How Home Equity May Help You Buy Your Next Home in Cash

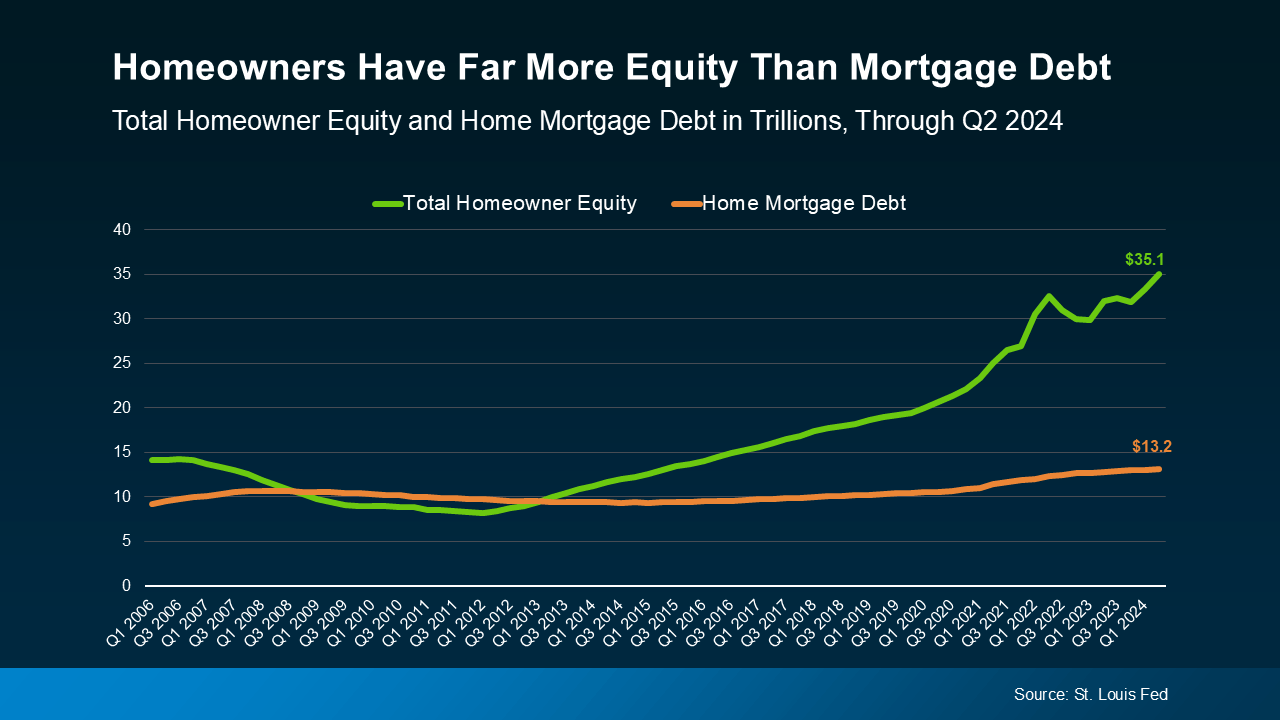

Building equity in your house is one of the biggest financial advantages of homeownership. And right now, homeowners across the country are sitting on record amounts of it.

Here’s a look at how that equity could be a game changer for you, and why it’ll flip your perspective from “Why would I move right now?” to “Why wouldn’t I?”

Home Equity: What Is It?

Home equity is the difference between how much your house is worth and how much you still owe on your mortgage. For example, if your house is valued at $400,000 and you only owe $200,000 on your mortgage, your equity would be $200,000.

Why Equity Is Such a Big Deal for Homeowners Looking To Sell

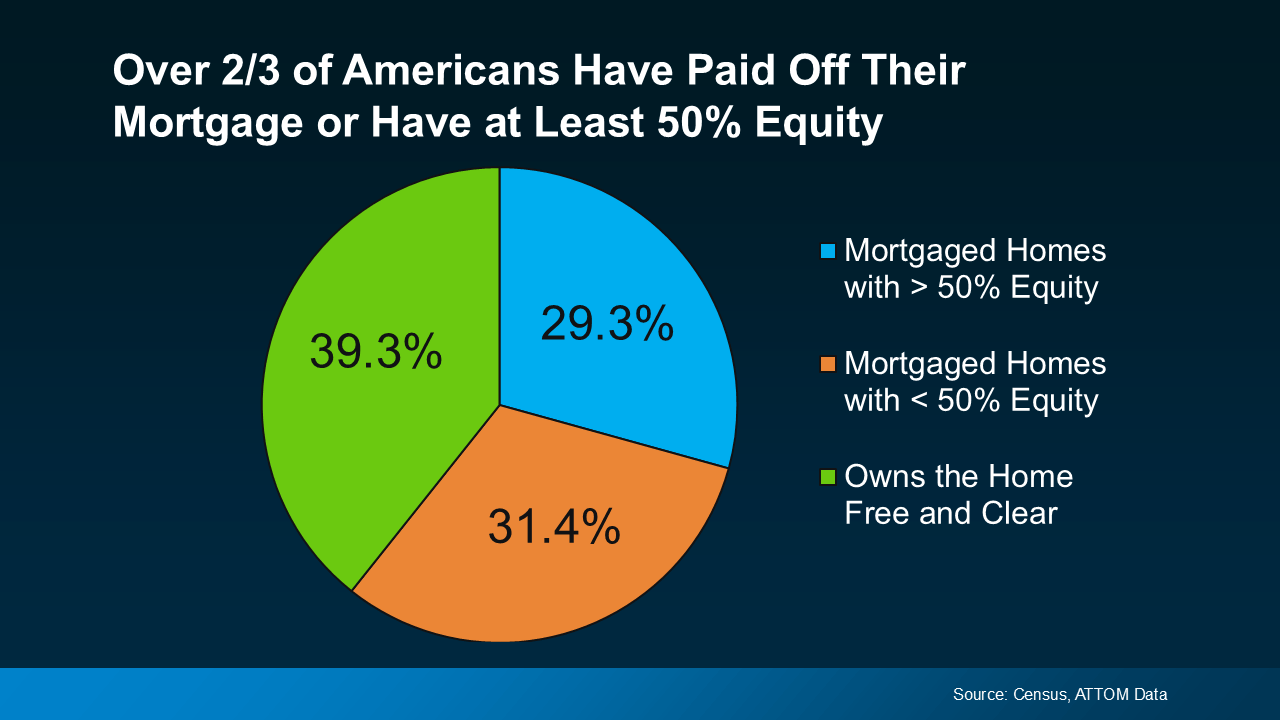

Recent data from the Census and ATTOM shows how significant today’s home equity really is. In fact, more than two out of three homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity in their homes (shown in blue in the chart below):

And that’s a big deal. Think about it: 2 out of 3 homeowners have at least 50% equity in their homes. To put a more tangible number on it so you can think about what that really means for someone like you, CoreLogic shows the average homeowner has $311,000 worth of equity built up. That kind of net worth can go a long way if you’re trying to make a move.

And that’s a big deal. Think about it: 2 out of 3 homeowners have at least 50% equity in their homes. To put a more tangible number on it so you can think about what that really means for someone like you, CoreLogic shows the average homeowner has $311,000 worth of equity built up. That kind of net worth can go a long way if you’re trying to make a move.

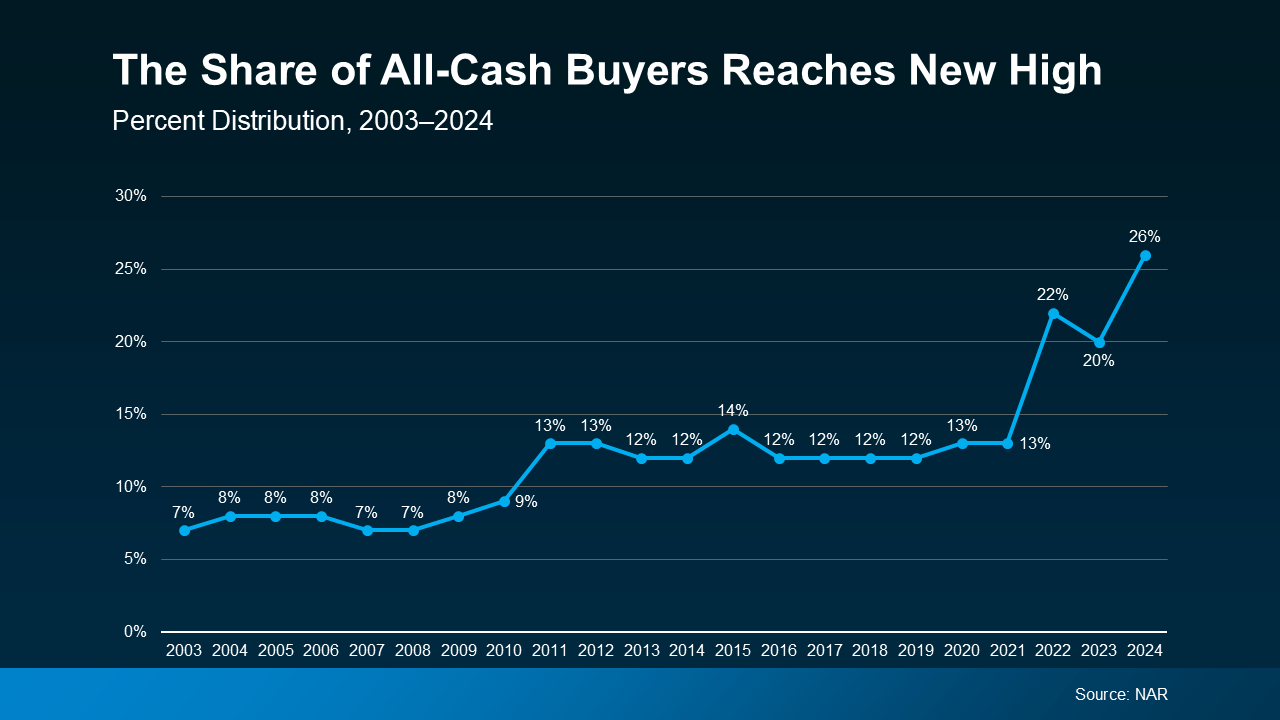

And that’s part of the reason why the share of all-cash buyers recently reached a new high. According to an annual report from the National Association of Realtors (NAR), 26% of buyers were able to buy without a mortgages (see graph below):

Imagine buying your next house in cash. No mortgage. No monthly payment. No interest rate to mess with. If you want to find out how much equity you have to see if that’s an option for you, connect with a real estate agent and ask for a professional equity assessment report (PEAR).

Imagine buying your next house in cash. No mortgage. No monthly payment. No interest rate to mess with. If you want to find out how much equity you have to see if that’s an option for you, connect with a real estate agent and ask for a professional equity assessment report (PEAR).

Who knows, you may find out you have enough equity to buy your next place outright– and with today’s mortgage rates, not having to take out a home loan is pretty incredible. Even if you don’t have enough equity to buy in all cash, you may still have enough to make a larger down payment, which has its own benefits too.

Homeowners have an incredible amount of equity today – and that’s why the share of all-cash buyers is on the rise. To see how much equity you have and talk through how it can help fuel your next move, let’s connect.

How Home Equity May Help You Buy Your Next Home in Cash

Building equity in your house is one of the biggest financial advantages of homeownership. Over time, as you pay down your mortgage and your property appreciates, your home equity grows. This wealth-building tool can be a game changer when it’s time to move. Imagine buying your next house in cash — no mortgage, no monthly payments, and no worries about fluctuating interest rates. Let’s dive into how this works and why today’s home equity could be your golden ticket to a mortgage-free future.

What Is Home Equity?

At its core, home equity is the difference between how much your house is worth and how much you owe on your mortgage. This is often referred to as your “stake” in the property. For example:

- If your house value is $400,000 and you owe $200,000, you have $200,000 in home equity.

- This equity calculation is straightforward but powerful.

According to Census Data and Attom Data, today’s home equity levels are at historic highs. Many homeowners have enough equity to buy their next home outright, eliminating the need for a home loan. It’s not just about the numbers; it’s about the financial advantage that equity provides.

Why Equity Could Be a Game Changer

Let’s explore why equity could be a game changer. Recent data from CoreLogic reveals that the average homeowner has $311,000 in equity. This level of wealth can reshape how you approach your next move. In fact:

- Two out of three homeowners either own their homes outright or have more than 50% equity in their properties.

- The share of all-cash buyers has reached a new high, according to the National Association of Realtors (NAR).

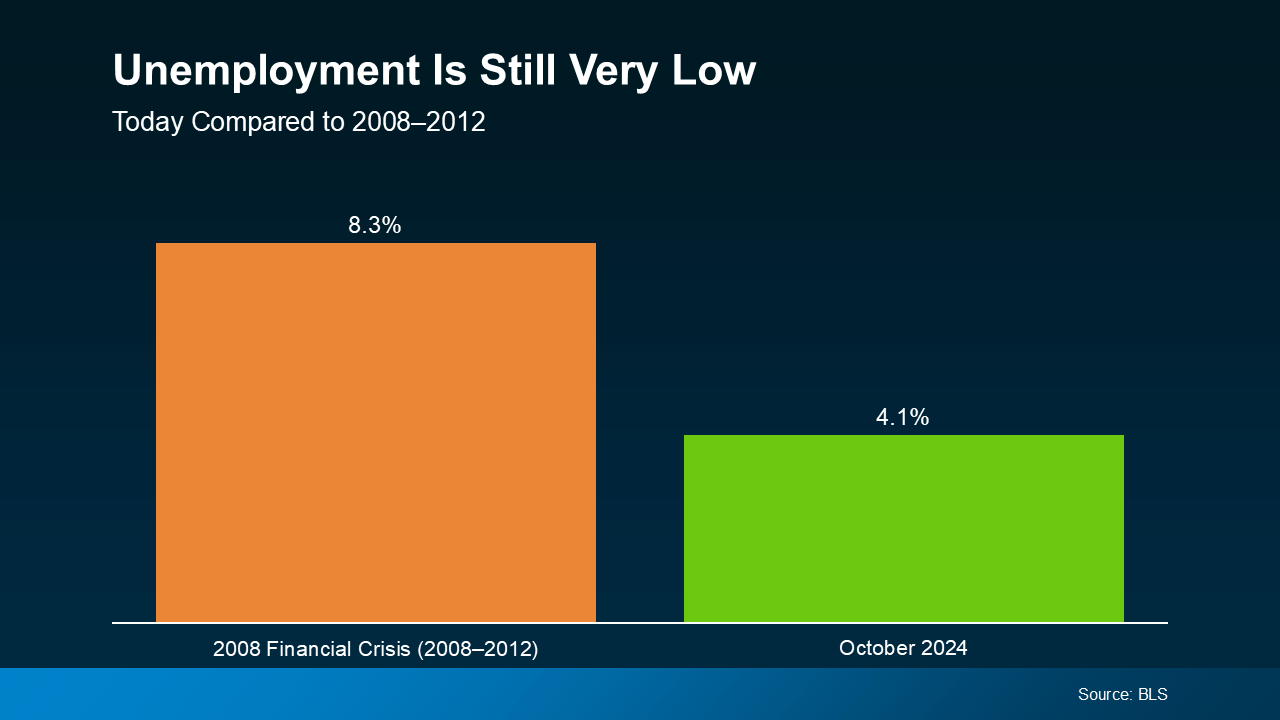

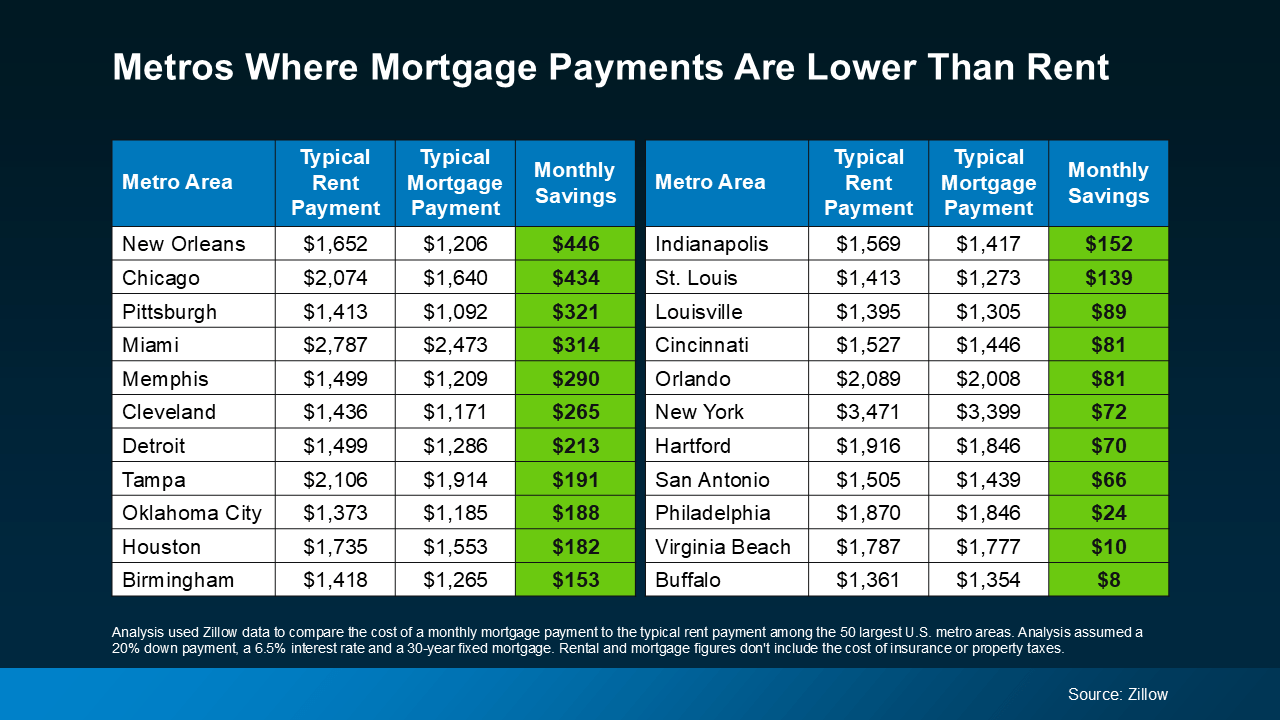

This means a significant portion of buyers are skipping the traditional home loan route altogether. Imagine the freedom of not having to deal with mortgage preapproval in West Palm Beach, finding the best mortgage rates in West Palm Beach, or navigating the complexities of first-time home buyer loans in West Palm Beach. Buying your next house in cash isn’t just a dream; it’s a real possibility for many.

How to Find Out How Much Equity You Have

Before making any decisions, it’s crucial to find out how much equity you have. This involves a few key steps:

- Equity Assessment: Consult a real estate agent or a West Palm Beach mortgage broker for a professional equity assessment report (PEAR). This report provides an accurate snapshot of your house value and how much equity you’ve built.

- Equity Calculation: Use West Palm Beach mortgage calculators to estimate your equity. These tools consider your mortgage balance, property value, and other factors.

- Connect with a Real Estate Agent: A local expert can guide you through the process and help you determine if you have enough equity to buy your next place without a home loan.

The Benefits of Buying Your Next House in Cash

The perks of buying your next house in cash are undeniable. Here are just a few:

- Mortgage-Free Living: No more monthly payments or worrying about interest rates.

- Financial Freedom: Use the money saved on mortgage payments to invest, travel, or simply enjoy life.

- Simplified Transactions: Cash purchases often close faster and come with fewer contingencies.

Even if you don’t have enough equity to buy in all cash, you could make a larger down payment. This reduces your loan amount, potentially qualifying you for affordable West Palm Beach home loans with better terms.

Leveraging Today’s Home Equity in West Palm Beach

For those in sunny South Florida, today’s home equity presents unique opportunities:

- Refinancing Options: Consider West Palm Beach refinancing options to access your equity without selling.

- Local Mortgage Lenders in West Palm Beach: Work with professionals who understand the local housing market.

- Property Loan Advice in West Palm Beach: Whether you’re exploring commercial mortgage brokers in West Palm Beach or seeking guidance on residential moves, local expertise is invaluable.

The Role of Real Estate Agents and Mortgage Brokers

Partnering with a trusted real estate agent or West Palm Beach mortgage broker can streamline your journey. They’ll help you:

- Navigate the housing market.

- Access resources like mortgage calculators and equity assessments.

- Understand home loan alternatives that align with your goals.

Their insights can ensure you’re making informed decisions based on your net worth and financial position.

Equity and Lifestyle Goals

Beyond financial gains, tapping into your home equity can help you align your housing choices with your lifestyle goals. Whether you’re looking for a bigger home for a growing family, downsizing for retirement, or relocating to a dream destination like West Palm Beach, your equity can make those dreams a reality.

- Relocation Freedom: With sufficient equity, moving to a different neighborhood, city, or even state becomes easier.

- Upgrading: Use your equity to buy a larger, more luxurious home without drastically increasing your financial burden.

- Downsizing: For empty nesters, downsizing can free up cash and reduce ongoing expenses, adding to your overall financial advantage.

Real Estate Trends and Equity Utilization

The current housing market offers unique opportunities for those leveraging their home equity. Here are some trends to keep in mind:

- Rising Property Values: Increased home values have contributed to record levels of equity. This trend benefits sellers looking to maximize their returns.

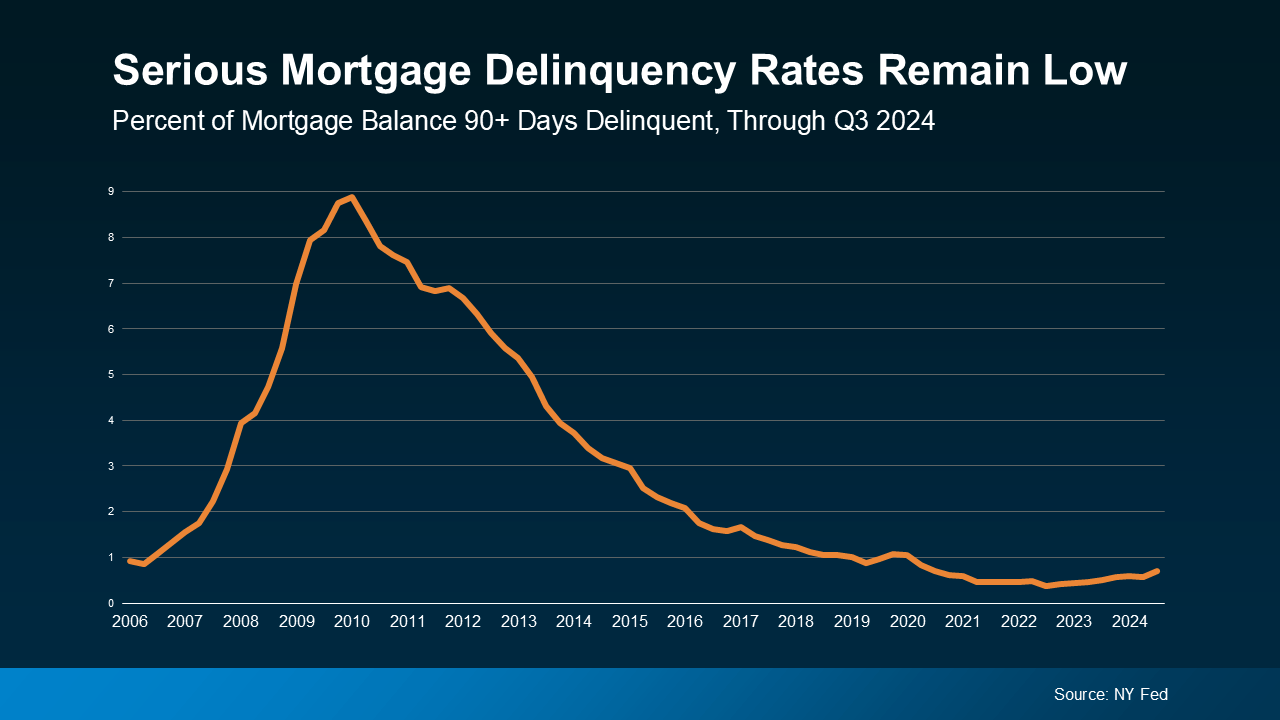

- Interest Rate Sensitivity: While today’s mortgage rates may discourage some buyers, those purchasing in cash can sidestep this challenge entirely.

- All-Cash Buyers on the Rise: With 26% of buyers purchasing homes without a mortgage, this demographic continues to grow, fueled by rising equity and smart financial planning.

Steps to Maximize Your Home Equity

If you’re considering buying your next house in cash, follow these steps to maximize your equity:

- Maintain Your Property: Regular maintenance and strategic renovations can increase your house value, boosting your equity.

- Pay Down Your Mortgage: The faster you reduce your loan balance, the more equity you’ll build.

- Monitor the Market: Keep an eye on property trends in your area, especially in hotspots like West Palm Beach, where rising values can rapidly grow your equity.

The Emotional and Lifestyle Impact of Buying in Cash

Imagine a life free from monthly mortgage payments. The peace of mind that comes with knowing your home is fully paid for extends beyond financial security. Here’s how buying in cash can impact your life:

- Stress Reduction: Eliminate the worry of missed payments or unexpected interest rate hikes.

- Career Flexibility: Without a home loan, you might feel freer to explore career changes or entrepreneurial ventures.

- Enhanced Stability: Owning your home outright can provide a sense of permanence and stability, especially during economic fluctuations.

A Spotlight on West Palm Beach

West Palm Beach offers unique advantages for cash buyers. Known for its vibrant culture, stunning beaches, and strong housing market, this city has become a prime destination for those looking to leverage their home equity.

Whether you’re working with a West Palm Beach mortgage broker to explore home loan alternatives or tapping into your equity to go mortgage-free, the opportunities in this region are unparalleled. From waterfront properties to downtown condos, there’s something for every lifestyle and budget.

Conclusion: Take Action Today

Home equity is more than a number; it’s a gateway to financial independence and flexibility. Whether you’re planning to relocate or invest, the amount of equity today could pave the way for buying your next house in cash. Take the time to find out how much equity you have, explore your options, and connect with experts who can guide you through the process. The freedom of being mortgage-free might be closer than you think.

Don’t wait—consult with a real estate agent, explore your options with a West Palm Beach mortgage broker, and take the first steps toward your next chapter in life.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice