What To Expect from Mortgage Rates and Home Prices in 2025

Curious about where the housing market is headed in 2025? The good news is that experts are offering some promising forecasts, especially when it comes to two key factors that directly affect your decisions: mortgage rates and home prices.

Whether you’re thinking of buying or selling, here’s a look at what the experts are saying and how it might impact your move.

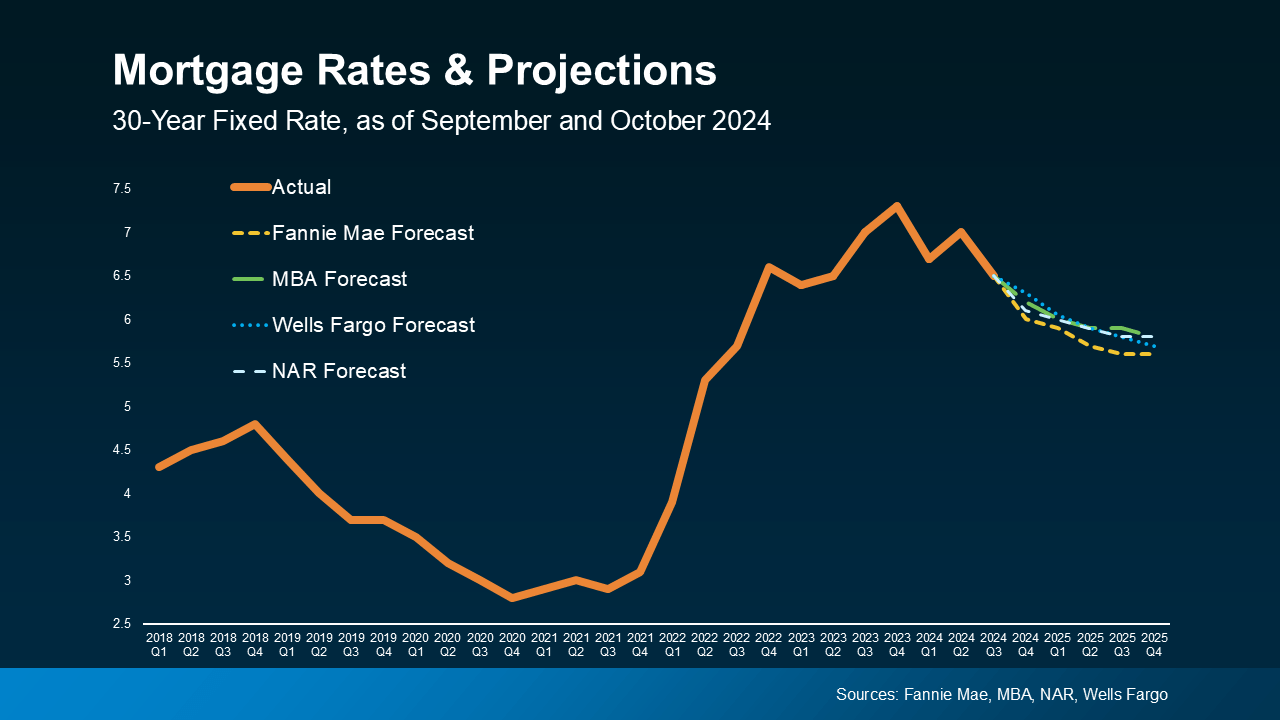

Mortgage Rates Are Forecast To Come Down

One of the biggest factors likely affecting your plans is mortgage rates, and the forecast looks positive. After rising dramatically in recent years, experts project rates will ease slightly throughout the course of 2025 (see graph below):

While that decline won’t be a straight line down, the overall trend should continue over the next year. Expect a few bumps along the way, because the trajectory of rates will depend on new economic data and inflation numbers as they’re released. But don’t get too hung up on those blips and reactions from the market as they happen. Focus on the bigger picture.

While that decline won’t be a straight line down, the overall trend should continue over the next year. Expect a few bumps along the way, because the trajectory of rates will depend on new economic data and inflation numbers as they’re released. But don’t get too hung up on those blips and reactions from the market as they happen. Focus on the bigger picture.

Lower mortgage rates mean improving affordability. As rates come down, your monthly mortgage payment decreases, giving you more flexibility in what you can afford if you buy a home.

This shift will likely bring more buyers and sellers back into the market, though. As Charlie Dougherty, Director and Senior Economist at Wells Fargo, explains:

“Lower financing costs will likely boost demand by pulling affordability-crunched buyers off of the sidelines.”

As that happens, both inventory and competition among buyers will ramp back up. The takeaway? You can get ahead of that competition now. Lean on your agent to make sure you understand how the shifts in rates are impacting demand in your area.

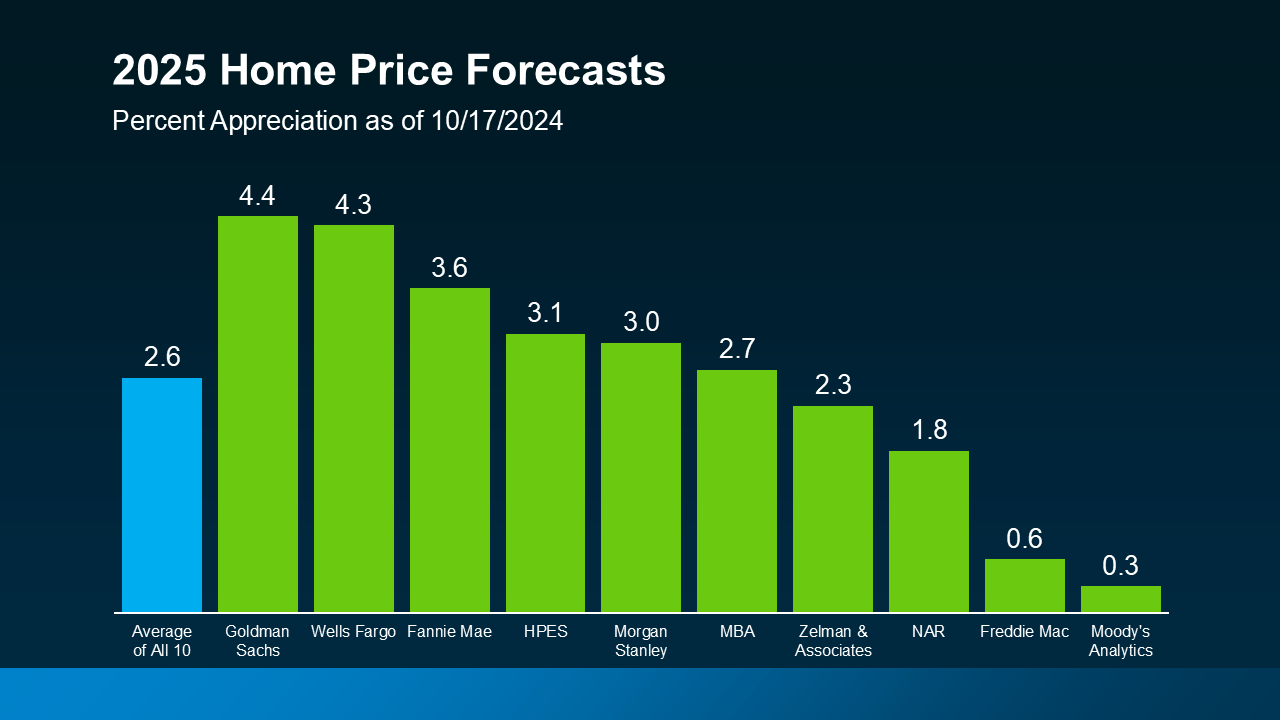

Home Price Projections Show Modest Growth

While mortgage rates are expected to come down slightly, home prices are forecast to rise—but at a much more moderate pace than the market has seen in recent years.

Experts are saying home prices will grow by an average of about 2.5% nationally in 2025 (see graph below):

This is far more manageable than the rapid price increases of previous years, which saw double-digit percentage growth in some markets.

This is far more manageable than the rapid price increases of previous years, which saw double-digit percentage growth in some markets.

What’s behind this ongoing increase in prices? Again, it has to do with demand. As more buyers return to the market, demand will rise – but so will supply as sellers feel less rate-locked.

More buyers in markets with inventory that’s still below the norm will put upward pressure on prices. But with more homes likely to be listed, supply will help keep price growth in check. This means that while prices will rise, they’ll do so at a healthier, more sustainable pace.

Of course, these national trends may not reflect exactly what’s happening in your local market. Some areas might see faster price growth, while others could see slower gains. As Lance Lambert, Co-Founder of ResiClub, says:

“Even if the average national home price forecast for 2025 is correct, it’s possible that some regional housing markets could see mild home price declines, while some markets could still see elevated appreciation. That has been, after all, the case this year.”

Even the few markets that may see flat or slightly lower prices in 2025 have had so much appreciation in recent years – it may not have a big impact. That’s why it’s important to work with a local real estate expert who can give you a clear picture of what’s happening where you’re looking to buy or sell.

Bottom Line

With mortgage rates expected to ease and home prices projected to rise at a more moderate pace, 2025 is shaping up to be a more promising year for both buyers and sellers.

If you have any questions about how these trends might impact your plans, let’s connect. That way you’ve got someone to help you navigate the market and make the most of the opportunities ahead.

What to Expect from Mortgage Rates and Home Prices in 2025

The housing market in 2025 is stirring a buzz among buyers and sellers alike. Whether you’re thinking of buying or selling a home, understanding where mortgage rates and home prices in 2025 might land is crucial. The interplay between borrowing costs and property values will shape decisions for everyone—from first-time buyers to seasoned investors. Let’s break down the key trends and insights to help you make informed choices and stay ahead of the curve.

1. Mortgage Rates: Where Are They Headed?

Experts are split on where mortgage rates will go in 2025, but one thing is certain: they will remain a focal point for anyone planning to buy a home. The Federal Reserve’s monetary policy will influence the cost of borrowing, and if inflation remains sticky, rates may hover on the higher side. However, the potential for a cooling economy could provide some relief for borrowers seeking the best mortgage rates in West Palm Beach or beyond.

If you’re a first-time home buyer, brace yourself for the possibility of elevated borrowing costs—though local real estate experts hint that competition among lenders will drive creative loan offers. Options like Affordable West Palm Beach home loans and West Palm Beach refinancing options may become lifelines for those looking to manage their monthly mortgage payments. Keep an eye out for rate fluctuations; timing your mortgage application could save you thousands in the long run.

Forecasts for 2025 Mortgage Rates

- Baseline Predictions: Some analysts suggest that rates may stabilize between 5% and 6% if inflation moderates.

- Upside Risks: If inflation persists, or the Fed tightens further, rates could inch toward 7%.

- Optimistic Scenarios: A sharp economic downturn could push rates back into the 4% range.

Using West Palm Beach mortgage calculators to simulate different interest rates will give you an idea of what you can comfortably afford in 2025. If rates do rise, it’s worth exploring mortgage preapproval in West Palm Beach early on to lock in favorable terms.

2. Home Prices in 2025: Will They Rise or Fall?

Navigating home prices in 2025 will feel like walking a tightrope. While many factors influence home prices, two key elements will dominate the landscape: supply and demand. If we see more homes coming onto the market, prices might stabilize. But, if inventory remains tight, expect to see upward pressure on home prices.

In hot markets like South Florida, local real estate experts are keeping a close watch on trends. While buyers and sellers are hoping for clarity, the truth is that conditions may vary dramatically from one area to another. In locations with new developments or increased housing supply, like parts of West Palm Beach, buyers could see more affordable opportunities. Conversely, in markets where inventory remains limited, home values could still rise, albeit at a slower pace than during the recent housing boom.

Factors Affecting Home Prices in 2025

- Economic Health: If job growth continues, it could sustain demand, keeping home prices elevated.

- Mortgage Rates: Rising mortgage rates tend to dampen demand, which could cool off prices.

- Supply Trends: If builders ramp up construction and we see more homes on the market, it might ease price pressures.

For those wondering, “Should I buy a home now or wait?”—the answer lies in understanding your local market. Consulting with a West Palm Beach mortgage broker or tapping into property loan advice in West Palm Beach can help you navigate these waters. The insights of local mortgage lenders in West Palm Beach can offer a leg up, especially if you’re considering niche products like commercial mortgage broker services.

3. The Buyer-Seller Dynamics in 2025

The balance of power between buyers and sellers will hinge on the interplay between mortgage rates and home prices. As rates climb, some sellers might hold off, fearing they’ll lose money by locking in a higher interest rate on their next purchase. This could further restrict inventory, frustrating buyers looking for the perfect property.

However, sellers in 2025 who are strategic about pricing and upgrades will still find success. In markets like West Palm Beach, those working with a West Palm Beach mortgage broker will have an advantage in finding the right buyer quickly, thanks to competitive financing offers tailored to the area. Meanwhile, buyers might focus more on West Palm Beach refinancing options down the line, as they search for ways to lower their monthly mortgage payments if rates eventually drop.

4. Why Mortgage Preapproval Will Be Essential

Given the uncertainties around mortgage rates and home prices in 2025, securing mortgage preapproval in West Palm Beach will be a smart move for serious buyers. A preapproval not only shows sellers that you’re a reliable buyer but also locks in your interest rate for a set period, shielding you from potential rate hikes.

For first-time home buyers in West Palm Beach, preapproval offers peace of mind. It’s the first step toward identifying the price range you can afford and finding Affordable West Palm Beach home loans that suit your financial situation. Working with local mortgage lenders in West Palm Beach can streamline the process, as they are more familiar with the intricacies of the local market.

5. The Role of Local Expertise and Tools

In a fluctuating market, having access to the right tools and professionals will be invaluable. For buyers, sellers, and investors alike, collaborating with a West Palm Beach mortgage broker or consulting property loan advice in West Palm Beach will make a significant difference. They’ll know where to find the best mortgage rates in West Palm Beach, as well as options for first-time home buyer loans in West Palm Beach.

Additionally, leveraging West Palm Beach mortgage calculators will allow you to make smarter decisions about your finances. These calculators offer insights into how much house you can afford, what your monthly mortgage payment will look like, and whether a particular loan product makes sense for you.

6. What Should You Do if You’re Thinking of Buying or Selling?

If you’re thinking of buying or selling in 2025, timing and preparation will be everything. Buyers should monitor mortgage rates closely and use tools like West Palm Beach mortgage calculators to plan their finances. Sellers, on the other hand, may need to be flexible with pricing or offer incentives to attract buyers in a higher-rate environment.

For those looking to refinance, the right West Palm Beach refinancing options could reduce your monthly mortgage payment and save you thousands over the life of your loan. Local mortgage lenders in West Palm Beach will be key partners in this journey, helping you navigate offers and secure the best terms available.

Final Thoughts

Whether you’re eyeing first-time home buyer loans in West Palm Beach, evaluating commercial mortgage broker services, or simply hoping for more homes to enter the market, 2025 will present unique opportunities and challenges. The dance between mortgage rates and home prices will determine the trajectory of the housing market. Stay proactive by consulting a West Palm Beach mortgage broker, using West Palm Beach mortgage calculators, and exploring Affordable West Palm Beach home loans to position yourself for success.

In the ever-shifting landscape of real estate, having the right information and partners will make all the difference. The housing market in 2025 may feel unpredictable, but with preparation, savvy buyers and sellers can still find the opportunities they’re looking for.

7. Strategies for Buyers to Succeed in 2025

The rising tide of mortgage rates doesn’t mean that homeownership is out of reach—it just requires more strategy. If you’re planning to buy a home in 2025, here are some smart moves to position yourself favorably:

1. Get Preapproved Early

Securing mortgage preapproval in West Palm Beach early in your search is crucial. This gives you a clearer picture of what you can afford, narrows your options, and shows sellers you’re serious. In competitive markets, having preapproval in hand can give you an edge over other buyers. Plus, it locks in your rate for a limited period, which can protect you if rates increase while you search.

2. Consider Adjustable-Rate Mortgages (ARMs)

While fixed-rate loans offer stability, an ARM could provide a lower initial interest rate, making it easier to manage your monthly mortgage payment. For example, if you plan to sell or refinance within five to seven years, ARMs can be a strategic tool to benefit from best mortgage rates in West Palm Beach in the short term.

3. Tap Into Local Expertise

Work closely with local mortgage lenders in West Palm Beach. They often have access to programs and Affordable West Palm Beach home loans that larger financial institutions might not offer. First-time buyers, in particular, may qualify for grants or reduced rates with the right guidance from West Palm Beach mortgage brokers.

4. Look for Motivated Sellers

Sellers who need to close quickly—due to relocation, financial constraints, or personal reasons—might offer price reductions or incentives. With fewer competing buyers, you may find better deals, especially if you act decisively with your mortgage preapproval in West Palm Beach ready to go.

8. Seller Strategies: How to Navigate a Shifting Market

Sellers in 2025 will need to adjust their expectations if mortgage rates remain elevated. While homes will still sell, the frenzy of bidding wars may subside. Here’s how sellers can stay competitive in this evolving housing market:

1. Price Competitively from the Start

Pricing your home right is key. Homes priced too high may linger on the market, especially with buyers now sensitive to higher borrowing costs. Consulting with a local real estate expert will help you set a realistic price based on local trends.

2. Offer Incentives

Consider offering incentives to sweeten the deal. Covering part of the buyer’s closing costs or helping with monthly mortgage payments can attract more interest. Offering West Palm Beach refinancing options in your listing, such as lender-partnered buy-down rates, may also appeal to buyers.

3. Stage and Market Your Home Effectively

Even in a market where more homes are available, presentation matters. Proper staging and professional photography can make your home stand out. Work with an experienced West Palm Beach mortgage broker to market financing offers, such as first-time home buyer loans in West Palm Beach, which can increase your pool of potential buyers.

9. Refinancing: A Smart Move for Homeowners in 2025?

For current homeowners, refinancing will remain a powerful tool in 2025—particularly if mortgage rates drop. Whether you’re looking to reduce your monthly mortgage payment or tap into home equity, staying proactive will help you seize the right opportunity.

When Should You Refinance?

- Lower Interest Rates: If rates fall by at least 0.75% to 1%, refinancing can be worth the effort.

- Debt Consolidation: Use home equity to consolidate high-interest debt, lowering overall monthly payments.

- Home Renovations: Refinancing can provide funds for upgrades, boosting your property’s value if you plan to sell in the future.

Exploring West Palm Beach refinancing options with a local mortgage lender ensures you get the best terms, whether through cash-out refinancing or rate-and-term adjustments.

10. The Future of the Housing Market Beyond 2025

While predictions are inherently uncertain, 2025 will likely serve as a reset year for the housing market. Both home prices and mortgage rates will need to strike a new equilibrium. Investors, buyers, and sellers will adjust their strategies based on the evolving landscape, but one thing is clear: localized expertise will remain invaluable.

West Palm Beach, with its unique blend of residential, luxury, and commercial mortgage broker opportunities, is poised to be a key area of interest. Whether you’re a first-time home buyer or a seasoned investor, working with West Palm Beach mortgage brokers and tapping into property loan advice in West Palm Beach will be essential for staying ahead of market changes.

11. Key Takeaways: How to Thrive in 2025

Whether you’re thinking of buying or selling, 2025 offers both challenges and opportunities. Here’s a quick recap to help you navigate the year ahead:

- Buyers: Secure mortgage preapproval in West Palm Beach and explore options like ARMs to manage costs.

- Sellers: Price strategically and consider offering incentives to attract buyers in a higher-rate environment.

- Refinancers: Stay alert for drops in rates and explore West Palm Beach refinancing options to lower payments or tap equity.

- Everyone: Use West Palm Beach mortgage calculators to simulate financial scenarios and plan with confidence.

The interplay between mortgage rates and home prices will remain a defining factor in 2025. But with the right planning, tools, and support from local real estate experts, you can turn the market conditions to your advantage.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today