Thinking About Buying a Home? Ask Yourself These Questions

If you’re thinking of buying a home this year, you’re probably paying closer attention than normal to the housing market. And you’re getting your information from a variety of channels: the news, social media, your real estate agent, conversations with friends and loved ones, the list goes on and on. Most likely, home prices and mortgage rates are coming up a lot.

Here are the top two questions you need to ask yourself as you make your decision, including the data that helps cut through the noise.

1. Where Do I Think Home Prices Are Heading?

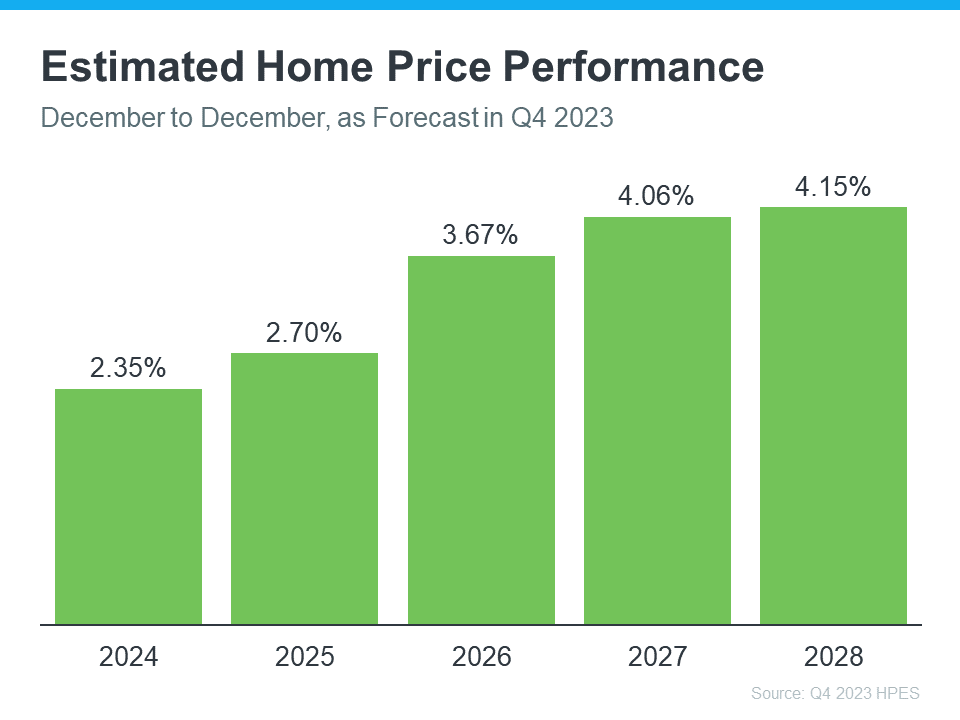

One reliable place you can turn to for information on home price forecasts is the Home Price Expectations Survey from Fannie Mae – a survey of over one hundred economists, real estate experts, and investment and market strategists.

According to the most recent release, the experts are projecting home prices will continue to rise at least through 2028 (see the graph below):

So, why does this matter to you? While the percent of appreciation may not be as high as it was in recent years, what’s important to focus on is that this survey says we’ll see prices rise, not fall, for at least the next 5 years.

And home prices rising, even at a more moderate pace, is good news not just for the market, but for you too. It means, by buying now, your home will likely grow in value, and you should gain home equity in the years ahead. But, if you wait, based on these forecasts, the home will only cost you more later on.

2. Where Do I Think Mortgage Rates Are Heading?

Over the past year, mortgage rates spiked up in response to economic uncertainty, inflation, and more. But there’s an encouraging sign for the market and mortgage rates. Inflation is moderating, and here’s why this is such a big deal if you’re looking to buy a home.

When inflation cools, mortgage rates generally fall in response. That’s exactly what we’ve seen in recent weeks. And, now that the Federal Reserve has signaled they’re pausing their Federal Funds Rate increases and may even cut rates in 2024, experts are even more confident we’ll see mortgage rates come down.

Danielle Hale, Chief Economist at Realtor.com, explains:

“. . . mortgage rates will continue to ease in 2024 as inflation improves and Fed rate cuts get closer. . . . a key factor in starting to provide affordability relief to homebuyers.”

As an article from the National Association of Realtors (NAR) says:

“Mortgage rates likely have peaked and are now falling from their recent high of nearly 8%. . . . This likely will improve housing affordability and entice more home buyers to return to the market . . .”

No one can say with absolute certainty where mortgage rates will go from here. But the recent decline and the latest decision from the Federal Reserve to stop their rate increases, signals there’s hope on the horizon. While we may see some volatility here and there, affordability should improve as rates continue to ease.

If you’re thinking about buying a home, you need to know what’s expected with home prices and mortgage rates. While no one can say for certain where they’ll go, making sure you have the latest information can help you make an informed decision. Let’s connect so you can stay up to date on what’s happening and why this is such good news for you.

Thinking About Buying a Home? Ask Yourself These Questions

The prospect of buying a home is undeniably exciting, akin to embarking on a journey where every step holds the promise of a future filled with comfort and security. However, before you delve into the realm of homeownership, it’s imperative to pause and reflect on various aspects. As you contemplate buying now your home, there are several questions that merit careful consideration. Let’s navigate through this significant decision-making process, ensuring you make informed choices every step of the way.

The Current Landscape: Housing Market and Economic Factors

1. Home Prices: A Critical Puzzle Piece

The first question to ponder revolves around home prices. Are they currently soaring to unprecedented heights, or is there a trend that aligns with a more buyer-friendly market? Exploring recent trends and gathering information on home price forecasts can provide valuable insights into the trajectory of the market.

In a dynamic real estate landscape, understanding the nuances of home prices is crucial. While you may be contemplating buying now, being aware of whether the market is favorably aligned can significantly impact your long-term investment.

2. The Ebb and Flow of Mortgage Rates

One of the cornerstones of buying a home is navigating the currents of mortgage rates. The Federal Reserve’s decisions regarding the Federal Funds Rate can send ripples through the housing market. It’s not merely about buying now; it’s about gauging the financial climate and ensuring you secure a mortgage under favorable conditions.

Real estate is a realm where timing is everything. Seize the opportunity when mortgage rates are on the lower end, strategically aligning your buying now venture with a financial environment that is conducive to your interests.

Strategic Collaborations: Real Estate Experts and Your Agent

3. The Role of Real Estate Experts

In your quest for the perfect abode, the guidance of real estate experts can be invaluable. These professionals possess a nuanced understanding of the ever-evolving housing market, equipped with the foresight to anticipate shifts in home prices and mortgage rates.

While contemplating buying a home, consider consulting with these seasoned individuals. Their insights can illuminate aspects that might elude the untrained eye, providing you with a comprehensive perspective before buying now becomes a concrete decision.

4. The Synergy with Your Real Estate Agent

Your real estate agent is not just a facilitator in the process of buying a home; they are your ally in this intricate journey. Have a candid conversation with them about the current dynamics of the housing market and how they perceive the trajectory of home prices in your target area.

Your agent is not merely a liaison; they are a repository of knowledge, offering insights into whether buying now aligns with your long-term goals. Leverage this partnership to ensure that every move you make is shrewd and well-informed.

Deliberate Decision-Making: Posing Essential Questions

5. Affordability and Financial Prudence

Amidst the excitement of buying a home, it’s crucial to evaluate your financial standing. Buying now your home might seem tempting, but is it a financially sound decision? Consider your income stability, existing debts, and future financial goals. Ensure that the allure of home prices doesn’t lead you into a realm of financial strain.

6. Long-Term Vision: Beyond Buying Now

When contemplating buying a home, it’s essential to think beyond the present moment. What are your long-term goals, and how does this home fit into the narrative? Don’t just focus on the immediate allure of home prices and favorable mortgage rates; envision how this investment aligns with your future aspirations.

7. Market Trends vs. Personal Preferences

While the housing market provides a broader context, your personal preferences should not be overshadowed. Buying a home is not just about the external factors like home prices and mortgage rates; it’s about finding a space that resonates with your lifestyle and aspirations. Strike a balance between market trends and your own desires.

Conclusion: Navigating the Landscape of Homeownership

In the tapestry of homeownership, each thread represents a decision, a consideration that shapes the final picture. Before buying now your home, immerse yourself in a thoughtful exploration of the housing market, considering the trajectory of home prices and the fluctuations in mortgage rates influenced by the Federal Reserve.

Consult with seasoned real estate experts and foster a collaborative relationship with your real estate agent. Pose questions that delve into the core of your financial well-being and long-term aspirations. As you navigate the intricate path of buying a home, let your decisions be informed, deliberate, and aligned with both the present and the future. In the realm of homeownership, the art lies not just in buying now but in crafting a future that reflects your dreams and aspirations.

Weighing Risks and Rewards: A Pragmatic Approach

8. Economic Indicators: Unraveling the Federal Reserve’s Influence

The Federal Reserve plays a pivotal role in shaping the economic landscape, impacting both mortgage rates and overall financial stability. As you contemplate buying a home, keep an eye on economic indicators. Understand how the Federal Reserve’s policies might influence the Federal Funds Rate, and subsequently, the dynamics of mortgage rates.

A savvy homebuyer doesn’t merely focus on buying now; they discern the intricate dance of economic factors, ensuring that their investment aligns with a stable and favorable financial climate.

9. Adapting to Market Fluctuations

In the ever-evolving world of real estate, adaptability is a virtue. Market trends, home prices, and mortgage rates are known to fluctuate. Ask yourself: Are you prepared to adapt to these changes? Buying now may seem opportune, but it requires a strategic mindset that accommodates shifts in the market, ensuring your investment remains resilient.

Anticipating Future Scenarios: A Forward-Thinking Approach

10. Resale Value: A Long-Term Consideration

While the excitement of buying a home may revolve around the present, don’t overlook the future resale value. Consider the potential appreciation of your chosen property. Assess how market trends and fluctuations in home prices might impact the resale value down the line. A forward-thinking approach ensures that your investment stands the test of time.

11. Local Insights: Beyond the Broader Housing Market

Zoom in on the microcosm of your desired locality. Your real estate agent can provide insights into localized trends, offering a nuanced perspective beyond the broader strokes of the housing market. It’s not just about buying now in any location; it’s about strategically selecting a neighborhood that aligns with your lifestyle and future growth.

Crafting Your Homeownership Narrative: Personalized Reflections

12. Lifestyle Considerations: Beyond Buying a Home

Beyond the realm of home prices and mortgage rates, your lifestyle preferences should guide your decision. Does the property cater to your current and future needs? As you embark on the journey of buying a home, let it be a place that harmonizes with your lifestyle aspirations, transcending the immediate allure of market dynamics.

13. Financial Literacy: Empowering Your Decision

Financial literacy is the cornerstone of sound decision-making in the realm of buying a home. Educate yourself on the intricacies of mortgage rates, terms, and potential financial scenarios. Being well-versed empowers you to navigate the process confidently, ensuring that buying now is not just a momentary decision but a well-informed choice with lasting implications.

The Tapestry Unfolds: A Holistic Approach to Homeownership

In the symphony of buying a home, each question you pose adds a unique note to the composition. From understanding the nuances of the housing market to envisioning your future within the walls of your chosen abode, the process is an art form. Buying now is not a singular act but a culmination of thoughtful considerations, a journey where each decision shapes the narrative of homeownership.

As you stand at the threshold of buying your home, let the tapestry you weave be a testament to your diligence, foresight, and the harmonious blending of market insights and personal aspirations. The art of buying a home is not confined to the present moment; it’s a lifelong masterpiece that reflects the essence of who you are and the dreams you nurture.

Bottom Line: Navigating the Art of Homeownership

In the labyrinth of considerations surrounding buying a home, the bottom line is a delicate equilibrium between the present and the future. While the allure of buying now your home beckons, it’s essential to approach this significant decision with a strategic mindset.

Home prices and mortgage rates, influenced by the fluctuating dynamics of the housing market and the decisions of the Federal Reserve, form the backdrop of your homeownership journey. Consulting with seasoned real estate experts and fostering a collaborative relationship with your real estate agent ensures that your decisions are anchored in a wealth of knowledge.

However, the tapestry of buying a home extends beyond market trends. Delve into the intricacies of your financial landscape, considering affordability, long-term goals, and the potential for market fluctuations. A forward-thinking approach involves anticipating scenarios, understanding the resale value, and immersing yourself in the microcosm of your chosen locality.

Buying a home is not a one-size-fits-all endeavor. It’s a personalized narrative that intertwines your lifestyle aspirations with market dynamics. Beyond the immediate allure of home prices and mortgage rates, let your decision be empowered by financial literacy, ensuring that your venture into homeownership is a well-informed and confident choice.

In essence, the art of buying a home is a holistic masterpiece, a symphony where each note represents a thoughtful consideration. As you stand at the crossroads of buying now, let the decisions you make resonate with the harmony of diligence, foresight, and a vision that transcends the present, crafting a narrative of homeownership that reflects the essence of who you are and the dreams you hold dear.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today