Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales.

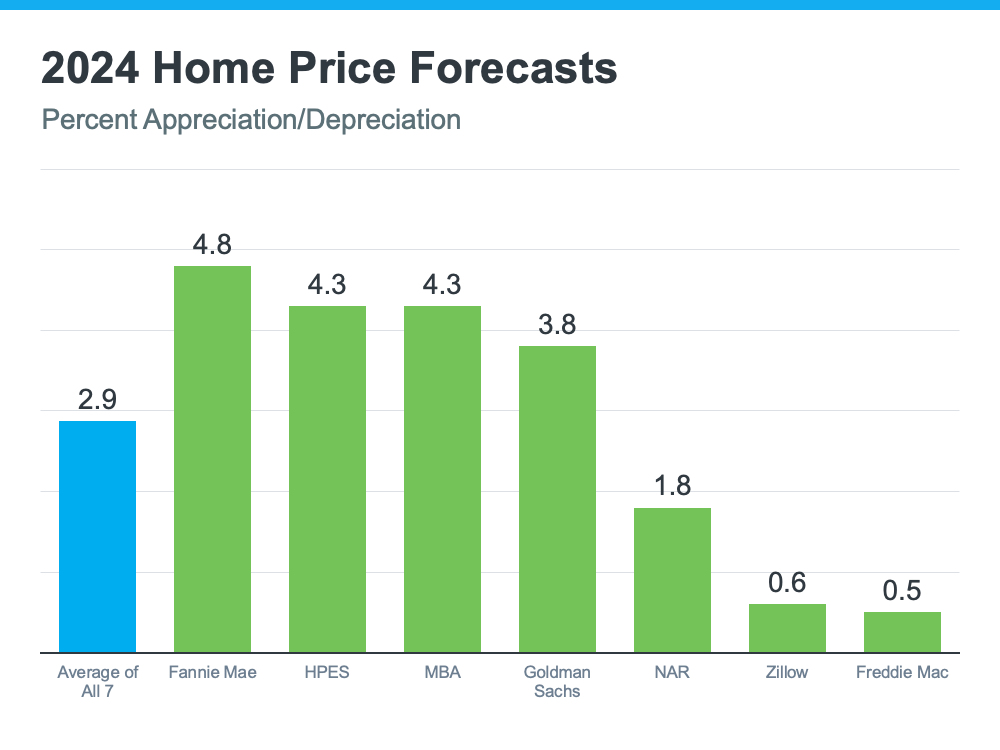

Home Prices Are Expected To Climb Moderately

Home prices are forecasted to rise at a more normal pace. The graph below shows the latest forecasts from seven of the most trusted sources in the industry:

The reason for continued appreciation? The supply of homes for sale. Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), explains:

“One thing that seems to be pretty solid is that home prices are going to continue to go up, and the reason is that we don’t have housing inventory.”

While inventory is up compared to the last couple of years, it’s still low overall. And because there still aren’t enough homes to go around, that’ll keep upward pressure on prices.

If you’re thinking of buying, the good news is you won’t have to deal with prices skyrocketing like they did during the pandemic. Just remember, prices aren’t expected to drop. They’ll continue climbing, just at a slower pace.

So, getting into the market sooner rather than later could still save you money in the long run. Plus, you can feel confident experts say your home will grow in value after you buy it.

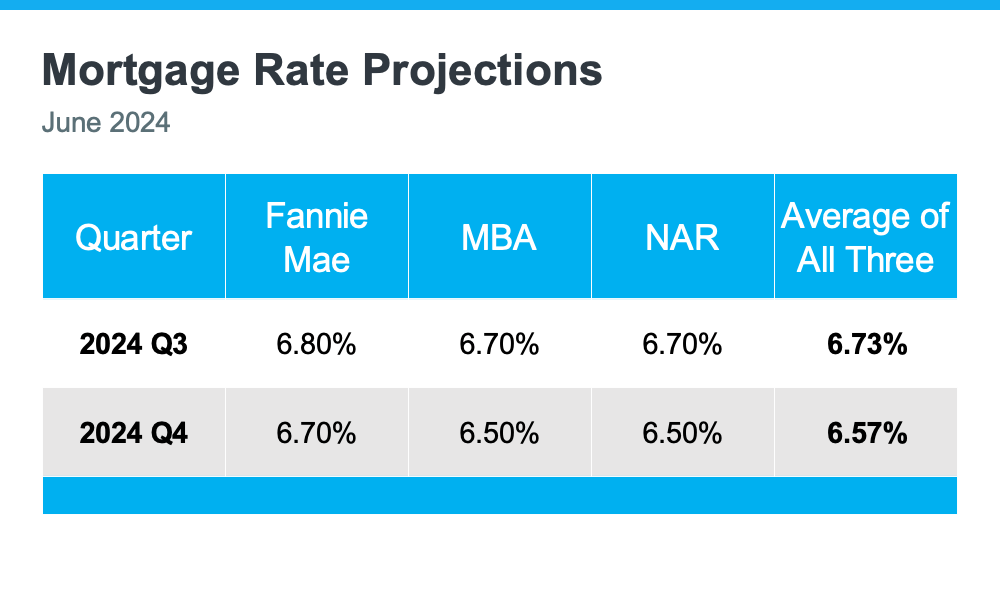

Mortgage Rates Are Forecast To Come Down Slightly

One of the best pieces of news for both buyers and sellers is that mortgage rates are expected to come down a bit, according to Fannie Mae, the Mortgage Bankers Association (MBA), and NAR (see chart below):

When you buy, even a small drop in mortgage rates can make a big difference in your monthly payments. For sellers, lower rates will bring more buyers back into the market, which can help you sell faster and potentially at a higher price. Plus, it may help you get off the fence, if you’ve been hesitant to sell due to today’s rates.

When you buy, even a small drop in mortgage rates can make a big difference in your monthly payments. For sellers, lower rates will bring more buyers back into the market, which can help you sell faster and potentially at a higher price. Plus, it may help you get off the fence, if you’ve been hesitant to sell due to today’s rates.

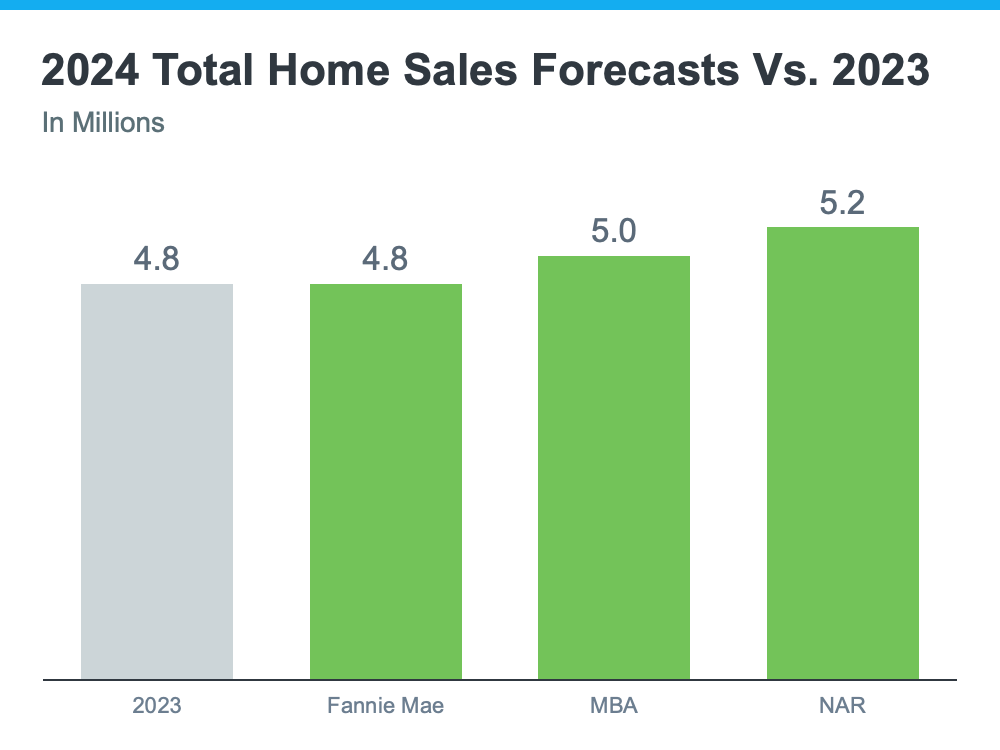

Home Sales Are Projected To Hold Steady

For 2024, the number of home sales will be about the same as last year and may even rise slightly. The graph below compares the 2024 home sales forecasts from Fannie Mae, MBA, and NAR to the 4.8 million homes that sold last year:

The average of the three forecasts is about 5 million sales in 2024 – a small increase from 2023. Lawrence Yun, Chief Economist at NAR, explains why:

“Job gains, steady mortgage rates and the release of inventory from pent-up home sellers will lead to more sales.”

With more inventory available and mortgage rates expected to go down, a few more homes are expected to be sold this year compared to last year. This means more people will be able to move. Let’s work together to make sure you’re one of them.

If you have any questions or need help navigating the market, reach out.

Housing Market Forecast: Buckle Up for a Second Half of Shifting Sands

Buckle up, friends! The housing market has been on a wild ride these past few years, and the second half of 2024 promises to be another chapter in this ongoing saga. While the breakneck pace of price increases might be over, the coming months will likely see a transition for both buyers and sellers.

For sellers, the good news is that home prices are still expected to climb moderately. The supply of homes for sale has finally begun to inch upwards from its pandemic lows, but overall, there simply aren’t enough houses to meet buyer demand. This imbalance keeps upward pressure on prices, ensuring your home will likely continue to grow in value.

However, the days of bidding wars and homes selling above asking price may be numbered. Rising mortgage rates are starting to cool buyer enthusiasm a touch. This means you might need to be a bit more flexible on negotiations compared to the seller’s market of the past two years.

Thinking of buying? Don’t despair! The second half of 2024 could be a sweet spot for you. With more homes for sale entering the market and mortgage rates potentially plateauing, you’ll have more options and some breathing room when negotiating. While affordability might still be a concern, a West Palm Beach mortgage broker can help you find the best mortgage rates and affordable West Palm Beach home loans to fit your budget.

Here’s a deeper dive into what’s brewing in the housing market crystal ball:

Home Prices: A Moderate Climb

Analysts predict home prices to continue rising, though at a slower pace than the double-digit surges witnessed during the pandemic. This is due to the limited supply of homes for sale. Remember, basic economics dictates that when there’s less supply of something desirable (like houses!), prices tend to go up.

Home Sales: Finding Equilibrium

The number of home sales is expected to hold relatively steady in the second half of 2024. This is a result of a few key factors: a projected increase in mortgage rates might dampen buyer enthusiasm slightly, but a corresponding rise in supply of homes for sale will create more options. Additionally, continued job growth is a positive indicator for the housing market, keeping demand from completely evaporating.

The Mortgage Rate Rollercoaster

Mortgage rates have been on an upward trajectory in 2024, and this trend is expected to continue, albeit at a slower pace. While this might make your monthly payments a tad higher, it’s important to remember that historically low rates were an anomaly. The current rise brings rates closer to their long-term averages.

West Palm Beach: Your Local Housing Market Navigator

The national forecast provides a general framework, but remember, the housing market is a local phenomenon. Here in West Palm Beach, a local mortgage lender can give you the most up-to-date insights on our specific market trends. They can also help you navigate the process of finding the perfect home or securing the best financing options, including first-time home buyer loans, West Palm Beach refinancing options, and even commercial mortgage broker services if you’re an investor.

Embrace the Transition: A Time for Strategic Moves

The second half of 2024 is shaping up to be a period of adjustment for the housing market. Don’t view this as uncertainty; instead, see it as an opportunity!

For sellers: Price your home competitively and be prepared for potentially more measured negotiations. Consider partnering with a knowledgeable real estate agent who can help you showcase your home’s strengths and attract serious buyers.

For buyers: Work with a West Palm Beach mortgage broker to get pre-approved for a loan so you’re ready to strike when you find the right house. Stay informed about market trends and be patient – the perfect home might take a little longer to find in this new market equilibrium, but it will be worth the wait.

So, buckle up, West Palm Beach! The housing market might be shifting gears, but with the right tools and guidance, you can navigate this transition and make smart moves towards your real estate goals. Utilize the expertise of local mortgage lenders and real estate professionals to make informed decisions, and remember, a little preparation can go a long way in this dynamic market.

Beyond the Basics: Unpacking the Nuances of the Housing Market

While the national forecast paints a broad picture, the true story of the housing market unfolds at the local level. Here in West Palm Beach, specific factors will influence how the national trends translate into our community. Let’s delve deeper into some of these local nuances:

Inventory Influencers: More Than Just Numbers

The supply of homes for sale is a crucial factor, but it’s not just about the raw numbers. The type of housing stock available also matters. Here in West Palm Beach, we have a vibrant mix of single-family homes, condos, and luxury properties. The specific segment you’re interested in – starter homes, move-up options, or waterfront estates – will influence the competition you face.

Location, Location, Location: A West Palm Beach Mantra

As the saying goes, location is paramount in real estate. Here in West Palm Beach, different neighborhoods cater to diverse preferences. You might crave the charming energy of the downtown core, the family-friendly vibes of the suburbs, or the beachfront bliss of coastal communities. Understanding the specific dynamics of your desired location – including average home values, school districts, and amenities – is essential for making informed decisions.

Seasonal Shifts: A West Palm Beach Reality

Unlike some areas with a steady housing market year-round, West Palm Beach experiences seasonal fluctuations. Our sunny skies and warm weather attract a surge of buyers during the winter months. This can tighten inventory and potentially push prices slightly higher. Conversely, the summer months tend to see a more relaxed pace, offering a potential window of opportunity for both buyers and sellers seeking a less frenetic experience.

West Palm Beach’s Economic Engine: A Powerful Force

The economic health of our community significantly impacts the housing market. West Palm Beach boasts a strong and diversified economy, fueled by tourism, healthcare, and a growing tech sector. This economic strength translates into job creation, which in turn fuels buyer demand for housing.

Navigating the Numbers: West Palm Beach Mortgage Expertise

While national trends offer valuable insights, a West Palm Beach mortgage broker can provide the most relevant data for our local market. They can analyze your financial situation, recommend the right loan products (including West Palm Beach refinancing options if you’re an existing homeowner), and guide you through the intricacies of the mortgage approval process.

By understanding these local factors and leveraging the expertise of West Palm Beach’s real estate and mortgage professionals, you can make informed decisions about buying or selling a home in the second half of 2024. Remember, knowledge is power, and in this dynamic market, having the right information can be the difference between securing your dream home or missing out on a great opportunity.

Beyond the Headlines: Embracing a Strategic Mindset

The housing market forecast might seem daunting at first glance, but fret not, West Palm Beach! By adopting a strategic mindset, you can not only navigate this transition but potentially thrive in it. Here are some actionable tips for both buyers and sellers:

For Sellers: Sharpen Your Competitive Edge

- Price Strategically: Conduct a thorough market analysis with your realtor to determine a competitive listing price. Overpricing can scare away buyers, while underpricing leaves money on the table.

- Highlight Your Home’s Strengths: Invest in curb appeal, stage your home for optimal presentation, and consider minor upgrades that can significantly boost buyer appeal.

- Embrace Flexibility: Be open to reasonable negotiations and consider offering incentives like closing cost assistance to attract buyers in a market with more options.

For Buyers: Be Prepared to Pounce

- Get Pre-Approved: Partner with a West Palm Beach mortgage broker to get pre-approved for a loan. This demonstrates your seriousness to sellers and strengthens your offer.

- Do Your Research: Stay informed about market trends, inventory levels, and average sale prices in your desired neighborhoods. Knowledge is power in negotiations.

- Be Patient and Persistent: The right home might take a little longer to find in this new market equilibrium. Don’t get discouraged – persistence pays off!

Embrace Technology: Your West Palm Beach Advantage

The digital age has transformed the way we interact with the housing market. Here are some tech tools to leverage:

- Real Estate Apps: Utilize real estate apps to stay updated on new listings, track market trends, and connect with local agents.

- Virtual Tours: Take advantage of virtual tours to explore potential homes from the comfort of your couch. This can help you narrow down your search before scheduling in-person visits.

- Online Mortgage Calculators: Use online mortgage calculators offered by West Palm Beach mortgage lenders to estimate your monthly payments and determine your affordability range.

The Power of Local Expertise: Your West Palm Beach Allies

Don’t underestimate the value of partnering with local professionals. Here in West Palm Beach, experienced real estate agents and mortgage brokers possess a deep understanding of our unique market dynamics. They can guide you through the intricacies of the buying or selling process, negotiate on your behalf, and connect you with valuable resources.

Remember: In a transitional market, communication is key. Clearly articulate your needs and goals to your real estate agent and mortgage broker. This collaborative approach will ensure you make informed decisions and achieve success in your real estate journey.

By following these tips and leveraging the expertise of local professionals, you can transform the second half of 2024 from a period of uncertainty into a season of opportunity in the dynamic West Palm Beach housing market. So, stay informed, embrace strategic thinking, and get ready to make your move!

Beyond the Forecast: A Glimpse into the Future of Housing

While the housing market forecast focuses on the immediate future, it’s also interesting to consider some emerging trends that could shape the landscape in the years to come. Here are a few thought-provoking concepts to ponder:

The Rise of the “Home as Hub” Mentality:

The pandemic fundamentally altered how we view our homes. The rise of remote work has blurred the lines between work and personal life, making features like dedicated home office spaces and high-speed internet even more desirable. Expect to see a continued emphasis on homes that function not just as living spaces, but also as productive hubs that cater to our evolving lifestyles.

The Evolving Landscape of Affordability:

Affordability remains a critical concern for many buyers, particularly in desirable areas like West Palm Beach. Innovative solutions like tiny homes, co-living arrangements, and rent-to-own options might gain traction as potential pathways to homeownership. Additionally, government initiatives and programs aimed at increasing affordability could emerge, impacting the overall market landscape.

The Influence of Technology:

Technology will continue to play an increasingly significant role in the housing market. Virtual reality tours could become even more immersive, allowing buyers to experience homes from anywhere in the world. Artificial intelligence-powered tools might assist with property valuations, streamlining the buying and selling process. Furthermore, blockchain technology could potentially revolutionize how real estate transactions are conducted, ensuring greater transparency and efficiency.

The Greener Side of Housing:

Sustainability is a growing concern for both buyers and sellers. Energy-efficient homes with features like solar panels and smart home technology are likely to become increasingly popular. Additionally, communities with walkable neighborhoods, access to public transportation, and green spaces might attract a premium.

The Local Nuances Remain Paramount:

While these broader trends offer a glimpse into the future, remember that the West Palm Beach housing market will continue to be shaped by its unique local dynamics. Staying informed about our community’s economic growth, infrastructure development, and neighborhood-specific trends will be crucial for navigating the ever-evolving landscape.

Conclusion: Embrace the Journey

The housing market is a complex and dynamic organism. The second half of 2024 promises to be a period of transition, but with the right knowledge, strategic planning, and the support of local professionals, you can not only navigate this shift but potentially turn it into an opportunity to achieve your real estate goals. So, stay curious, embrace the evolving landscape, and get ready to make your mark on the vibrant West Palm Beach housing market!

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice