How the Federal Reserve’s Next Move Could Impact the Housing Market

Now that it’s September, all eyes are on the Federal Reserve (the Fed). The overwhelming expectation is that they’ll cut the Federal Funds Rate at their upcoming meeting, driven primarily by recent signs that inflation is cooling, and the job market is slowing down. Mark Zandi, Chief Economist at Moody’s Analytics, said:

“They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.”

But what does this mean for the housing market, and more importantly, for you as a potential homebuyer or seller?

Why a Federal Funds Rate Cut Matters

The Federal Funds Rate is one of the key factors that influences mortgage rates – things like the economy, geopolitical uncertainty, and more also have an impact.

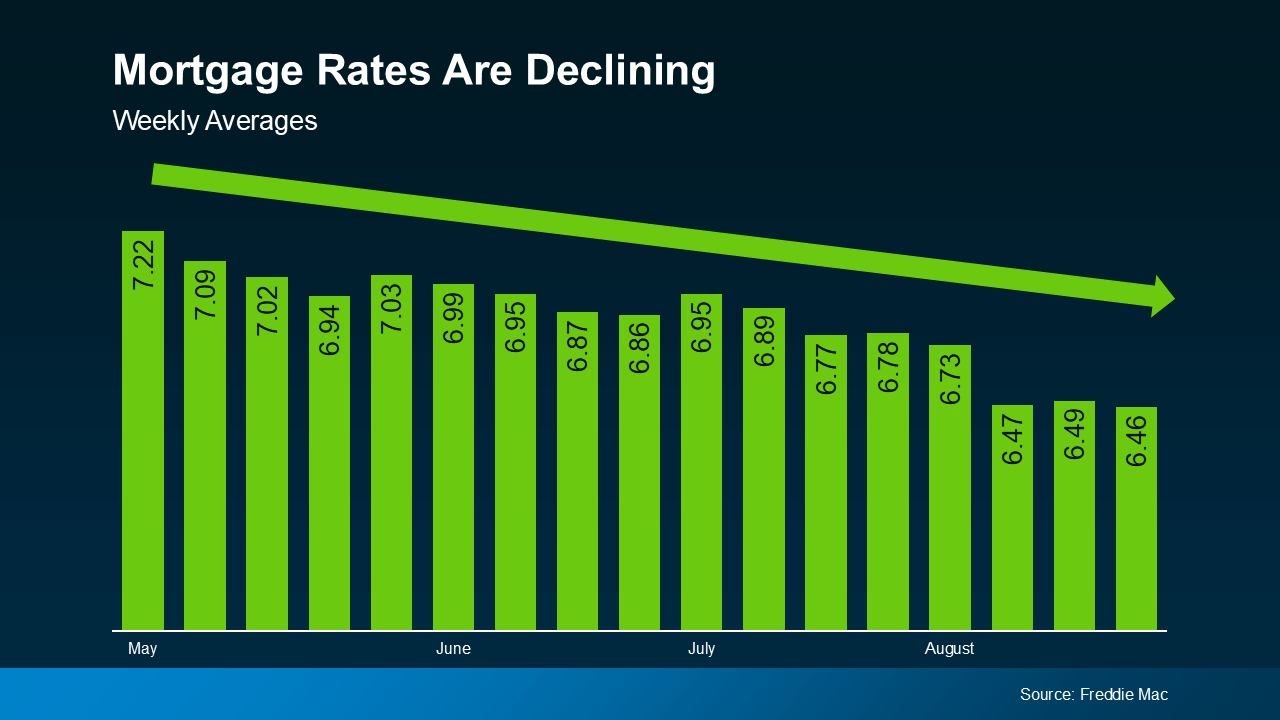

When the Fed cuts the Federal Funds Rate, it signals what’s happening in the broader economy, and mortgage rates tend to respond. While a single rate cut might not lead to a dramatic drop in mortgage rates, it could contribute to the gradual decline that’s already happening.

As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), points out:

“Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.”

And any upcoming Federal Funds Rate cut likely won’t be a one-time event. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely.”

The Projected Impact on Mortgage Rates

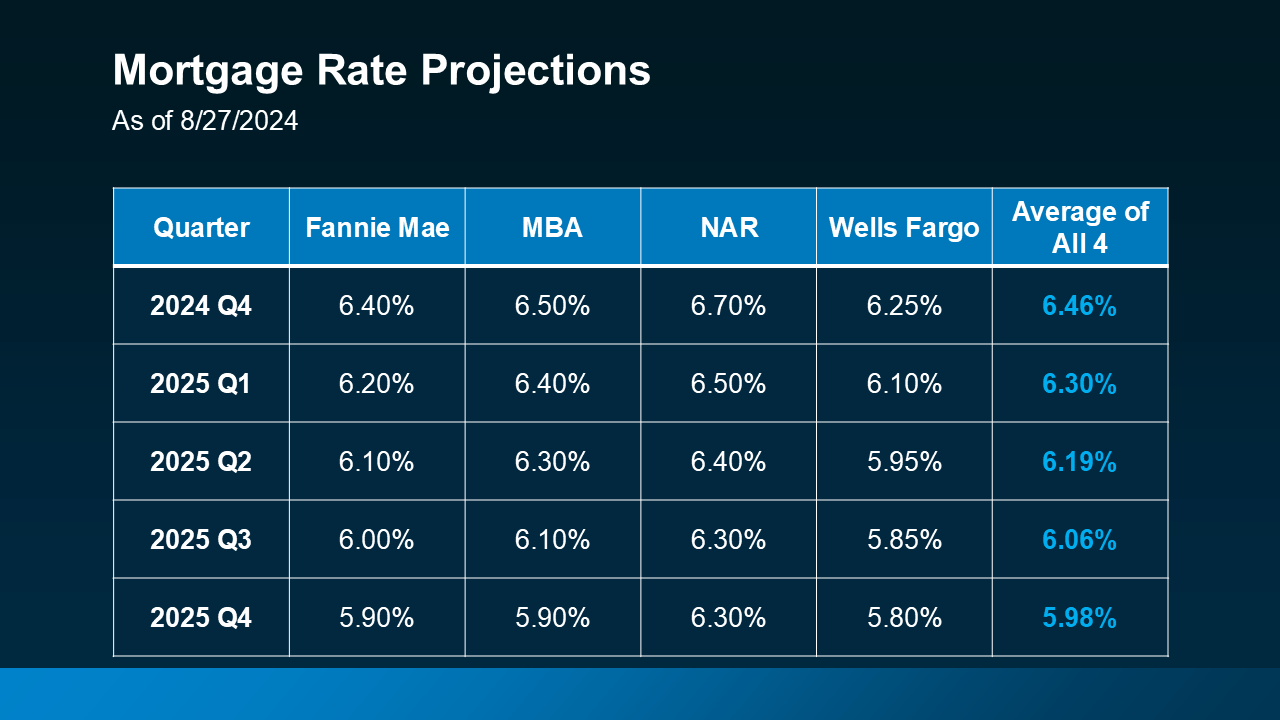

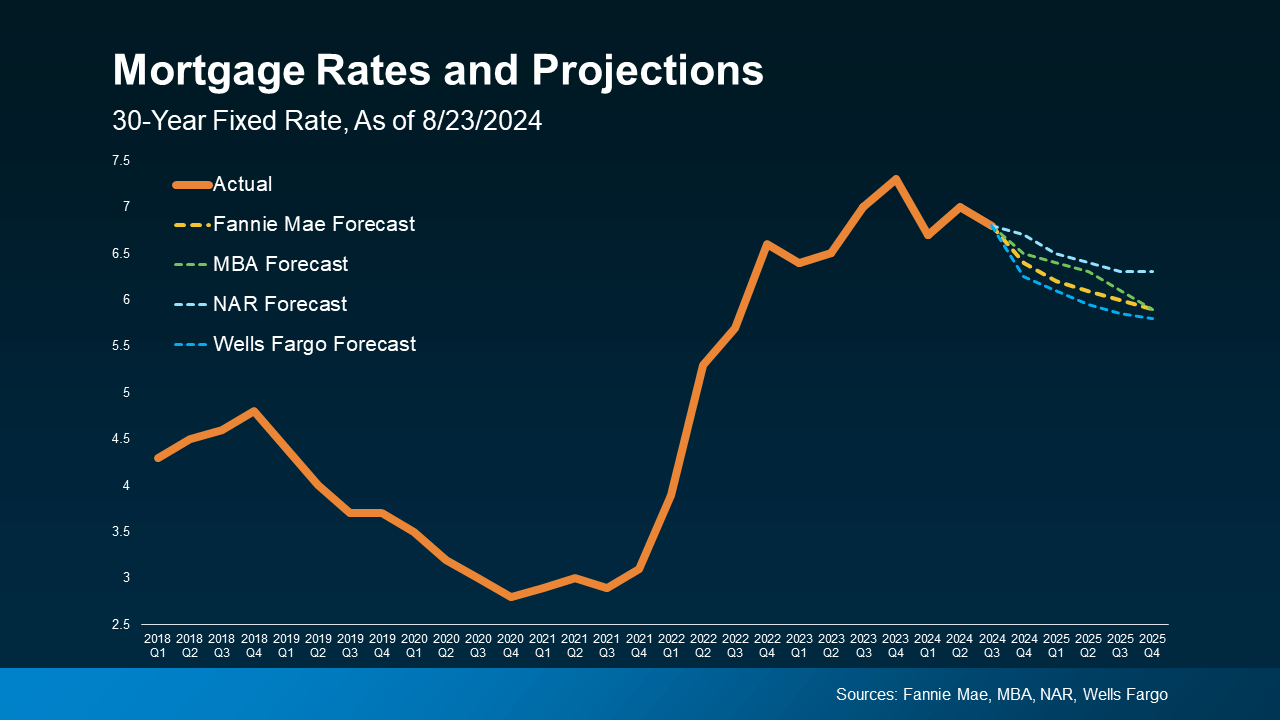

Here’s what experts in the industry project for mortgage rates through 2025. One contributing factor to this ongoing gradual decline is the anticipated cuts from the Fed. The graph below shows the latest forecasts from Fannie Mae, MBA, NAR, and Wells Fargo (see graph below):

So, with recent improvements in inflation and signs of a cooling job market, a Federal Funds Rate cut is likely to lead to a moderate decline in mortgage rates (shown in the dotted lines). Here are two big reasons why that’s good news for both buyers and sellers:

So, with recent improvements in inflation and signs of a cooling job market, a Federal Funds Rate cut is likely to lead to a moderate decline in mortgage rates (shown in the dotted lines). Here are two big reasons why that’s good news for both buyers and sellers:

1. It Helps Alleviate the Lock-In Effect

For current homeowners, lower mortgage rates could help ease the lock-in effect. That’s where people feel stuck within their current home because today’s rates are higher than what they locked in when they bought their current house.

If the fear of losing your low-rate mortgage and facing higher costs has kept you out of the market, a slight reduction in rates could make selling a bit more attractive again. However, this isn’t expected to bring a flood of sellers to the market, as many homeowners may still be cautious about giving up their existing mortgage rate.

2. It Should Boost Buyer Activity

For potential homebuyers, any drop in mortgage rates will provide a more inviting housing market. Lower mortgage rates can reduce the overall cost of homeownership, making it more feasible for you if you’ve been waiting to make a move.

What Should You Do?

While a Federal Funds Rate cut is not expected to lead to drastically lower mortgage rates, it will likely contribute to the gradual decrease that’s already happening.

And while the anticipated rate cut represents a positive shift for the future of the housing market, it’s important to consider your options right now. Jacob Channel, Senior Economist at LendingTree, sums it up well:

“Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.”

The expected Federal Funds Rate cut, driven by improving inflation and slower job growth, is likely to have a positive, though gradual, impact on mortgage rates. That could help unlock opportunities for you. When you’re ready, let’s connect. That way you’ll be prepared to take action when the time is right for you.

How the Federal Reserve’s Next Move Could Impact the Housing Market

The Federal Reserve has long been the most important institution shaping the American economy. Whether you’re buying your first home, selling a property, or even thinking about refinancing, every move the Fed makes reverberates throughout the Housing Market. The big question on everyone’s mind right now: What will the Federal Reserve do next, and how will it ripple through the housing sector?

As you sip your morning coffee, keeping an eye on housing prices and contemplating the cost of homeownership, you might not realize that the decisions made by a roomful of economists in Washington, D.C., could directly influence your next move. Let’s break down how this works.

The Federal Funds Rate and Its Far-Reaching Influence

When we talk about the Fed’s next move, we’re primarily focusing on the Federal Funds Rate. This rate isn’t just some obscure financial term—it’s the bedrock for borrowing costs across the economy. Essentially, it’s the interest rate at which banks lend to each other overnight, and it serves as the baseline for many other interest rates, including those affecting your mortgage.

So, why does the Federal Reserve tinker with this rate? The central bank uses the Federal Funds Rate as a lever to keep inflation in check or to stimulate the economy when it’s slowing down. Lowering the rate encourages borrowing and spending, while raising it reins in inflation by making borrowing more expensive. But here’s where it gets interesting: every tweak the Fed makes sends ripples throughout the Housing Market.

The Impact on Mortgage Rates

One of the most direct ways the Federal Reserve’s decisions affect the Housing Market is through Mortgage Rates. When the Fed hikes the Federal Funds Rate, it pushes up the cost of borrowing money. This translates into higher interest rates for mortgages, meaning you’ll be paying more in interest if you’re in the market for a new home loan.

For instance, let’s say you’re eyeing a cozy West Palm Beach property. If the Fed raises rates, your West Palm Beach mortgage broker might offer you higher rates than you would’ve seen a few months earlier. Suddenly, those once-appealing Affordable West Palm Beach home loans might seem a bit steeper.

Conversely, if the Fed lowers rates, it could drive down Mortgage Rates, potentially offering homebuyers a much more favorable deal. That means lower monthly payments, making the cost of homeownership more affordable for first-time buyers or those looking to upgrade. But the flipside of this equation is that low rates can also spur demand, driving up home prices and making it tougher to find a deal.

So, while lower rates might sound like a win for buyers, they can have unintended consequences that require careful consideration.

How Buyers and Sellers Should Navigate the Changing Landscape

If you’re a homebuyer or seller, the prospect of a rate hike or cut from the Fed should inform your strategy. For buyers and sellers, timing can be everything.

Consider this: if the Fed signals an upcoming rate increase, you might see a rush of sellers to the market trying to offload their properties before higher Mortgage Rates squeeze demand. Simultaneously, buyers might scramble to lock in current rates, creating a short-term surge in activity. This frenetic environment can be both exhilarating and stressful, depending on where you stand in the transaction.

On the other hand, if the Fed suggests a more dovish approach, opting to keep rates low for longer, homebuyers could have more breathing room to secure favorable loans. In such a scenario, First time home buyer loans in West Palm Beach might become more accessible, and competition among buyers could cool, allowing for more thoughtful decision-making.

But don’t get too comfortable—real estate markets are notoriously unpredictable. Even a hint of a rate change can send shockwaves through the market, influencing everything from housing prices to the types of loans buyers are seeking.

The West Palm Beach Factor

Speaking of West Palm Beach, this vibrant coastal city has its own unique housing dynamics. Whether you’re seeking a vacation home, a permanent residence, or looking to refinance, the local market is highly sensitive to interest rate fluctuations. Working with a Local mortgage lender in West Palm Beach who understands these nuances can make all the difference. They can guide you through the process, helping you weigh the pros and cons of locking in a rate or holding out for a potential Fed cut.

And it’s not just residential real estate. The Commercial mortgage broker in West Palm Beach is also keeping a close eye on the Federal Reserve’s next move. Commercial real estate often mirrors trends in the residential sector but with its own set of complexities. Whether you’re developing office space or acquiring a retail property, changes in interest rates can dramatically alter the financial viability of your project.

Refinancing Options and the Fed’s Role

If you already own property, your focus might be on refinancing rather than buying. The impact on mortgage rates here is just as critical. Let’s say you secured a loan at a higher rate a few years ago. If the Fed decides to cut rates, you might want to explore West Palm Beach refinancing options. Lower interest rates could reduce your monthly payments, free up cash, or shorten your loan term.

But what if the Fed hikes rates? In that case, refinancing might not be as attractive, and you’ll need to weigh whether staying with your current mortgage makes more sense financially. Consulting with a West Palm Beach mortgage broker can provide clarity, as they can offer Property loan advice in West Palm Beach tailored to your specific needs.

The Psychological Impact on the Housing Market

Beyond the tangible effects on Mortgage Rates and loan accessibility, the Fed’s decisions also have a psychological impact on the market. The mere suggestion of a rate change can influence buyer and seller behavior, sometimes in unpredictable ways. If buyers believe rates are about to climb, they might rush into the market, creating a temporary bubble. Conversely, if there’s a widespread belief that rates will stay low, some buyers may hold off, waiting for even better deals down the road.

This psychological component can’t be underestimated. Buyers and sellers aren’t just responding to numbers—they’re responding to sentiment, news cycles, and the perception of economic stability. The Federal Reserve wields significant power in shaping this sentiment, making its announcements as much about market psychology as economics.

Mortgage Preapproval in West Palm Beach: Why It Matters More Than Ever

In a market as dynamic as West Palm Beach, getting Mortgage preapproval in West Palm Beach can give you a competitive edge. With uncertainty around every corner, having that preapproval in hand shows sellers that you’re serious and financially capable, which can be a game-changer when multiple offers are on the table.

If the Fed increases rates, that preapproval becomes even more critical. It locks in your ability to borrow at the current rate, shielding you from the potential sting of higher borrowing costs down the road. A savvy buyer will always ensure they’re preapproved before entering negotiations, especially in a market as sensitive to interest rate fluctuations as West Palm Beach.

Navigating the Terrain with Local Expertise

With all this complexity, one thing becomes clear: working with local experts can help you navigate the ever-changing terrain. Whether you’re looking for Affordable West Palm Beach home loans, seeking advice on West Palm Beach mortgage calculators, or needing guidance on West Palm Beach refinancing options, having someone who understands both the national and local landscape is crucial.

The Federal Reserve may be making decisions that affect the entire country, but how those decisions impact your specific market can vary widely. Partnering with a West Palm Beach mortgage broker who’s attuned to both the national trends and local conditions will position you for success, no matter what the Fed does next.

Conclusion: Bracing for the Fed’s Next Move

The Federal Reserve holds a powerful sway over the Housing Market, and its next move could reshape the landscape for both buyers and sellers. Whether you’re a first-time homebuyer, a seasoned investor, or looking to refinance, understanding how the Fed’s decisions affect Mortgage Rates and the cost of homeownership is key to making informed decisions.

West Palm Beach, with its unique real estate market, offers both opportunities and challenges, especially in a rate-sensitive environment. Keeping a close eye on the Fed, working with local experts, and staying informed about your options—from First time home buyer loans in West Palm Beach to Commercial mortgage broker in West Palm Beach services—can help you stay ahead of the curve.

The path forward may be uncertain, but with the right knowledge and the right partners, you can navigate the twists and turns of the Housing Market with confidence.

How to Stay Ahead in a Volatile Housing Market

When dealing with the Housing Market, especially in a dynamic area like West Palm Beach, it’s essential to stay ahead of the curve. The Federal Reserve’s decisions may seem distant, but they have an immediate impact on your wallet, your home search, and your long-term financial plans. Whether you’re considering buying, selling, or refinancing, you need to have a plan that can adapt to the changing economic climate.

One key strategy is to closely monitor not just the Fed’s decisions but also the broader economic indicators that might give you clues about future rate movements. This includes keeping an eye on inflation data, unemployment rates, and consumer spending trends. These are the same factors that influence the Fed’s decision-making process, so being aware of them can give you a head start on predicting where Mortgage Rates might be heading.

For buyers and sellers, staying ahead in the market means knowing when to act. Timing is everything. If the Fed hints at a rate hike, sellers might want to list their homes before higher borrowing costs dampen demand. For buyers, this could mean locking in a rate before it rises, securing a more affordable loan in the process.

Strategies for Homebuyers in a Rising Rate Environment

If you’re a homebuyer facing a rising rate environment, there are still strategies you can employ to make homeownership affordable. One option is to explore different loan types. For example, adjustable-rate mortgages (ARMs) might offer a lower initial rate than fixed-rate mortgages, which could be appealing if you plan to move or refinance in the next few years. However, ARMs come with risks, as rates can increase after the initial fixed period.

Working with a West Palm Beach mortgage broker can help you navigate these options. They’ll be able to provide tailored advice, helping you compare various loan products to find the best fit for your financial situation. Mortgage preapproval in West Palm Beach can also help you in a competitive market. Not only does it show sellers that you’re serious, but it also helps you understand exactly how much you can afford as rates fluctuate.

Another smart move is to utilize West Palm Beach mortgage calculators. These tools allow you to play with different scenarios—such as varying interest rates and down payments—so you can see how changes in the Fed’s policies could affect your monthly payments. It’s all about preparation and understanding your financial position before diving into the market.

Refinancing in a Volatile Market

For current homeowners, refinancing can be a great way to take advantage of favorable rates. However, it’s crucial to time your refinancing just right. If you refinance too early, you might miss out on potential rate cuts. If you wait too long, you could end up locking in a higher rate. Consulting with a Local mortgage lender in West Palm Beach can help you determine the best moment to refinance based on the latest market conditions.

For example, say you bought your home during a period of high-interest rates, and the Fed is now signaling a potential rate cut. This could be an opportune time to explore West Palm Beach refinancing options. Lowering your interest rate can reduce your monthly payment, saving you thousands of dollars over the life of the loan.

But refinancing isn’t just about lowering your rate. It’s also about re-evaluating your loan terms. You might opt to switch from a 30-year mortgage to a 15-year mortgage, shaving off years of payments and potentially saving even more in interest. Again, your West Palm Beach mortgage broker can help you weigh the pros and cons of different refinancing strategies based on your personal financial goals.

The Role of Commercial Real Estate in the Rate Debate

While much of the discussion around the Fed’s impact focuses on residential real estate, Commercial mortgage brokers in West Palm Beach are also paying close attention to the Fed’s moves. Commercial real estate deals often involve much larger sums of money and longer-term loans, meaning that even a small shift in interest rates can have a significant impact on a project’s profitability.

For business owners and investors, understanding how the Fed’s decisions will affect commercial lending is crucial. Just like with residential real estate, higher interest rates can make commercial loans more expensive, potentially deterring investment or forcing businesses to rethink their expansion plans. On the flip side, lower rates can spur commercial development, driving economic growth in areas like West Palm Beach.

But commercial real estate comes with its own set of challenges. Unlike residential mortgages, commercial loans often have shorter terms and balloon payments, meaning that timing a refinancing or loan renewal can be even more critical. That’s why working with an experienced Commercial mortgage broker in West Palm Beach is essential. They can help you navigate the complexities of commercial lending, ensuring that you make informed decisions in a volatile rate environment.

Preparing for the Long Haul: Building Resilience

Whether you’re dealing with residential or commercial real estate, the key to success in a rate-sensitive environment is building financial resilience. This means not only staying informed about the Fed’s moves but also being proactive in managing your finances.

For homeowners, this could mean building up your savings so you’re prepared for unexpected expenses or rate increases. It could also mean exploring options like West Palm Beach refinancing to lower your monthly payments and free up cash flow.

For investors, building resilience might mean diversifying your portfolio to reduce your exposure to interest rate fluctuations. It could also mean being strategic about when and where you invest, focusing on areas like West Palm Beach that are poised for growth even in a challenging economic climate.

Ultimately, resilience is about being prepared for whatever the market throws your way. By staying informed, working with local experts, and having a clear financial plan, you can navigate the ups and downs of the Housing Market with confidence.

Navigating First-Time Homebuyer Challenges

First-time homebuyers face unique challenges in today’s market, especially when the Federal Reserve is in the spotlight. If you’re a first-timer, you might be juggling the excitement of buying your first home with the anxiety of navigating a complex and ever-changing market. The prospect of rate hikes might feel overwhelming, but there are ways to prepare and take advantage of opportunities.

Start by exploring First time home buyer loans in West Palm Beach. Many of these programs are designed to make homeownership more accessible, offering lower down payments and more flexible credit requirements. Additionally, some programs provide assistance with closing costs, which can help ease the financial burden of buying a home in a high-demand market like West Palm Beach.

Getting Mortgage preapproval in West Palm Beach should be at the top of your to-do list. This not only gives you a clear understanding of your budget but also positions you as a serious contender in a competitive market. Sellers are more likely to take you seriously when they see that you’ve already been preapproved for financing, giving you a leg up against other buyers who might be less prepared.

Finally, use tools like West Palm Beach mortgage calculators to better understand the potential financial impact of different loan options. These calculators allow you to compare various scenarios, helping you make an informed decision about the best mortgage for your needs. When the market is volatile, having a clear picture of your financial situation can provide peace of mind and guide your decision-making process.

Final Thoughts: Staying Nimble in an Unpredictable Market

As the Federal Reserve weighs its next move, the Housing Market waits in anticipation. Every shift in the Federal Funds Rate has the potential to reshape the landscape for buyers and sellers, from the cost of homeownership to Mortgage Rates and refinancing options. But while the Fed’s decisions may seem daunting, they also create opportunities for those who are prepared.

Whether you’re buying your first home, looking for the Best mortgage rates in West Palm Beach, or considering a commercial real estate investment, staying informed and working with knowledgeable professionals is key. The Fed may hold significant sway over the market, but with the right strategies and local expertise, you can navigate these changes confidently.

Remember, real estate is a long game. Markets will rise and fall, rates will shift, and economic conditions will change. But by staying nimble, staying informed, and staying prepared, you can position yourself for success, no matter what the Federal Reserve does next.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice