2025 Housing Market Forecast

2025 Housing Market Forecast: What Buyers and Sellers Need to Know

The housing market is always evolving, and as we step into 2025, many are wondering what to expect. Will home prices continue to rise? Is it the best time to buy a home? How will mortgage rates impact affordability? Whether you’re planning to buy a home in 2025, invest, or sell, this forecast will provide insights based on the most trusted sources in real estate.

Expert Home Price Forecasts for 2025

Housing trends are influenced by multiple factors, from economic conditions to buyer demand. Housing market experts predict that home prices will experience moderate growth, but at a slower pace than the rapid appreciation seen in previous years. According to expert home price forecasts, affordability will remain a significant concern, but opportunities will exist for both buyers and sellers.

What Will Influence Home Prices?

- Mortgage rates: While they have fluctuated over the past few years, they are expected to stabilize, making it easier for buyers to enter the market.

- Supply and demand: The number of homes available for sale will impact pricing. In some regions, an influx of houses up for sale may create a more balanced market.

- Regional market variations: Some areas, like West Palm Beach, continue to be hotspots for buyers, particularly those looking for affordable West Palm Beach home loans.

- Inflation and economic stability: Economic conditions will heavily impact the housing market, with inflation playing a crucial role in how much consumers can afford.

- Government policies and incentives: New policies could influence homeownership plans, including tax credits or subsidies for first-time buyers.

The Best Time to Buy a Home in 2025

Timing the market is always a challenge. However, many real estate analysts suggest that the first half of 2025 could be an opportune moment. Here’s why:

- Moderate price increases: Waiting too long could mean paying more as home price forecasts suggest a steady incline.

- More options on the market: There are expected to be more available homes on the market, giving buyers a wider selection.

- Favorable mortgage conditions: With stable mortgage rates, those securing mortgage preapproval in West Palm Beach can lock in competitive financing options.

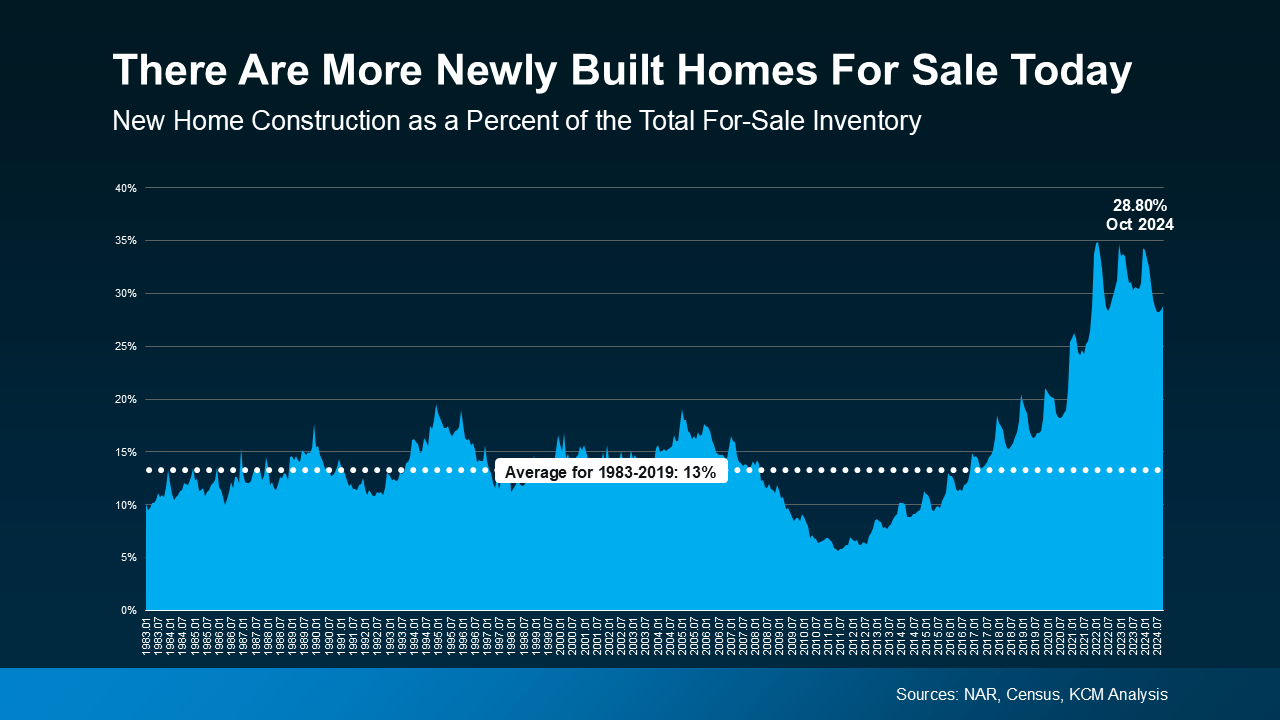

- Increased builder activity: New construction is expected to rise, providing more choices for buyers looking for modern amenities and energy-efficient homes.

- More negotiation power for buyers: With an increase in houses up for sale, buyers may have more leverage to negotiate better deals.

Home Affordability in 2025: Will It Get Easier?

Home affordability is a pressing concern for many, especially first-time buyers. The key to making homeownership plans a reality is securing the right financing. Working with a West Palm Beach mortgage broker can help buyers navigate West Palm Beach mortgage calculators and secure the best mortgage rates in West Palm Beach.

Tips for Making Your Homeownership Dreams a Reality

- Get mortgage preapproval in West Palm Beach early to understand your budget.

- Explore first-time home buyer loans in West Palm Beach to access special financing options.

- Use West Palm Beach mortgage calculators to estimate payments and affordability.

- Compare rates from local mortgage lenders in West Palm Beach for the best deals.

- Work on improving your credit score, as this will directly impact the mortgage rates you qualify for.

- Consider alternative financing options like adjustable-rate mortgages (ARMs) if you plan to move within a few years.

- Look into down payment assistance programs that may be available in your area.

Finding the Right Home in 2025

A successful home search requires strategy and patience. Whether you’re looking at new developments or existing homes available for sale, here are some key steps to consider:

- Define your needs: Prioritize must-have features and location preferences.

- Partner with real estate experts: Work with the most trusted sources in real estate to streamline the process.

- Understand market conditions: Stay updated on housing market trends to make informed decisions.

- Be prepared to act quickly: Competitive markets require fast decision-making when you find the home you love.

- Consider future resale value: Choose locations and home features that will likely appreciate over time.

- Inspect properties thoroughly: Always conduct a home inspection to avoid costly surprises later.

- Be flexible with your search criteria: Expanding your search radius can lead to better deals and more housing options.

West Palm Beach: A Hotspot for Homebuyers in 2025

West Palm Beach remains an attractive market for buyers seeking affordability and quality living. With numerous houses up for sale, buyers can take advantage of various financing options, including:

- Affordable West Palm Beach home loans for budget-conscious buyers.

- West Palm Beach refinancing options for homeowners looking to optimize their mortgage.

- Commercial mortgage broker in West Palm Beach services for those interested in investment properties.

- Property loan advice in West Palm Beach to navigate complex financing scenarios.

- First-time home buyer loans in West Palm Beach designed to help new buyers get into the market with lower down payments.

Mortgage Tips for 2025

Securing a favorable mortgage can make all the difference. Here are some essential mortgage tips for buyers and homeowners in 2025:

- Improve your credit score to qualify for lower rates.

- Compare multiple lenders, including local mortgage lenders in West Palm Beach, to get the best deal.

- Consider different loan types, such as fixed-rate and adjustable-rate mortgages.

- Refinance strategically with West Palm Beach refinancing options if interest rates drop.

- Budget for closing costs, which can be a significant expense.

- Factor in long-term affordability, not just monthly payments.

- Stay informed on market trends to anticipate rate fluctuations.

Final Thoughts: Is 2025 the Right Time to Buy?

Deciding on the time to buy a home is personal and depends on financial readiness, market conditions, and long-term goals. With a strategic approach, buyers can find the right home while sellers can capitalize on market demand.

If you’re considering buying or selling, consulting real estate experts and working with a West Palm Beach mortgage broker can provide valuable guidance. With the right preparation, you can make your homeownership dreams a reality in 2025!

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

To schedule a time to talk with me just click here:

To schedule a time to talk with me just click here:

Apply for a mortgage now at

Apply for a mortgage now at  561-861-3987 or

561-861-3987 or Call me directly

Call me directly  561-861-3987

561-861-3987

or to BUY

or to BUY  , SELL

, SELL  , LEASE

, LEASE  , INVEST

, INVEST  , or BUILD your DREAM HOME

, or BUILD your DREAM HOME  or OFFICE

or OFFICE  , we’ve got you covered! From residential properties

, we’ve got you covered! From residential properties  to commercial real estate & development

to commercial real estate & development  , we provide expert solutions tailored to your needs. Enhance your waterfront property with custom docks

, we provide expert solutions tailored to your needs. Enhance your waterfront property with custom docks  , seawalls

, seawalls

. Need disaster cleanup? Our heavy-duty grapple trucks

. Need disaster cleanup? Our heavy-duty grapple trucks

are ready for storm damage

are ready for storm damage

, fallen debris removal

, fallen debris removal

, and rapid response cleanup

, and rapid response cleanup

. We also specialize in luxury financing for yachts

. We also specialize in luxury financing for yachts  , aircrafts

, aircrafts  , RVs

, RVs  , and exotic cars

, and exotic cars  . Looking for insurance & financial solutions? We offer homeowners & commercial insurance, life insurance, estate planning, and access to top real estate attorneys, CPAs, and financial advisors

. Looking for insurance & financial solutions? We offer homeowners & commercial insurance, life insurance, estate planning, and access to top real estate attorneys, CPAs, and financial advisors  . Call us TODAY

. Call us TODAY

, no matter your NEED

, no matter your NEED  or GOAL

or GOAL  !

!

Christian Penner Personal Site:

Christian Penner Personal Site: Christian Penner’s LinkTree:

Christian Penner’s LinkTree: Helpful Resources & Websites:

Helpful Resources & Websites: Rate Ranges & Trends:

Rate Ranges & Trends: Service Level Agreement (SLA):

Service Level Agreement (SLA): HomeBot Dashboard:

HomeBot Dashboard: Search Homes on HomeBot:

Search Homes on HomeBot: HomeBot App:

HomeBot App: HomeBot Android App:

HomeBot Android App: KCM Video Blog – Market Updates:

KCM Video Blog – Market Updates: KCM Blog – Real Estate News & Trends:

KCM Blog – Real Estate News & Trends: Advanced Search:

Advanced Search: Off-Market Homes:

Off-Market Homes: AMS Google Review:

AMS Google Review:

Privacy Policy & Disclosures:

Privacy Policy & Disclosures: