Should I Rent or Buy a Home?

Some Highlights

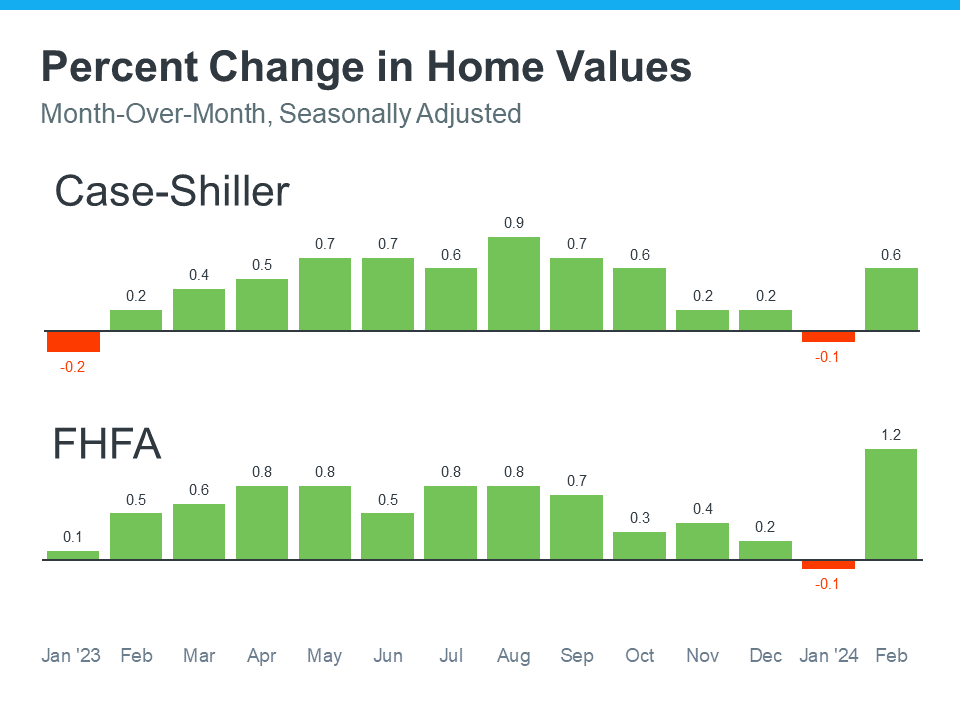

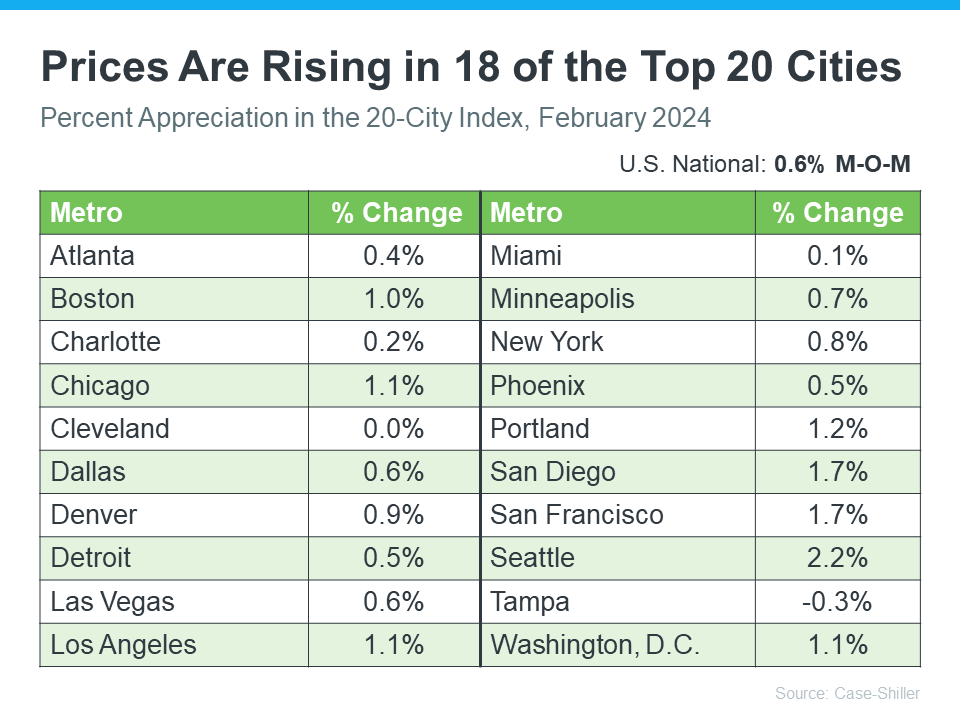

- While renting may be less expensive in some areas right now, there are two big benefits homeownership provides that renting can’t.

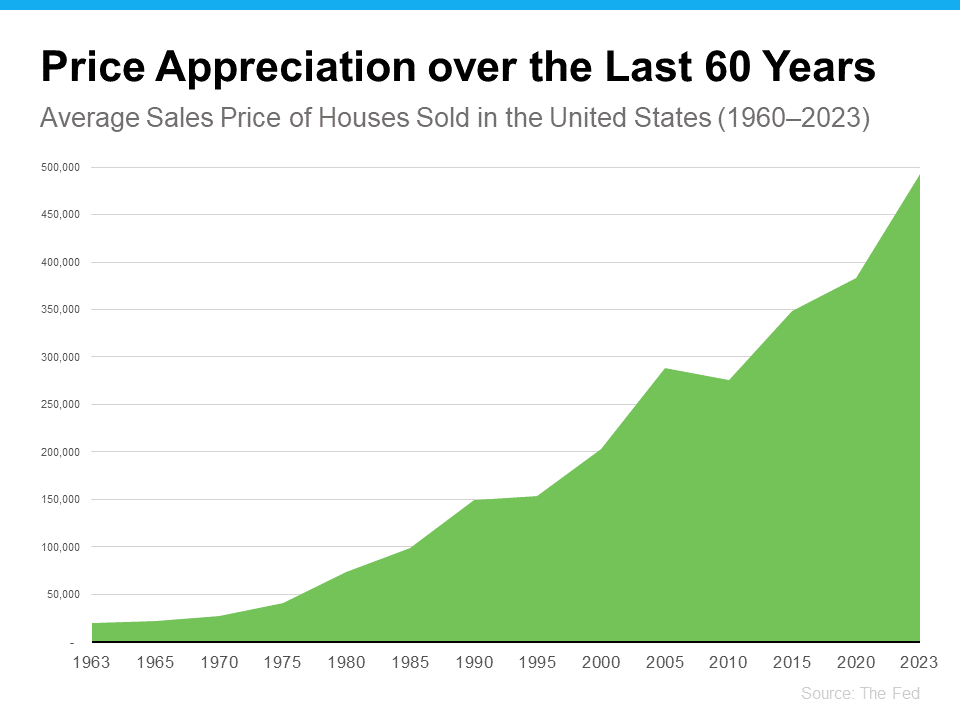

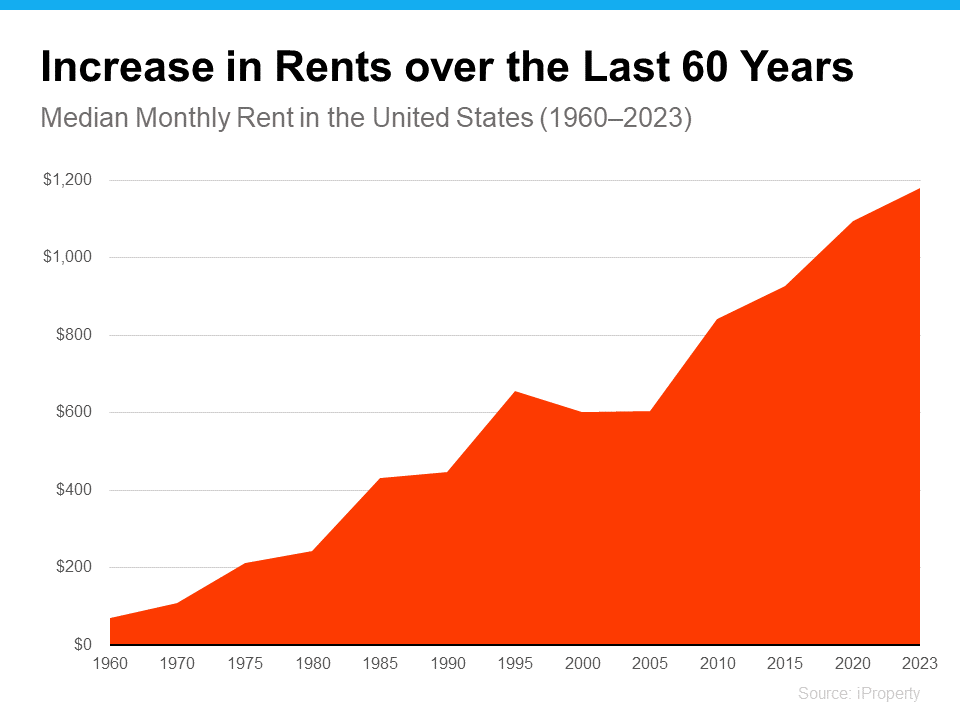

- Owning a home means you get to say goodbye to rising rents and hello to stability. It also gives you the chance to gain equity as home values rise over time.

- If you’re ready to learn more about the perks of owning a home, let’s chat.

The Great Rent vs. Buy Debate: Unpacking the Maze and Finding Your Perfect Place

Ah, the age-old question that has perplexed millennials and baffled boomers alike: rent or buy a home? It’s a pivotal decision, fraught with financial considerations, lifestyle implications, and a healthy dose of emotional yearning. Buying a home can conjure up images of picket fences, backyard barbecues, and generational wealth-building. Renting, on the other hand, might whisper of flexibility, carefree weekends, and the freedom to chase new opportunities. But before you get swept away by romanticized visions (or anxieties!), let’s unpack this labyrinth and help you find the path that leads to your perfect housing situation.

When You Rent:

Imagine life as a renter as a breezy beach vacation. You show up with your swimsuit and flip flops, ready to enjoy the sunshine and the waves. The property manager handles the leaky faucet, the pesky lawnmower, and the ever-increasing property taxes. You get to paint your accent wall sunshine yellow and enjoy the convenience of moving on if a better beach beckons. Here are some of the benefits of renting:

- Flexibility: Feeling the itch to explore a new city or job opportunity? Renting allows you to pack your bags and go without the burden of selling a house.

- Predictable Costs: Rent payments typically remain stable for the lease term, offering a clear picture of your monthly housing expenses.

- Lower Upfront Costs: Security deposits pale in comparison to the down payment required for buying a home.

- Maintenance-Free Living: Got a dripping tap? The responsibility falls on the landlord, freeing up your evenings and weekends.

But hold on a sec, renting isn’t all sunshine and piña coladas. There are some downsides to consider:

- No Equity Gain: The rent you pay each month goes towards someone else’s bottom line, not yours. You won’t be building equity in a property that you can leverage or sell down the line.

- Limited Customization: Want to knock down a wall and create an open floor plan? Probably not going to happen in a rental.

- Potential Rent Increases: While rent typically stays fixed for the lease term, it can rise significantly upon renewal, impacting your budget.

When You Buy:

Owning a home is often likened to planting roots and cultivating a haven. It’s a commitment, but one that can offer stability, a sense of accomplishment, and the potential for long-term financial rewards. Here are some of the advantages of buying:

- With Homeownership You Gain Equity: Every mortgage payment you make contributes to your ownership stake in the property. As home values rise (and with a little TLC on your part), so does your equity, creating a valuable asset.

- Stability and Control: You’re the captain of this ship! You get to paint the walls your favorite shade of purple, renovate the kitchen of your dreams, and enjoy a sense of permanence in your community.

- Potential Tax Advantages: Homeownership comes with tax breaks, such as deductions for mortgage interest and property taxes, which can offer some financial relief.

Homeownership isn’t all sunshine and rainbows either. Here are some things to consider:

- Upfront Costs: Buying a home requires a significant down payment, closing costs, and various homeownership expenses that renters don’t face.

- Transaction Costs: Selling a house involves realtor fees, closing costs, and the potential for market fluctuations that could impact your profit.

- Maintenance Responsibilities: Leaky faucets, malfunctioning appliances, and overgrown lawns? These become your weekend warriors, or require hiring professionals, adding to your financial burden.

So, How Do You Decide?

The answer, my friend, depends on a unique blend of your personal circumstances, financial situation, and future goals. Here are some key questions to ask yourself:

- Lifestyle: Do you crave flexibility and the freedom to move around, or do you yearn for a sense of permanence and the ability to put down roots?

- Finances: Can you comfortably afford the upfront costs and ongoing expenses associated with buying a home? West Palm Beach mortgage brokers can help you assess your affordability and explore options like affordable West Palm Beach home loans or first-time home buyer loans in West Palm Beach.

- Timeline: Do you plan on staying put for the next five to ten years, or is your career path more transient?

Finding Your Perfect Place

Ultimately, the decision of whether to rent or buy a home is a personal one. There’s no right or wrong answer, just the path that leads you to a place

that feels both comfortable and financially sound. Here are some additional tips to help you navigate the maze:

- Do Your Research: Educate yourself on the current housing market in your desired area. West Palm Beach real estate trends, for instance, might be vastly different from the national average. Utilize online resources, attend open houses, and speak to local real estate agents to get a feel for the market.

- Consider All Costs: Don’t just focus on the monthly rent or mortgage payment. Factor in potential maintenance costs, property taxes, homeowners insurance (if buying), and even homeowner association fees (if applicable) for a more holistic picture. Utilize West Palm Beach mortgage calculators to estimate your potential monthly payment and explore options like West Palm Beach refinancing options.

- Get Pre-Approved: If you’re considering buying, secure a mortgage preapproval from a reputable local mortgage lender in West Palm Beach. This will not only solidify your financial standing for sellers but also provide valuable insights into your borrowing power and the price range you should be targeting.

- Seek Professional Help: Don’t be afraid to leverage the expertise of a real estate agent. Whether you’re renting or buying, a good agent can be an invaluable resource, guiding you through the process, negotiating on your behalf, and ensuring a smooth transaction.

Beyond the Binary:

Remember, the world isn’t always black and white. There are situations where renting and buying can co-exist. Perhaps you’re not quite ready to settle down but dream of homeownership someday. Consider a rent-to-own arrangement, where a portion of your rent goes towards eventual ownership. This can be a fantastic option for building equity while enjoying some of the benefits of renting.

The key takeaway? There’s no one-size-fits-all answer. By carefully considering your circumstances, exploring your options, and seeking professional guidance, you can confidently navigate the rent vs. buy debate and find the perfect place to call home, a place that aligns with your lifestyle and empowers you to build a secure and prosperous future.

The Rent vs. Buy Debate: A Deep Dive for West Palm Beach Residents

Now, let’s get a little granular and focus on the unique considerations for residents of the vibrant city of West Palm Beach. The West Palm Beach housing market boasts a dynamic blend of charming neighborhoods, trendy high-rises, and stunning beachfront properties. But with its undeniable allure comes a price tag. Here are some additional factors to consider for West Palm Beach dwellers:

Market Specificity:

- Explosive Growth: West Palm Beach has witnessed significant population growth in recent years, driving up home values and demand. This can be a boon for homeowners looking to build equity, but it also translates to a competitive market for buyers, particularly those seeking affordable West Palm Beach home loans.

- Seasonal Fluctuations: West Palm Beach thrives on tourism, and the housing market reflects this seasonality. Rental prices might spike during peak tourist seasons, while buying opportunities could arise during off-seasons. Consider your personal tolerance for these fluctuations.

Lifestyle Considerations:

- Urban Appeal: West Palm Beach offers a vibrant downtown scene with art galleries, upscale restaurants, and a thriving nightlife. If you crave this urban energy, renting an apartment in the heart of the action might be ideal. Owning a condo downtown can offer the same convenience with the added benefit of building equity.

- Family-Friendly Suburbs: For families seeking a more suburban environment, West Palm Beach offers numerous charming neighborhoods with excellent schools and a strong sense of community. Buying a single-family home in these areas can provide stability and a sense of belonging, but be prepared for potentially higher property taxes and maintenance costs.

Financial Considerations:

- Mortgage Rates: West Palm Beach mortgage rates can be influenced by national trends, but also by local economic factors. Research current rates and explore options with various local mortgage lenders in West Palm Beach. Consider locking in a competitive rate with a West Palm Beach refinancing option if you’re already a homeowner.

- Hidden Costs: Factor in potential association fees, flood insurance (especially in coastal areas), and homeowner association (HOA) regulations if you’re considering buying.

Seeking Expert Guidance:

- Reputable Realtors: Partnering with a knowledgeable West Palm Beach real estate agent can be invaluable. They can navigate the local market intricacies, identify hidden gems, and help you negotiate the best deal, whether you’re renting or buying.

- Mortgage Brokers: A qualified West Palm Beach mortgage broker can shop around for the best mortgage rates in West Palm Beach and tailor a loan package that suits your specific needs and financial situation.

Remember:

The decision to rent or buy a home in West Palm Beach is a deeply personal one. There’s no cookie-cutter solution. By understanding the unique dynamics of the local market, aligning your decision with your lifestyle goals, and seeking professional guidance from real estate agents and mortgage brokers, you can confidently navigate the rent vs. buy debate and find your perfect piece of paradise in the heart of sunny West Palm Beach.

Beyond the Basics: Unconventional Considerations for the Modern Renter or Buyer

The rent vs. buy debate doesn’t end at traditional considerations. Let’s delve into some less-explored factors that might influence your decision:

The Rise of the Sharing Economy:

The sharing economy has disrupted traditional models of ownership. Platforms like Airbnb offer flexible living arrangements for renters, while co-living spaces provide a sense of community and affordability. For potential buyers, house hacking (renting out a portion of your property) can help offset mortgage costs and accelerate equity building.

The Remote Work Revolution:

The rise of remote work has unshackled many individuals from the geographical constraints of traditional jobs. This opens doors for location-independent renters to explore more affordable markets, while remote-working buyers can consider properties outside of bustling city centers.

The Environmental Impact:

Sustainability is a growing concern. Consider the environmental footprint of your choice. Smaller, energy-efficient homes have a lower environmental impact than sprawling estates. Alternatively, renting a LEED-certified building can offer eco-conscious living without the long-term commitment of buying.

The Future of Housing:

The future of housing is constantly evolving. Emerging technologies like 3D-printed homes or modular construction offer intriguing possibilities for affordability and customization. As a renter or buyer, staying informed about these trends can help you make informed decisions for the future.

Remember:

The key isn’t just about making the “right” choice, but about making a well-informed one. Approach the rent vs. buy debate with an open mind, explore unconventional options, and prioritize solutions that align with your evolving needs and values.

Beyond West Palm Beach: A Nationwide Perspective

While the West Palm Beach market provided a specific example, the rent vs. buy debate takes on different nuances across the country. Here are some additional considerations to keep in mind depending on your location:

Cost of Living:

In areas with a high cost of living, renting might be a more economical option, especially if you don’t plan on staying put for a long time. Buying a home in these areas can be a sound investment for long-term wealth building, but the upfront costs can be significant.

Market Volatility:

Some markets experience greater fluctuations in home values than others. If you’re risk-averse, renting might offer more stability. However, for those comfortable with some risk, buying in a volatile market could lead to significant gains down the line, especially if you’re in it for the long haul.

Job Market:

If you work in a field with frequent job changes, renting might provide the flexibility to move quickly for new opportunities. Owning a home in this scenario could mean selling quickly, potentially at a loss depending on the market conditions.

Community and Amenities:

Owning a home in a desirable neighborhood with excellent schools and amenities can significantly improve your quality of life. While renting allows you to explore different neighborhoods, finding a rental in a similar caliber might come at a premium.

Remember:

There’s no magic formula that applies everywhere. By understanding the unique characteristics of your chosen location, you can tailor your decision to the specific market dynamics and ensure your housing choice complements your lifestyle and financial goals.

The Power of Information:

Ultimately, the power to make an informed decision lies in your hands. Utilize online resources, attend local housing seminars, and connect with real estate professionals to gain valuable insights into the market trends and financial implications of renting or buying in your desired location.

The Journey Continues:

The rent vs. buy debate is an ongoing conversation, and the answer might evolve as your circumstances change. Regularly reassess your needs, stay informed about market fluctuations, and don’t be afraid to adjust your course if necessary.

The Takeaway:

Finding your perfect place is a marathon, not a sprint. Embrace the journey, prioritize comprehensive research, and trust your instincts. With a well-informed approach, you’ll unlock the door to a space that reflects your individuality, empowers your dreams, and paves the way for a secure and prosperous future.

The Final Word:

Finding your perfect place, whether rented or owned, is a journey of self-discovery. By delving into your personal circumstances, exploring the intricacies of the local market, and seeking professional guidance, you’ll be well-equipped to navigate the rent vs. buy maze and unlock the door to a space that fosters your dreams and empowers your future.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice