The Surprising Amount of Home Equity You’ve Gained over the Years

There are a number of reasons you may be thinking about selling your house. And as you weigh your options, you may find you’re unsure how you’re going to deal with one thing about today’s housing market – and that’s affordability. If that’s your biggest concern, understanding how much equity you have in your house could help make your decision that much easier. Here are two key factors that have a big impact on your equity.

How Long You’ve Been in Your Home

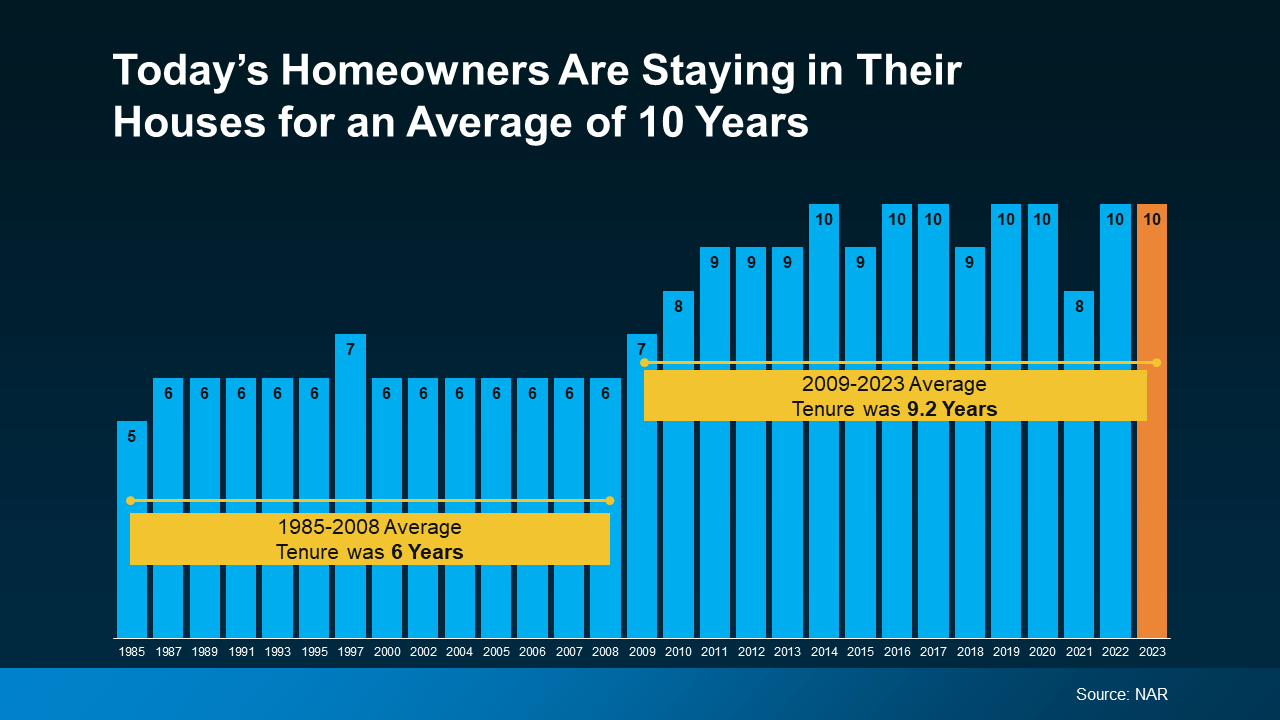

First up is homeowner tenure. That’s how long homeowners live in a house, on average, before selling or choosing to move. From 1985 to 2009, the average length of time homeowners stayed put was roughly six years.

But according to the National Association of Realtors (NAR), that number has been climbing. Now, the average tenure is 10 years (see graph below):

Here’s why that’s such a big deal. You gain equity as you pay down your home loan and as home prices climb. And when you combine all of your mortgage payments with how much prices have gone up over the span of 10 years, that adds up. So, if you’ve lived in your house for a while now, you may be sitting on a pile of equity.

Here’s why that’s such a big deal. You gain equity as you pay down your home loan and as home prices climb. And when you combine all of your mortgage payments with how much prices have gone up over the span of 10 years, that adds up. So, if you’ve lived in your house for a while now, you may be sitting on a pile of equity.

How Home Prices Appreciate over Time

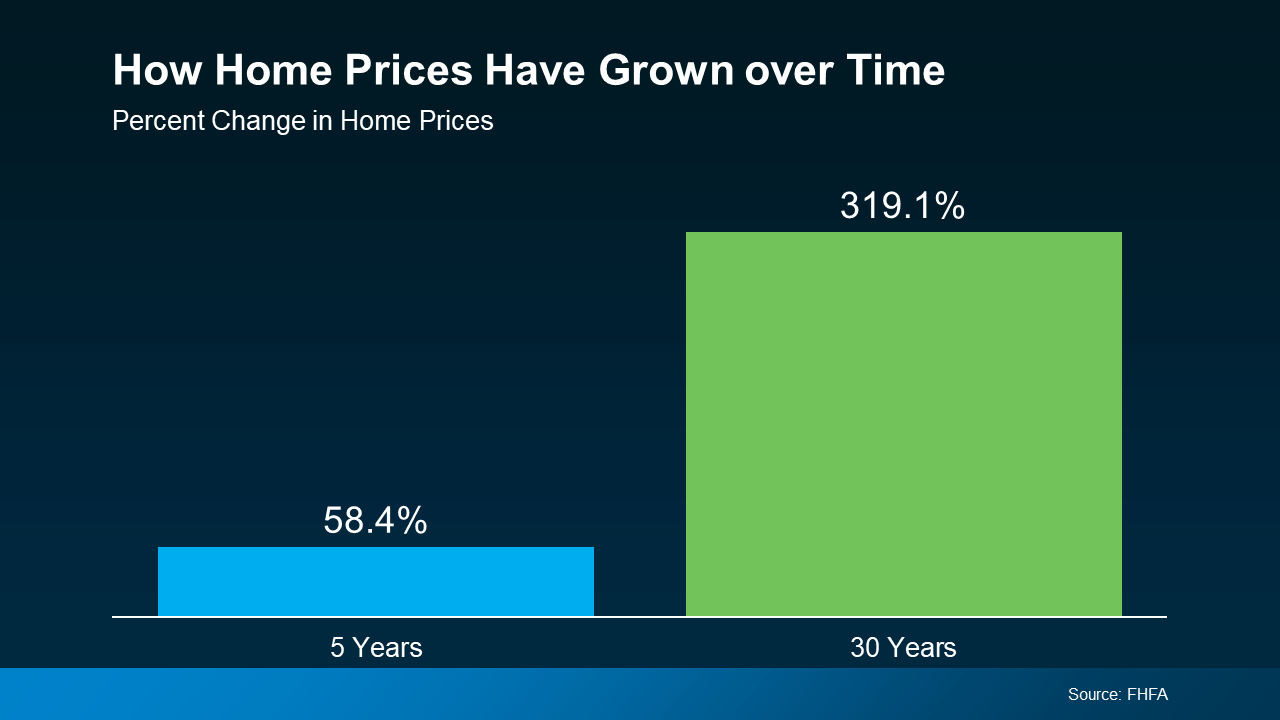

To help show how much the price appreciation piece adds up, take a look at this data from the Federal Housing Finance Agency (FHFA) (see graph below):

Here’s what this means for you. While home prices vary by area, the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it more than triple in value in that time.

Here’s what this means for you. While home prices vary by area, the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it more than triple in value in that time.

Whether you’re looking to downsize, relocate to a dream destination, or move so you can live closer to friends or loved ones, your equity can be a game changer.

If you want to find out how much equity you’ve built up over the years and how you can use it to buy your next home, let’s connect.

The Surprising Amount of Home Equity You’ve Gained Over the Years

Imagine, for a moment, the day you first bought your home. The excitement, the sense of possibility, the feeling that you’d finally made it. Fast forward to today, and what you have now is more than just a roof over your head; it’s an investment that’s been quietly growing in value, possibly in ways you hadn’t even imagined.

Welcome to the world of Home Equity—a silent force that could transform your financial future, open doors to new opportunities, and perhaps, help you finally move into that dream destination you’ve been eyeing. Whether you’re looking to buy your next home, improve your financial standing, or just want to know where you stand in today’s fast-evolving Housing Market, understanding how much equity you have in your house is critical. And trust me, the results can be quite surprising.

What is Home Equity, and Why Should You Care?

Home Equity is the difference between the market value of your home and what you owe on your home loan. Over the years, this gap can widen dramatically. This isn’t just because you’ve been steadily paying off your mortgage, but because home prices tend to rise.

In markets like West Palm Beach, where real estate values have experienced notable appreciation, the equity you’ve built up might just be your ticket to more financial freedom than you ever anticipated. Whether you’re considering refinancing options to reduce your monthly payments or hoping to make a down payment on another property, equity is key. And in this climate, understanding your home’s value has a big impact on your equity and future plans.

The Power of Rising Home Prices

There’s a tendency for people to underestimate just how much their property has appreciated, especially if they’ve owned it for more than a few years. The truth is, home values have been steadily climbing in many areas. West Palm Beach, for example, has seen significant growth in the real estate sector. If you bought your home when the market was more affordable, or even during a downturn, the affordability of those earlier home prices could now translate into substantial wealth.

For example, let’s say you bought a property 10 years ago for $300,000. At the time, it may have seemed like a stretch, but now, with the way home prices have risen in West Palm Beach, that same property could be worth $500,000 or more. Even after accounting for your mortgage balance, you could easily find that you’ve gained hundreds of thousands of dollars in Home Equity.

How to Find Out How Much Equity You’ve Built Up

Understanding how much equity you’ve built up isn’t as complicated as it may seem. The first step is figuring out your home’s current market value. In areas like West Palm Beach, a local real estate agent or an online home valuation tool can help give you an idea of what your home is worth today.

Next, subtract the remaining balance on your home loan from the current value of your home. The difference is your equity. For instance, if your home is now worth $500,000 and your mortgage balance is $200,000, then you’ve got $300,000 in equity—money that’s just sitting there, waiting to be used to your advantage.

Leveraging Your Equity: A Wealth of Options

Once you know how much equity you have in your house, the possibilities open up. Whether you want to invest in another property, remodel your current home, or even fund a large life event like a wedding or college tuition, your equity can help make these dreams a reality.

Some homeowners in West Palm Beach are choosing to tap into their equity to make a move to a dream destination, perhaps a larger home or even a vacation property. Others are opting to stay put and invest in significant home improvements, which can increase their home’s value even more.

If you’re considering Selling Your House, that equity could become a sizable profit when you sell, potentially enough to pay off your mortgage and still have a substantial down payment for your next property. In a market like West Palm Beach, where property values have risen sharply, sellers are often surprised by the big impact on your equity that current market conditions can create.

Affordability in West Palm Beach

Despite the rise in home prices, there are still affordable options for those looking to buy. With the help of a knowledgeable West Palm Beach mortgage broker, finding affordable West Palm Beach home loans or securing first-time home buyer loans in West Palm Beach is still possible. These experts are also adept at helping you find the best mortgage rates in West Palm Beach, ensuring that your new home purchase is as financially sound as it is exciting.

Local mortgage lenders in West Palm Beach can also help you figure out whether refinancing options or a home equity loan might make sense for your situation. By taking advantage of historically low interest rates, you may be able to reduce your mortgage payments or even cash out some of your equity to fund other projects or investments.

The Power of Refinancing

One of the best ways to make the most of your Home Equity is by refinancing your mortgage. In West Palm Beach, many homeowners are discovering that West Palm Beach refinancing options can save them hundreds of dollars a month, simply by securing a lower interest rate or extending the term of their loan. This can be especially helpful if you’ve already paid off a significant portion of your mortgage and are now looking to reduce your monthly payments or access the cash you’ve built up.

A West Palm Beach mortgage broker can guide you through the process, ensuring that you not only get the best mortgage rates in West Palm Beach but also the most suitable terms for your situation. They can also offer property loan advice in West Palm Beach, helping you make sense of the many options available for utilizing your equity effectively.

Navigating Your Home Equity with Local Expertise

For those who aren’t yet sure how to best utilize their equity, or for first-time buyers wondering how to make their first home purchase, the role of a local expert is invaluable. Whether you’re seeking first-time home buyer loans in West Palm Beach or guidance on mortgage preapproval in West Palm Beach, local professionals know the ins and outs of the market.

These experts, including commercial mortgage brokers in West Palm Beach, understand that each buyer or homeowner’s financial situation is unique. They can help guide you through the maze of West Palm Beach mortgage calculators, credit checks, and loan options, ensuring that your decisions are informed and financially sound. Whether you’re planning to buy your next home, tap into your equity, or refinance your current loan, having the right support makes all the difference.

A Bright Future: Using Your Equity to Build Wealth

As the housing market continues to evolve, Home Equity remains one of the most powerful tools homeowners have for building long-term wealth. In West Palm Beach, where home prices have increased significantly, the equity in your home could be the key to unlocking a wealth of opportunities. Whether you choose to reinvest in real estate, fund personal goals, or simply reduce your monthly mortgage payments, knowing how much equity you have in your house can help you take control of your financial future.

So, what’s next? It might be time to find out how much equity you’ve built up and start planning your next move. Your home has been working for you in ways you might not have realized, and the equity you’ve built could be your ticket to achieving the lifestyle, security, or dreams you’ve been working toward.

The Next Chapter: Leveraging Your Equity for Bigger Goals

As you begin to explore what your home equity can do for you, the possibilities expand far beyond just your current property. The equity you’ve built could be the stepping stone to your next financial adventure. Maybe it’s the dream of owning a second home, perhaps in a sunny destination, or an investment in rental properties that bring in passive income. The good news? Home Equity can help you achieve those bigger goals, all while allowing you to stay financially secure.

Buying Your Next Home with Equity

For many homeowners, the thought of using their Home Equity to purchase their next property is an appealing one. If your current home no longer fits your needs, or if you’ve simply outgrown it, using the equity you’ve built can allow you to afford a more expensive home without increasing your monthly expenses. The equity acts as a sizable down payment on your next property, often eliminating the need for private mortgage insurance and even securing you a better interest rate.

Whether you’re looking to upgrade to a larger home, downsize to something more manageable, or even move to that dream destination you’ve always wanted, buying your next home can be done with the equity you’ve already built. In West Palm Beach, for instance, local mortgage lenders in West Palm Beach often work with clients looking to leverage their home equity to transition seamlessly into a new property. They’ll help you navigate mortgage preapproval in West Palm Beach, so you’re ready to make your move as soon as the perfect home hits the market.

Equity as a Path to Financial Freedom

What if you’re not interested in selling your home or buying a new one? No problem—your equity is still a tremendous asset. Many homeowners use their equity to secure low-interest loans for things like debt consolidation, major home renovations, or even personal investments. Since home equity loans and lines of credit are generally offered at much lower interest rates than personal loans or credit cards, tapping into this resource can provide you with a smarter, more affordable way to access funds when needed.

Consider this: if you’re juggling high-interest credit card debt, using a home equity loan to consolidate those debts into a single, lower-interest payment could save you thousands of dollars in interest over the life of the loan. And the best part? Because your equity is tied to a tangible asset (your home), these loans typically come with much more favorable terms than unsecured loans.

In West Palm Beach, many homeowners are using West Palm Beach refinancing options to restructure their debt and put their equity to work. By refinancing into a lower-rate mortgage or accessing a home equity line of credit (HELOC), they’re able to improve their financial health while also reducing monthly payments. A West Palm Beach mortgage broker can help you determine the best strategy for your situation, whether that’s refinancing, securing a home equity loan, or exploring other options.

Renovating Your Home: Increasing Value with Equity

Your home is more than just an asset; it’s where you live, entertain, and make memories. So, why not use some of that equity to improve it? Many homeowners choose to reinvest their equity back into their homes through renovations, upgrades, and additions. Not only can these improvements make your living space more enjoyable, but they can also significantly increase the market value of your home, which means even more equity down the road.

Whether you’re planning to add a new kitchen, build a pool, or update your home’s exterior, tapping into your equity can make these dreams possible without straining your finances. And in a competitive market like West Palm Beach, where buyers are often looking for homes that are move-in ready, investing in upgrades can make a huge difference when it comes time to sell.

A well-placed renovation not only enhances your quality of life but can also increase the market value of your property, helping you build even more equity over time. This is particularly important if you’re thinking about selling in the near future. With property loan advice in West Palm Beach, you can strategically use your home’s equity to finance improvements that will yield the highest returns.

Commercial Investment: Using Equity to Expand Your Portfolio

For those who want to expand their investment portfolio, Home Equity can be an invaluable resource. In West Palm Beach, where real estate continues to be a strong investment, many homeowners are using their equity to buy commercial properties. From office spaces to retail shops and multifamily buildings, the commercial market offers a wealth of opportunities for investors looking to diversify.

By leveraging your home equity, you can potentially secure a down payment for a commercial property, opening the door to a new stream of income. Whether you’re interested in renting out office space or investing in a retail location, working with a commercial mortgage broker in West Palm Beach can help you navigate the nuances of the commercial market. They’ll help you find the right property, secure favorable loan terms, and make the most of your investment.

Owning commercial real estate not only provides an additional revenue stream but also offers significant tax advantages and the potential for long-term appreciation. And thanks to your home equity, you can enter this market without having to come up with a large cash down payment.

First-Time Buyers: Equity Isn’t Just for Seasoned Homeowners

You don’t have to be a seasoned homeowner to take advantage of Home Equity. In fact, for first-time home buyers in West Palm Beach, understanding the concept of equity can help you make smarter financial decisions right from the start. Buying a home is one of the most significant investments you’ll ever make, and building equity from day one should be part of your long-term strategy.

For first-time buyers, the key is securing a loan that works for your budget, while still allowing you to build equity over time. First-time home buyer loans in West Palm Beach are designed to help buyers with low down payments or imperfect credit get into the housing market, without sacrificing affordability. As you pay down your loan and home values increase, you’ll start building equity—creating a financial cushion that can grow with you.

Working with a West Palm Beach mortgage broker can help first-time buyers navigate the loan process, ensuring that you get the best mortgage rates in West Palm Beach and that you’re set up for success from the very beginning.

Use a Mortgage Calculator to See the Power of Equity

Before you make any decisions, it’s always a good idea to get a clear picture of your current financial situation. A West Palm Beach mortgage calculator is a great tool to help you see how much you could save by refinancing or how much you can borrow against your home equity. These calculators can also show you what your monthly payments would look like with different loan terms or interest rates.

By plugging in your numbers, you can get a clearer sense of how your equity can work for you. Whether you’re thinking about refinancing, taking out a home equity loan, or selling your home, understanding the financial impact is crucial to making informed decisions.

The Big Picture: Making Your Equity Work for You

The equity in your home isn’t just sitting there—it’s a tool that can be used to achieve your financial goals. Whether you’re looking to buy your next home, make home improvements, or invest in commercial real estate, the power of Home Equity can help you reach those milestones faster.

In today’s market, especially in areas like West Palm Beach, the potential for equity growth is significant. With the help of local mortgage lenders in West Palm Beach, you can take full advantage of the equity you’ve built, ensuring that you’re making the smartest financial moves for your future.

It’s time to take control of your home’s value, explore your options, and start planning for the future. Whether that means moving to a new home, improving your current one, or investing in something entirely new, your Home Equity is the key to making it all happen. The next chapter of your financial journey is just beginning, and your home is playing a bigger role than you ever imagined.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice