The Perks of Buying over Renting

Thinking about buying a home? While today’s mortgage rates might seem a bit intimidating, here are two solid reasons why, if you’re ready and able, it could still be a smart move to get your own place.

1. Home Values Typically Go Up Over Time

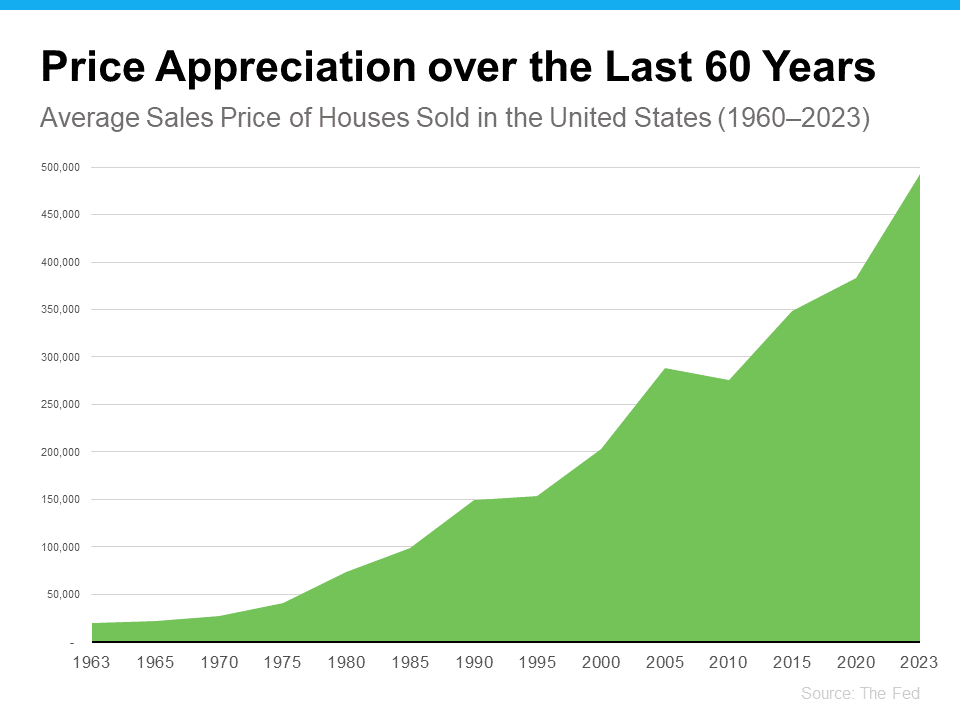

There’s been some confusion over the past year or so about which way home prices are headed. Make no mistake, nationally they’re still going up. In fact, over the long-term, home prices almost always go up (see graph below):

Using data from the Federal Reserve (the Fed), you can see the overall trend is home prices have climbed steadily for the past 60 years. There was an exception during the 2008 housing crash when prices didn’t follow the normal pattern, but generally, home values kept rising.

This is a big reason why buying a home can be better than renting. As prices go up and you pay down your mortgage, you build equity. Over time, this growing equity can really increase your net worth. The Urban Institute says:

“Homeownership is critical for wealth building and financial stability.”

2. Rent Keeps Rising in the Long Run

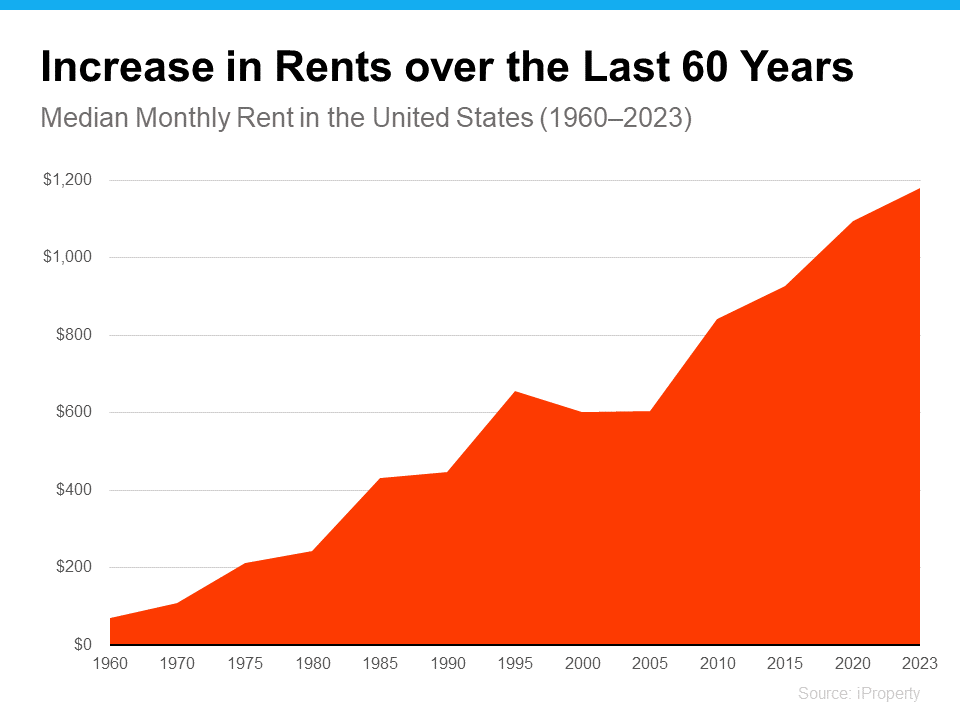

Here’s another reason you may want to think about buying a home instead of renting – rent just keeps going up over the years. Sure, it might be cheaper to rent right now in some areas, but every time you renew your lease or sign a new one, you’re likely to feel the squeeze of your rent getting higher. According to data from iProperty Management, rent has been going up pretty consistently for the last 60 years, too (see graph below):

So how do you escape the cycle of rising rents? Buying a home with a fixed-rate mortgage helps you stabilize your housing costs and say goodbye to those annoying rent increases. That kind of stability is a big deal.

Your housing payments are like an investment, and you’ve got a decision to make. Do you want to invest in yourself or keep paying your landlord?

When you own your home, you’re investing in your own future. And even when renting is cheaper, that money you pay every month is gone for good.

As Dr. Jessica Lautz, Deputy Chief Economist and VP of Research at the National Association of Realtors (NAR), says:

“If a homebuyer is financially stable, able to manage monthly mortgage costs and can handle the associated household maintenance expenses, then it makes sense to purchase a home.”

Bottom Line

If you’re tired of your rent going up and want to explore the many benefits of homeownership, let’s talk to explore your options.

Tips & Benefits: The Perks of Buying over Renting

When it comes to the decision between buying a home and renting, many factors come into play. However, the benefits of homeownership often outweigh the advantages of renting. Here’s why:

1. Build Equity Over Time

One of the most significant benefits of homeownership is the ability to build equity. As you pay down your mortgage, you gain ownership interest in your property. This equity can be a powerful financial tool, allowing you to borrow against it in the future if needed.

2. Fixed-Rate Mortgage Stability

With a fixed-rate mortgage, your monthly payments remain the same for the life of the loan. This stability allows you to manage monthly mortgage costs effectively, without worrying about rent increases.

3. Appreciation of Home Values

Over time, home values tend to rise. By buying a home, you’re investing in an asset that could appreciate in value, potentially providing a significant return on your investment.

4. Freedom to Make Your Space Your Own

When you own your home, you have the freedom to customize it to your liking. Whether it’s painting the walls your favorite color or renovating the kitchen, homeownership allows you to create a space that reflects your personal style.

5. Potential for Rental Income

If you purchase a home and decide to move in the future, you could rent out the property for additional income. This potential for rental income is a perk that renters do not enjoy.

6. Local Market Conditions

In areas like West Palm Beach, where there are affordable home loans and best mortgage rates, buying can be a smart financial move. Local mortgage lenders in West Palm Beach can provide valuable advice and help you secure a loan that fits your budget.

7. Long-Term Cost Savings

While the upfront costs of buying a home can be higher than renting, the long-term costs often favor homeownership. Over time, the costs associated with renting can surpass the costs of owning a home, especially when you consider the potential for equity growth and appreciation.

8. Planning for the Future

If you’re thinking about buying a home, consider the long-term benefits. Homeownership can provide a sense of stability and financial security that renting cannot offer. Plus, once your mortgage is paid off, your housing costs can significantly decrease, providing more financial freedom in your retirement years.

In conclusion, while both renting and buying have their pros and cons, the perks of buying a home often make it a worthwhile investment. Whether you’re looking at first-time home buyer loans in West Palm Beach or exploring West Palm Beach refinancing options, consider speaking with a West Palm Beach mortgage broker to understand your options better. Utilize tools like West Palm Beach mortgage calculators and seek property loan advice in West Palm Beach to make an informed decision. Remember, the goal is not just to buy a house, but to secure a home where you can build a future.

9. Tax Benefits

One of the most overlooked benefits of homeownership is the potential tax benefits. Homeowners may be able to deduct mortgage interest and property taxes, which can lead to significant savings over time. It’s always a good idea to consult with a tax professional to understand these benefits fully.

10. A Sense of Community

When you purchase a home, you’re not just buying a property; you’re investing in a community. Homeowners often have a stronger connection to their neighborhood, contributing to local events, schools, and organizations.

11. The Satisfaction of Ownership

There’s a unique sense of satisfaction that comes with owning your home. It’s a place where you can create lasting memories, provide a stable environment for your family, and take pride in ownership.

12. Utilizing Local Expertise

Whether you’re seeking a commercial mortgage broker in West Palm Beach or need assistance with mortgage preapproval in West Palm Beach, local experts can provide invaluable insights and guidance. They understand the local market conditions and can help you navigate the home buying process.

13. Future Financial Security

Homeownership can contribute to your future financial security. As you pay down your mortgage and build equity, you’re creating a financial cushion that you can rely on in the future.

In conclusion, while renting may seem like the easier or more affordable option in the short term, the long-term benefits of homeownership often outweigh the costs. From building equity and enjoying tax benefits to experiencing the satisfaction of owning your own home, there are numerous reasons to consider buying over renting.

Remember, buying a home is a significant decision, and it’s essential to do your research and consult with professionals. Whether you’re looking for affordable West Palm Beach home loans or seeking the best mortgage rates in West Palm Beach, local experts can provide the guidance you need to make an informed decision. Happy house hunting!

9. Tax Benefits

One of the most overlooked benefits of homeownership is the potential tax benefits. Homeowners may be able to deduct mortgage interest and property taxes, which can lead to significant savings over time. It’s always a good idea to consult with a tax professional to understand these benefits fully.

10. A Sense of Community

When you purchase a home, you’re not just buying a property; you’re investing in a community. Homeowners often have a stronger connection to their neighborhood, contributing to local events, schools, and organizations.

11. The Satisfaction of Ownership

There’s a unique sense of satisfaction that comes with owning your home. It’s a place where you can create lasting memories, provide a stable environment for your family, and take pride in ownership.

12. Utilizing Local Expertise

Whether you’re seeking a commercial mortgage broker in West Palm Beach or need assistance with mortgage preapproval in West Palm Beach, local experts can provide invaluable insights and guidance. They understand the local market conditions and can help you navigate the home buying process.

13. Future Financial Security

Homeownership can contribute to your future financial security. As you pay down your mortgage and build equity, you’re creating a financial cushion that you can rely on in the future.

In conclusion, while renting may seem like the easier or more affordable option in the short term, the long-term benefits of homeownership often outweigh the costs. From building equity and enjoying tax benefits to experiencing the satisfaction of owning your own home, there are numerous reasons to consider buying over renting.

Remember, buying a home is a significant decision, and it’s essential to do your research and consult with professionals. Whether you’re looking for affordable West Palm Beach home loans or seeking the best mortgage rates in West Palm Beach, local experts can provide the guidance you need to make an informed decision. Happy house hunting!

18. The Joy of Homeownership

There’s a unique joy that comes with owning your own home. It’s a place where you can create lasting memories, provide a stable environment for your family, and take pride in ownership. This emotional satisfaction is something that renting often can’t provide.

19. Greater Privacy

Owning a home often comes with a greater level of privacy compared to renting. You don’t have to worry about landlords or other tenants; your home is your own personal sanctuary.

20. A Sound Investment

Real estate is often considered a sound investment. While the market can fluctuate, over the long term, owning a home can be a great way to build wealth.

21. The Power of Predictability

With renting, you’re subject to the whims of your landlord and the rental market. However, with a fixed-rate mortgage, you have the power of predictability. Your monthly payments remain the same, allowing you to budget effectively.

22. The Advantage of Local Expertise

Whether you’re seeking a commercial mortgage broker in West Palm Beach or need assistance with mortgage preapproval in West Palm Beach, local experts can provide invaluable insights and guidance. They understand the local market conditions and can help you navigate the home buying process.

In conclusion, the decision to buy a home is a significant one, but it comes with numerous perks. From building equity to enjoying greater privacy and stability, the benefits of buying over renting are clear. So, if you’re considering making the leap from renter to homeowner, remember these perks and consider seeking advice from local experts to help guide your decision. Happy house hunting!

23. The Security of Homeownership

Owning your home provides a sense of security that renting often can’t match. You have the comfort of knowing that your home is yours as long as you meet your mortgage obligations.

24. Building Your Financial Portfolio

Homeownership is a key part of building a diverse financial portfolio. Your home is an asset that can increase in value over time, contributing to your overall wealth.

25. The Role of Local Mortgage Brokers

Local mortgage brokers, such as those in West Palm Beach, play a crucial role in the home buying process. They can help you understand your financing options, secure the best mortgage rates, and navigate the complexities of the home buying process.

26. The Potential for Growth

As a homeowner, you have the potential for growth – both in terms of your property’s value and your personal growth as you build a life in your new home.

27. The Final Word

The perks of buying over renting are numerous and varied, from financial benefits to personal satisfaction. If you’re considering making the leap from renter to homeowner, remember these perks and consider seeking advice from local experts to help guide your decision. After all, there’s no place like a home you can call your own.

In conclusion, the decision to buy a home is a significant one, but it comes with numerous perks. From building equity to enjoying greater privacy and stability, the benefits of buying over renting are clear. So, if you’re considering making the leap from renter to homeowner, remember these perks and consider seeking advice from local experts to help guide your decision. Happy house hunting!

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice