Experts Project Home Prices Will Increase in 2024

Even though home prices are going up nationally, some people are still worried they might come down. In fact, a recent survey from Fannie Mae found that 24% of people think home prices will actually decline over the next 12 months. That means almost one out of every four people are dealing with that fear, and you might be, too.

To help ease that concern, here’s what experts forecast will happen with prices this year.

Experts Project a Modest Increase

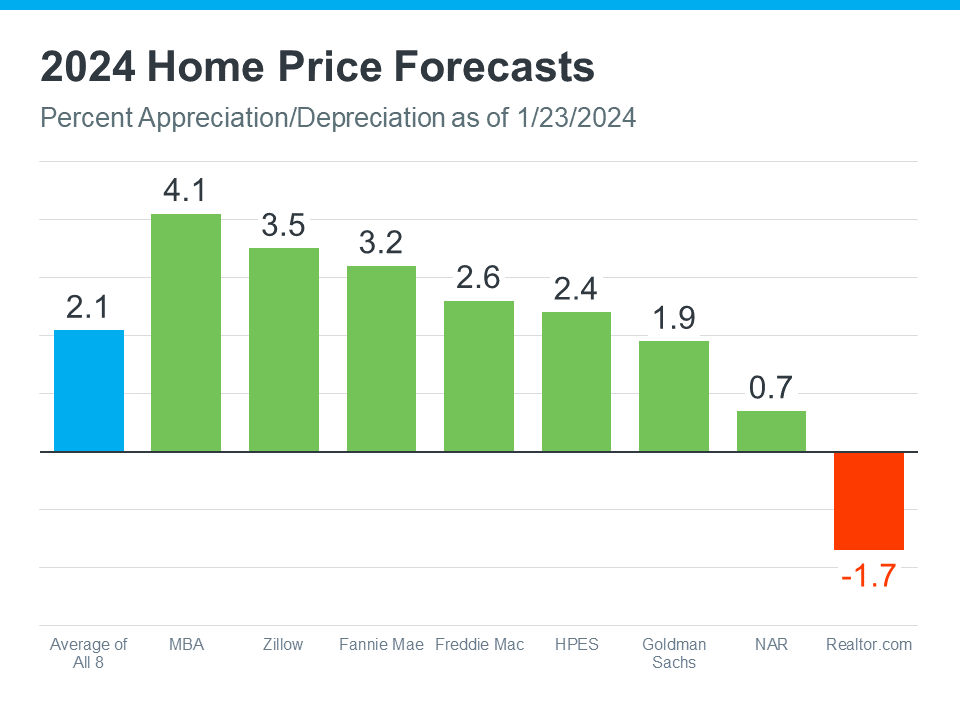

Check out the latest home price forecasts from eight different sources (see graph below):

The blue bar on the left means, on average, experts think home prices will go up over 2% by the end of this year – not down.

Prices aren’t likely to depreciate in 2024 because inventory is still tight and lower mortgage rates are leading to strong buyer demand. Those two factors will keep pushing prices up as the year goes on. As Selma Hepp, Chief Economist at CoreLogic, explains:

“With mortgage rates dropping, demand for homes in early 2024 is likely to be strong and will again put pressure on prices, similar to trends observed in early 2023 . . . Most markets will continue to reach new home price highs over the course of 2024.”

What Does This Mean for You?

Experts are saying home prices will go up this year, and that’s good news if you’re thinking about buying a home. When you become a homeowner, you want the value of your house to go up. That appreciation is what builds equity and makes homeownership such a good investment over time.

Beyond that, expected home price appreciation also means if you’re ready, willing, and able to buy, waiting just means it will cost more later.

If you’re worried home prices will come down, don’t be. Many experts believe they’ll actually go up this year. If you have questions or worries about what’s happening with prices in our area, let’s connect.

Unlocking the Crystal Ball: Experts Project Home Prices Will Increase in 2024

In the intricate dance of real estate, the spotlight often falls on the crystal ball wielded by market experts. The burning question on many minds is whether home prices will follow an upward trajectory in 2024. As we navigate the labyrinth of factors influencing the housing market, the consensus among experts suggests a crescendo in property values.

The Allure of Homeownership

At the heart of this forecast lies the perennial allure of homeownership. The dream of having a place to call your own has consistently fueled the housing market, propelling it forward even in the face of economic headwinds. The year 2024 appears poised to be no exception.

Experts point to a confluence of factors that are likely to bolster home prices. The synergy of low inventory, robust demand, and a resilient job market creates a perfect storm, one that seemingly sets the stage for an ascent in property values.

The Tug of War: Buying A Home in 2024

Buying a home has always been a delicate dance between supply and demand, and 2024 seems to be no different. The housing inventory, akin to a precious commodity, is expected to remain relatively scarce, exerting upward pressure on home prices. As the pool of available homes shrinks, prospective buyers find themselves grappling with increased competition, which, in turn, further fans the flames of a potential surge in property values.

However, the landscape is not solely defined by supply constraints. The ebb and flow of mortgage rates also emerges as a pivotal player in this intricate game. The pendulum of economic forces swings, and with it, the cost of borrowing fluctuates. Industry experts project a gradual yet perceptible rise in mortgage rates throughout 2024. This subtle shift in the financial ecosystem could potentially act as a counterbalance to the upward momentum of home prices, introducing an element of caution into the market.

The Symphony of Economics: Unraveling the Threads

To understand the symphony of factors influencing the value of your house, one must delve into the intricacies of economic trends. The cyclical nature of real estate markets reveals itself through a kaleidoscope of interconnected elements.

Supply and Demand Dynamics

The supply-demand tango is a ballet choreographed by economic fundamentals. The scarcity of available homes creates an environment where demand outstrips supply, pushing home prices skyward. This dance becomes particularly pronounced in regions witnessing population growth or areas with limited land for new construction.

The Shadow of Interest Rates

One of the haunting shadows cast over the value of your house is the specter of mortgage rates. These rates, determined by a complex interplay of economic indicators, influence the cost of borrowing. A rise in mortgage rates can potentially dampen demand, acting as a natural check on runaway home prices.

Employment and Wage Trends

The rhythm of the housing market is intricately linked to the beat of employment and wage trends. A robust job market, accompanied by wage growth, empowers more individuals to take the plunge into homeownership. This surge in demand, in turn, contributes to an uptick in home prices.

The Prognosis: A Surge in Home Prices on the Horizon

As we decipher the intricate threads woven into the tapestry of the housing market, the prognosis points toward a surge in home prices in 2024. The scarcity of available homes, amplified by sustained demand and a resilient job market, sets the stage for an ascent in property values.

While the prospect of rising mortgage rates casts a shadow over this trajectory, the overall momentum appears resilient. The allure of homeownership remains a potent force, and the dance of supply and demand continues to shape the landscape.

Navigating the Waters: Strategic Considerations for Homebuyers

For those contemplating buying a home in 2024, strategic considerations become paramount. As home prices potentially climb, prospective buyers may find themselves reevaluating their priorities and financial strategies.

1. Mortgage Rates: A Calculated Approach

In a landscape where mortgage rates are expected to gradually rise, a calculated approach to financing becomes imperative. Securing favorable rates early in the homebuying journey can translate into significant long-term savings. Exploring fixed-rate mortgages versus adjustable-rate options adds another layer of strategy for the discerning buyer.

2. Diversification of Location

Given the regional nuances in home prices, diversifying the search for a home across different neighborhoods or even cities can be a savvy move. By casting a wider net, buyers may uncover hidden gems where the surge in property values is more tempered.

3. Long-Term Investment Mindset

Buying a home is not merely a transaction; it’s an investment. Adopting a long-term mindset allows buyers to weather short-term fluctuations in home prices. As the adage goes, real estate is a marathon, not a sprint.

The Tapestry Unfurls: Closing Thoughts

As the tapestry of the 2024 housing market unfurls, the narrative is one of anticipation and complexity. The synergy of factors influencing the value of your house paints a portrait of a market poised for growth, even as nuances like rising mortgage rates add layers of intrigue.

For those considering buying a home in this landscape, the key lies in navigating the waters with wisdom and strategy. The journey may be complex, but for many, the allure of homeownership and the potential appreciation in home prices make it a voyage worth undertaking.

The Evolving Landscape: Adapting Strategies for Home Sellers

While prospective homebuyers strategize their moves, sellers too find themselves at the heart of this dynamic dance. For those contemplating selling their homes in 2024, understanding the pulse of the market is paramount.

The Seller’s Dilemma: Timing and Home Prices

For sellers, timing is often the linchpin that determines the success of a transaction. The anticipated surge in home prices casts a favorable shadow on those looking to capitalize on their property’s appreciation. However, navigating the delicate balance of maximizing returns while remaining competitive in a potentially crowded market poses a unique challenge.

1. Market Research: A Seller’s North Star

In the quest to align with the trajectory of rising home prices, sellers should embark on a journey of thorough market research. Understanding the micro and macroeconomic factors influencing the local real estate scene provides sellers with a compass to navigate the intricacies of pricing.

2. Home Improvement Investments: Enhancing Appeal

In a market where home prices are on the rise, investing in strategic home improvements becomes a tool for sellers to enhance the appeal of their property. From minor cosmetic touch-ups to significant renovations, these investments can pay dividends by attracting buyers seeking value in an appreciating market.

3. Agile Pricing Strategies

The fluidity of the real estate landscape demands agility in pricing strategies. While aiming to capitalize on the expected surge in home prices, sellers must also be mindful of setting a competitive price that sparks interest and generates multiple offers. The art of pricing becomes a delicate dance of strategy and adaptability.

The Ripple Effect: Broader Economic Impacts

As we dissect the prognosis for 2024, it’s crucial to recognize that the trajectory of home prices extends beyond individual transactions. The housing market, with its intricate web of interconnections, has a ripple effect that resonates through the broader economic landscape.

1. Wealth Effect: A Boost to Consumer Spending

The appreciation of home prices often triggers a wealth effect, influencing consumer behavior. Homeowners, buoyed by the perceived increase in their net worth, may be more inclined to engage in discretionary spending. This uptick in consumer activity, in turn, contributes to economic growth.

2. Investor Sentiment: Real Estate as an Asset Class

The anticipated surge in home prices also captures the attention of investors seeking opportunities in real estate. As the market gains momentum, real estate becomes an attractive asset class, further fueling demand and potentially perpetuating the cycle of rising home prices.

Navigating Uncertainty: A Constant in Real Estate

In the ever-evolving realm of real estate, one constant is the presence of uncertainty. The intricate dance of supply and demand, coupled with economic variables like mortgage rates and employment trends, introduces an element of unpredictability.

1. Contingency Planning: Mitigating Risks

For both buyers and sellers, contingency planning emerges as a crucial tool in navigating uncertainty. Contingencies in contracts provide a safety net, allowing parties to navigate unexpected challenges that may arise during the transaction process.

2. Financial Wellness: A Sturdy Anchor

Amidst the flux of the real estate market, maintaining financial wellness becomes a sturdy anchor for individuals. Whether buying a home or selling one, having a solid understanding of personal finances and a well-defined budget safeguards against unforeseen shifts in the economic landscape.

The Tapestry’s Finale: Embracing the Journey

As we approach the finale of this exploration into the intricacies of home prices in 2024, it’s essential to embrace the journey rather than fixate solely on the destination. The real estate market, with its ebbs and flows, offers a dynamic landscape for both buyers and sellers.

In the delicate dance of homeownership, where the value of your house is not just a numerical figure but a culmination of dreams and aspirations, the twists and turns of the market add depth to the narrative. Whether one is buying a home with an eye on the future or selling to unlock newfound potential, the evolving tapestry of the 2024 housing market invites all participants to be active contributors to this captivating story.

As we navigate the complex intersection of economic forces, individual decisions, and market dynamics, the resonance of rising home prices in 2024 echoes not just as a numerical forecast but as a vibrant chapter in the ongoing saga of the ever-evolving real estate landscape.

Bottom line

In the intricate tapestry of the 2024 real estate market, experts predict a surge in home prices. The dance between supply and demand, influenced by factors like low inventory, robust demand, and a resilient job market, sets the stage for an upward trajectory in property values.

For those considering buying a home, strategic considerations such as navigating mortgage rates, diversifying locations, and adopting a long-term investment mindset become crucial in this dynamic landscape. On the other side of the spectrum, sellers face the challenge of timing and pricing strategies to maximize returns in a competitive market where home prices are on the rise.

The broader economic impacts of this anticipated surge include the wealth effect, influencing consumer spending, and the attraction of real estate as an asset class for investors. However, the constant in real estate remains uncertainty, emphasizing the importance of contingency planning and maintaining financial wellness for both buyers and sellers.

In the grand finale of this exploration, the key takeaway is to embrace the journey of homeownership and real estate transactions. The market’s twists and turns add depth to the narrative, turning the rising home prices of 2024 into a vibrant chapter in the ongoing saga of the ever-evolving real estate landscape.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice