Time in the Market Beats Timing the Market

Trying to decide whether it makes more sense to buy a home now or wait? There’s a lot to consider, from what’s happening in the market to your changing needs. But generally speaking, aiming to time the market isn’t a good strategy – there are too many factors at play for that to even be possible.

That’s why experts usually say time in the market is better than timing the market.

In other words, if you want to buy a home and you’re able to make the numbers work, doing it sooner rather than later is usually worth it. Bankrate explains why:

“No matter which way the real estate market is leaning, though, buying now means you can start building equity immediately.”

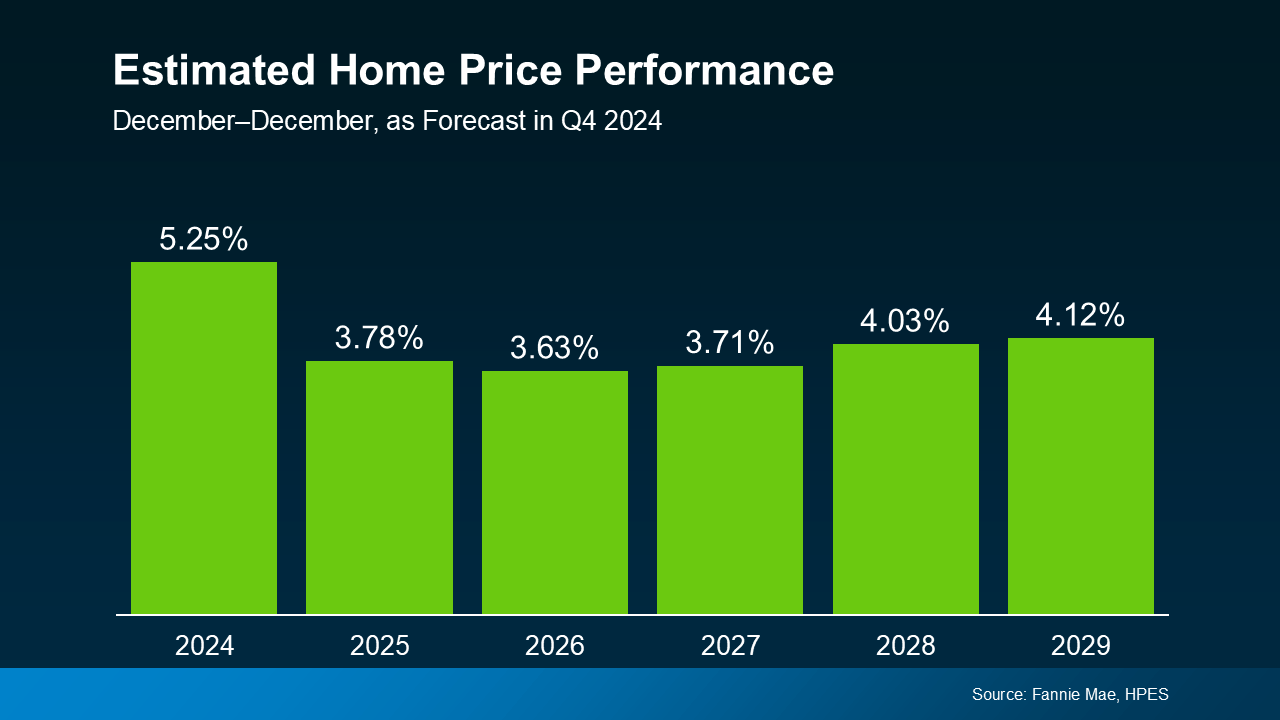

Here’s some data to break this down so you can really see the benefit of buying now versus later – if you’re able to. Each quarter, Fannie Mae releases the Home Price Expectations Survey. It asks over one hundred economists, real estate experts, and investment and market strategists what they forecast for home prices over the next five years. In the latest release, experts are projecting home prices will continue to rise through at least 2029 – just at a slower, more normal pace than they did over the past few years (see the graph below):

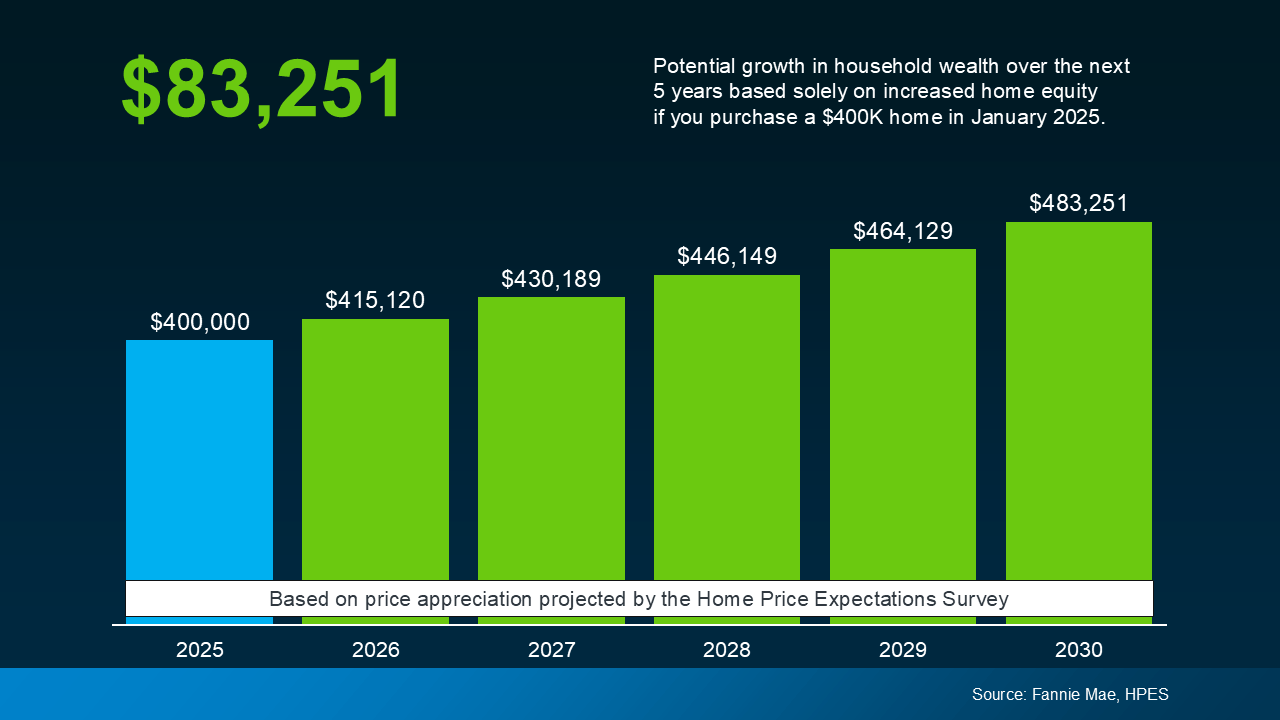

But what does that really mean for you? To give these numbers context, the graph below uses a typical home value to show how it could appreciate over the next few years using those HPES projections (see graph below). This is what you could start to earn in equity if you buy a home in early 2025.

But what does that really mean for you? To give these numbers context, the graph below uses a typical home value to show how it could appreciate over the next few years using those HPES projections (see graph below). This is what you could start to earn in equity if you buy a home in early 2025.

In this example, let’s say you go ahead and buy a $400,000 home this January. Based on the expert forecasts from the HPES, you could gain more than $83,000 in household wealth over the next five years. That’s not a small number. If you keep on renting, you’re losing out on this equity gain.

In this example, let’s say you go ahead and buy a $400,000 home this January. Based on the expert forecasts from the HPES, you could gain more than $83,000 in household wealth over the next five years. That’s not a small number. If you keep on renting, you’re losing out on this equity gain.

And while today’s market has its fair share of challenges, this is why buying is going to be worth it in the long run. If you want to buy a home, don’t give up. There are creative ways we can make your purchase possible. From looking at more affordable areas, to considering condos or townhomes, or even checking out down payment assistance programs, there are options to help you make it happen.

So sure, you could wait. But if you’re just waiting it out to perfectly time the market, this is what you’re missing out on. And that decision is up to you.

If you’re torn between buying now or waiting, don’t forget that it’s time in the market, not timing the market that truly matters. Let’s connect if you want to talk about what you need to do to get the process started today.

Time in the Market Beats Timing the Market

Deciding when to buy a home can feel overwhelming. After all, buying real estate is one of the largest financial decisions you’ll ever make. But amidst all the noise about interest rates, housing shortages, and fluctuating prices, one timeless principle stands firm: time in the market beats timing the market.

This isn’t just a catchy phrase; it’s a proven strategy for building lasting household wealth. In this article, we’ll explore why buying sooner rather than later can set you up for financial success, how to navigate today’s market, and what tools and strategies you can use to make homeownership achievable—whether it’s your first purchase or your next big investment.

The Fallacy of Market Timing

Trying to perfectly time the real estate market is like predicting the weather weeks in advance. There are simply too many variables—economic shifts, interest rate changes, and local demand fluctuations—to guarantee that you’ll hit the “perfect” moment to buy.

Many prospective buyers fall into the trap of waiting, hoping for lower home prices or a drop in mortgage rates. Unfortunately, this strategy often backfires. While you wait, prices continue to climb, inventory tightens, and the dream home you once could afford may slip out of reach.

This is where the concept of time in the market comes into play. The sooner you enter the market, the sooner you begin building equity. It’s that simple. You’re not just buying a place to live; you’re investing in an appreciating asset. Over time, the value of that asset grows, creating a foundation for lasting financial security.

The Long-Term Power of Equity

One of the most compelling reasons to buy a home now is the opportunity to build equity gain over time. Equity is the difference between what your home is worth and what you owe on your mortgage. Each mortgage payment you make increases your ownership stake in your property while its value appreciates.

Imagine this scenario: You purchase a $400,000 home in January 2025. According to expert forecasts from the Home Price Expectations Survey (HPES), home values are projected to rise steadily over the next five years. By 2030, your home could be worth upwards of $480,000 or more. That’s over $80,000 in household wealth built simply by owning your home and letting time do the work.

If, on the other hand, you remain a renter, that potential equity goes to your landlord. While renting can sometimes make sense in the short term, it doesn’t offer the same long-term investment benefits as homeownership.

Rising Home Prices: The 2025 Housing Market

The 2025 housing market is expected to present both opportunities and challenges. While the pace of home price appreciation is moderating compared to the pandemic-driven surge, values are still expected to rise. This steady growth underscores why buying now is often the wiser choice.

In markets like West Palm Beach, for instance, demand remains strong. Partnering with a knowledgeable West Palm Beach mortgage broker can help you secure the best financing options, including affordable West Palm Beach home loans tailored to your needs. Whether you’re a first-time buyer or looking to upgrade, staying informed about local trends will give you a competitive edge.

Creative Buying Strategies for Today’s Market

There’s no denying that today’s market comes with its fair share of challenges: higher interest rates, low inventory, and fierce competition. But these obstacles shouldn’t deter you from pursuing homeownership. With creative buying strategies, you can overcome these hurdles and find a path that works for you.

- Explore Condos and Townhomes

If single-family homes are out of budget, consider condos or townhomes. These property types are typically more affordable while still offering the chance to build equity. Additionally, they often come with lower maintenance responsibilities, making them a great option for busy professionals or those seeking a low-maintenance lifestyle. - Focus on Affordable Areas

Look beyond the hotspots. Affordable areas often offer hidden gems where you can get more for your money. These neighborhoods may not have the name recognition of trendy locales, but they often provide excellent potential for home value appreciation. - Leverage Down Payment Assistance Programs

For many buyers, saving for a down payment is the biggest hurdle. Fortunately, there are down payment assistance programs designed to ease the burden. From grants to low-interest loans, these programs can help you get into your first home faster. Local resources like first-time home buyer loans in West Palm Beach are invaluable for those entering the market for the first time. - Consider Refinancing Options

If higher interest rates are giving you pause, remember that refinancing is an option down the road. Many buyers take advantage of West Palm Beach refinancing options to lower their monthly payments once rates stabilize. This flexibility makes buying now more feasible, even in less-than-ideal rate environments.

Financial Planning: Your Key to Success

Successful homeownership begins with meticulous financial planning. Start by understanding your budget and using tools like West Palm Beach mortgage calculators to estimate your monthly costs. Once you’ve established what you can afford, securing a mortgage preapproval in West Palm Beach will strengthen your position as a buyer.

Work closely with local mortgage lenders in West Palm Beach who understand the nuances of the area. Their expertise can help you navigate the application process, compare loan options, and identify the best West Palm Beach mortgage rates for your situation.

The Cost of Waiting

Every year you wait to buy is a year you miss out on potential equity gain. While waiting might feel like the safer choice, the numbers tell a different story. Rising home prices, inflation, and lost equity can significantly outweigh the perceived benefits of waiting for the “perfect” market conditions.

Take, for example, a family renting in West Palm Beach. Over five years, they might spend $100,000 on rent without gaining any equity. If that same family had purchased a home, they could have built tens of thousands of dollars in wealth through equity and appreciation.

The Commercial Perspective

Real estate isn’t just about residential properties. For business owners, investing in commercial real estate can be a lucrative move. Whether you’re looking to open a storefront, expand an office, or secure warehouse space, partnering with a commercial mortgage broker in West Palm Beach can help you navigate this unique sector of the market.

Like residential properties, commercial real estate benefits from the principle of time in the market. The longer you hold the property, the greater the potential for value appreciation and income generation.

Why West Palm Beach is a Hotspot

West Palm Beach is more than a picturesque coastal city—it’s a thriving hub for real estate. From affordable West Palm Beach home loans to tailored property loan advice in West Palm Beach, the city offers abundant resources for buyers. Its growing economy, desirable location, and vibrant culture make it an attractive destination for homeowners and investors alike.

Conclusion

In the world of real estate, the adage time in the market beats timing the market holds true. Whether you’re considering a starter home, exploring condos and townhomes, or eyeing a commercial investment, the sooner you enter the market, the sooner you start building equity and growing your household wealth.

With tools like down payment assistance programs, expert financial planning, and guidance from a seasoned West Palm Beach mortgage broker, homeownership is within your reach. Don’t let the challenges of today’s market deter you. The opportunities for long-term investment far outweigh the risks of waiting.

Let this year be the year you take the leap and make homeownership a reality. After all, the best time to plant a tree was 20 years ago. The second-best time is now.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today