The Latest Trends in Housing

Some Highlights

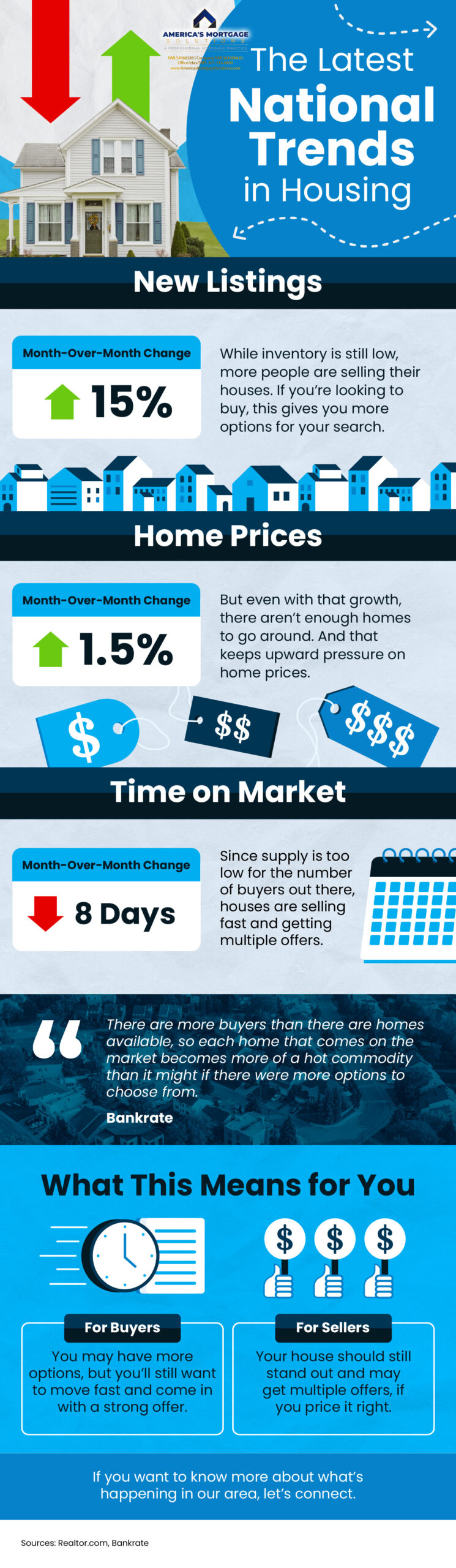

- With the number of new listings going up and average days on market going down, buyers may have more options, but will still want to move fast.

- For sellers, inventory is still low and houses are selling fast, meaning your house should stand out and may get multiple offers if you price it right.

- If you want to know more about what’s happening in our area, let’s connect.

The Latest Trends in Housing

The world of real estate is always evolving, and 2024 is no exception. This year, we’re seeing some exciting trends in housing that are shaping the market for both buyers and sellers. From fluctuating home prices to the rise of new technologies, here’s what you need to know.

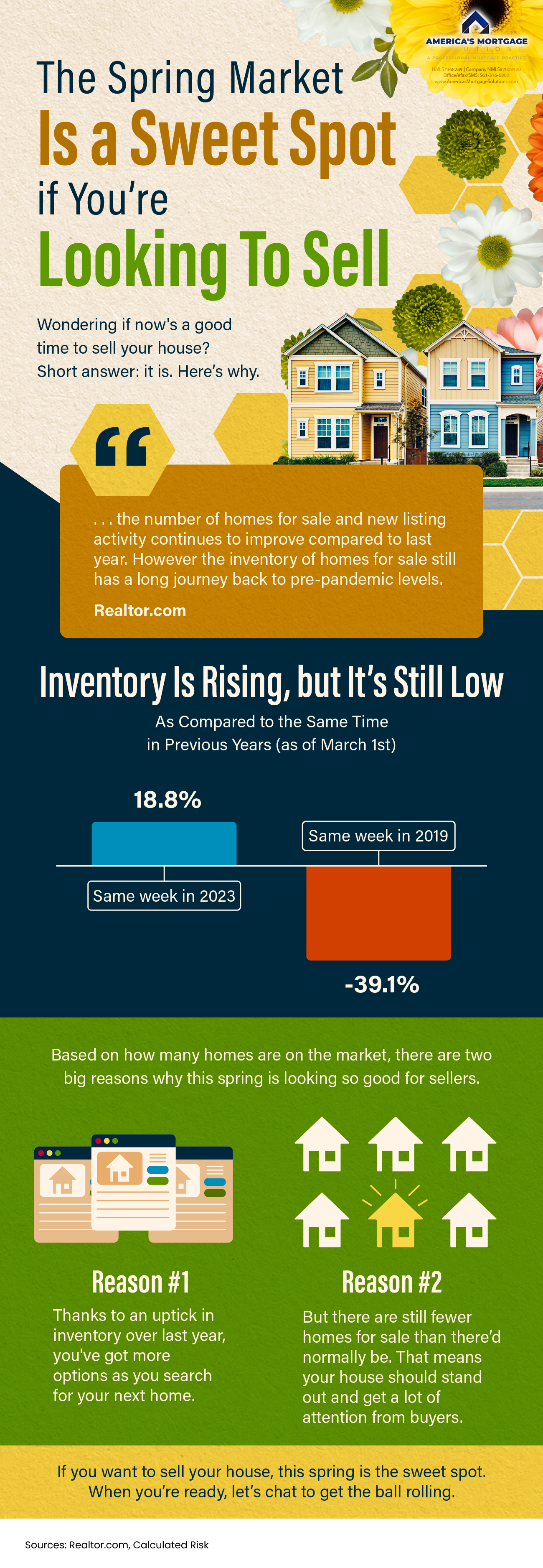

Fast-Selling Houses

One of the most notable trends this year is that houses are selling fast. With a surge in demand and a shortage of supply, homes are flying off the market at record speeds. This is great news for sellers, but it can make the home buying process stressful for buyers. To navigate this fast-paced market, Home Buying Tips and Home Selling Tips have become more important than ever.

Rising Home Prices

Another trend we’re seeing is an increase in home prices. While this might be a challenge for some buyers, it’s a positive sign for sellers and homeowners, as it indicates a strong and healthy market. However, it’s important to remember that real estate trends can vary greatly by location. For instance, the trends in North Palm Beach might be different from those in West Palm Beach.

New Listings

Despite the fast-paced market, we’re also seeing a steady stream of new listings. This is encouraging for buyers who have been struggling to find their dream home in the competitive market. It’s also a reminder for sellers that your house should stand out to attract potential buyers.

Mortgage Trends in West Palm Beach

When it comes to financing a home, there are several trends to watch out for in West Palm Beach. The West Palm Beach mortgage broker scene is thriving, with many offering Affordable West Palm Beach home loans. In fact, some of the Best mortgage rates in West Palm Beach can be found right now, making it an excellent time for First time home buyer loans in West Palm Beach.

In addition, West Palm Beach refinancing options are becoming increasingly popular as homeowners look to take advantage of the low-interest rates. And with the help of Local mortgage lenders in West Palm Beach, getting a mortgage or refinancing your home has never been easier.

To help you navigate the financing process, there are several West Palm Beach mortgage calculators available online. These tools can provide valuable Property loan advice in West Palm Beach, helping you understand how much you can afford and what your monthly payments might be.

For those interested in commercial properties, the Commercial mortgage broker in West Palm Beach scene is also seeing significant growth. And with services like Mortgage pre-approval in West Palm Beach, getting a loan for a commercial property is more straightforward than ever.

In conclusion, 2024 is shaping up to be an exciting year in the world of real estate. Whether you’re a buyer, a seller, or just a real estate enthusiast, keeping an eye on these trends can help you make informed decisions and stay ahead of the game.

The Impact of Technology on Real Estate

Technology is also playing a significant role in shaping the latest trends in housing. From virtual tours to AI-powered property recommendations, technology is transforming the way we buy and sell homes.

Virtual Tours

With the advent of virtual reality, potential buyers can now tour properties from the comfort of their own homes. This not only saves time but also allows buyers to view multiple properties in different locations without the need to travel. For sellers, virtual tours provide an opportunity to showcase their property to a wider audience.

AI-Powered Property Recommendations

Artificial Intelligence (AI) is another technology that’s making waves in the real estate industry. AI-powered platforms can analyze a buyer’s preferences and financial capacity to recommend properties that best match their needs. This personalized approach not only enhances the buyer’s experience but also increases the chances of a successful sale.

Online Mortgage Services

The mortgage process is also being revolutionized by technology. Online services offered by West Palm Beach mortgage brokers are making it easier for buyers to apply for Affordable West Palm Beach home loans. These platforms provide a range of tools, including West Palm Beach mortgage calculators, to help buyers understand their borrowing capacity and plan their finances accordingly.

The Rise of Proptech

Proptech, or property technology, is a term used to describe any technology designed to improve the real estate process. From platforms that streamline property management to apps that simplify the home buying process, proptech is set to play a big role in the future of real estate.

In conclusion, the latest trends in housing are being driven by a combination of market dynamics and technological advancements. Whether you’re a buyer, a seller, or a real estate professional, staying abreast of these trends can help you navigate the market and make informed decisions. Remember, the real estate market can be unpredictable, so it’s always a good idea to seek advice from a West Palm Beach mortgage broker or a real estate professional before making any major decisions.

The Future of Housing Trends

As we look ahead, several emerging trends could further reshape the housing landscape. Here are a few to watch:

Sustainable and Eco-Friendly Homes

Sustainability is becoming a key consideration for many homebuyers. Eco-friendly homes, which are designed to minimize environmental impact and maximize energy efficiency, are growing in popularity. These homes often feature energy-efficient appliances, solar panels, and sustainable building materials.

Smart Homes

The rise of smart home technology is another trend to watch. More and more homeowners are embracing devices like smart thermostats, security systems, and appliances that can be controlled remotely. These technologies not only provide convenience but can also lead to significant energy savings.

Co-Living Spaces

Co-living spaces are also gaining traction, particularly in urban areas. These shared living arrangements offer a more affordable alternative to traditional housing options, making them particularly appealing to young professionals and students.

Remote Work and Housing

The shift towards remote work is also impacting housing trends. With more people working from home, there’s an increased demand for homes with dedicated office spaces. Additionally, remote work has also led to increased interest in suburban and rural properties, as workers are no longer tied to living near their place of employment.

In conclusion, the housing market is continually evolving, influenced by changes in technology, societal shifts, and economic factors. By staying informed about these trends, both buyers and sellers can make more informed decisions and navigate the housing market with confidence. As always, a West Palm Beach mortgage broker can provide valuable insights and advice tailored to your specific needs and circumstances.

The Influence of Economic Factors on Housing Trends

Economic factors play a significant role in shaping housing trends. Interest rates, employment rates, and economic growth all have a direct impact on the housing market.

Interest Rates

Interest rates are a key factor in the housing market. When interest rates are low, it’s cheaper to borrow money, making it easier for buyers to afford a home. This can lead to increased demand for homes, driving up prices. On the other hand, when interest rates rise, borrowing becomes more expensive, which can dampen demand and slow down price growth.

Employment Rates

Employment rates also influence housing trends. When employment rates are high, more people have the financial stability to buy a home, leading to increased demand. Conversely, when employment rates are low, fewer people may be able to afford a home, leading to decreased demand.

Economic Growth

Economic growth can also impact the housing market. When the economy is growing, people may feel more confident about their financial future and be more willing to invest in a home. However, during periods of economic downturn, people may be more cautious about making large investments, leading to decreased demand for homes.

In conclusion, understanding these economic factors can help both buyers and sellers make informed decisions about when to buy or sell a home. As always, it’s a good idea to consult with a West Palm Beach mortgage broker or a real estate professional to get personalized advice based on your specific circumstances.

Conclusion

The housing market is complex and ever-changing, influenced by a variety of factors including market dynamics, technological advancements, societal shifts, and economic factors. Whether you’re a buyer or a seller, staying informed about the latest trends in housing can help you navigate the market and make informed decisions. Remember, every real estate market is local, and trends can vary greatly from one location to another. Therefore, it’s always a good idea to seek advice from local real estate professionals, such as a West Palm Beach mortgage broker, who can provide insights and advice tailored to your specific needs and circumstances. Happy house hunting or selling!

The Role of Mortgage Brokers in the Housing Market

Mortgage brokers play a crucial role in the housing market, especially in areas like West Palm Beach. They act as intermediaries between lenders and borrowers, helping potential homeowners find the best mortgage rates and terms.

West Palm Beach Mortgage Brokers

In West Palm Beach, mortgage brokers have a deep understanding of the local real estate market and the various loan products available. They can provide valuable advice to both first-time homebuyers and those looking to refinance their existing mortgages.

Affordable West Palm Beach Home Loans

One of the key services provided by West Palm Beach mortgage brokers is helping clients secure Affordable West Palm Beach home loans. They do this by comparing loan products from various lenders and negotiating the best terms on behalf of their clients.

First Time Home Buyer Loans in West Palm Beach

For first-time homebuyers, navigating the housing market can be daunting. This is where West Palm Beach mortgage brokers come in. They can guide these buyers through the process, helping them understand their borrowing capacity, the types of loans available, and how to secure the best mortgage rates.

West Palm Beach Refinancing Options

For homeowners looking to refinance their homes, West Palm Beach mortgage brokers can provide valuable advice on West Palm Beach refinancing options. They can help homeowners understand when it’s the right time to refinance, what to expect from the process, and how to choose the best refinancing option for their needs.

Commercial Mortgage Broker in West Palm Beach

For those interested in commercial properties, West Palm Beach mortgage brokers can also provide assistance. They can help clients understand the complexities of commercial loans, including the different types of commercial mortgages, the application process, and how to secure the best terms.

Mortgage Pre-Approval in West Palm Beach

Another important service provided by West Palm Beach mortgage brokers is mortgage pre-approval. This process involves assessing a potential borrower’s creditworthiness to determine how much they can borrow. Having a mortgage pre-approval can give buyers a competitive edge in the fast-paced housing market.

In conclusion, whether you’re a first-time homebuyer, looking to refinance your home, or interested in commercial properties, working with a West Palm Beach mortgage broker can make the process smoother and more successful. They can provide valuable advice, help you understand your options, and guide you through the complex world of mortgages.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice