact small businesses. As younger generations inherit wealth, they may be more inclined to start their own businesses or invest in existing ones.

Increased Entrepreneurial Activity

The influx of generational wealth can provide a financial cushion for aspiring entrepreneurs, allowing them to take risks and pursue their dreams. This increased entrepreneurial activity can lead to job creation, innovation, and economic growth.

Moreover, as more individuals become business owners, they may be more likely to support local businesses and invest in their communities. This can create a virtuous cycle of economic development and prosperity.

Investment Opportunities

The Great Wealth Transfer can also create new investment opportunities for small businesses. As individuals seek to diversify their portfolios and generate income, they may turn to small business investments, such as equity crowdfunding or angel investing.

This increased investment can provide small businesses with the capital they need to grow and expand. It can also foster a culture of innovation and risk-taking, which is essential for long-term economic success.

Challenges and Opportunities

While the Great Wealth Transfer presents many opportunities for small businesses, it also poses some challenges. For example, increased competition from new businesses may make it more difficult for existing firms to survive.

However, by adapting to the changing landscape and leveraging the resources available to them, small businesses can thrive in this new era.

Conclusion: A Catalyst for Growth

The Great Wealth Transfer has the potential to be a powerful catalyst for economic growth and job creation. By fostering entrepreneurship, increasing investment, and stimulating consumer spending, this generational shift can create a more vibrant and prosperous future for small businesses and communities.

As we navigate this new era, it is essential for policymakers, business leaders, and individuals to work together to harness the opportunities presented by the Great Wealth Transfer and create a more equitable and sustainable economy.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice