What Are Experts Saying About the Spring Housing Market?

If you’re planning to move soon, you might be wondering if there’ll be more homes to choose from, where prices and mortgage rates are headed, and how to navigate today’s market. If so, here’s what the professionals are saying about what’s in store for this season.

Odeta Kushi, Deputy Chief Economist, First American:

“. . . it seems our general expectation for the spring is that we will see a pickup in inventory. In fact, that already seems to be happening. But it won’t necessarily be enough to satiate demand.”

Lisa Sturtevant, Chief Economist, Bright MLS:

“There is still strong demand, as the large millennial population remains in the prime first-time homebuying range.”

Danielle Hale, Chief Economist, Realtor.com:

“Where we are right now is the best of both worlds. Price increases are slowing, which is good for buyers, and prices are still relatively high, which is good for sellers.”

Skylar Olsen, Chief Economist, Zillow:

“There are slightly more homes for sale than this time last year, and there is still plenty of competition for well-priced houses. Buyers should prep their credit scores and sellers should prep their properties now, attractive listings are going pending in less than a month, and time on market will shrink in the weeks ahead.”

Jiayi Xu, Economist, Realtor.com:

“While mortgage rates remain elevated, home shoppers who are looking to buy this spring could find more affordable homes on the market than they saw at the same time last year. Specifically, there were 20.6% more homes available for sale ranging between $200,000 and $350,000 in February 2024 than a year ago, surpassing growth in other price ranges.”

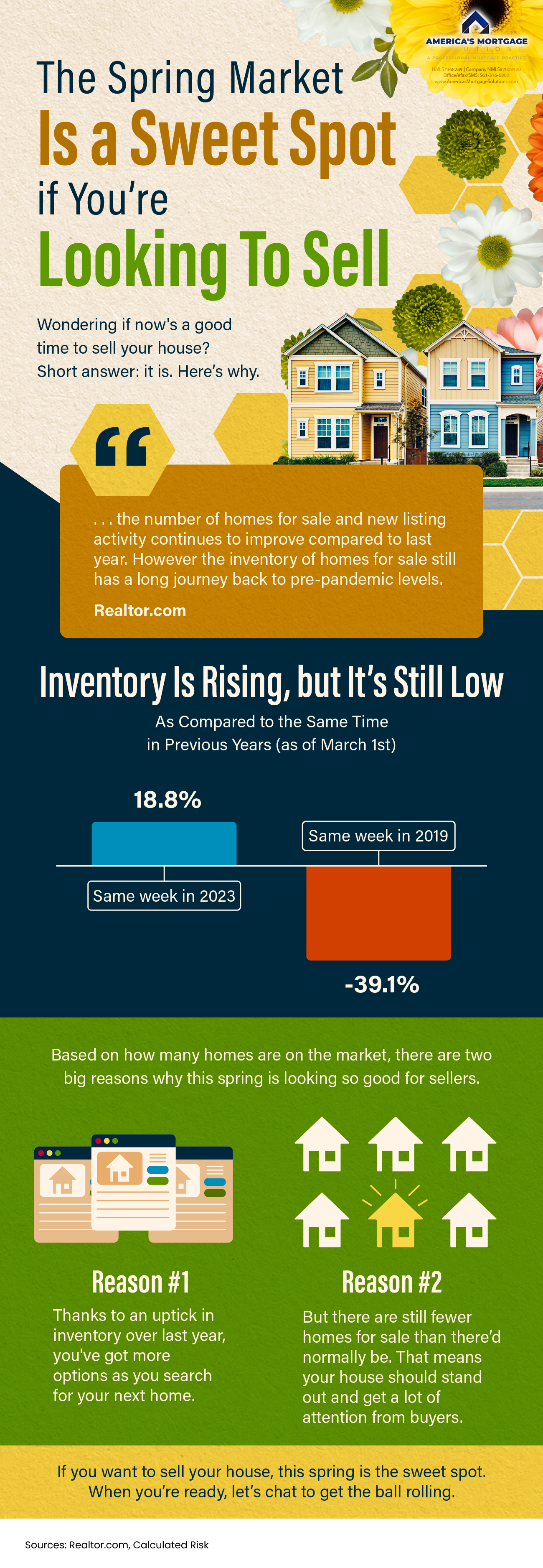

If you’re looking to sell, this spring might be your sweet spot because there just aren’t many homes on the market. Sure, inventory is rising, but it’s nowhere near enough to meet today’s buyer demand. That’s why they’re still selling so quickly.

If you’re looking to buy, the growing number of homes for sale this spring means you’ll have more choices than this time last year. But be prepared to move quickly since there’ll be plenty of competition with other buyers.

No matter what you’re planning, let’s team up to confidently navigate the busy spring housing market.

What Are Experts Saying About the Spring Housing Market?

As the Spring Housing Market blooms into full swing, experts are buzzing with insights and forecasts about the trajectory of real estate in the coming months. Whether you’re looking to buy or looking to sell, staying abreast of the latest trends and expert opinions can empower you to make informed decisions in today’s market. Let’s delve into what experts are saying and how it might impact your home buying or selling journey.

Current Landscape: More Homes for Sale

One notable trend experts are observing is the increase in homes for sale. This surge in inventory provides prospective buyers with a broader selection and greater flexibility. Those looking to buy will likely find more options to explore and potentially find more affordable homes on the market.

According to recent data, the Spring Housing Market is witnessing a substantial uptick in available properties. This influx of listings not only expands choices for buyers but also introduces competitive dynamics in certain segments of the market. Sellers must strategize effectively to stand out amidst the heightened inventory.

Mortgage Rates and Affordability

Mortgage rates continue to play a pivotal role in shaping today’s market dynamics. With rates hovering at historically low levels, buyers are presented with favorable opportunities to secure financing for their dream homes. However, fluctuations in mortgage rates can influence buyer behavior and overall affordability.

For first-time homebuyers, understanding how credit scores impact mortgage rates is crucial. Lenders consider credit scores when determining interest rates, making it imperative for buyers to maintain healthy credit profiles. Mortgage Tips from experts emphasize the significance of improving credit scores to unlock better financing options and terms.

Insights from West Palm Beach Mortgage Brokers

Local expertise adds a valuable dimension to navigating the Spring Housing Market. In areas like West Palm Beach, mortgage brokers offer tailored guidance and insights tailored to the region’s unique dynamics.

West Palm Beach mortgage brokers are attuned to the nuances of the local market, providing invaluable assistance to both buyers and sellers. Whether it’s exploring affordable West Palm Beach home loans or understanding refinancing options, leveraging the expertise of local mortgage lenders can streamline the home buying or selling process.

First-Time Homebuying in West Palm Beach

For first-time homebuyers in West Palm Beach, navigating the complexities of today’s market may seem daunting. However, with the right guidance and resources, purchasing your first home can be a rewarding experience.

Local mortgage lenders specializing in first-time home buyer loans offer tailored solutions to meet the unique needs of novice buyers. From assisting with mortgage pre-approval to providing property loan advice, these professionals serve as trusted allies throughout the home buying journey.

Strategies for Sellers

On the seller’s front, effectively positioning your property amidst increased competition is paramount. Employing strategic marketing tactics and leveraging the expertise of commercial mortgage brokers can enhance visibility and attract potential buyers.

In markets like West Palm Beach, where demand remains robust, sellers have an opportunity to capitalize on favorable conditions. Partnering with local mortgage lenders who offer mortgage pre-approval can streamline the buying process for prospective buyers, potentially expediting the sale of your property.

Market Dynamics and Predictions

While the current landscape favors buyers with increased inventory and low mortgage rates, experts anticipate continued market evolution in the coming months. Factors such as economic indicators, demographic shifts, and geopolitical developments can influence homes available for sale and overall market sentiment.

Staying informed and adaptable is key in navigating the dynamic Spring Housing Market. Whether you’re a buyer seeking the perfect property or a seller aiming to maximize returns, being attuned to expert insights and market trends empowers you to make informed decisions in today’s ever-changing real estate landscape.

In conclusion, the Spring Housing Market presents a myriad of opportunities and challenges for both buyers and sellers alike. By leveraging the expertise of local mortgage lenders and staying informed about today’s market dynamics, individuals can navigate the home buying and selling process with confidence and clarity. As the season unfolds, remaining proactive and adaptable will be essential in capitalizing on emerging trends and seizing favorable opportunities in the real estate market.

Embracing Mortgage Technology

In today’s digital age, the real estate industry is witnessing a paradigm shift with the integration of innovative mortgage technology. Platforms offering West Palm Beach mortgage calculators and digital tools streamline the home buying process, enabling buyers to estimate monthly payments, evaluate affordability, and explore financing options with ease.

Additionally, advancements in mortgage pre-approval processes expedite transactions, reducing paperwork and enhancing efficiency for both buyers and sellers. By embracing mortgage technology, stakeholders can navigate the Spring Housing Market more seamlessly, capitalizing on streamlined processes and enhanced accessibility.

Navigating Market Volatility

While the Spring Housing Market typically heralds increased activity and optimism, it’s essential to acknowledge and prepare for potential market volatility. Economic fluctuations, regulatory changes, and unforeseen events can impact homes for sale inventory, mortgage rates, and buyer sentiment.

Experts advise maintaining a balanced approach, incorporating risk mitigation strategies and remaining adaptable to changing market dynamics. Whether you’re looking to buy or looking to sell, a proactive stance and strategic planning can mitigate risks and position you for success in fluctuating market conditions.

Investment Opportunities

Beyond traditional home buying and selling, the Spring Housing Market presents enticing opportunities for real estate investors. With an array of properties available for purchase, investors can diversify portfolios and capitalize on rental income or property appreciation.

Moreover, strategic partnerships with local mortgage lenders and commercial mortgage brokers can unlock access to financing options tailored to investment objectives. Whether you’re considering residential or commercial investments, expert guidance and financial acumen are instrumental in maximizing returns and mitigating risks.

Community Engagement and Local Insights

In the vibrant landscape of West Palm Beach, community engagement and local insights play a pivotal role in real estate decisions. Local mortgage lenders and real estate professionals possess intimate knowledge of neighborhood dynamics, school districts, and lifestyle amenities, offering invaluable guidance to buyers and sellers alike.

By fostering relationships within the community and tapping into local mortgage broker expertise, individuals gain a deeper understanding of market trends, investment potential, and emerging opportunities. From waterfront properties to downtown condominiums, leveraging local insights enriches the home buying experience and fosters long-term satisfaction with real estate decisions.

Conclusion

As the Spring Housing Market unfolds, the consensus among experts underscores a landscape brimming with opportunities and possibilities. From increased inventory and favorable mortgage rates to innovative mortgage technology and local insights, stakeholders are poised to navigate the market with confidence and clarity.

Whether you’re a first-time homebuyer exploring West Palm Beach mortgage options or a seasoned investor seeking lucrative opportunities, staying informed and leveraging expert guidance are paramount. By embracing technology, understanding market dynamics, and fostering community engagement, individuals can embark on their home buying or selling journey with optimism and assurance.

In the dynamic realm of real estate, the convergence of expertise, innovation, and local insights forms the cornerstone of informed decision-making. As the Spring Housing Market unfolds, seize the moment to embark on your real estate journey, empowered by knowledge, guided by expertise, and enriched by the promise of home.

Looking Ahead: Sustainable Housing Trends

Looking beyond the immediate horizon, experts are also shedding light on sustainable housing trends shaping the future of real estate. With increasing emphasis on environmental stewardship and energy efficiency, sustainable features such as solar panels, smart home technology, and eco-friendly materials are gaining traction among buyers.

Moreover, urban planning initiatives and mixed-use developments are redefining urban landscapes, promoting walkability, and fostering vibrant communities. As sustainability becomes integral to real estate decision-making, buyers and sellers alike are recognizing the long-term benefits of investing in environmentally conscious properties.

Navigational Strategies for Buyers

For buyers navigating the Spring Housing Market, strategic approaches can enhance the home buying experience and position them for success. Beyond scouting homes for sale listings, conducting thorough research on neighborhoods, amenities, and market trends is essential.

Engaging with local mortgage lenders early in the process to obtain mortgage pre-approval and assess financing options provides a competitive edge in negotiations. Additionally, leveraging mortgage calculators and budgeting tools aids in establishing realistic financial parameters and identifying properties aligned with your preferences and budget.

Seller Strategies in a Competitive Market

In a competitive market characterized by increased inventory, sellers must differentiate their properties to attract discerning buyers. Strategic staging, professional photography, and effective marketing campaigns are instrumental in showcasing the unique features and value proposition of your home.

Collaborating with experienced real estate agents and local mortgage brokers enhances visibility and facilitates seamless transactions. By leveraging their expertise and market insights, sellers can navigate pricing strategies, negotiate offers, and optimize the selling process to achieve desirable outcomes in today’s dynamic real estate landscape.

Final Thoughts: Empowering Real Estate Decisions

As the narrative of the Spring Housing Market unfolds, it underscores the interplay of myriad factors shaping real estate dynamics. From market trends and mortgage rates to technological innovations and sustainable initiatives, stakeholders are presented with a landscape ripe with opportunities and challenges.

Amidst this backdrop, informed decision-making emerges as the cornerstone of success for buyers, sellers, and investors alike. By harnessing expert insights, embracing innovation, and fostering community engagement, individuals can navigate the Spring Housing Market with confidence, clarity, and a sense of purpose.

Ultimately, whether you’re embarking on the journey of home buying, exploring investment opportunities, or contemplating refinancing options, the wisdom of experts and the guidance of seasoned professionals serve as invaluable assets. As you embark on your real estate endeavors, may you be empowered to make informed decisions, seize opportunities, and realize your aspirations in the ever-evolving landscape of the Spring Housing Market.

Embracing Digital Transformation in Real Estate

In parallel with the evolving landscape of the Spring Housing Market, the realm of real estate is undergoing a profound digital transformation. The proliferation of online platforms, virtual tours, and digital marketing strategies has revolutionized the way properties are showcased and transactions are conducted.

Buyers can now explore homes for sale from the comfort of their own homes, accessing comprehensive information, high-quality images, and immersive virtual experiences. This shift towards digitalization not only enhances convenience and accessibility but also expands the reach of listings to a global audience.

The Role of Data Analytics in Market Insights

Central to navigating the complexities of the Spring Housing Market is the utilization of data analytics to glean actionable insights and trends. By harnessing big data analytics, real estate professionals can identify patterns, forecast market trends, and tailor strategies to align with evolving consumer preferences.

From predictive modeling to demographic analysis, data-driven approaches empower stakeholders to make informed decisions and capitalize on emerging opportunities. By leveraging data analytics, buyers and sellers can gain a competitive edge in today’s dynamic real estate landscape.

Cultivating Resilience in Uncertain Times

While the Spring Housing Market exudes optimism and potential, it’s essential to acknowledge the inherent uncertainties and challenges that may arise. Economic volatility, regulatory changes, and global events can all impact market dynamics and influence homes available for sale and mortgage rates.

In navigating these uncertainties, cultivating resilience and adaptability is paramount. Buyers and sellers alike must remain agile, responsive to market shifts, and proactive in their decision-making processes. By embracing uncertainty as a catalyst for innovation and growth, stakeholders can navigate the Spring Housing Market with confidence and resilience.

The Importance of Financial Literacy

Amidst the excitement of home buying and selling, fostering financial literacy is crucial for making sound real estate decisions. Understanding mortgage options, budgeting effectively, and managing finances prudently are essential components of a successful real estate journey.

Mortgage tips and resources provided by local mortgage lenders empower buyers to navigate the intricacies of financing with confidence. From exploring first-time home buyer loans to evaluating refinancing options, building financial literacy equips individuals with the knowledge and skills to make informed decisions aligned with their long-term goals.

Conclusion: Navigating the Spring Housing Market with Confidence

As the Spring Housing Market unfolds, it presents a tapestry of opportunities, challenges, and possibilities for buyers, sellers, and investors alike. From increased inventory and favorable mortgage rates to digital innovation and data-driven insights, stakeholders are poised to embark on their real estate journeys with confidence and clarity.

By leveraging expert guidance, embracing technological advancements, and cultivating resilience in the face of uncertainty, individuals can navigate the Spring Housing Market with poise and purpose. Whether you’re embarking on your first home buying journey, exploring investment opportunities, or selling your property, may you approach the process with optimism, informed decision-making, and a steadfast commitment to realizing your real estate aspirations.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

|

|

|

|

|

|

|

|

|

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

|

We Specialize in All Types of Financing, Mortgage Loans and Real Estate Deals.

We have been in the Mortgage and Real Estate Business since 1997!

Personal Profiles:

American Dream TV Show | Mortgage Process Steps | Homebot Videos | Traditional Loan Programs | NON-QM & Portfolio Loan Programs

HomeBot: Build more wealth with your home

Our goal for you is to help you to minimize your tax liability and maximize your cash flow. In today’s market, a mortgage loan is more than ever a financial instrument that must be tied into your long and short-term personal financial plan. This will allow you to create a debt strategy that will help you to build long-term wealth for you and your family.

Check Our Reviews:Residential Financing Options:

Most all loan options are available in just about every state in the country : VA | FHA | USDA | Fannie/Freddie Conventional Loans |Reverse Mortgages | Jumbo Reverse Mortgages | Self Employed Loans | Bank Statement Loans | Investor DSCR Loans | Private Hard Money Loans | Fix & Flip Loans | Bridge Loans | No Ratio | No Income Primary Residence Loans | Jumbo & Super Jumbo loans to $50M.

Temporary Interest Rate Buy-downs on a fixed-rate conventional | FHA | VA loans: 3-2-1, 2/1 or 1/0.

Luxury Sales & Epic Loan Options:

We work with all types of Real Estate Sales & Financing options for Residential & Commercial Real Estate | Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Real Estate Closings | Residential & Commercial Insurance.

Commercial Financing Options:

Our commercial division and can do business in any state in the country for all types of Commercial Loans for owner occupied properties or for business purposes from $50k to $500M | bridge loans | new construction loans for both owner occupied & for investors for individual single family Developer or Builder Spec Homes Loans | Townhomes | Condos | Real Estate Projects for Single Family Home Communities | Townhome Communities | Ground up new construction condominium buildings | Commercial Buildings | Apartment Complex’s | Mixed-Use Projects | SBA loans for new businesses | new construction | acquisition | Refinancing an exciting Loan | business purpose loans for A/R | inventory or cash flow | Doctor Loans for Business Acquisition & Commercial Real Estate with LTV’s as high as 100% LTV

We are your One-Stop Brokerage for all your Personal Residential Mortgage Financing & Sales | Commercial Real Estate Mortgage Financing & Sales | Commercial Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Homeowners insurance | Business Purpose personal and commercial needs.

Keep in mind we shop more than 250 residential and over 10K Commercial banks, lenders & mortgage companies to give you amazingly low rates and the largest product line in the country!

If you have any questions or if you have friends, family or clients, that are buying a home & need a mortgage or want to chat about a scenario just contact us right away:

1) 📅To schedule a time to talk with me just click here: 🔗 Schedule an Appointment with me: Click Here (pick the calendar that fits your specific situation)

2) 🏦 Apply for a mortgage now at www.ChristianPennersLoanApp.com

If you apply, please text me your full name and email address 📱561-373-0987 or

3) 📞Call me directly ☎️561-373-0987

Helping You Achieve The American Dream Of Home Ownership.

#AmericasMortgageSolutions #christianpenner #onestopbrokershop #mortgagebrokerwestpalmbeach #epicrealeststedeals #luxuryhomes #LuxurySales&EpicLoanOptions #TheChristianPennerMortgageTeam #buildwealth #mortgagebrokerflorida #theamericandream #finacingtheamericandream #realestate #mortgage #mortgagebroker #thanks #mortgagetips #mortgageadvice #RealEstateJourney #realtor #realestateexpert #realestatelife #realestategoals #realestatetips #realtorlifestyle #realtorsoffacebook #realtorforlife #businesspupose #mortgageloans #HouseHunting #DreamHome #homeownership #vacationhome #secondhome #homebuyer #interestrates #HousingMarket #stoprenting #commercialloans #ResidentialRealEstateDevelopments #CommercialRealEstateDevelopments #Yachts #Aircrafts #RVs #CollectorCars #ExoticCars #roofsolar #solar #roofSolarFinancingPackages #buildequity #planforyourfuture #buildyoufuture #television #host #tvproduction #streaming #travel #amazon #motivational #Agentmastermindclass #HorseFarms #EquestrianCenters #Vineyards #FruitandVegetableFarms #HobbyFarms #RealEstateInvestment #LuxuryRealEstate #PropertyManagement #RealEstateDevelopment #RealEstateAdvice #HomeStaging #RealEstateGoals #PropertyListing #EcoFriendlyHomes #RealEstatePhotography #UrbanRealEstate #SuburbanHomes #RuralProperties #RealEstateMarket #RealEstateForSale #RealEstateBrokerage #HomeRenovation #RealEstateTech #SmartHomeTechnology #GreenRealEstate #RealEstateNetworking #RealEstateSeminars #RealEstateLaw #RealEstateFinance #LuxuryApartments #CommercialProperties #RealEstateAuctions #HistoricHomes #WaterfrontProperties #CondoLiving

🔍 Whether you’re looking for financing 💰 or to BUY 🏡, SELL 🔄, LEASE 📝, INVEST 💹 or BUILD YOUR DREAM HOME 🏗️ or OFFICE 🏢 on Residential Properties 🏘️, Commercial Real Estate 🏬, or Development Commercial Real Estate 🏗️, Yachts 🛥️, Aircrafts ✈️, RVs 🚐, or Exotic Cars 🚗 – call us TODAY 📞. No matter the NEED 🎯 or GOAL 🏆 – let’s make CONFIDENT decisions together 👥💼.

Christian Penner, CMA

President | CEO | Mortgage Broker

NMLS#368289

America’s Mortgage Solutions, Inc NMLS#2009420

Cell/SMS: 561-373-0987

Direct/efax/SMS: 561-316-6800

Christian Penner712 U.S. Highway 1 North #300, North Palm Beach, FL 33408 |