How Co-Buying a Home Helps with Affordability Today

Buying a home in today’s market can feel like an uphill battle – especially with home prices and mortgage rates putting pressure on your budget. If you’re feeling stuck, co-buying could be one way to help you get your foot in the door. Freddie Mac says:

“If you are an aspiring homeowner, buying a home with your family or friends could be an option.”

But there are some things you’ll want to consider first. Let’s explore why co-buying is gaining popularity right now among some buyers and see if it may make sense for you too.

What Is Co-Buying?

Co-buying means buying a home with someone like a friend, sibling, or even a group of people. And, with today’s high home prices and mortgage rates, it’s an option more people are turning to.

According to a survey done by JW Surety Bonds, nearly 15% of Americans have already co-purchased a home with someone, and another 48% would consider doing it.

Why Consider Co-Buying?

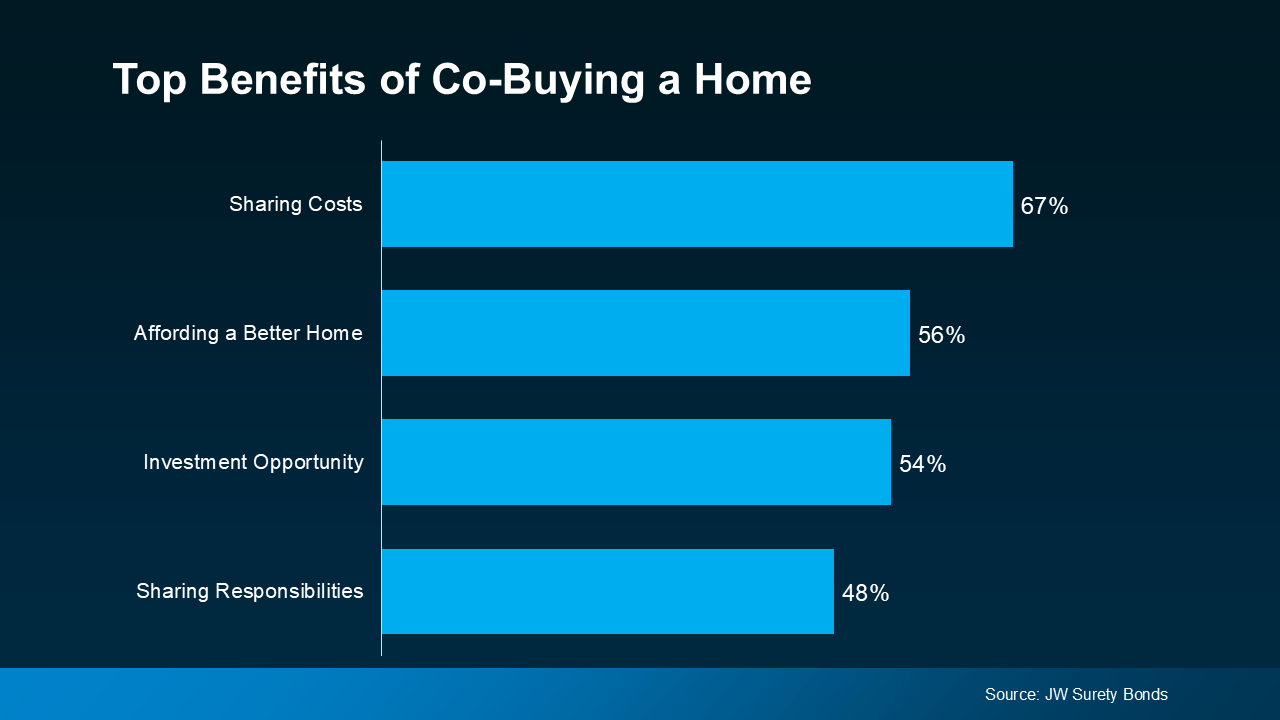

The same survey also asked people about the perks of co-buying a home. Here are some of the top responses (see graph below):

Sharing Costs (67%): From saving for a down payment to managing monthly payments, buying a home is a big financial step. When you co-buy, you split these costs, making it easier to afford a home.

Sharing Costs (67%): From saving for a down payment to managing monthly payments, buying a home is a big financial step. When you co-buy, you split these costs, making it easier to afford a home.

Affording a Better Home (56%): By pooling your financial resources, you may also be able to afford a larger or higher-quality home than you could have on your own. This may mean getting that extra bedroom, a bigger backyard, or living in a more desirable neighborhood.

Investment Opportunity (54%): Co-buying a home can also be an investment. You could buy a house with someone so you can rent out, which could help generate passive income.

Sharing Responsibilities (48%): Owning a home comes with a lot of responsibilities, including maintenance and upkeep and more. When you co-buy, you share these commitments, which can lighten the load for everyone involved.

Other Co-Buying Considerations

While co-buying has its benefits, there’s something else you need to consider before deciding if this approach is right for you. As Rocket Mortgage says:

“Buying a house with a friend or multiple friends might be a great way for you to achieve homeownership, but it’s not a decision you should make lightly. Before diving in, make sure you understand the financial and logistical hurdles you’ll face, as well as the human and emotional elements that might affect the purchase or, more importantly, your relationship.”

Basically, make sure you and your co-buyer are on the same page about things like how costs will be split, who will handle what responsibilities, and what will happen if one of you wants to sell your share of the home in the future. Leaning on an expert can help you weigh the pros and cons to make that conversation easier.

If you’re looking to get your foot in the door but are having a tough time with today’s affordability challenges, co-buying could be an option to make your move happen. But, it’s important to plan carefully and make sure all parties are clear on the details. To figure out if co-buying makes sense for you, let’s connect.

How Co-Buying a Home Helps with Affordability Today

Buying a home can feel like a distant dream for many aspiring homeowners. With home prices soaring and mortgage rates climbing, the financial strain has left countless individuals questioning their ability to achieve homeownership. However, there’s a growing trend that’s reshaping the way people approach the housing market: co-buying a home. This innovative strategy is not only helping people overcome financial hurdles, but it’s also paving the way to owning a higher-quality home than they might afford on their own.

In this comprehensive guide, we’ll delve into what co-buying entails, its benefits and challenges, and why it’s a smart option for those navigating buying a home in today’s market—whether you’re in bustling cities or sunny havens like West Palm Beach.

What Is Co-Buying?

Co-buying a home refers to the process of purchasing property with another person or group. Whether you’re buying a house with a close friend, sibling, or romantic partner, the idea is simple: pool your financial resources to share the burdens and joys of owning a home.

According to recent surveys, nearly 15% of Americans have already co-purchased a home, and a significant 48% would consider it. This trend underscores how buying a home with your family or friends has evolved from a creative concept into a practical solution for achieving home affordability.

The Benefits of Co-Buying a Home

1. Shared Costs Make It Easier to Afford a Home

From the initial down payment to the ongoing monthly payments, purchasing a home requires a hefty financial commitment. By sharing these costs, co-buying could be an option that makes homeownership more accessible.

For instance, West Palm Beach mortgage calculators show how splitting expenses with a co-buyer can significantly reduce the individual financial burden. Whether you’re opting for first-time home buyer loans in West Palm Beach or other affordable West Palm Beach home loans, shared costs can open doors to homes that might otherwise be out of reach.

2. Affording a Larger Home or Higher-Quality Home

Pooling financial resources allows buyers to consider properties they might not afford solo. Want an extra bedroom, a spacious backyard, or a prime location? Buying a home with your family or friends might be the ticket to unlocking these possibilities.

Imagine living in a luxurious neighborhood with the help of a trusted partner—what once seemed unattainable suddenly becomes achievable. This advantage is especially valuable in competitive markets like West Palm Beach, where securing the best mortgage rates can mean the difference between a starter home and a dream property.

3. An Exciting Investment Opportunity

For some, co-buying a home isn’t just about splitting costs; it’s a strategic move toward generating passive income. By purchasing property to rent out or even co-investing in commercial real estate, you could build a portfolio that works for you.

For example, a commercial mortgage broker in West Palm Beach could guide co-buyers toward lucrative investments in rental properties, ensuring the venture yields long-term financial benefits.

4. Shared Responsibilities Simplify Ownership

Let’s face it—owning a home comes with its fair share of challenges. From maintenance and upkeep to landscaping and repairs, these tasks can feel overwhelming. However, shared responsibilities lighten the load for everyone involved.

In a co-ownership arrangement, you can divide chores based on expertise, availability, or even preference. This shared commitment fosters collaboration and helps co-buyers stay organized and efficient.

Challenges and Considerations in Co-Buying

While co-buying has many advantages, it’s not without its complexities. Before jumping into a joint purchase, it’s crucial to understand the potential pitfalls and plan accordingly.

1. Logistical Challenges

Co-buying requires careful coordination, from deciding on the property to securing financing. Using tools like West Palm Beach mortgage calculators and working with local mortgage lenders in West Palm Beach can simplify the process, but open communication is key to avoiding misunderstandings.

2. Emotional Considerations and Relationship Impact

When buying a home with your family or friends, emotions can run high. Disagreements about expenses, design choices, or future plans can strain relationships. Setting clear expectations and boundaries upfront is essential for long-term harmony.

3. Planning for the Home in the Future

What happens if one person wants to sell your share of the property? Will the remaining owner buy them out, or will the property be sold entirely? Addressing these questions in a legal agreement ensures everyone is on the same page.

4. Lean on Expert Guidance

Navigating co-buying requires professional advice. Working with a West Palm Beach mortgage broker or consulting an attorney can help co-buyers address potential issues, such as how to divide equity or handle disputes. Experts can also provide insights into West Palm Beach refinancing options and property loan advice in West Palm Beach, making the process smoother and more secure.

Why West Palm Beach Is Perfect for Co-Buying

For those considering co-buying a home, West Palm Beach offers unique advantages. With its competitive housing market, beautiful neighborhoods, and a range of affordable West Palm Beach home loans, it’s an ideal location for buyers pooling their resources.

The Role of West Palm Beach Mortgage Brokers

Whether you’re seeking mortgage preapproval in West Palm Beach or exploring refinancing options, local brokers have the expertise to guide you toward the best deals. They understand the nuances of the market and can tailor loan packages to fit co-buyers’ specific needs.

Tools to Streamline the Process

- West Palm Beach mortgage calculators: These tools help co-buyers plan their budgets and estimate payments.

- First-time home buyer loans in West Palm Beach: Perfect for co-buyers entering the market for the first time.

- Local mortgage lenders in West Palm Beach: Personalized advice ensures you secure the best rates and terms.

How to Get Started with Co-Buying

- Find the Right Partner(s): Choose someone you trust and with whom you share similar goals.

- Discuss Financials: Clarify how costs will be split, including the down payment, monthly payments, and ongoing expenses like maintenance and upkeep.

- Draft a Co-Buying Agreement: Work with an attorney to outline responsibilities, equity shares, and plans for selling the property in the future.

- Seek Expert Guidance: Collaborate with a West Palm Beach mortgage broker or local mortgage lender to secure financing that aligns with your goals.

- Consider Long-Term Plans: Discuss how you’ll handle changes, such as one party wanting to move or sell their share.

Final Thoughts

In today’s challenging housing market, co-buying could be an option that transforms dreams of homeownership into reality. By leveraging shared costs, splitting responsibilities, and pooling financial resources, co-buyers can achieve more together than they might alone.

Whether you’re exploring first-time home buyer loans in West Palm Beach, looking for affordable West Palm Beach home loans, or considering investment opportunities, the right partner and expert advice can make all the difference.

Ready to take the next step? Start your journey today with the guidance of a West Palm Beach mortgage broker and unlock the door to your dream home.

Addressing Concerns About Co-Buying

While the concept of co-buying a home may sound appealing, prospective buyers often have concerns. Let’s explore some common questions and strategies to address them effectively.

1. What If Someone Can’t Keep Up with Payments?

Financial setbacks are a reality, and one co-buyer falling behind on payments can impact the entire arrangement. To mitigate this risk:

- Create an Emergency Fund: Establish a joint savings account for unexpected expenses like missed monthly payments or emergency repairs.

- Set Clear Terms: Use a co-buying agreement to outline how financial shortfalls will be addressed. For example, will the other buyer cover the shortfall temporarily? If so, how and when will repayment occur?

- Consult Experts: A West Palm Beach mortgage broker can recommend flexible loan options tailored to co-buyers, helping you prepare for potential challenges.

2. What Happens If Someone Wants to Sell Their Share?

Life is unpredictable, and a co-buyer may eventually decide to move on. Planning for this scenario in advance is essential.

- Include a Buyout Clause: Your agreement should define how one party can buy out the other’s share. This ensures a smooth transition without disputes.

- Explore Refinancing Options: West Palm Beach refinancing options can help remaining buyers adjust the mortgage terms to take full ownership.

- Agree on Valuation Methods: Outline how the property’s value will be determined if one party decides to sell, ensuring a fair division of assets.

3. How Do We Maintain the Property?

Maintenance and upkeep can become a source of friction, especially when responsibilities aren’t clearly defined.

- Assign Roles: Decide who will handle specific tasks, such as yard work, interior repairs, or overseeing contractors.

- Budget for Repairs: Pool funds monthly to cover maintenance costs, preventing financial surprises down the line.

- Leverage Property Loan Advice: A West Palm Beach mortgage broker can help you factor maintenance costs into your overall financial planning.

4. Will This Impact Our Relationship?

The potential for relationship impact is one of the most significant concerns when buying a home with your family or friends. Misaligned goals or unresolved disagreements can strain even the closest bonds.

- Have Honest Conversations: Before entering into a co-buying arrangement, openly discuss your expectations, future plans, and potential concerns.

- Use Mediation When Necessary: If disputes arise, consider working with a neutral third party to resolve them.

- Revisit Your Agreement Regularly: Life circumstances change, so updating your co-buying agreement periodically ensures it remains relevant.

Co-Buying as a Path to Building Wealth

Buying a house is not just about securing a place to live—it’s also a significant financial milestone. For many, co-buying a home represents a strategic step toward building long-term wealth.

Unlocking Equity

When you own a home, you’re building equity with every payment. Over time, this equity can be a powerful financial tool, whether used for future investments, funding a child’s education, or planning retirement.

Generating Passive Income

Some co-buyers choose to rent out portions of their shared property, creating a source of passive income. For example, a duplex or multi-family property allows co-buyers to live in one unit while renting out the other. With the guidance of a West Palm Beach mortgage broker, buyers can explore loan options tailored to income-generating properties.

Diversifying Investments

For those interested in expanding their portfolio, commercial mortgage brokers in West Palm Beach can help co-buyers explore opportunities beyond residential properties. Co-investing in commercial real estate opens the door to higher returns and diversified risk.

Why Timing Matters in Co-Buying

The current housing market presents both challenges and opportunities. While home prices remain high, savvy buyers can capitalize on trends with the right approach.

Competitive Mortgage Rates

Securing the best mortgage rates in West Palm Beach can significantly lower your overall costs. Co-buyers benefit from their combined financial standing, often qualifying for better terms than they would individually.

Increased Buying Power

Pooling financial resources enhances your bargaining power, whether negotiating with sellers or working with local mortgage lenders in West Palm Beach. This advantage can make a critical difference in a competitive market.

Planning for the Future

The sooner you invest in real estate, the sooner you begin building equity. Whether your ultimate goal is to live in the home, rent it out, or sell it for profit, acting now positions you for success in the future.

The Role of Expert Guidance

When navigating the complexities of co-buying a home, having the right support can make all the difference. Professionals in West Palm Beach, from brokers to real estate agents, offer valuable resources to help you make informed decisions.

- Mortgage Preapproval in West Palm Beach: Preapproval simplifies the buying process and demonstrates your financial readiness to sellers.

- Property Loan Advice in West Palm Beach: Local experts can recommend loan packages tailored to co-buyers’ unique needs.

- First-Time Home Buyer Loans in West Palm Beach: These loans often come with favorable terms, making them ideal for co-buying arrangements.

Conclusion

In an era where buying a home in today’s market feels increasingly out of reach, co-buying offers a refreshing alternative. By sharing costs, responsibilities, and goals, co-buyers can achieve home affordability while opening doors to larger homes, higher-quality homes, and even investment opportunities.

Whether you’re considering affordable West Palm Beach home loans or exploring the best mortgage rates in West Palm Beach, teaming up with a trusted partner and leaning on expert guidance can turn your vision of homeownership into a reality.

So, gather your family or friends, outline your plans, and take the first step toward buying a home together. With the right strategy, careful planning, and professional support, co-buying a home could be the key to unlocking your dreams in today’s challenging housing market.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice