Thinking About Using Your 401(k) To Buy a Home?

Are you dreaming of buying your own home and wondering about how you’ll save for a down payment? You’re not alone. Some people think about tapping into their 401(k) savings to make it happen. But before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert. Here’s why.

The Numbers May Make It Tempting

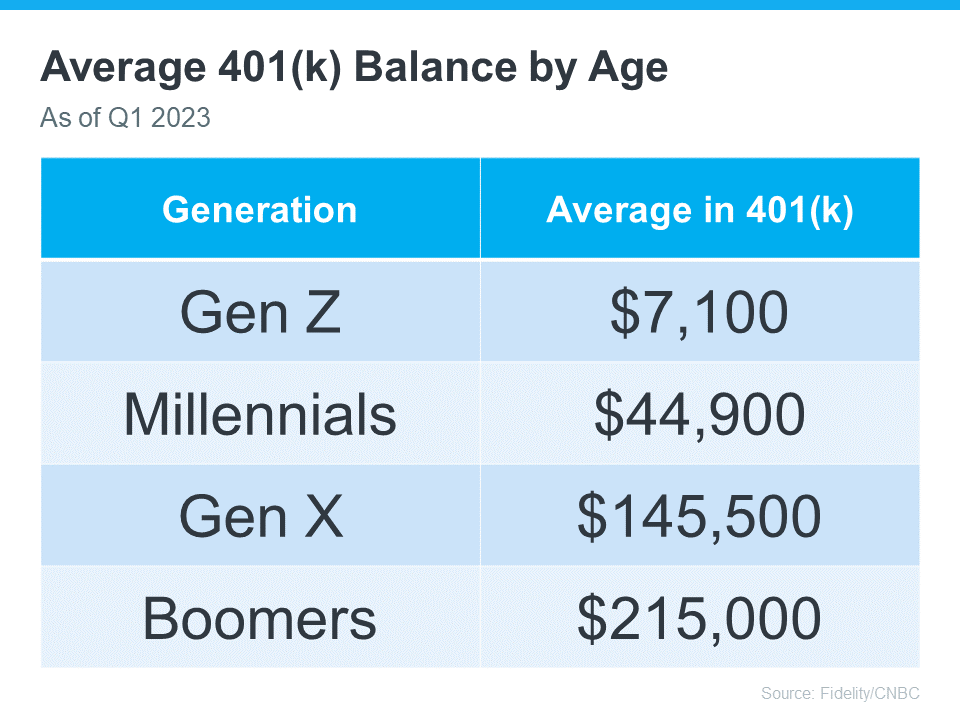

The data shows many Americans have saved a considerable amount for retirement (see chart below):

It can be really tempting when you have a lot of money saved up in your 401(k) and you see your dream home on the horizon. But remember, dipping into your retirement savings for a home could cost you a penalty and affect your finances later on. That’s why it’s important to explore all your options when it comes to saving for a down payment and buying a home. As Experian says:

“It’s possible to use funds from your 401(k) to buy a house, but whether you should depends on several factors, including taxes and penalties, how much you’ve already saved and your unique financial circumstances.”

Alternative Ways To Buy a Home

Using your 401(k) is one way to finance a home, but it’s not the only option. Before you decide, consider a couple of other methods, courtesy of Experian:

- FHA Loan: FHA loans allow qualified buyers to put down as little as 3.5% of the home’s price, depending on their credit scores.

- Down Payment Assistance Programs: There are many national and local programs that can help first-time and repeat homebuyers come up with the necessary down payment.

Above All Else, Have a Plan

No matter what route you take to purchase a home, be sure to talk with a financial expert before you do anything. Working with a team of experts to develop a concrete plan prior to starting your journey to homeownership is the key to success. Kelly Palmer, Founder of The Wealthy Parent, says:

“I have seen parents pausing contributions to their retirement plans in favor of affording a larger home often with the hope they can refinance in the future… As long as there is a tangible plan in place to get back to saving for their retirement goals, I encourage families to consider all their options.”

Unlocking the Door to Homeownership: A Deep Dive into Using Your 401(k) Wisely

In the intricate tapestry of financial planning, the dream of buying your own home often stands as a monumental milestone. For many, this aspiration is accompanied by a conundrum: how to effectively leverage existing assets, such as 401(k)-retirement savings for a home down payment, without compromising long-term financial security.

The Crossroads: Retirement Goals vs. Homeownership Dreams

As we navigate the labyrinth of financial decisions, the intersection of retirement goals and the desire to own a home becomes a focal point. The allure of turning to your 401(k) to buy a house is a siren call for those eager to step into the realm of homeownership. However, the journey warrants meticulous consideration.

Unveiling the Canvas: Home Prices and Financial Landscape

Home prices, like the ebb and flow of tides, dictate the feasibility of this endeavor. In today’s dynamic real estate market, understanding the nuances of financing a home is essential. While traditional routes exist, such as FHA loans, the prospect of tapping into your retirement coffers adds an intriguing layer to the narrative.

The 401(k) Dilemma: Untangling the Threads

401(k)-Retirement Savings for a Home Down Payment: A Viable Strategy?

The idea of utilizing your 401(k) to buy a house is not without its merits. It’s akin to unlocking a hidden treasure chest, providing a substantial sum that could potentially expedite your journey to homeownership. However, the path is fraught with complexities.

On one hand, the allure of a more significant down payment looms large, potentially translating to lower monthly mortgage payments and enhanced financial stability. On the other hand, the long-term repercussions on your retirement nest egg must not be underestimated.

Navigating the Terrain: Financial Expertise and Professional Guidance

In this intricate dance between homeownership aspirations and retirement security, the importance of seeking professional advice cannot be overstated. A prudent step is to talk with a financial expert who can dissect the nuances of your financial landscape.

The Mosaic of Financial Planning: Working with a Financial Professional

To embark on the journey of using your 401(k)-retirement savings for a home, it’s imperative to work with a financial professional. These experts possess the acumen to analyze your unique situation, offering insights that extend beyond the surface-level considerations. Their role is akin to that of a seasoned navigator, steering you through the turbulent seas of financial decisions.

The Tapestry of Considerations: Weaving Homeownership into Your Financial Future

Homeownership and Beyond: Planning for the Future

While the prospect of buying a home is a pivotal chapter, the overarching narrative extends to the entirety of your financial future. Will the decision to leverage your 401(k) for a home lead to a satisfying conclusion, or will it cast a shadow on your retirement goals?

Striking a balance is an art form, and each stroke of financial planning contributes to the masterpiece. It’s not merely about the present desire for homeownership but about crafting a legacy of financial stability that endures.

The Epilogue: Decisions Carved in Financial Stone

In the grand tapestry of financial decisions, contemplating the use of your 401(k) to buy a house is a chapter that demands precision and foresight. The keywords – “buying your own home, retirement savings for a home, 401(k) to buy a house, finance a home, FHA loans, talk with a financial expert, retirement goals, 401(k)-retirement savings for a home down payment, work with a financial professional, homeownership, home prices, buying a home” – are not mere strands but integral threads that weave through this narrative.

As the penultimate decision rests in your hands, the echoes of financial wisdom guide the way. The journey towards homeownership need not be at the expense of your retirement dreams; rather, it should be a harmonious melody that resonates through the corridors of both present and future financial landscapes.

Charting the Course: Mitigating Risks and Maximizing Benefits

As we delve deeper into the labyrinth of using your 401(k) to buy a house, a nuanced understanding of risks and benefits is imperative. The canvas upon which your financial future is painted requires deliberate strokes to achieve both immediate gratification and sustained stability.

The Sirens of Risks: Unveiling the Perils

The Opportunity Cost of Tomorrow for the Dreams of Today

One cannot embark on the quest of homeownership without acknowledging the inherent risks. The primary concern lies in the compromise of retirement goals for the allure of immediate homeownership. The funds withdrawn from your 401(k) are not just dollars; they represent the potential growth that compounds over time, a crucial aspect often underestimated.

Tax Implications: Navigating the Fiscal Maze

The interplay of taxes in the realm of using your 401(k) for a home is akin to a complex dance. While certain withdrawals for a first-time home purchase may escape the punitive early withdrawal penalties, the tax implications are intricate. Understanding the tax ramifications is paramount, as it can significantly impact the net gain from your retirement savings.

The Beacon of Benefits: Illuminating the Path

The Power of a Substantial Down Payment

One of the prominent advantages of tapping into your 401(k)-retirement savings for a home down payment lies in the potential for a substantial upfront investment. A larger down payment can open doors to more favorable financing terms, potentially reducing the overall cost of homeownership in the long run.

Diversification of Investments: A Balancing Act

The very nature of homeownership introduces a unique form of investment diversification. Real estate, as an asset class, can provide a hedge against market volatility. By leveraging your 401(k) for a home, you are essentially broadening the spectrum of your investment portfolio, albeit with a shift in the risk-reward dynamics.

The Symphony of Decision-Making: Harmonizing Short-Term Goals and Long-Term Vision

The Imperative of Holistic Financial Planning

In the pursuit of using your 401(k) to buy a house, the essence lies in holistic financial planning. It’s not a binary decision but rather a symphony of choices that harmonize the present desires with the overarching goals. The conversation must extend beyond the immediate gratification of homeownership to encompass the entire financial landscape.

Seeking Guidance in the Financial Constellation

The Role of a Financial Professional: A North Star in the Night Sky

Navigating the celestial expanse of financial decisions requires a guide, and that guide is often a seasoned financial professional. Their role extends beyond number crunching; it encompasses understanding your aspirations, deciphering the intricate language of the financial markets, and charting a course that aligns with your unique financial constellation.

The Uncharted Territories: Future Considerations

Mitigating Risks: A Contingency Plan

As you contemplate the path of using your 401(k) to buy a house, the creation of a contingency plan becomes paramount. What if the real estate market takes an unexpected turn? What if your employment situation changes? These uncertainties underscore the need for a robust plan that accounts for potential pitfalls.

The Flexibility Factor: Adapting to Changing Circumstances

Flexibility is the linchpin in the dynamic landscape of financial decisions. Life is a tapestry of twists and turns, and a decision made today might need recalibration tomorrow. Being adaptable and open to reassessing your strategy is the hallmark of prudent financial management.

In Conclusion: The Tapestry Unfolds

As we unravel the intricacies of using your 401(k) to buy a house, the narrative transcends mere financial transactions. It’s a tale of balancing dreams and pragmatism, of navigating risks and embracing opportunities. The decision to intertwine homeownership aspirations with retirement goals is a profound one, and each brushstroke on this financial canvas contributes to the masterpiece of your life.

In the final analysis, the keywords – “buying your own home, retirement savings for a home, 401(k) to buy a house, finance a home, FHA loans, talk with a financial expert, retirement goals, 401(k)-retirement savings for a home down payment, work with a financial professional, homeownership, home prices, buying a home” – echo not just as search engine optimizations but as beacons guiding you through the labyrinth of financial choices. The tapestry is yours to weave, and every decision is a thread in the intricate mosaic of your financial journey.

The Unfolding Chapters: A Forward Gaze into Financial Prudence

As we navigate the ever-evolving landscape of financial decisions, it becomes crucial to delve into the subsequent chapters that unfold after the initial decision to use your 401(k) to buy a house is made. Beyond the immediate considerations lie a myriad of factors that shape the ongoing narrative of your financial journey.

Post-Decision Realities: Adapting to New Norms

The Mortgage Odyssey: Navigating Monthly Commitments

The decision to leverage your 401(k) for a home is but a prelude to the ongoing saga of mortgage payments. It’s essential to recalibrate your budget and lifestyle to accommodate these new financial commitments. The initial allure of homeownership may pale if not harmonized with the day-to-day realities of mortgage obligations.

Homeownership Responsibilities: Beyond the Purchase Price

Owning a home is not merely about acquiring a piece of real estate; it comes with a set of responsibilities. Maintenance costs, property taxes, and unforeseen repairs become integral parts of the homeownership equation. Anticipating and planning for these elements is crucial to avoid financial strain in the long term.

The Tapestry of Investment: Monitoring and Adjusting

Evaluating the Investment: Home Equity and Beyond

As the years unfold, your home transforms from a dwelling place to an investment asset. Monitoring the growth of home equity becomes pivotal, especially if the initial decision involved tapping into your 401(k)-retirement savings for a home down payment. The interplay between real estate values and your overall investment portfolio requires vigilant attention.

The Resilience of Retirement Accounts: Rebuilding and Enhancing

Using your 401(k) for a home is not a one-way street; it’s a dynamic process. The subsequent chapters involve not just preserving but enhancing your retirement savings. Contributions, investment strategies, and periodic reassessments become essential to ensure that the decision made today doesn’t compromise the financial security of your tomorrows.

Collaborating with Financial Architects: The Ongoing Role of Experts

Continued Dialogue with Financial Professionals

The relationship with financial professionals doesn’t conclude with the decision to use your 401(k) to buy a house. Instead, it evolves into a continuous dialogue. Regular check-ins, reassessments, and realignments of your financial strategy are integral components of a dynamic partnership aimed at steering your financial ship through the changing tides.

Future Horizons: Reimagining Long-Term Goals

Retirement Reimagined: Balancing Present and Future

The decision to leverage your 401(k) for homeownership invites a reevaluation of retirement goals. What once may have been a linear trajectory now requires a nuanced approach. This involves envisioning not just the dream home but the lifestyle you aspire to lead in your golden years.

Legacy Building: Crafting a Financial Legacy

The chapters post the decision to use your 401(k) to buy a house extend beyond personal aspirations. It’s about legacy building—creating a financial narrative that resonates through generations. The choices made today ripple into the financial future of your heirs, emphasizing the profound impact of each decision.

The Final Tapestry: Reflections on a Financial Journey

As we arrive at the conclusion of this exploration into the intricate dance between homeownership dreams and retirement goals, the tapestry reveals itself as a living, breathing entity. The decision to use your 401(k) to buy a house is not a solitary act but a continuum that demands adaptability, foresight, and ongoing collaboration with financial experts.

In the grand symphony of financial choices, the echo of keywords – “buying your own home, retirement savings for a home, 401(k) to buy a house, finance a home, FHA loans, talk with a financial expert, retirement goals, 401(k)-retirement savings for a home down payment, work with a financial professional, homeownership, home prices, buying a home” – resonates as a melodic reminder. Each word represents not just a search engine algorithm but a thread in the rich tapestry of your financial journey—an intricate story woven with wisdom, prudence, and a keen understanding of the dynamic interplay between dreams and reality.

Bottom Line

In the grand tapestry of financial decisions, using your 401(k) to buy a house is a chapter that demands both attention and introspection. The allure of homeownership, woven with dreams and aspirations, is a compelling force. However, it requires a delicate dance with the intricate threads of your retirement savings.

The bottom line echoes with the necessity for a balanced approach. While the prospect of a substantial down payment and immediate homeownership beckons, the long-term consequences on your retirement goals cannot be overlooked. This is not a decision to be taken lightly but one that necessitates a holistic perspective.

Consulting with a financial professional becomes not just a suggestion but a beacon guiding you through the complexities. Their role is not confined to the initial decision-making but extends into the subsequent chapters, ensuring that the symphony of your financial choices resonates with both present desires and future security.

In the end, as you navigate the terrain of using your 401(k) to buy a house, remember that each decision is a brushstroke on the canvas of your financial masterpiece. It’s a narrative that unfolds over time, requiring adaptability, vigilance, and a commitment to crafting a legacy that extends beyond the immediate gratification of homeownership. The bottom line is not just about unlocking the doors to your dream home but ensuring that those doors open onto a path of enduring financial stability.

Read from source: “Click Me”

Mortgage Brokers in North Palm Beach FL, Christian Penner Mortgage Team, North Palm Beach FL mortgage lender specializes in conventional, FHA, VA, Jumbo and Reverse Mortgages.

Competitive Rates, Apply Today!

America’s Mortgage Solutions, NMLS #: 2009420

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Christian Penner, Branch Manager Mortgage Broker West Palm Beach talks about Real Estate West Palm Beach. He also serves other Local Areas and provides home Mortgage Solutions for Palm Beach Gardens, Jupiter, Boca Raton, Wellington and Tequesta. Christian Penner Mortgage Broker Jupiter has the lowest mortgage rates and the best home mortgage programs like; Jumbo loans, FHA Home Loans, VA Home Loans, Reverse Mortgage Home Loans, Freddie Mac Home Loans, Fannie Mae Home Loans and HARP Mortgage Loans. Christian Penner Mortgage Broker Palm Beach Gardens has Served the area for over 18 years with his Home Loan Lending Needs and Works with The Christian Penner Mortgage Team.

Ask Me About A Mortgage, Palm Beach Mortgage Lender, West Palm Beach Mortgage Lender, Palm Beach Gardens Mortgage Lender.

Christian Penner712 U.S. Highway 1 North #300, North Palm Beach, FL 33408 |

– – –

ChristianPenner.com

– “Thinking About Using Your 401(k) To Buy a Home?” –

The Christian Penner Mortgage Team | Cell/Text: (561) 316-6800