Worried About Mortgage Rates? Control the Controllables

Chances are you’re hearing a lot about mortgage rates right now. You may even see some headlines talking about last week’s Federal Reserve (the Fed) meeting and what it means for rates. But the Fed doesn’t determine mortgage rates, even if the headlines make it sound like they do.

The truth is, mortgage rates are impacted by a lot of factors: geo-political uncertainty, inflation and the economy, and more. And trying to pin down when all those factors will line up enough for rates to come down is tricky.

That’s why it’s generally not worth it to try to time the market. There’s too much at play that you can’t control. The best thing you can do is control the controllables.

And when it comes to rates, here’s what you can influence to make your moving plans a reality.

Your Credit Score

Credit scores can play a big role in your mortgage rate. As an article from CNET explains:

“You can’t control the economic factors influencing interest rates. But you can get the best rate for your situation, and improving your credit score is the right place to start. Lenders look at your credit score to decide whether to approve you for a loan and at what interest rate. A higher credit score can help you secure a lower interest rate, maybe even better than the average.”

That’s why it’s even more important to maintain a good credit score right now. With rates where they are, you want to do what you can to get the best rate possible. If you want to focus on improving your credit score, your trusted loan officer can give you expert advice to help.

Your Loan Type

There are many types of loans, each offering different terms for qualified buyers. The Consumer Financial Protection Bureau (CFPB) says:

“There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose.”

When working with your team of real estate professionals, make sure you find out what’s available for your situation and which types of loans you may qualify for.

Your Loan Term

Another factor to consider is the term of your loan. Just like with loan types, you have options. Freddie Mac says:

“When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Depending on your situation, the length of your loan can also change your mortgage rate.

Bottom Line

Remember, you can’t control what happens in the broader economy. But you can control the controllables.

Work with a trusted lender to go over the things you can do that’ll make a difference. By being strategic with these factors, you may be able to combat today’s higher rates and lock in the lowest one you can.

Worried About Mortgage Rates? Control the Controllables

Let’s talk about the elephant in the room – mortgage rates. They’ve been on a bit of a rollercoaster lately, leaving aspiring homeowners feeling like they’re strapped to the front car. But fear not, intrepid house hunters! While we can’t control the whims of the financial markets, there’s a whole lot we can control on our end of the homeownership equation.

This blog post is your roadmap to navigating the categories of mortgage loans with confidence. We’ll delve into the nitty-gritty of choosing the right home loan for you, empowering you to make informed decisions and snag that dream West Palm Beach abode.

Conventional vs. Government-Backed Loans: Understanding Your Options

First things first, let’s unpack the two main categories of mortgage loans: conventional and government-backed.

Conventional loans are the bread and butter of the mortgage world. Offered by private lenders, they typically require a higher credit score (think 620 or above) and a down payment of at least 20%. However, they often boast the most competitive mortgage rates.

On the other hand, government-backed loans like FHA and USDA loans are designed to make homeownership more accessible. They come with more flexible credit score requirements and lower down payment options, making them ideal for first-time homebuyers or those with less cash saved up. However, they may come with slightly higher mortgage rates and require private mortgage insurance (PMI) if your down payment is less than 20%.

The Credit Score Conundrum: It’s All About Building Trust

Let’s be honest, your credit score is like your financial report card. It tells lenders how responsible you’ve been with managing debt in the past, and that directly impacts the mortgage rates they offer you. The higher your credit score, the lower the interest rate you’ll qualify for, potentially saving you tens of thousands of dollars over the life of your loan.

So, if your credit score isn’t singing soprano, don’t despair! There are steps you can take to improve it. Consider these credit score boosters:

- Pay down existing debt: This demonstrates your ability to manage financial obligations.

- Become a credit card virtuoso: Make on-time payments in full to rack up those good credit vibes.

- Seek out errors: Regularly check your credit report for inaccuracies and dispute them if necessary.

Inflation’s Impact: A Double-Edged Sword

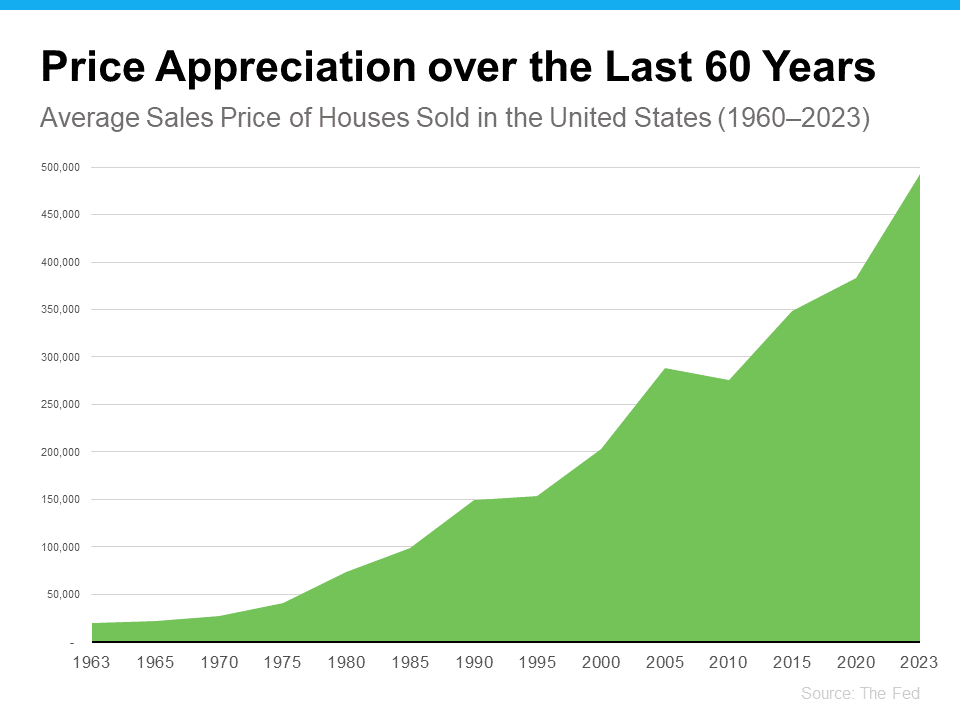

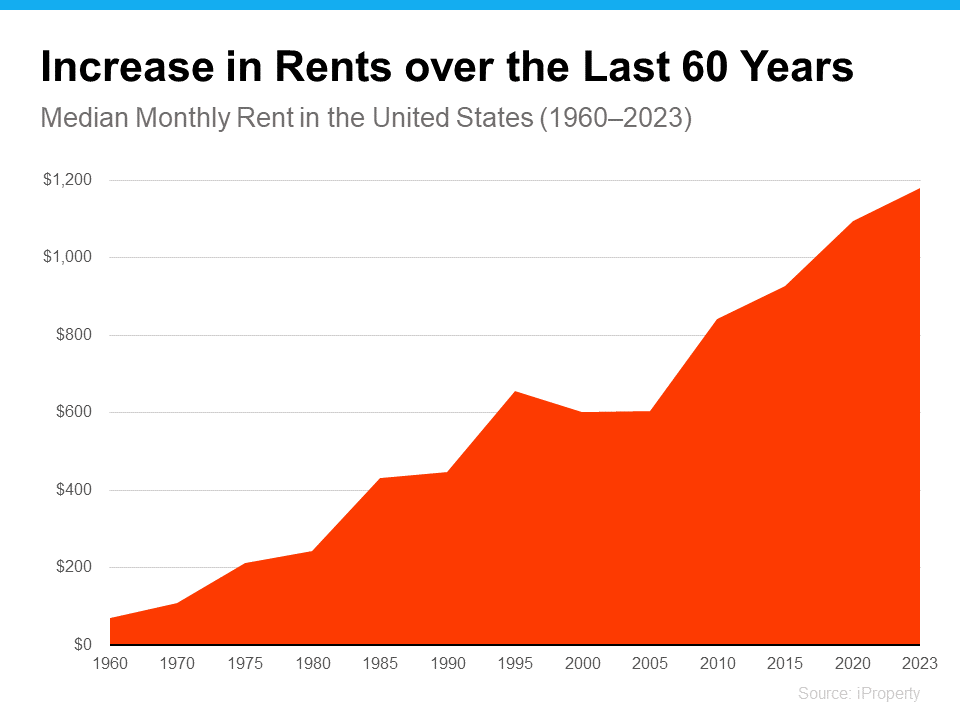

While rising mortgage rates might seem like the ultimate buzzkill, let’s consider the bigger picture. Inflation, which is on the rise these days, can actually work in your favor. Here’s why:

As home prices generally increase with inflation, the value of your home is likely to go up as well. This means you’ll be building equity faster, potentially creating a buffer against future fluctuations in the housing market.

The Power of Partnership: Finding Your Trusted Lender

Look, navigating the mortgage maze can feel like deciphering ancient hieroglyphics. That’s where your West Palm Beach mortgage broker comes in. They’re your personal mortgage guru, guiding you through the many types of loans you may qualify for, explaining the intricacies of your loan term, and negotiating the best possible mortgage rates on your behalf.

Think of them as your financial wingman (or wingwoman!), someone who has your back and advocates for your best interests. Now, that’s a partnership worth celebrating!

Beyond the Basics: Tailoring Your Loan to Your Needs

Now that we’ve covered the fundamentals, let’s delve a little deeper. Here are some additional factors to consider when choosing the right home loan for you:

- Your loan type: This could be a fixed-rate loan with a guaranteed interest rate for the entire term, or an adjustable-rate mortgage (ARM) with rates that can fluctuate over time.

- Your loan term: The term of your loan refers to the length of time you have to repay it. Shorter terms typically come with lower interest rates, but require higher monthly payments.

- Down payment: The more you put down upfront, the lower your loan amount and potentially the better your mortgage rates.

Turning Worries into Wins: Taking Action

Alright, let’s ditch the anxiety and get proactive! Here are some actionable steps you can take to conquer your homeownership goals:

- Get Pre-Approved: This golden ticket demonstrates your financial readiness to potential sellers and puts you in a stronger negotiating position.

- Work with a Trusted Lender: West Palm Beach mortgage brokers are your secret weapon.

West Palm Beach: Your Mortgage Matchmaker

Finding the best mortgage rates in West Palm Beach can feel like searching for a four-leaf clover. But fret not, future homeowner! Here’s how to leverage the local landscape to your advantage:

-

Local Mortgage Lenders vs. National Chains: While national lenders have a broad reach, local West Palm Beach mortgage brokers often have a deeper understanding of the specific market trends and nuances. They can tailor loan options to the unique characteristics of West Palm Beach real estate, potentially unlocking better mortgage rates or loan programs specifically suited to the area.

-

Embrace Technology, But Prioritize Relationships: Utilize West Palm Beach mortgage calculators to get a ballpark estimate of what you can afford. However, don’t underestimate the power of human connection. Building a rapport with a local trusted loan officer allows for personalized guidance and a deeper dive into your specific financial situation.

-

First-Time Homebuyer Programs: West Palm Beach offers a plethora of programs specifically designed to help first-time homebuyers overcome the down payment hurdle. Explore options like FHA loans with lower down payment requirements, or USDA loans for qualified rural property purchases. Your local mortgage broker can be an invaluable resource in navigating these programs and determining your eligibility.

Beyond the Numbers: Unveiling the Human Touch

Finding the right home loan goes beyond just the mortgage rates. Here are some additional qualities to seek in your West Palm Beach mortgage broker:

-

Communication is Key: Ensure your trusted loan officer is a clear and concise communicator. You should feel comfortable asking questions and completely understand the loan options presented.

-

Responsiveness is King (or Queen): A prompt and attentive loan officer is crucial. Buying a home is a time-sensitive process, and you need someone who can navigate the complexities efficiently and keep you informed every step of the way.

-

Advocacy Above All: Your West Palm Beach mortgage broker should be your champion, fighting for your best interests and negotiating the most favorable terms possible.

West Palm Beach Refinance Options: Breathe New Life into Your Mortgage

Thinking about refinancing your existing mortgage? Let’s explore the potential benefits:

-

Lower Your Interest Rate: If mortgage rates have dropped since you bought your home, refinancing can save you significant money over the long haul.

-

Shorten Your Loan Term: Refinancing can allow you to pay off your mortgage sooner, potentially freeing up monthly cash flow and building equity faster.

-

Tap into Your Home’s Equity: A cash-out refinance allows you to access the built-up equity in your home for renovations, debt consolidation, or other financial goals.

Remember: Refinancing isn’t a one-size-fits-all solution. Consult with your trusted loan officer to determine if refinancing makes sense for your specific financial situation.

The Final Chapter: Your West Palm Beach Homeownership Journey Begins Here

Whew! We’ve covered a lot of ground, but hopefully, you now feel empowered to navigate the exciting, yet sometimes daunting, world of homeownership in West Palm Beach. Remember, knowledge is power. Utilize the resources at your disposal, from West Palm Beach mortgage calculators to the expertise of local mortgage brokers.

With careful planning, the right financial partner by your side, and a healthy dose of proactive spirit, that dream home in West Palm Beach can become your reality. So, take a deep breath, embrace the journey, and let’s make homeownership a reality!

Conquer Your West Palm Beach Homeownership Dreams: A Bonus Toolbox

Here’s a bonus toolbox filled with handy resources to jumpstart your West Palm Beach homeownership adventure:

-

Government Resources: The U.S. Department of Housing and Urban Development (HUD) offers a wealth of information for homebuyers, including resources on first-time homebuyer programs, financial counseling, and fair housing rights. You can explore their website at https://www.hud.gov/

-

Florida Housing Coalition: This non-profit organization provides education and resources to empower Floridians to achieve sustainable homeownership. They offer workshops, counseling services, and information on down payment assistance programs. Check out their website at https://www.flhousing.org/

-

West Palm Beach Real Estate Professionals: Partner with a knowledgeable and reputable West Palm Beach real estate agent. They can guide you through the local market landscape, identify properties that match your needs and budget, and advocate for you throughout the negotiation process.

Remember: Don’t be afraid to ask questions! A good real estate agent and mortgage broker will be happy to address any concerns you have and ensure you feel confident and informed every step of the way.

The Takeaway: Owning Your Dreamscape in West Palm Beach

While mortgage rates may fluctuate, the dream of homeownership doesn’t have to. By taking control of the controllables, like your credit score and down payment, and leveraging the expertise of local professionals, you can navigate the West Palm Beach real estate market with confidence.

So, unleash your inner explorer, delve into the resources provided, and start crafting your West Palm Beach homeownership story. With a little planning and the right guidance, you’ll be celebrating housewarming festivities in that dream abode before you know it!

West Palm Beach: A City Where Dreams Take Root

West Palm Beach isn’t just a collection of streets and buildings; it’s a vibrant community brimming with culture, opportunity, and that quintessential Florida sunshine. Owning a piece of this paradise offers a lifestyle unlike any other.

Here’s a glimpse into the magic that awaits:

-

Sun-Kissed Shores and Sparkling Waters: West Palm Beach boasts pristine beaches, perfect for soaking up the rays, building sandcastles with the little ones, or indulging in exhilarating water sports. Kayaking through mangrove forests, paddleboarding on calm waterways, or deep-sea fishing for a trophy catch are just a few of the aquatic adventures that beckon.

-

A Cultural Tapestry: Immerse yourself in West Palm Beach’s rich cultural tapestry. Explore the Norton Museum of Art, showcasing an impressive collection of European and American masterpieces. Catch a captivating performance at the Kravis Center for the Performing Arts, or delve into the city’s vibrant street art scene.

-

A Foodie’s Paradise: From fresh seafood caught just off the coast to delectable international cuisine, West Palm Beach tantalizes taste buds of all persuasions. Sample the local catch at a waterfront restaurant, savor authentic Cuban fare in Little Havana, or embark on a culinary journey through trendy cafes and upscale eateries.

-

Nature’s Playground: Escape the urban bustle and explore the natural wonders surrounding West Palm Beach. Take a hike through John D. MacArthur State Park, teeming with diverse wildlife. Rent a bike and explore the scenic Peanut Island, or kayak through the Loxahatchee River, a designated National Wild and Scenic River.

Owning a home in West Palm Beach isn’t just about acquiring bricks and mortar; it’s about embracing a lifestyle. Imagine waking up to the gentle ocean breeze, spending weekends exploring hidden coves, and evenings savoring vibrant sunsets with loved ones. This is the life that awaits you as a West Palm Beach homeowner.

The Final Word: Your West Palm Beach Homeownership Journey Starts Now

So, what are you waiting for? With the right knowledge, resources, and a trusted team of professionals by your side, navigating the West Palm Beach mortgage landscape doesn’t have to be daunting. Take that first step today.

Remember, the key to unlocking your West Palm Beach dream home lies in controlling the controllables, embracing the local expertise, and believing in the power of your aspirations. With a little planning and a lot of heart, you’ll be basking in the sunshine of your very own West Palm Beach haven in no time.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice