Your Home Is a Powerful Investment

Going into 2023, there was a lot of talk about a possible recession that would cause the housing market to crash. Some in the media were even forecasting home prices would drop by as much as 10-20%—and that might have made you feel a bit unsure about buying a home.

But here’s what actually happened: home prices went up more than usual. Brian D. Luke, Head of Commodities at S&P Dow Jones Indices, explains:

“Looking back at the year, 2023 appears to have exceeded average annual home price gains over the past 35 years.”

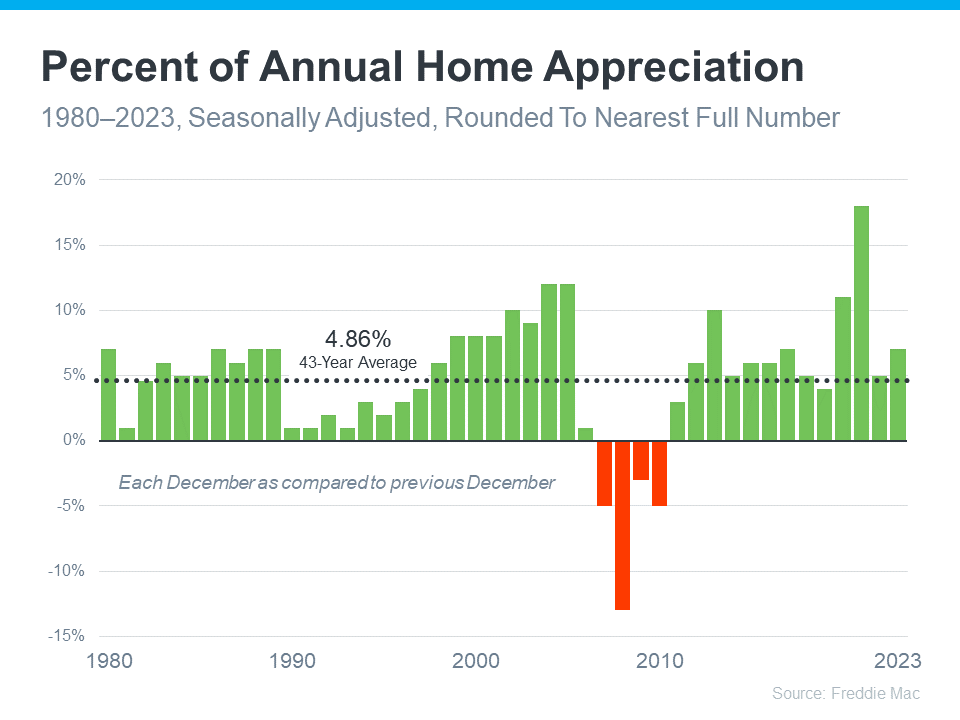

To put last year’s growth into context, the graph below uses data from Freddie Mac on how home prices have changed each year going back to 1980. The dotted line shows the long-term average for appreciation:

The big takeaway? Home prices almost always go up.

As an article from Forbes says:

“. . . the U.S. real estate market has a long and reliable history of increasing in value over time.”

In fact, since 1980, the only time home prices dropped was during the housing market crash (shown in red in the graph above). Fortunately, the market today isn’t like it was in 2008. For starters, there aren’t enough available homes to meet buyer demand right now. On top of that, homeowners have a tremendous amount of equity, so they’re on much stronger footing than they were back then. That means there won’t be a wave of foreclosures that causes prices to fall.

The fact that home values went up every single year except those four in red is why owning a home can be one of the smartest moves you can make. When you’re a homeowner, you own something that typically becomes more valuable over time. And as your home’s value appreciates, your net worth grows.

So, if you’re financially stable and prepared for the costs and expenses of homeownership, buying a home might make a lot of sense for you.

Home prices almost always go up over time. That makes buying a home a smart move, if you’re ready and able. Let’s connect to talk about your goals and what’s available in our area.

Your Home Is a Powerful Investment

In the vast landscape of the U.S. real estate market, where dreams take shape and aspirations find a tangible address, the concept of homeownership becomes more than a mere transaction. Buying a home transcends the exchange of keys and contracts; it unfolds as a significant chapter in the narrative of personal and financial growth.

Unveiling the Tapestry of Homeownership

Consider your home not just as a structure with walls and a roof but as a dynamic force, a powerful investment in your journey through life. As you navigate the diverse array of available homes, each with its unique charm and character, you embark on a journey that intertwines your dreams with the very essence of the housing market.

The pulse of the housing market echoes through the fluctuations in home prices and home values, acting as a reflection of economic trends and societal shifts. Your home becomes a living testament to the intricacies of this market, holding within its walls the story of your financial decisions and the broader economic landscape.

Unlocking the Potential: Your Home’s Value

The key to unleashing the full potential of homeownership lies in understanding and harnessing the concept of your home’s value. This value is not merely a sum on a real estate listing but a dynamic entity influenced by various factors, from local market trends to the unique features of your property.

In the bustling cityscape of West Palm Beach, where the sun kisses the Atlantic and cultural richness permeates the air, a West Palm Beach mortgage broker becomes your guide in navigating the complexities of property finance. With affordable West Palm Beach home loans and the best mortgage rates in West Palm Beach, you can carve a path to homeownership that aligns seamlessly with your aspirations.

First-Time Homebuyer Bliss

For those embarking on the journey of homeownership for the first time, the prospect of securing a residence goes beyond a financial transaction; it is a rite of passage, a tangible symbol of independence. First-time homebuyers in West Palm Beach are met with a spectrum of options, including tailored first-time home buyer loans in West Palm Beach designed to ease the transition into property ownership.

As you explore the realm of homeownership, the concept of owning a home takes on a deeply personal meaning. It is not just a matter of acquiring property but an investment in stability, a stake in the community, and a canvas for your unique lifestyle.

The Financial Dance: West Palm Beach Refinancing Options

In the dance of finances, where rates waltz and economic winds change direction, consider the significance of West Palm Beach refinancing options. Refinancing is more than a financial maneuver; it’s a strategic step to optimize your investment, ensuring that your mortgage aligns harmoniously with your current financial situation and goals.

Local nuances come into play, and having access to local mortgage lenders in West Palm Beach becomes a strategic advantage. These professionals understand the intricacies of the local market, offering insights that transcend generic advice. Navigating this landscape involves not just financial acumen but a keen understanding of the unique dynamics shaping West Palm Beach’s real estate scene.

Calculating Your Path: West Palm Beach Mortgage Calculators

In the age of information, where data empowers decision-making, leverage the tools at your disposal. West Palm Beach mortgage calculators provide a numerical roadmap, allowing you to envisage the financial journey ahead. From estimating monthly payments to gauging the impact of interest rates, these calculators serve as beacons, illuminating the path to financial stability.

Beyond Residential Horizons: Commercial Mortgage Brokers

For those with a vision extending beyond residential boundaries, the realm of commercial real estate beckons. A commercial mortgage broker in West Palm Beach becomes an invaluable ally, offering tailored solutions for those seeking to invest in commercial properties. As your aspirations expand, these professionals provide the expertise required to navigate the intricacies of commercial real estate finance.

The Prelude to Ownership: Mortgage Pre-Approval

Picture this as the prelude to homeownership, a crescendo that builds anticipation and confidence. Mortgage pre-approval in West Palm Beach sets the stage, providing you with a clear understanding of your financial standing in the eyes of lenders. Armed with this pre-approval, you venture into the housing market with a strengthened position, ready to turn the key to your dream home.

Embracing the Future: Property Loan Advice

As you navigate the labyrinth of property finance, seek counsel from those well-versed in the language of real estate. Property loan advice in West Palm Beach goes beyond mere consultation; it is a compass guiding you through the intricacies of mortgage options, ensuring that your investment aligns with both your immediate needs and long-term goals.

Crafting Your Real Estate Symphony

In the grand orchestration of real estate, your home becomes the principal instrument, each note resonating with the unique melody of your life. As you delve into the realms of available homes and explore the fluctuations in the housing market, remember that buying a home is more than a transaction; it’s a dynamic venture into the heart of financial growth.

Your home’s value is not just a numerical figure but a testament to your journey, shaped by the nuances of the U.S. real estate market. From the sunlit streets of West Palm Beach to the rhythmic dance of interest rates, your investment in homeownership reflects not just a place of residence but a powerful chapter in your life’s narrative.

So, embrace the journey, seize the opportunities, and let your home be the powerful investment that propels you into a future defined by financial stability, personal growth, and the fulfillment of your unique dreams.

The Heartbeat of Homeownership

In the ever-evolving landscape of the housing market, where trends ripple through neighborhoods and communities, the concept of homeownership pulsates as the heartbeat of stability. Beyond the numerical ebbs and flows of home prices and home values, there exists a deeper resonance—an emotional connection that transforms a property into a haven, a sanctuary, and a canvas for your life’s unfolding masterpiece.

The Dance of Home Prices and Values

The ebb and flow of home prices is like a choreographed dance, a rhythmic movement reflecting the sway of economic winds. It is a symphony of supply and demand, influenced by local developments and global shifts. As you delve into the housing market, observe the dance with a discerning eye, recognizing the patterns that shape the value of your investment.

Your home’s value transcends the tangible features; it encapsulates the intangible essence of memories, growth, and community. As neighborhoods evolve and transform, your property becomes a part of the narrative, echoing the collective pulse of the housing market.

West Palm Beach: A Tapestry of Opportunity

In the sun-drenched city of West Palm Beach, where the Atlantic breeze carries the promise of new beginnings, homeownership takes on a distinct flavor. The role of a West Palm Beach mortgage broker becomes paramount, guiding you through the intricacies of financing in this vibrant locale.

With a tapestry of available homes, each embodying the spirit of the city, West Palm Beach offers an array of opportunities to craft your own version of the American Dream. The juxtaposition of modern amenities and historic charm creates a unique backdrop for your homeownership journey.

Unveiling Financial Horizons: Affordable Home Loans

As you step into the realm of property ownership, the affordability of your venture becomes a pivotal consideration. Affordable West Palm Beach home loans lay the foundation for a sustainable investment, ensuring that your financial commitment aligns with both your immediate needs and future aspirations.

The best mortgage rates in West Palm Beach become the compass guiding you through the intricate waters of interest rates and financial commitments. Your home, nestled within this coastal haven, becomes not just a dwelling but a strategic move in the intricate dance of financial growth.

Crafting Dreams for First-Time Homebuyers

For those embarking on the enchanting journey of homeownership for the first time, the prospect is both exhilarating and, at times, daunting. The allure of tailored first-time home buyer loans in West Palm Beach acts as a beacon, illuminating a path through the labyrinth of options.

Owning a home becomes a rite of passage, an investment in personal growth, and a commitment to the vibrant community that defines West Palm Beach. The city welcomes first-time homebuyers with open arms, offering a range of options to suit diverse tastes and aspirations.

Financial Symmetry: West Palm Beach Refinancing

In the ever-shifting landscape of financial markets, the concept of West Palm Beach refinancing options emerges as a tool for maintaining financial symmetry. Refinancing is not merely a reactive measure but a proactive step toward optimizing your investment, ensuring that your mortgage aligns harmoniously with your evolving financial circumstances.

Local mortgage lenders in West Palm Beach become partners in this financial dance, offering insights rooted in the nuances of the city’s real estate market. Their expertise goes beyond numbers, providing a personalized touch that transforms the refinancing process into a strategic move in your financial playbook.

Navigating Complexity: Commercial Real Estate

For those with a vision extending beyond the residential realm, commercial real estate beckons as an avenue for growth and diversification. A commercial mortgage broker in West Palm Beach becomes a guide, navigating the complexities of commercial property finance.

As you venture into the world of commercial real estate, the dynamics change, and the investment landscape expands. The cityscape becomes a canvas for entrepreneurial dreams, and the commercial mortgage broker becomes an essential collaborator, translating your visions into tangible financial strategies.

The Prelude to Possibility: Mortgage Pre-Approval

Picture the process of mortgage pre-approval in West Palm Beach as the prelude to a symphony of possibilities. It is not merely a procedural step but a gateway to confidence and anticipation. Armed with pre-approval, you stand on the threshold of homeownership, ready to explore the array of available homes with a sense of financial empowerment.

Wisdom in Numbers: Mortgage Calculators

In the digital age, where information is at your fingertips, West Palm Beach mortgage calculators serve as digital allies, offering clarity in the realm of numbers. These calculators empower you to make informed decisions, whether you’re estimating monthly payments, evaluating interest rates, or projecting the financial trajectory of your investment.

The Art of Advisory: Property Loan Guidance

Amidst the plethora of financial information, the importance of property loan advice in West Palm Beach cannot be overstated. Beyond calculators and rates, seek the guidance of professionals who understand the art of real estate finance.

Property loan advice is more than a service; it is a collaborative effort to craft a financial strategy that aligns with your unique goals. From residential ventures to commercial endeavors, this advice becomes a compass, ensuring that your real estate journey unfolds with wisdom and foresight.

The Crescendo of Your Real Estate Symphony

In the grand symphony of real estate, your home takes center stage, echoing with the melodies of your life’s journey. As you navigate the nuances of the U.S. real estate market, West Palm Beach becomes a vibrant backdrop for your homeownership tale.

Your home is not just a structure; it is a powerful investment in your growth, stability, and dreams. From the rhythmic dance of home prices to the strategic moves of West Palm Beach mortgage brokers, each element contributes to the symphony of your real estate narrative.

So, embrace the journey with enthusiasm, make informed decisions, and let your home be the crescendo that defines a chapter in your life marked by financial prosperity, personal fulfillment, and the lasting echoes of a wise investment.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

|

|

|

|

|

|

|

|

|

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

|

We Specialize in All Types of Financing, Mortgage Loans and Real Estate Deals.

We have been in the Mortgage and Real Estate Business since 1997!

Personal Profiles:

American Dream TV Show | Mortgage Process Steps | Homebot Videos | Traditional Loan Programs | NON-QM & Portfolio Loan Programs

HomeBot: Build more wealth with your home

Our goal for you is to help you to minimize your tax liability and maximize your cash flow. In today’s market, a mortgage loan is more than ever a financial instrument that must be tied into your long and short-term personal financial plan. This will allow you to create a debt strategy that will help you to build long-term wealth for you and your family.

Check Our Reviews:Residential Financing Options:

Most all loan options are available in just about every state in the country : VA | FHA | USDA | Fannie/Freddie Conventional Loans |Reverse Mortgages | Jumbo Reverse Mortgages | Self Employed Loans | Bank Statement Loans | Investor DSCR Loans | Private Hard Money Loans | Fix & Flip Loans | Bridge Loans | No Ratio | No Income Primary Residence Loans | Jumbo & Super Jumbo loans to $50M.

Temporary Interest Rate Buy-downs on a fixed-rate conventional | FHA | VA loans: 3-2-1, 2/1 or 1/0.

Luxury Sales & Epic Loan Options:

We work with all types of Real Estate Sales & Financing options for Residential & Commercial Real Estate | Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Real Estate Closings | Residential & Commercial Insurance.

Commercial Financing Options:

Our commercial division and can do business in any state in the country for all types of Commercial Loans for owner occupied properties or for business purposes from $50k to $500M | bridge loans | new construction loans for both owner occupied & for investors for individual single family Developer or Builder Spec Homes Loans | Townhomes | Condos | Real Estate Projects for Single Family Home Communities | Townhome Communities | Ground up new construction condominium buildings | Commercial Buildings | Apartment Complex’s | Mixed-Use Projects | SBA loans for new businesses | new construction | acquisition | Refinancing an exciting Loan | business purpose loans for A/R | inventory or cash flow | Doctor Loans for Business Acquisition & Commercial Real Estate with LTV’s as high as 100% LTV

We are your One-Stop Brokerage for all your Personal Residential Mortgage Financing & Sales | Commercial Real Estate Mortgage Financing & Sales | Commercial Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Homeowners insurance | Business Purpose personal and commercial needs.

Keep in mind we shop more than 250 residential and over 10K Commercial banks, lenders & mortgage companies to give you amazingly low rates and the largest product line in the country!

If you have any questions or if you have friends, family or clients, that are buying a home & need a mortgage or want to chat about a scenario just contact us right away:

1) 📅To schedule a time to talk with me just click here: 🔗 Schedule an Appointment with me: Click Here (pick the calendar that fits your specific situation)

2) 🏦 Apply for a mortgage now at www.ChristianPennersLoanApp.com

If you apply, please text me your full name and email address 📱561-373-0987 or

3) 📞Call me directly ☎️561-373-0987

Helping You Achieve The American Dream Of Home Ownership.

#AmericasMortgageSolutions #christianpenner #onestopbrokershop #mortgagebrokerwestpalmbeach #epicrealeststedeals #luxuryhomes #LuxurySales&EpicLoanOptions #TheChristianPennerMortgageTeam #buildwealth #mortgagebrokerflorida #theamericandream #finacingtheamericandream #realestate #mortgage #mortgagebroker #thanks #mortgagetips #mortgageadvice #RealEstateJourney #realtor #realestateexpert #realestatelife #realestategoals #realestatetips #realtorlifestyle #realtorsoffacebook #realtorforlife #businesspupose #mortgageloans #HouseHunting #DreamHome #homeownership #vacationhome #secondhome #homebuyer #interestrates #HousingMarket #stoprenting #commercialloans #ResidentialRealEstateDevelopments #CommercialRealEstateDevelopments #Yachts #Aircrafts #RVs #CollectorCars #ExoticCars #roofsolar #solar #roofSolarFinancingPackages #buildequity #planforyourfuture #buildyoufuture #television #host #tvproduction #streaming #travel #amazon #motivational #Agentmastermindclass #HorseFarms #EquestrianCenters #Vineyards #FruitandVegetableFarms #HobbyFarms #RealEstateInvestment #LuxuryRealEstate #PropertyManagement #RealEstateDevelopment #RealEstateAdvice #HomeStaging #RealEstateGoals #PropertyListing #EcoFriendlyHomes #RealEstatePhotography #UrbanRealEstate #SuburbanHomes #RuralProperties #RealEstateMarket #RealEstateForSale #RealEstateBrokerage #HomeRenovation #RealEstateTech #SmartHomeTechnology #GreenRealEstate #RealEstateNetworking #RealEstateSeminars #RealEstateLaw #RealEstateFinance #LuxuryApartments #CommercialProperties #RealEstateAuctions #HistoricHomes #WaterfrontProperties #CondoLiving

🔍 Whether you’re looking for financing 💰 or to BUY 🏡, SELL 🔄, LEASE 📝, INVEST 💹 or BUILD YOUR DREAM HOME 🏗️ or OFFICE 🏢 on Residential Properties 🏘️, Commercial Real Estate 🏬, or Development Commercial Real Estate 🏗️, Yachts 🛥️, Aircrafts ✈️, RVs 🚐, or Exotic Cars 🚗 – call us TODAY 📞. No matter the NEED 🎯 or GOAL 🏆 – let’s make CONFIDENT decisions together 👥💼.

Christian Penner, CMA

President | CEO | Mortgage Broker

NMLS#368289

America’s Mortgage Solutions, Inc NMLS#2009420

Cell/SMS: 561-373-0987

Direct/efax/SMS: 561-316-6800

Christian Penner712 U.S. Highway 1 North #300, North Palm Beach, FL 33408 |