Is a Fixer Upper Right for You?

Looking to buy a home but feeling like almost everything is out of reach? Here’s the thing. There’s still a way to become a homeowner, even when affordability seems like a huge roadblock – and it might be with a fixer upper. Let’s dive into why buying a fixer upper could be your ticket to homeownership and how you can make it work.

What Is a Fixer Upper?

A fixer upper is a home that’s in livable condition but needs some work. The amount of work varies by home – some may need cosmetic updates like wallpaper removal and new flooring, while others might require more extensive repairs like replacing a roof or updating plumbing.

Because they need some elbow grease, these homes typically have a lower price point, based on local market value. In fact, a survey from StorageCafe explains that fixer uppers generally cost about 29% less than move-in-ready homes.

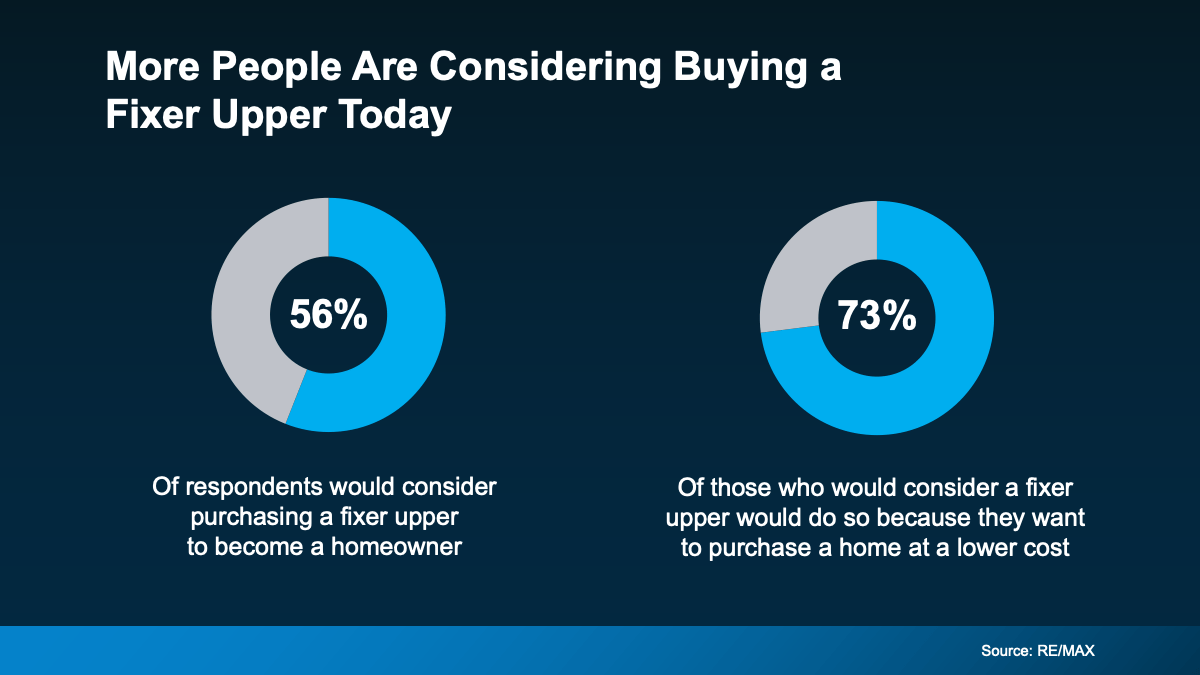

And that’s why, according to a recent survey, more buyers are considering homes that need a little extra work right now (see below):

If you’re looking for an option to get your foot in the door, and you’re willing to roll up your sleeves and do a bit of work, a house with untapped potential may be a good option.

If you’re looking for an option to get your foot in the door, and you’re willing to roll up your sleeves and do a bit of work, a house with untapped potential may be a good option.

Tips for Buying a Home That Needs Some Work

Before you buy a home that may need a makeover, here are a few things to keep in mind:

- Choose a Good Location: You can repair a house, but you can’t change where it is. Make sure the home is in a neighborhood you like or one with increasing property values and a growing number of local amenities. This way, even after you spend money fixing it up, the house will be worth more later.

- Budget for Surprises: Fixing up a house can take more time and money than you might think. Make sure you save room in your budget for unexpected repairs or other unknowns that might come up while you’re working on the house.

- Get a Home Inspection: Before you buy, hire an inspector to check out the house. They’ll help you determine the necessary repairs, so you don’t end up with expensive surprises later.

- Plan Your Priorities: When deciding what to tackle first, it helps to categorize your goals. Think of your home in three ways: the must-haves (essential repairs), the nice-to-haves (upgrades that would make life easier), and the dream-state features (luxuries you can add later). This will help you prioritize and stick to your budget.

Remember, the perfect home is the one you perfect after buying it. By starting with a fixer upper, you have the opportunity to customize a home to your liking while saving money on the initial purchase price. With careful planning, budgeting, and a little bit of vision, you can turn a house that needs some love into your perfect home.

Real estate agents are great at finding homes with potential. They know the local market and can guide you to homes where smart upgrades can add value. With their help, you’re more likely to find a house that fits your total budget and has room for worthwhile improvements.

In today’s market, where the cost of homeownership can be intimidating, finding a move-in-ready home that fits your budget can feel like a real challenge. But if you’re open to putting in a little work, you can transform a fixer upper into your ideal home over time. Let’s explore what’s possible and find a place that’ll work for you.

When it comes to owning a home, the idea of finding a move-in-ready home with everything in pristine condition may seem like the dream. But in today’s competitive housing market, where prices soar and bidding wars are common, buying such a property might feel out of reach. However, there’s an exciting, more affordable option that could bring you closer to homeownership than you think: the fixer upper. This is not only a way to become a homeowner but also an opportunity to shape a home into something truly unique.

In this guide, we’ll delve into whether a fixer upper might be the perfect choice for you, what to consider before diving in, and how to make the most of it. With the right mindset, you might find that a fixer upper could indeed be your ticket to homeownership and, eventually, your ideal home.

What is a Fixer Upper?

Simply put, a fixer upper is a property that’s in livable condition but needs work. Unlike a move-in-ready home, which is polished and primed for immediate enjoyment, a fixer upper typically has quirks or issues that will require attention. These properties are often sold at a lower price point than their fully updated counterparts, which makes them enticing to buyers looking for affordability and customization potential.

A fixer upper might need cosmetic updates—such as a fresh coat of paint, new flooring, or removing old wallpaper—to bring it up to your standards. Some homes might need more serious attention, such as plumbing updates, roof replacement, or even structural repairs.

According to a Storagecafe survey, fixer uppers generally cost about 29% less than move-in-ready homes. This price difference provides not only a more accessible entry point into the market but also flexibility in using the savings for improvements. Buying a fixer upper is an option for those willing to invest time, energy, and a bit of vision into turning an “almost-there” property into your perfect home.

Why Consider a Fixer Upper?

The appeal of a fixer upper lies largely in its potential and affordability. When you buy a home that requires some work, you can benefit in several key ways:

- Customization: Unlike a move-in-ready home, a fixer upper allows you to add personal touches and create a space tailored to your preferences. If you’ve always dreamed of designing your kitchen, redoing a bathroom to suit your style, or adding smart tech upgrades, a fixer upper offers a blank canvas.

- Add Value: By investing in targeted improvements, you can significantly add value to the property, enhancing its local market value and even setting yourself up for a profitable resale in the future. A well-chosen fixer upper in a good location can pay off with increased property values over time.

- Affordability: Many people find that purchasing a fixer upper is the most accessible path to homeownership. By opting for a property that isn’t in perfect condition, you’re often able to buy a home at a lower price point than if you were competing for a pristine, move-in-ready home.

- Opportunity for Smart Upgrades: Making smart upgrades such as energy-efficient windows, modernized fixtures, and upgraded appliances can provide both comfort and cost savings. These upgrades can make the home more sustainable, boosting its appeal in a future resale and enhancing daily life.

Key Factors to Consider

Buying a fixer upper is a big decision, and it’s not for everyone. Before you dive into a renovation project, consider the following key points:

1. Location is Everything

The old adage “location, location, location” rings particularly true with fixer uppers. You can make changes to the home itself, but you can’t alter its location. A property in a good location will typically see property values rise over time, which is crucial if you plan to add value through renovations. Look for areas with rising popularity, increasing local amenities, and a strong sense of community.

2. Understand Your Total Budget

Setting a total budget is essential when purchasing a fixer upper. The purchase price might be lower, but buying a fixer upper means you’ll need to factor in renovation costs. Make sure to budget for essentials as well as potential surprises. Many new buyers overlook the importance of having a budget for surprises, but the truth is, renovations often uncover unexpected expenses, like outdated wiring or unforeseen water damage.

3. Prioritize Repairs and Upgrades

When you’re renovating, it helps to organize your goals into three categories: must-haves (essential repairs), nice-to-haves (upgrades that would enhance daily living), and dream features (luxuries you’d love but could wait on). Prioritizing repairs will help you stay within your total budget while ensuring that the essential repairs are done first.

4. Get a Home Inspection

A home inspection is critical for understanding the true condition of a fixer upper. Before you buy, hire a professional inspector who can identify major repairs or safety issues. An inspection provides a clearer picture of what you’re getting into and might reveal necessary work, from roof replacement to plumbing updates, that could be more costly than anticipated. A detailed inspection ensures there are no major surprises that could throw off your renovation plans.

5. Work with Knowledgeable Real Estate Agents

Real estate agents are invaluable resources when it comes to finding homes with potential. They know the local market inside and out and can help guide you to homes that meet your criteria and budget. An experienced agent will understand local market value and help you assess whether the investment in renovations could yield a good return.

Renovation Tips for Your Fixer Upper

Once you’ve secured your fixer upper and created a realistic budget, it’s time to start transforming the space. Here are some renovation tips to help maximize value and bring out the best in your new home.

Focus on Cosmetic Updates First

Cosmetic updates can have a surprisingly large impact on a home’s look and feel without breaking the bank. Consider refreshing the walls with a fresh coat of paint, replacing old fixtures, or redoing the floors. These small changes can make the property feel newer and cleaner right away. In many cases, cosmetic updates can also increase a home’s appeal and add value when it comes time to sell.

Prioritize Essential Repairs

Addressing essential repairs, such as roof replacement or plumbing updates, is critical to ensure the home is safe and functional. Ignoring these issues can lead to more serious—and more expensive—problems down the line.

Make Smart Upgrades

Smart upgrades are those that improve the functionality and value of the home. Adding energy-efficient appliances, modernizing lighting, and upgrading windows can make your home more comfortable and sustainable. For example, energy-efficient appliances and modern HVAC systems can reduce utility bills, which can be particularly appealing in the warm climate of West Palm Beach.

Financing Options for Fixer Uppers in West Palm Beach

For those considering a fixer upper in West Palm Beach, exploring the various financing options available can be a game changer. There are numerous West Palm Beach mortgage broker options, each offering unique ways to fund your home purchase and renovations.

Affordable West Palm Beach Home Loans

Finding affordable West Palm Beach home loans can make a fixer upper more feasible. Many lenders offer loans that are specifically geared toward buyers planning to make renovations. Consulting a local mortgage lender in West Palm Beach can help you explore options that fit your financial situation, whether you’re looking for the best mortgage rates in West Palm Beach or a first time home buyer loan.

Mortgage Preapproval in West Palm Beach

Before you start shopping for your fixer upper, consider getting a mortgage preapproval in West Palm Beach. A preapproval will not only help you understand how much you can afford but also give you a competitive edge in the market.

Budget-Friendly Renovation Loans

Some loans, like FHA 203(k) loans, are specifically designed for buying a fixer upper and include funds for renovations. These types of loans allow you to purchase a property and finance the repairs within the same mortgage, making it easier to stay within your total budget.

Refinancing Options

For those who already own a home and are interested in refinancing for renovation purposes, there are several West Palm Beach refinancing options available. West Palm Beach mortgage brokers can provide insights into refinancing solutions that may allow you to tap into your home equity and fund upgrades that add value to your property.

Choosing a fixer upper isn’t just a purchase—it’s a journey, and with the right strategy, it’s one that can be both fulfilling and financially rewarding. Finding homes with potential and adding your personal touch can turn a dated property into your perfect home. From working with real estate agents who understand the local market value to securing property loan advice in West Palm Beach, there are many ways to ensure your fixer upper experience is a successful one.

Embracing the process with an open mind, a clear budget, and a vision for the future can truly transform not only the property itself but also your experience of homeownership.

Benefits of Customization with a Fixer Upper

One of the most exciting aspects of choosing a fixer upper is the power to customize your space from the ground up. Unlike a move-in-ready home, which might have been designed with someone else’s tastes in mind, a fixer upper gives you a blank slate to craft a home that reflects your lifestyle and preferences. Here are some ways customization can elevate your fixer upper journey:

Personalize Every Space

With a fixer upper, each room becomes an opportunity to express your individuality. Do you love the modern look of clean lines and open spaces, or are you more drawn to cozy, rustic finishes? Whether you’re designing a minimalist kitchen, installing custom lighting fixtures, or creating a dream bathroom, the freedom to personalize every element is one of the greatest rewards.

Build Functionality Around Your Life

A fixer upper allows you to focus on smart upgrades that enhance the functionality of your space. For example, if you work from home, you can create a dedicated office space with the technology and storage you need. Perhaps you’re a chef at heart—this might be the time to create a kitchen layout tailored to your cooking style.

Add Value Strategically

When thoughtfully executed, these personalized renovations can not only make the home uniquely yours but also add value that aligns with local market demands. For instance, energy-efficient appliances and modern heating and cooling systems are attractive to future buyers and reduce costs in the meantime. These smart upgrades can boost resale value, allowing you to benefit financially down the line.

Challenges to Keep in Mind with Fixer Uppers

Owning a fixer upper can be immensely rewarding, but it comes with its share of challenges. A successful fixer upper project requires careful planning, a willingness to adapt, and a certain level of resilience. Here’s what to keep in mind as you move forward:

1. Time and Patience are Essential

Transforming a fixer upper into your perfect home won’t happen overnight. Depending on the level of repairs and upgrades needed, renovations can take anywhere from a few weeks to several months. Even with the best-laid plans, unexpected challenges may arise, and renovations often take longer than anticipated. Patience and flexibility will be your best assets.

2. Be Prepared to Make Trade-Offs

When working within a total budget, prioritization is key. Sometimes, unexpected repairs will mean reallocating funds from one area to another. You might need to delay a dream upgrade or scale back on certain luxuries until a later date. Prioritizing repairs and distinguishing between essential fixes and cosmetic upgrades will help keep your project on track.

3. Managing Renovation Stress

It’s no secret that renovations can be stressful. Working closely with trusted contractors, setting clear timelines, and communicating openly can help you manage the stress that often accompanies a fixer upper. Breaking down the renovation into smaller, manageable phases can also make the process more enjoyable.

Tips for Financing Your Fixer Upper Project in West Palm Beach

For buyers considering a fixer upper in West Palm Beach, securing the right financing options is critical. West Palm Beach’s mortgage landscape offers various lending solutions designed to support both the purchase and renovation of homes, ensuring that you’re financially prepared for every phase of the project. Here are a few loan types and strategies to explore:

Explore First-Time Home Buyer Loans

If this is your first home purchase, you may be eligible for first-time home buyer loans in West Palm Beach, which can offer favorable terms and lower down payments. These loans are often designed to support buyers in high-demand markets, helping you achieve homeownership even if you don’t have a large down payment.

Consider Local Mortgage Lenders

Working with a local mortgage lender in West Palm Beach can provide unique advantages, including insights into the area’s specific housing needs and market trends. Local lenders often have a stronger understanding of West Palm Beach’s real estate market, enabling them to tailor mortgage solutions to suit your fixer upper ambitions.

Use a Mortgage Calculator for Budget Planning

A West Palm Beach mortgage calculator can be an invaluable tool for budgeting. By plugging in different loan terms and interest rates, you’ll get a clearer picture of monthly payments and how your budget will be impacted over time. This will allow you to assess the feasibility of various financing options before making a decision.

Look into FHA 203(k) Loans

If you’re buying a fixer upper, an FHA 203(k) loan might be your best option. These loans are specifically designed for buyers purchasing homes that need significant repairs, covering both the property’s purchase price and renovation costs. This can simplify financing by consolidating everything into a single mortgage. A West Palm Beach mortgage broker can help determine if this type of loan is right for you.

Check Out West Palm Beach Refinancing Options

If you already own a home in West Palm Beach and want to fund renovations, refinancing can provide the funds you need. West Palm Beach refinancing options allow homeowners to tap into home equity, using those funds to finance home improvements. Refinancing can be especially helpful if you want to undertake larger projects without taking on a separate loan.

The Role of Real Estate Agents in Finding the Right Fixer Upper

A knowledgeable real estate agent can be instrumental in helping you locate the perfect fixer upper. West Palm Beach is a dynamic market, and experienced agents can guide you to homes that meet your criteria, helping you identify properties with the most potential. Here’s how they can assist:

Insights into Local Market Value

Experienced real estate agents have a deep understanding of local market value. They can assess a property’s current worth and its potential after renovations. This knowledge is essential in helping you make smart buying decisions, especially if you’re planning to resell in the future.

Identifying Properties with Potential

Finding homes with potential is an art, and agents often have the best eye for it. They can spot diamonds in the rough—properties that may appear modest but have untapped value due to their location, layout, or architectural features.

Negotiating Favorable Terms

Real estate agents are skilled negotiators and can help you secure favorable terms, potentially saving you thousands on your fixer upper purchase. By leveraging their expertise, you can ensure you’re getting a fair price and have room in your budget for the renovations that will turn the property into your ideal home.

Access to Comprehensive Home Inspections

Many agents work with reputable inspectors who provide thorough home inspections. A comprehensive inspection will reveal any underlying issues, from structural concerns to plumbing updates needed to bring the home up to code. Having this detailed insight allows you to budget accurately and avoid costly surprises later on.

Transforming a Fixer Upper into Your Perfect Home

When the dust settles and the paint dries, the work you put into a fixer upper reveals its true beauty. Through the process of customization, prioritizing essential repairs, and carefully planning upgrades, you have the opportunity to transform a modest property into your perfect home.

There’s something profoundly satisfying about standing in a space you’ve helped shape—a home that reflects your tastes, meets your needs, and has been infused with your energy and vision. Every room you renovate, every fixture you replace, and every wall you paint adds to the story of your home, a testament to the journey you’ve taken toward homeownership.

Conclusion: Making the Fixer Upper Dream a Reality

If you’re ready to take on the challenges and embrace the rewards, a fixer upper can be one of the most fulfilling ways to buy a home. With the right financial strategy, an understanding of local market nuances, and a vision for the future, you can make your dream of owning and creating a unique home a reality.

Whether you’re taking advantage of affordable West Palm Beach home loans, navigating mortgage preapproval in West Palm Beach, or working with a seasoned commercial mortgage broker in West Palm Beach, each step you take brings you closer to your ideal home.

So, if you’re ready to roll up your sleeves, tap into the creativity that homeownership allows, and turn potential into property value, a fixer upper may just be the best way forward in today’s market.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice