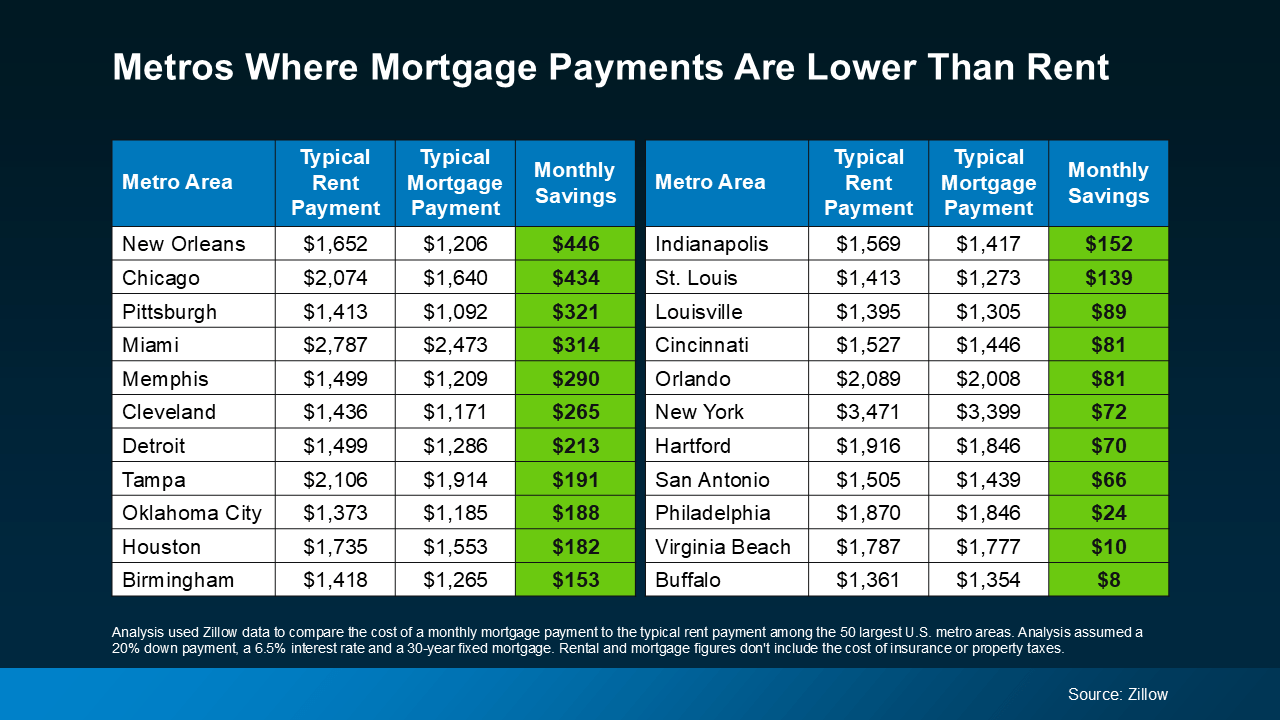

Buying Beats Renting in 22 Major U.S. Cities

That’s right—according to a recent study from Zillow, in 22 of the 50 largest metro areas, monthly mortgage payments are now lower than rent payments (see chart below):

As mortgage rates have eased off their recent peak, home prices have moderated, and inventory has ticked up, affordability has improved significantly. When you add all of that up, it’s getting less expensive to buy a home than to rent one in many parts of the country.

As mortgage rates have eased off their recent peak, home prices have moderated, and inventory has ticked up, affordability has improved significantly. When you add all of that up, it’s getting less expensive to buy a home than to rent one in many parts of the country.

This is a big deal if you’ve been renting for a while now. But if you don’t see your city on this list, don’t sweat it. Things are moving fast, and your area might be joining these top metros soon.

You see, talking with a local real estate agent about what’s happening in your market before this happens in your ideal neighborhood could really change the game for you. It’s all about being informed by a true expert, and understanding what was out of reach before might actually be getting more affordable than you think.

Now, while this study compares monthly rent to principal and interest on a mortgage payment (not the whole monthly payment), let’s think through this. As Zillow notes, what you can’t ignore when you buy a home are things like taxes, insurance, utilities, and maintenance that should also be factored into your budget and your monthly payment.

But remember – renters pay extra fees too, like renters’ insurance, utilities, parking, and more. And while doing the math may feel like a drag, this equation could be a much more exciting one to work through today.

So, grab your calculator and your agent because the big takeaway is this: it may be time to determine if you’re in a spot to afford what you couldn’t just a few months ago.

As Orphe Divounguy, Senior Economist at Zillow, says:

“… for those who can make it work, homeownership may come with lower monthly costs and the ability to build long-term wealth in the form of home equity — something you lose out on as a renter. With mortgage rates dropping, it’s a great time to see how your affordability has changed and if it makes more sense to buy than rent.”

Whether you live in one of these budget-friendly metros where the scales have already tipped in your favor, or any town in-between, it’s time to connect with a local real estate agent to get the conversation started.

With mortgage rates coming down and more homes hitting the market, you’ll want to be ready to jump back into your search – before everyone else does.

If you’re tired of renting and ready to find out what it takes to purchase a home in our area now that the landscape may be shifting, let’s do the math together to see if buying a home makes sense for you now or sometime soon.

Buying Beats Renting in 22 Major U.S. Cities

In today’s ever-changing real estate market, making the leap from renting to buying isn’t just a matter of personal preference; it’s a strategic financial decision. Owning a home in one of America’s major cities is not only a status symbol but a smart long-term investment that promises security, Home Equity, and ultimately, wealth-building. And while renting might seem like the easier, more affordable choice at first glance, purchasing a home often provides a much more robust financial future. Here’s why buying often beats renting in 22 of the most sought-after U.S. cities.

Why Buying A Home is Better Than Renting

The allure of renting comes from its convenience, its flexibility, and the absence of long-term commitment. But the hidden truth? Renters often miss out on building Home Equity. Unlike rent payments that disappear into the abyss of a landlord’s pocket, your monthly mortgage payments build your stake in a property that’s entirely yours. Yes, with a mortgage, you’re making payments too, but each payment increases your ownership percentage. Essentially, every month, you’re building wealth, not just treading water.

Additionally, let’s not forget how home prices have steadily climbed in many U.S. markets. Imagine the potential for your home’s value to rise significantly over time, allowing you to gain even more than you paid initially. Renting, in comparison, provides no such future financial upside.

1. West Palm Beach, FL: A Hot Market for Buyers

When it comes to desirable locations, West Palm Beach is high on the list, offering a blend of urban and coastal living with a more relaxed vibe than its neighboring cities. Here, owning a home is often more affordable than renting due to favorable mortgage rates and relatively moderate home prices.

Working with a West Palm Beach mortgage broker is essential if you’re looking to secure a property in this competitive market. Brokers can help you lock in the best mortgage rates in West Palm Beach, and even assist with Affordable West Palm Beach home loans. For those new to the game, first-time home buyer loans in West Palm Beach make it even more feasible to transition from renting to owning. A savvy broker will also guide you through West Palm Beach refinancing options, so you can restructure your payments to maximize savings. If you’re looking to take the next step, local mortgage lenders in West Palm Beach provide personalized service, while West Palm Beach mortgage calculators help estimate what your monthly mortgage payments would be, making it easier than ever to compare the cost of renting versus owning.

When you invest in West Palm Beach, you’re making a smart financial move. The city’s mix of job growth, new developments, and the rising appeal of Florida’s tax benefits make it an ideal place to purchase a home.

2. Austin, TX: Where Buying Rules

In Austin, Texas, the real estate market is exploding. Known for its tech industry, music scene, and food culture, Austin attracts new residents every day. But renting in Austin is costly and is expected to get more expensive as demand continues to outstrip supply. This is why the smarter decision in Austin is to buy a home.

Mortgage rates in Austin are still quite favorable, and purchasing will give you a foothold in one of the hottest housing markets in the country. Plus, home prices here are projected to increase, making it an excellent place to build Home Equity quickly. Owning property in Austin offers long-term gains in a city that promises even greater value over time.

3. Phoenix, AZ: The Affordable Oasis

For those looking for a place where owning is not only possible but profitable, Phoenix delivers. The cost of living in Phoenix is much lower than coastal cities, and while home prices are rising, they remain more affordable than in markets like Los Angeles or San Francisco.

The Phoenix real estate market has seen tremendous growth, and monthly mortgage payments here are often lower than the average rent. Combine that with a strong job market and desirable climate, and Phoenix quickly becomes a top choice for savvy buyers looking to invest in a home.

4. Charlotte, NC: A Southern Gem for Buyers

Charlotte is another market where the cost of monthly mortgage payments often beats renting. This fast-growing city offers many job opportunities, and home prices remain relatively affordable compared to other major metros. Local lenders in Charlotte frequently offer competitive mortgage rates, which makes this city an ideal place for first-time buyers.

5. Las Vegas, NV: Betting on Home Ownership

Las Vegas is more than just the Strip—it’s becoming a great place to live, and more people are seeing the benefits of buying a home here rather than renting. Home prices in Vegas have been on the rise but remain far lower than in markets like Los Angeles or New York. That means your monthly mortgage payments can be significantly lower than rent.

Additionally, the ability to tap into growing Home Equity in such a bustling and expanding city makes buying in Las Vegas a winning bet for anyone looking to capitalize on the city’s growth.

6. Denver, CO: The Mile-High Advantage

In Denver, the housing market has been on fire for years. Renters often pay exorbitant amounts for apartments in trendy areas like LoDo and RiNo. Meanwhile, those who purchase a home here find that their mortgage payment builds value and Home Equity with every check they write. Plus, Denver’s real estate market has proven resilient and attractive to investors, making it one of the safest cities to put down roots.

7. Seattle, WA: High Prices, Higher Rewards

Seattle’s home prices are high, but that doesn’t mean renting is the better option. In fact, buying is the smarter choice for those who can swing it. The city’s booming tech economy means that more homes are being built to accommodate an influx of new residents. Buying in Seattle secures your spot in a city where property values are only headed in one direction: up.

8. Nashville, TN: Music City’s Hidden Value

Nashville has become one of the trendiest cities in the country, but rent prices are climbing quickly as more people move to the area. Buying, on the other hand, often provides better value for your money. Nashville’s home prices are still considered relatively affordable, especially compared to other major markets. Plus, the growth in the city ensures that your Home Equity will increase over time.

9. Atlanta, GA: A Booming Hub for Buyers

Atlanta offers everything from Southern hospitality to a bustling urban core, and while rents are rising fast, home prices are still manageable. Owning in Atlanta not only gets you more space for your money but allows you to enjoy growing Home Equity in one of the fastest-growing metro areas in the U.S. Mortgage rates remain favorable, making this city a prime spot for buyers.

10. Orlando, FL: More Than Theme Parks

Orlando might be famous for its theme parks, but its housing market is also attracting attention. As more people flock to Central Florida, both rents and home prices have climbed. Buying in Orlando offers more long-term value, as your mortgage payment will likely be lower than the increasing rents. Moreover, Florida’s favorable tax structure makes homeownership in this state even more appealing.

11. Tampa, FL: A Gulf Coast Gem

Tampa has become one of the fastest-growing cities in Florida. Home prices here are rising, but they remain more affordable than in Miami or Fort Lauderdale. Owning a home in Tampa means locking in today’s prices and benefiting from significant Home Equity growth in the future.

12. Dallas, TX: Big City, Bigger Benefits

Dallas has a reputation for being a big city with affordable housing, and while rents are climbing, buying a home still remains the better option. Home prices are on the rise, and buyers are locking in lower mortgage rates. This means that purchasing property in Dallas now could lead to significant Home Equity gains in the coming years.

13. Chicago, IL: Own Your Piece of the Windy City

Despite the chilly winters, Chicago’s housing market is hot. Renting in Chicago’s most desirable neighborhoods can be extremely expensive, but those who choose to purchase a home will find that their monthly mortgage payments often come out lower than rent. Moreover, home prices in Chicago are expected to appreciate, giving buyers a valuable investment.

14. San Antonio, TX: Affordable and Appealing

San Antonio remains one of the most affordable large cities in the U.S. to buy a home. Renters in this city often find that transitioning into homeownership is not only feasible but financially wise. With home prices still moderate and mortgage rates favorable, owning in San Antonio sets buyers up for Home Equity growth without breaking the bank.

15. Portland, OR: Invest in the Pacific Northwest

Portland is a city known for its unique culture and beautiful surroundings, but that comes at a cost, especially for renters. Buying in Portland, however, offers the opportunity to get ahead of skyrocketing rents while building Home Equity in one of the most vibrant cities in the Pacific Northwest.

16. Raleigh, NC: The Research Triangle’s Best Kept Secret

Raleigh, part of North Carolina’s famed Research Triangle, has been a magnet for tech workers, students, and families alike. As more people move to this vibrant and innovation-driven region, both rents and home prices have seen upward movement. However, buying a home in Raleigh remains a more financially sound decision than renting, thanks to competitive mortgage rates and the potential for excellent Home Equity growth. With Raleigh’s continued economic expansion, your home could be worth significantly more in just a few short years.

17. Houston, TX: Oil, Industry, and Opportunity

Houston is one of the few major U.S. cities where housing remains relatively affordable despite its size and economic significance. As the city continues to grow as a hub for energy, healthcare, and manufacturing, home prices have been rising steadily, but they’re still well within reach for first-time buyers. In many cases, your monthly payment on a mortgage can actually be less than rent in this sprawling metropolis. Buyers in Houston can tap into lower mortgage rates and quickly start building Home Equity in a city with a bright economic future.

18. Minneapolis, MN: The Twin Cities Advantage

Minneapolis offers a unique combination of urban convenience and natural beauty, making it an attractive destination for homebuyers. Rent prices have been climbing, but monthly mortgage payments in many areas of the city are often lower than the average rent, making homeownership a more attractive option. Home prices in Minneapolis have seen steady growth, and buyers here can expect to see their investment grow over time. Whether you’re drawn to the city’s thriving arts scene, job opportunities, or its ample green spaces, owning in Minneapolis is a smart long-term financial move.

19. Philadelphia, PA: A City Steeped in History and Homeownership

Philadelphia’s real estate market offers something for everyone, from historic homes in Old City to modern condos in Center City. Renting in Philadelphia, however, has become increasingly expensive as more people flock to the city for its cultural attractions and job opportunities. For those looking to purchase a home, mortgage rates remain favorable, and many find that their mortgage payment is more manageable than local rents. Buying in Philadelphia also allows you to benefit from Home Equity growth, especially as neighborhoods continue to be revitalized. Owning a home in this historic city ensures you’re part of its ongoing story.

20. Miami, FL: Luxury Meets Smart Investing

Miami may be known for its high-end luxury condos and breathtaking waterfront properties, but it’s also a city where owning is often better than renting, even for those on more modest budgets. While home prices in Miami can be steep, monthly mortgage payments are often more predictable and stable than skyrocketing rents. With Miami’s thriving international business scene and increasing demand for properties, buying is a smart investment, especially for those looking to capitalize on the city’s long-term growth potential. Plus, with Florida’s no state income tax and favorable property tax structure, homeownership in Miami makes even more financial sense.

21. Washington, D.C.: Invest in the Nation’s Capital

The nation’s capital offers an exciting blend of historic charm and modern innovation. However, renting in Washington, D.C. can come at a premium, especially in desirable neighborhoods like Dupont Circle, Georgetown, and Capitol Hill. Buying a home in D.C. can be a much better financial decision in the long run, as home prices in the region continue to appreciate, and monthly mortgage payments often rival the cost of rent. By owning in D.C., you not only gain a foothold in one of the country’s most dynamic cities, but you also build Home Equity that grows alongside the city’s economy.

22. New Orleans, LA: More Than Just Mardi Gras

New Orleans is famous for its culture, cuisine, and festivals, but it’s also becoming a great place to buy a home. Home prices here have remained relatively low compared to other major cities, making it a prime location for first-time buyers or those looking for an investment property. In many cases, the cost of monthly mortgage payments is significantly less than renting in some of the city’s trendiest neighborhoods. Moreover, the ability to build Home Equity in a city that’s seeing ongoing investment and revitalization projects makes buying in New Orleans a wise financial move.

The Financial Edge of Homeownership

Across the 22 cities we’ve explored, the common theme is clear: buying a home often provides more financial benefits than renting. When you rent, you’re paying for a roof over your head without any long-term return. On the other hand, when you purchase, your monthly mortgage payments contribute to Home Equity, which is essentially your personal financial asset that grows over time.

As home prices continue to rise in many parts of the country, the sooner you secure your home, the sooner you can begin reaping the benefits of appreciation and stability. Even in markets where home prices may seem daunting, today’s favorable mortgage rates make buying much more attainable than many people realize. Working with a local real estate agent and mortgage broker can help you navigate the process and secure a home that fits both your budget and your lifestyle.

The Role of West Palm Beach in the National Market

A city like West Palm Beach is a perfect example of where owning makes more sense than renting. With a vibrant real estate market, securing Affordable West Palm Beach home loans has never been more accessible. Additionally, West Palm Beach mortgage brokers can assist you in finding the best mortgage rates in West Palm Beach, ensuring your monthly payment aligns with your financial goals. Whether you’re looking for first-time home buyer loans in West Palm Beach, considering West Palm Beach refinancing options, or working with local mortgage lenders in West Palm Beach, there are plenty of resources to make homeownership in this sunny coastal city achievable. Tools like West Palm Beach mortgage calculators can help determine your mortgage preapproval in West Palm Beach and give you a clear picture of your financial landscape.

For those with business aspirations, connecting with a commercial mortgage broker in West Palm Beach is also an excellent option. The opportunities for growth in West Palm Beach’s real estate market are vast, and buying now ensures that you’ll be part of the city’s upward trajectory.

Conclusion

From West Palm Beach to Seattle, buying a home offers the kind of financial security that renting simply can’t match. Every monthly mortgage payment builds wealth, establishes roots, and provides a place to call your own. With the right approach, expert guidance, and attention to market trends, owning property in America’s top cities sets you up for long-term success.

It’s time to move from renting to owning and start building your future—one mortgage payment at a time.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice