Q&A: How Do Presidential Elections Impact the Housing Market?

Some Highlights

- Even if you’re not looking to move right away, you may have questions about how the election will impact the housing market.

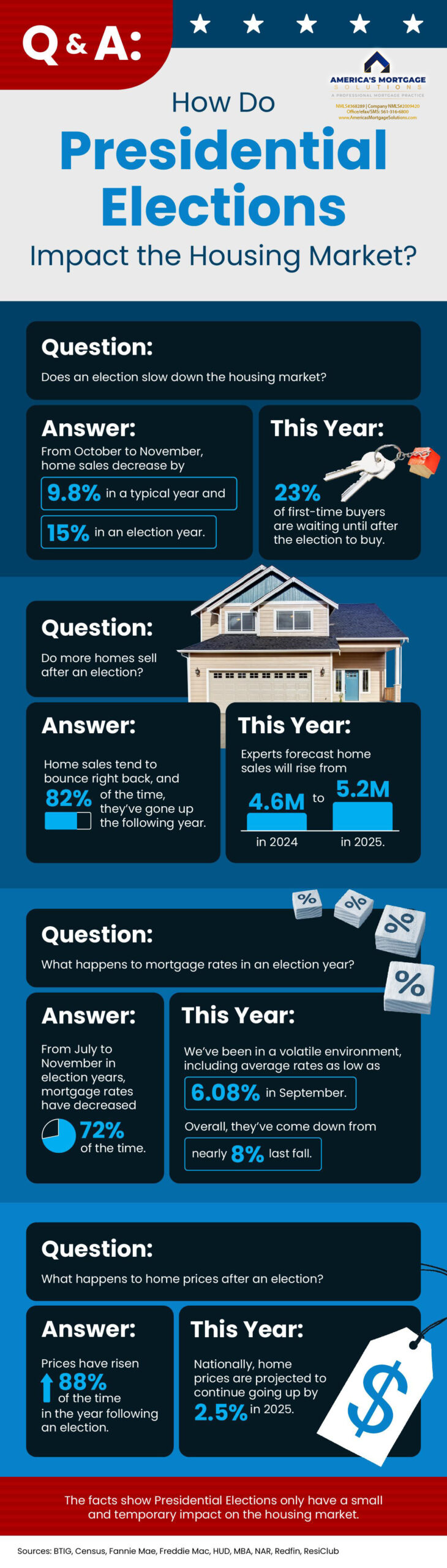

- When we look at historical trends, combined with what’s happening right now, we can find your answers. Based on historical data, mortgage rates decrease in the months before and home prices and sales increase the year after the election.

- The facts show Presidential elections only have a small and temporary impact on the housing market.

Q&A: How Do Presidential Elections Impact the Housing Market?

The buzz surrounding a Presidential election often seems to touch every part of life, from the daily news cycle to dinner table debates. But how does this political excitement truly influence the housing market? Whether you’re a seasoned homeowner, a first-time home buyer in West Palm Beach, or simply curious about the potential changes to home prices and mortgage rates, understanding how these factors shift during an election cycle can help you make informed decisions.

In this article, we’ll answer your most pressing questions about the impact of the election on the housing market. With insights rooted in historical trends and a look at the likely temporary and lasting effects, we’ll explore how home sales, home prices and sales, and even regional markets like West Palm Beach might respond.

1. How Do Presidential Elections Typically Affect the Housing Market?

During election seasons, economic jitters are common. Historical trends show that consumers and businesses alike may hesitate to make large financial moves amid uncertainty about future policies. This pause often extends to the housing market. While real estate isn’t affected to the same extent as sectors like stocks, elections can still bring about subtle, temporary shifts. Specifically, home sales may slow slightly as potential buyers adopt a “wait and see” approach. However, this slowdown is typically brief, and the impact on the housing market usually fades soon after the election.

2. Do Mortgage Rates Change During Election Years?

Mortgage rates are often influenced by economic indicators, which can be volatile in election years. Historical trends suggest that mortgage rates may decrease in the months leading up to the election as the Federal Reserve aims to stabilize the economy and encourage consumer confidence. However, these changes are usually temporary. In regions like West Palm Beach, homeowners may benefit from securing affordable West Palm Beach home loans or even refinancing at best mortgage rates in West Palm Beach during this time. If you’re considering a new property, a mortgage preapproval in West Palm Beach could help you lock in a favorable rate ahead of potential fluctuations.

3. Are There Advantages for First-Time Buyers During an Election Cycle?

For first-time home buyers in West Palm Beach, an election year can present unique opportunities. If the impact on the housing market drives home prices down, this may create a more accessible entry point for new buyers. Home prices and sales often rebound the year following the election, so getting in at a lower price could pay off in the long term. Additionally, West Palm Beach mortgage calculators can help potential buyers estimate their monthly payments and see if it’s feasible to take advantage of first-time home buyer loans in West Palm Beach before rates shift post-election.

4. How Are Home Prices and Sales Affected in West Palm Beach?

In regional markets like West Palm Beach, the impact of national elections is often buffered by local dynamics, but home prices and sales can still experience a temporary lull. In past election years, home prices in some areas have shown a slight decline in the months leading up to the big event, with a steady increase in the year that follows. This cycle means that, while home prices may dip temporarily, buyers looking to settle in a desirable area like West Palm Beach could see a slight reprieve in cost.

For current homeowners, the election year might also be a good time to consider West Palm Beach refinancing options. Locking in a lower interest rate now could offset potential price fluctuations and provide greater financial stability, especially if housing costs begin to rise again in the post-election period.

5. Is It Wise to Wait Until After the Election to Buy a Home?

Timing a home purchase around an election can feel tricky. If you’re debating a move, consider both the historical trends and your personal circumstances. Some experts suggest waiting until after the election when market uncertainty may have decreased. Yet, others argue that, due to the temporary impact of elections, a great deal on a property or a West Palm Beach mortgage broker could be worth pursuing now.

In cities like West Palm Beach, market changes might be more subtle than in other regions, meaning there’s still potential to make a wise investment even in the heat of an election season. Consulting with local mortgage lenders in West Palm Beach can provide insight into current rates and options that may be advantageous during this time.

6. What Should Commercial Buyers Know About the Housing Market During Election Cycles?

For those in commercial real estate, elections can bring a unique set of considerations. In an area like West Palm Beach, which continues to attract business growth, potential buyers may benefit from working with a commercial mortgage broker in West Palm Beach to understand how election outcomes could affect property investments. While commercial buyers are often less influenced by residential shifts, they may find favorable loan terms during the election cycle, especially if mortgage rates temporarily decrease.

7. Why Is the Impact of Elections on the Housing Market Typically Temporary?

The temporary impact of elections on the housing market can be attributed to the resilience of real estate as a long-term investment. Unlike stocks, where election outcomes can trigger immediate swings, real estate tends to weather political changes with minimal volatility. By the time the election dust settles, buyers and sellers often resume their normal pace, and home prices generally stabilize within a few months.

Moreover, in areas like West Palm Beach, where local factors like tourism, economic growth, and seasonal fluctuations play a significant role, the impact of a national election is often dampened by these other forces.

8. How Can Buyers and Sellers in West Palm Beach Prepare for Post-Election Market Changes?

In a market as dynamic as West Palm Beach, a post-election strategy can make a world of difference. Buyers can consider consulting property loan advice in West Palm Beach to get a clear picture of available opportunities and secure favorable terms. Additionally, local mortgage lenders in West Palm Beach offer resources like West Palm Beach mortgage calculators to help buyers anticipate costs more accurately.

For sellers, the post-election period might be an optimal time to put a property on the market, as demand usually increases after the initial hesitation tied to election season fades. Sellers should monitor home sales trends closely, as a post-election surge could potentially drive home prices higher.

The Bottom Line

Elections are part of a broader economic landscape that influences home prices, home sales, and mortgage rates but rarely shifts the housing market in a lasting way. If you’re navigating the West Palm Beach real estate scene, understanding these historical trends and knowing that the impact of the election on the housing market is typically brief can empower you to make decisions with confidence.

Whether you’re eyeing affordable West Palm Beach home loans, seeking the best mortgage rates in West Palm Beach, or exploring West Palm Beach refinancing options, this election cycle presents unique considerations but should not deter a well-timed and informed investment decision.

9. What Are the Pros and Cons of Refinancing During an Election Year?

Refinancing can be a smart move in an election year, especially if mortgage rates are expected to dip in response to market uncertainty. Lower rates may make it possible to reduce monthly payments or shorten a loan term, offering savings over time. For homeowners in West Palm Beach, exploring West Palm Beach refinancing options might be a particularly timely decision, as lenders may offer competitive terms to attract customers in a cautious market.

The benefits of refinancing during an election cycle can be appealing, but it’s essential to weigh the potential risks. While the temporary impact of elections on the housing market might create favorable conditions, there’s always a chance that mortgage rates could climb back up after the election. Consulting with a West Palm Beach mortgage broker or using West Palm Beach mortgage calculators can help you estimate whether refinancing now aligns with your financial goals.

10. How Can a West Palm Beach Mortgage Broker Guide You Through Election-Year Market Trends?

A local mortgage broker can be invaluable during an election cycle, as they understand the nuances of both national trends and specific market conditions in West Palm Beach. A West Palm Beach mortgage broker brings expertise in tracking home prices and sales and can provide personalized advice tailored to your unique situation. Whether you’re considering first-time home buyer loans in West Palm Beach or looking for commercial mortgage options, working with a broker who understands election-driven fluctuations can give you a competitive edge.

Additionally, local brokers often have access to specialized programs like affordable West Palm Beach home loans, which can be advantageous if you’re hoping to take advantage of lower rates in an uncertain economy. By leveraging their knowledge, you can navigate the process with clarity and make confident choices despite any pre-election jitters.

11. What Role Do Local Mortgage Lenders in West Palm Beach Play During Election Season?

Local mortgage lenders in West Palm Beach can provide invaluable insights and products that align with the specific needs of buyers and sellers in the area. During an election year, many lenders adjust their offerings to respond to potential shifts in consumer demand, often presenting options that cater to first-time buyers, experienced homeowners, and investors alike. Working with a lender that understands the election’s impact on the housing market in West Palm Beach is particularly advantageous, as they can offer competitive rates and financing structures to accommodate both immediate and long-term goals.

Lenders may also offer tools like West Palm Beach mortgage calculators to help you plan for the future, assess how a dip or rise in mortgage rates could impact your monthly payments, and ultimately feel more prepared to buy, sell, or refinance in a fluctuating market. For anyone considering a purchase in West Palm Beach, this type of lender guidance can make the difference between a smooth process and one clouded by election-related anxiety.

12. Will the Election Impact Commercial Real Estate Differently Than Residential?

Commercial real estate often reacts differently to political shifts than residential markets, primarily because it’s more sensitive to changes in business and economic policy rather than individual consumer confidence. For those considering commercial properties, working with a commercial mortgage broker in West Palm Beach can be especially useful during election years. Brokers specializing in commercial loans can help you assess how policy changes may affect the market for retail, office, and industrial properties in the coming years.

In West Palm Beach, where commercial development is robust, the election’s temporary impact might present opportunities for business investors looking to secure properties or refinance at favorable rates. In some cases, rates for commercial loans may even be more competitive during election season, allowing investors to lock in a desirable rate before the market readjusts.

13. How Can Buyers and Sellers Maximize Their Success in the Post-Election Market?

Once the election results are in, the housing market usually returns to its regular rhythm. Buyers who have been holding back often re-enter the market, which can lead to an uptick in home sales and, potentially, home prices. For sellers, this post-election period may be ideal to list properties, as motivated buyers could drive demand, lifting home prices in popular areas like West Palm Beach.

For those looking to buy, keeping an eye on mortgage preapproval in West Palm Beach can be advantageous in the post-election market. A preapproval not only shows sellers that you’re serious but also helps you lock in a rate before any increases that might come as the market gains momentum again. Additionally, property loan advice in West Palm Beach can help both buyers and sellers prepare for post-election dynamics, whether it involves securing a loan, negotiating prices, or timing the market for the best possible outcomes.

Key Takeaways

The relationship between Presidential elections and the housing market can feel complex, but in reality, the impact on the housing market is typically mild and short-lived. Here’s a summary of what to keep in mind:

- Mortgage Rates: Rates may temporarily decrease before the election, creating a window for buyers to secure lower costs.

- Home Prices and Sales: Home prices might see a slight dip pre-election, with sales often rebounding in the year following the election.

- West Palm Beach Opportunities: Unique to the area, affordable West Palm Beach home loans and best mortgage rates in West Palm Beach may present buyers with options that cater to local needs.

- Refinancing and Preapprovals: Election years might be a great time for West Palm Beach refinancing options or obtaining a mortgage preapproval in West Palm Beach to lock in favorable terms.

As you navigate the West Palm Beach real estate market during this election cycle, remember that while politics can influence the economy, the housing market remains resilient. Equipped with local mortgage lenders in West Palm Beach and tailored tools like West Palm Beach mortgage calculators, you can confidently move forward, knowing that the election’s temporary impact is just a small chapter in the much larger story of your real estate journey.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice