Home Price Growth Is Moderating – Here’s Why That’s Good for You

Over the past few years, home prices skyrocketed. That’s been frustrating for buyers, leaving many wondering if they’d ever get a shot at owning a home. But here’s some welcome news: that whirlwind pace of home price growth is slowing down.

Home Prices Are Rising at a Healthy Pace

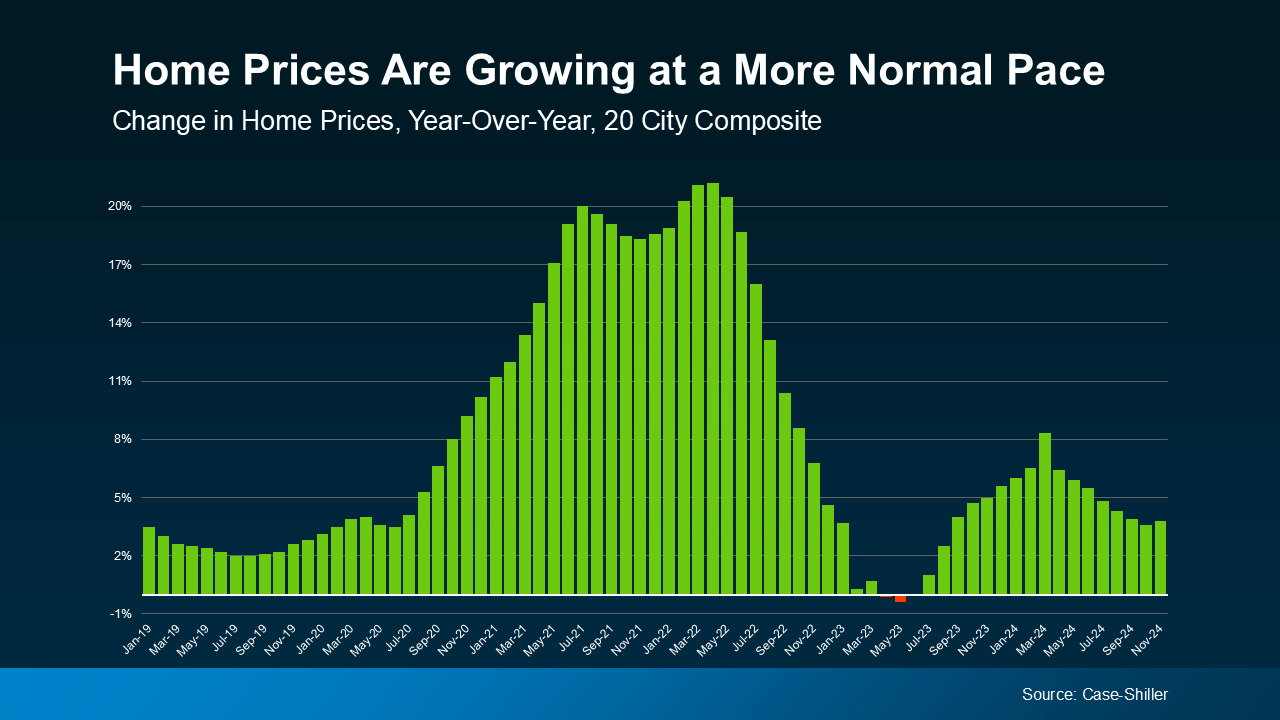

At the national level, home prices are still going up, but at a much more moderate, normal pace. For example, in November, the year-over-year increase in home prices was just 3.8% nationally, according to Case-Shiller. That’s a far cry from the double-digit spikes that occurred in 2021 and 2022 (see graph below):

This more normal home price growth might make buying a home feel more attainable for many buyers. You won’t face the same sticker shock or rapid price jumps that made it hard to plan your purchase just a few years ago.

This more normal home price growth might make buying a home feel more attainable for many buyers. You won’t face the same sticker shock or rapid price jumps that made it hard to plan your purchase just a few years ago.

At the same time, steady growth means the home you buy today will likely appreciate in value over time.

Prices Vary from Market to Market

While the national story is one of moderate price growth, it’s important to remember that all real estate is local. Some markets are seeing stronger growth, while others are cooling off or even seeing slight declines. As Selma Hepp, Chief Economist at CoreLogic, notes:

“Regionally, variations persist, as some affordable areas – including smaller metros in the Midwest — remain in high demand and continue to see upwardhome price pressures.”

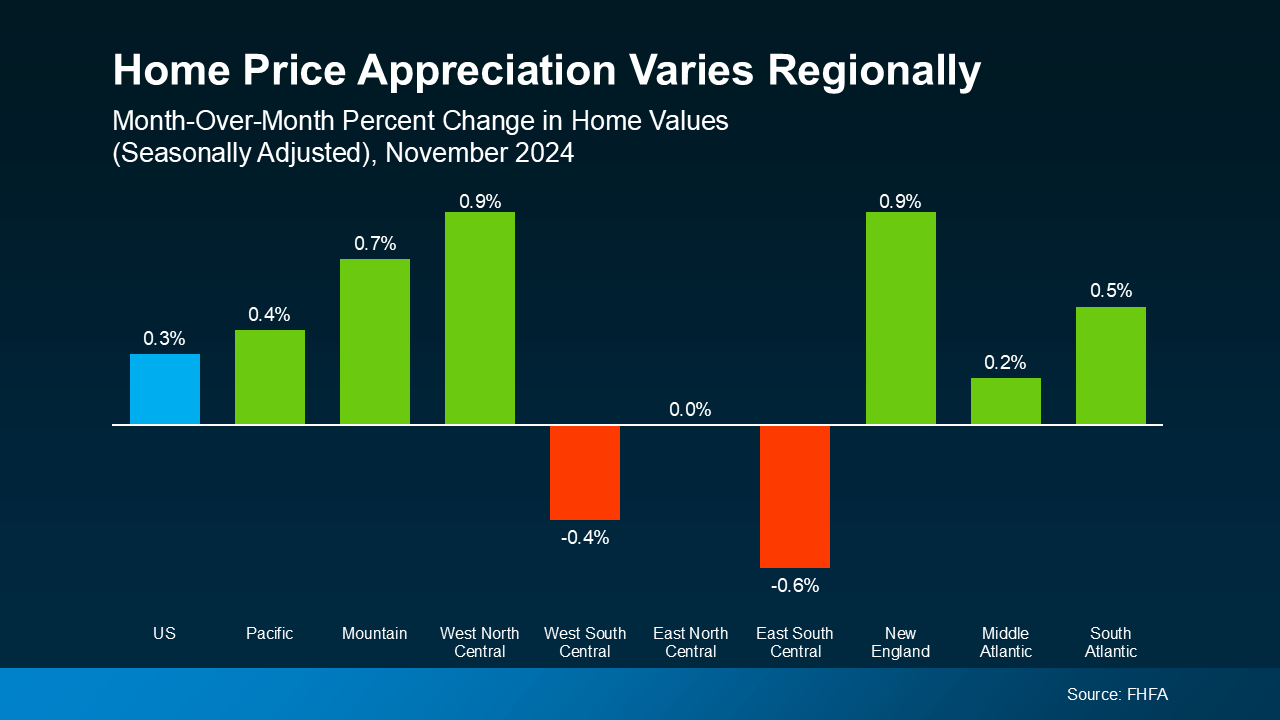

Meanwhile, other regions saw slight month-over-month declines in November, according to Federal Housing Finance Agency (FHFA) data (see graph below):

What does this mean for you? It’s crucial to understand what’s happening in your local market. A national average can’t tell the whole story. That’s where working with a local real estate agent can really help. They have the tools and expertise to give you the full picture of what’s happening in your area and how to plan for that in your move.

What does this mean for you? It’s crucial to understand what’s happening in your local market. A national average can’t tell the whole story. That’s where working with a local real estate agent can really help. They have the tools and expertise to give you the full picture of what’s happening in your area and how to plan for that in your move.

Bottom Line

Home prices are growing at a more manageable pace, and working with a local real estate agent can help you navigate the ups and downs of your specific market.

How have changing home prices impacted your plans to buy? Let’s talk about it.

Home Price Growth Is Moderating – Here’s Why That’s Good for You

A Shift in the Real Estate Market: What It Means for You

Over the past few years, we’ve witnessed an unprecedented surge in home prices, leaving many prospective buyers feeling like homeownership was slipping out of reach. But now, there’s a shift underway. The rapid home price growth that characterized 2021 and 2022 is finally moderating, ushering in a new era of opportunity for those looking to achieve their dream of owning a home.

This transition brings with it a wave of benefits, particularly in terms of affordability and long-term home appreciation. Whether you’re a first-time buyer, an investor, or someone looking to upsize or downsize, understanding these market trends can help you make informed decisions in your local market.

Home Prices Are Rising at a Sustainable Pace

For the last few years, skyrocketing home prices made buying a home increasingly difficult. But as 2023 progressed, we saw a deceleration in home price growth. According to the Case-Shiller Home Price Index, national home prices rose by just 3.8% year-over-year in November. Compare that to the double-digit spikes of previous years, and it’s clear that the market is taking a more balanced approach.

A healthy, steady appreciation rate is good for both buyers and sellers. Buyers no longer face extreme sticker shock, and homeowners can still count on consistent home appreciation over time. This stability means fewer market fluctuations and a more predictable path toward wealth-building through real estate.

The Economic Factors Behind Moderation

Several economic factors have contributed to the moderation in home price growth. Rising mortgage rates, inflation concerns, and a shift in buyer demand have all played a role. Additionally, the Federal Reserve’s efforts to control inflation have impacted borrowing costs, making affordability a key concern for many buyers.

Inventory levels have also begun to normalize, reducing the extreme competition that previously drove home prices higher. More balanced supply and demand dynamics mean that buyers now have more options and negotiating power when entering the market.

The Role of Local Market Variations

While the national narrative tells one story, housing market changes vary widely depending on location. Some areas are still experiencing stronger home price growth, while others are cooling off. As CoreLogic‘s Chief Economist, Selma Hepp, explains:

“Regionally, variations persist, as some affordable areas – including smaller metros in the Midwest – remain in high demand and continue to see upward home price pressures.”

For example, Midwest housing demand is soaring as buyers seek out more affordable areas with lower costs of living. Meanwhile, coastal markets that saw explosive growth in recent years are seeing prices stabilize or even decline slightly.

Hot and Cool Markets: What to Watch For

In hot markets, such as certain regions of Florida, Texas, and Arizona, demand continues to be high, and home prices are still climbing, albeit at a slower rate. In contrast, cooler markets like California and some parts of the Northeast are seeing more price reductions and increased time on market for listings. Understanding these local market variations is crucial when making a buying or selling decision.

The Importance of Working With a Local Real Estate Agent

National trends are insightful, but when it comes to making the right move, your best bet is to understand what’s happening in your local market. That’s where a seasoned local real estate agent becomes invaluable.

A real estate agent can provide hyper-local insights into pricing, inventory, and neighborhood trends. Whether you’re eyeing a home in a high-demand region or seeking out affordable areas, a local real estate agent can guide you through the process with expertise.

The Benefits of Professional Guidance

- Market Knowledge: A local real estate agent understands trends that may not be immediately obvious in national reports.

- Negotiation Power: An experienced agent can help buyers negotiate favorable terms, saving money in the long run.

- Access to Listings: Agents have access to off-market properties and exclusive deals that buyers might not find on their own.

- Understanding Market Timing: Knowing when to buy or sell is crucial, and a real estate agent can help time the market effectively.

Mortgage Considerations in West Palm Beach

For those looking at the South Florida market, specifically in West Palm Beach, navigating mortgage options is crucial. The area offers a mix of affordable West Palm Beach home loans, high-end properties, and various financing options tailored to different needs. If you’re considering purchasing, it’s worth exploring:

- West Palm Beach mortgage broker services to compare loan options.

- Finding the best mortgage rates in West Palm Beach to secure an affordable monthly payment.

- Checking out first-time home buyer loans in West Palm Beach to take advantage of special programs.

- Learning about West Palm Beach refinancing options if you already own a home and want to lower your rate.

- Partnering with local mortgage lenders in West Palm Beach for personalized loan solutions.

- Using West Palm Beach mortgage calculators to estimate your costs before diving in.

- Seeking property loan advice in West Palm Beach to make informed financial decisions.

- Working with a commercial mortgage broker in West Palm Beach if you’re investing in business real estate.

- Getting a mortgage preapproval in West Palm Beach to strengthen your buying power in a competitive market.

Why This Matters Now More Than Ever

With housing market changes in full swing, taking a strategic approach to buying a home is more important than ever. As home price growth returns to sustainable levels, buyers gain more negotiating power, making it easier to enter the market without the frenzy of bidding wars.

At the same time, homeownership remains a strong long-term investment. With steady home appreciation, owning a home continues to be a pathway to financial stability and wealth accumulation.

Future Outlook and Predictions

Experts predict that home price growth will continue at a moderate pace in 2024 and beyond. While interest rates may fluctuate, overall stability in the real estate market is expected. Buyers should remain vigilant about market conditions, explore financing options carefully, and seek professional guidance to make the most of their real estate investments.

The Bottom Line

The real estate market is shifting in favor of buyers, with home prices growing at a more manageable pace. This moderation means more affordability, especially in affordable areas, and better opportunities for those looking to achieve their goal of owning a home.

Understanding local market variations is key, and working with a local real estate agent can help you navigate the nuances of your local market. If you’re in West Palm Beach, taking advantage of expert mortgage services—whether through a West Palm Beach mortgage broker, local mortgage lenders in West Palm Beach, or West Palm Beach mortgage calculators—can help you find the best financing solutions available.

Now is the time to explore your options and make a move that aligns with your goals. Whether you’re looking for the best mortgage rates in West Palm Beach, seeking first-time home buyer loans in West Palm Beach, or considering West Palm Beach refinancing options, the opportunities are abundant. The key is to stay informed, work with professionals, and take advantage of the evolving market conditions.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice