The Real Benefits of Buying a Home This Year

Have you been wondering whether you should keep renting or finally make the leap into homeownership? It’s a big decision, and let’s be real — renting can feel like the easier option, especially if buying a home feels out of reach.

But here’s the thing: a recent report from Bank of America highlights that 70% of prospective buyers fear the long-term consequences of renting, including not building equity and dealing with rising rents.

Maybe you’re feeling that too — concerned about where renting might leave you down the road, but still unsure if you’d even be able to buy right now. The truth is, if you’re able to make the numbers work, buying a home has powerful long-term financial benefits.

Let’s break down why homeownership is worth considering in 2025 and beyond, and how it can help set you up for the future.

Buying Builds Wealth Over Time

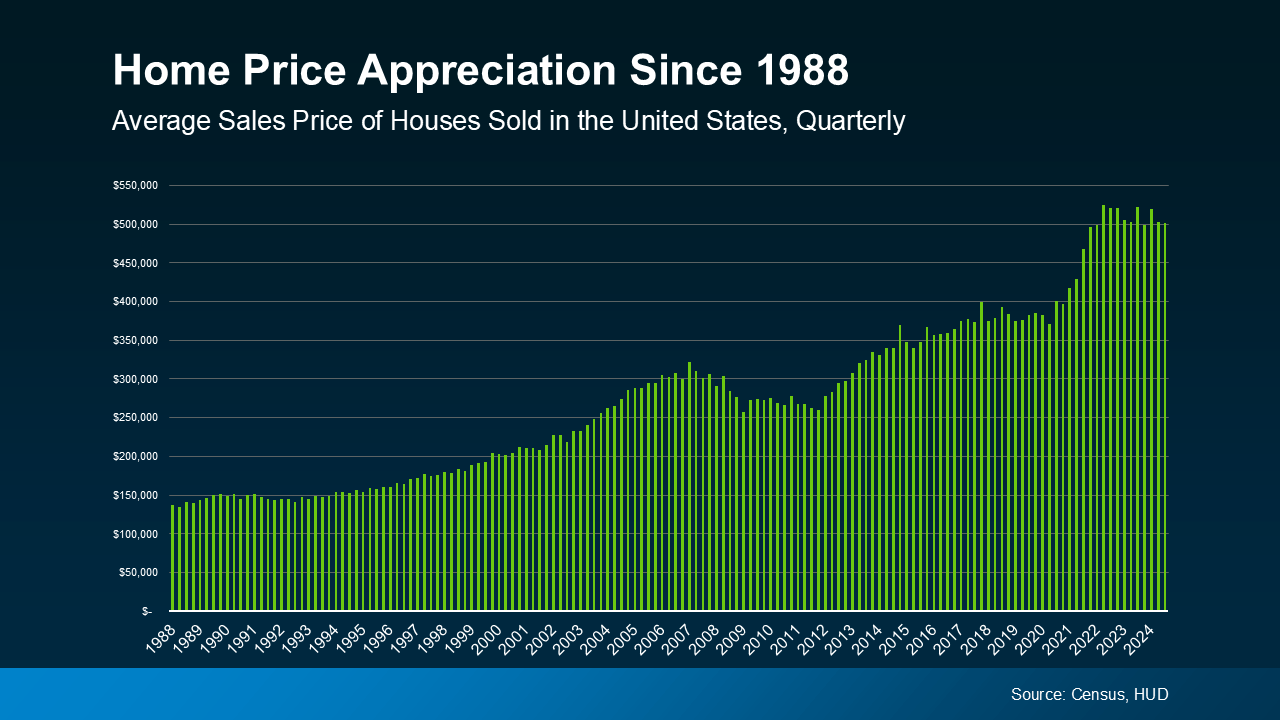

Buying a home allows you to turn your monthly housing costs into a long-term investment. That’s because, as shown in data from the Census and the Department of Housing and Urban Development (HUD), home prices tend to increase over time (see graph below):

Rising home prices directly benefit homeowners. That’s because when you own a home, you build equity — meaning your ownership stake in your home grows as you pay down your mortgage and your home’s value appreciates. And that, in turn, makes your net worth grow too.

Rising home prices directly benefit homeowners. That’s because when you own a home, you build equity — meaning your ownership stake in your home grows as you pay down your mortgage and your home’s value appreciates. And that, in turn, makes your net worth grow too.

Maybe that’s why, according to the National Association of Realtors (NAR), 79% of buyers believe owning a home is a good financial investment.

Renting Comes with Rising Costs

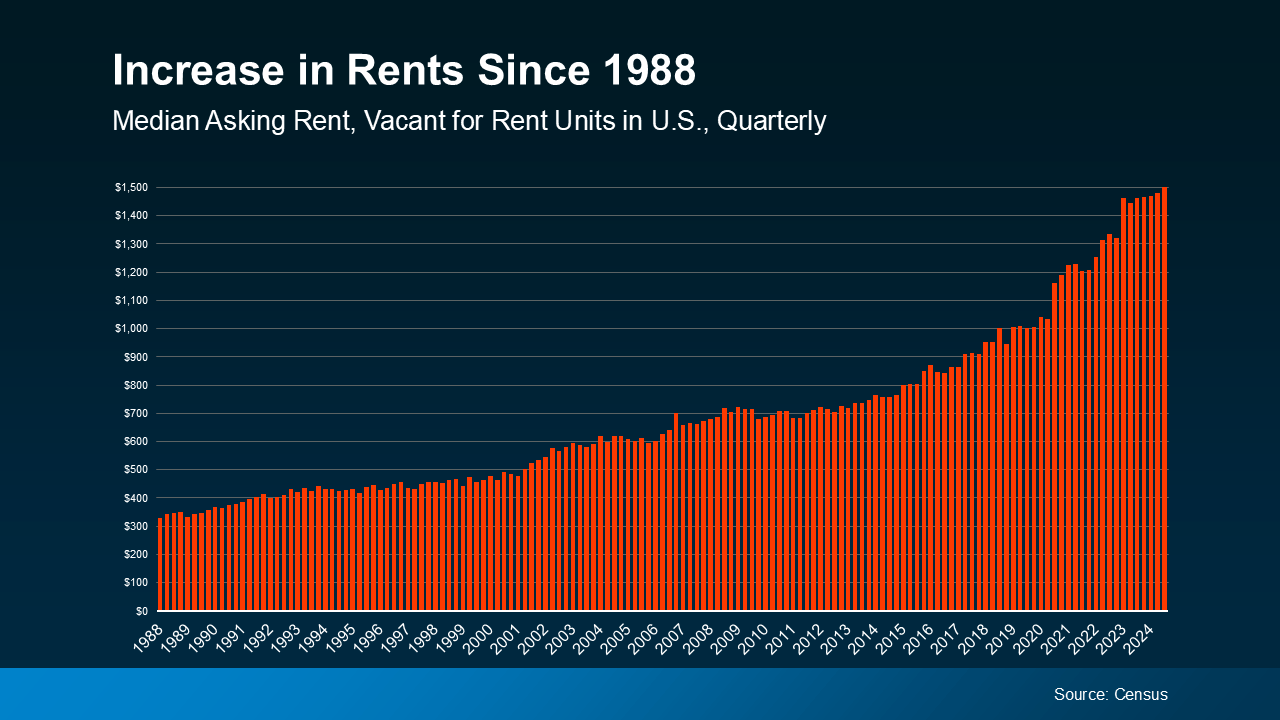

Renting may feel more affordable in the short term, especially right now with today’s home prices and mortgage rates. But the reality is, over time, rent almost always goes up too. Take a look at the data and you can see that play out. According to Census data, rents have significantly increased over the decades (see graph below):

This means if you decide to rent, you’ll likely face growing expenses each time you renew or sign a new lease – and that’ll happen without building any wealth in return. Plus, those rising costs may make it harder to save up to buy a home down the road.

This means if you decide to rent, you’ll likely face growing expenses each time you renew or sign a new lease – and that’ll happen without building any wealth in return. Plus, those rising costs may make it harder to save up to buy a home down the road.

Renting vs. Buying: The Long-Term Impact

When you own a home, your payments are an investment in your future. Renting, on the other hand, means your money is gone for good — it helps your landlord build equity, not you.

Renting works for those not ready (or able) to buy today. But if you are able to make the numbers work, buying a home builds equity and sets you up for long-term financial success. So, even though renting may seem easier now, it can’t match the benefits of homeownership.

If you can afford it, take control of your financial future by making homeownership part of your plan. It’s an investment you won’t regret.

Do you want to see what starter homes are available in our market? Let’s connect today to explore your options.

The Real Benefits Of Buying A Home This Year

The decision to buy a home is one of the most significant financial moves you’ll ever make. Whether you’re a first-time buyer or considering upgrading, stepping into homeownership unlocks a world of financial and personal opportunities. While renting can seem like the easier option, it comes with its own challenges, like rising rents and lack of long-term financial return.

If you’re on the fence about making the transition from renting to owning a home, let’s break down the long-term benefits and why now is the right time to take the plunge.

1. Wealth Building Through Homeownership

One of the biggest benefits of homeownership is its ability to help you accumulate wealth over time. Unlike rent, which disappears into your landlord’s pocket, your mortgage payments contribute to building equity—increasing your net worth year after year.

According to Census Data, the median net worth of homeowners is significantly higher than that of renters. The Department of Housing and Urban Development (HUD) confirms that home values tend to appreciate, meaning your investment grows. This makes buying a home a good financial investment that can set you up for future success.

Beyond financial gains, owning a home provides a sense of stability, security, and pride. Unlike renting, where rules and lease terms can change at any time, homeownership allows you to establish roots, personalize your space, and create lasting memories.

Additionally, homeownership can offer a hedge against inflation. As the economy experiences fluctuations, real estate remains a relatively stable asset that appreciates over time, safeguarding your purchasing power.

2. Stabilizing Your Housing Costs

Today’s home prices may seem daunting, but in the long run, owning a home provides more financial stability compared to renting. With a fixed-rate mortgage, your monthly payments remain predictable, whereas rent increases are almost inevitable.

According to the National Association of Realtors (NAR), rents have been steadily increasing over the years. This means that every lease renewal comes with the risk of higher housing costs, making it harder to budget and save. By locking in a mortgage rate, you protect yourself from unpredictable rent hikes, making homeownership a smart move.

In addition to predictable housing expenses, homeownership allows you to invest in improvements and upgrades that enhance the functionality and aesthetic appeal of your living space. Unlike renting, where renovations are limited to landlord approvals, owning a home gives you complete creative control.

3. Building Equity and Increasing Property Value

Every mortgage payment contributes to building equity, which is the difference between your property value and the remaining balance on your mortgage. This equity acts as a financial safety net, giving you the flexibility to borrow against it for major expenses like home renovations or education.

Additionally, your home’s value appreciates over time. The real estate market historically trends upward, meaning that your home could be worth significantly more in the future than what you paid for it. This appreciation adds to your overall financial security, making homeownership a powerful wealth-building tool.

Furthermore, homeowners can leverage their accumulated equity through home equity loans or lines of credit, which can be used for various financial needs such as medical expenses, investment opportunities, or even funding a small business. Having this asset provides a level of financial flexibility that renters simply do not have.

4. Homeownership as a Long-Term Financial Investment

Buying a home is not just about having a place to live; it’s a financial investment in your future. Here’s why:

- Tax Benefits – Homeowners can deduct mortgage interest and property taxes, saving thousands annually.

- Forced Savings – Every mortgage payment is an investment in your future, unlike rent, which is a sunk cost.

- Retirement Security – By the time you retire, your home could be fully paid off, eliminating housing expenses in your later years.

- Generational Wealth – A home can be passed down to family members, ensuring financial stability for future generations.

- Diversified Investments – Real estate provides a tangible asset that diversifies your investment portfolio and reduces financial risk.

When compared to renting, where every payment benefits your landlord, owning a home puts you on a path to long-term financial security.

5. West Palm Beach: A Great Market for Homeownership

If you’re considering buying a home, now is the time to explore homes available in our market. West Palm Beach offers incredible opportunities for both first-time buyers and seasoned investors. With the help of a West Palm Beach mortgage broker, you can find affordable West Palm Beach home loans tailored to your needs.

Here’s what West Palm Beach offers for homebuyers:

- Best mortgage rates in West Palm Beach for competitive financing options.

- First-time home buyer loans in West Palm Beach for those new to homeownership.

- West Palm Beach refinancing options to help you lower your existing mortgage rate.

- Local mortgage lenders in West Palm Beach who understand the nuances of the area.

- West Palm Beach mortgage calculators to help you determine affordability.

- Property loan advice in West Palm Beach to guide you through the process.

- Commercial mortgage broker in West Palm Beach for business-related property investments.

- Mortgage preapproval in West Palm Beach to give you an advantage in a competitive real estate market.

With the right resources and expert guidance, buying a home in West Palm Beach can be a smooth and rewarding experience. The city’s vibrant lifestyle, strong economy, and beautiful surroundings make it an ideal place to put down roots.

Bottom Line: Is Now the Right Time to Buy?

The advantages of owning a home are undeniable. From building equity to stabilizing housing costs, homeownership offers long-term financial security. While today’s home prices may seem high, the reality is that they will likely continue to rise, making now a strategic time to buy a home.

If you’re ready to take control of your financial future, connect with a West Palm Beach mortgage broker today. Explore affordable West Palm Beach home loans, compare the best mortgage rates in West Palm Beach, and secure your place in a thriving real estate market.

Your dream home—and a brighter financial future—awaits.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice