Is Affordability Starting To Improve?

Over the past couple of years, a lot of people have had a hard time buying a home. And while affordability is still tight, there are signs it’s getting a little better and might keep improving throughout the rest of the year. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Housing affordability is improving ever so modestly, but it is moving in the right direction.”

Here’s a look at the latest data on the three biggest factors affecting home affordability: mortgage rates, home prices, and wages.

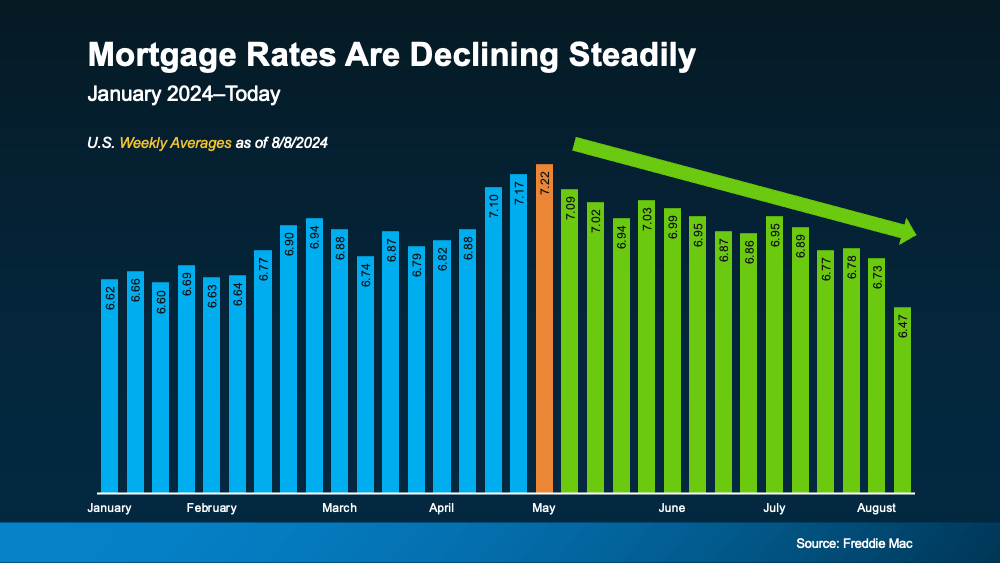

1. Mortgage Rates

Mortgage rates have been volatile this year, bouncing around from the mid-6% to low 7% range. But there’s some good news. Data from Freddie Mac shows rates have been trending down overall since May (see graph below):

Mortgage rates have improved lately in part because of recent economic, employment, and inflation data. Moving forward, some rate volatility is to be expected. But if future economic data continues to show signs of cooling, experts say mortgage rates could keep going down.

Mortgage rates have improved lately in part because of recent economic, employment, and inflation data. Moving forward, some rate volatility is to be expected. But if future economic data continues to show signs of cooling, experts say mortgage rates could keep going down.

Even a small drop can help you out. When rates decline, it’s easier to afford the home you want because your monthly payment will be lower. Just don’t expect them to go back down to 3%.

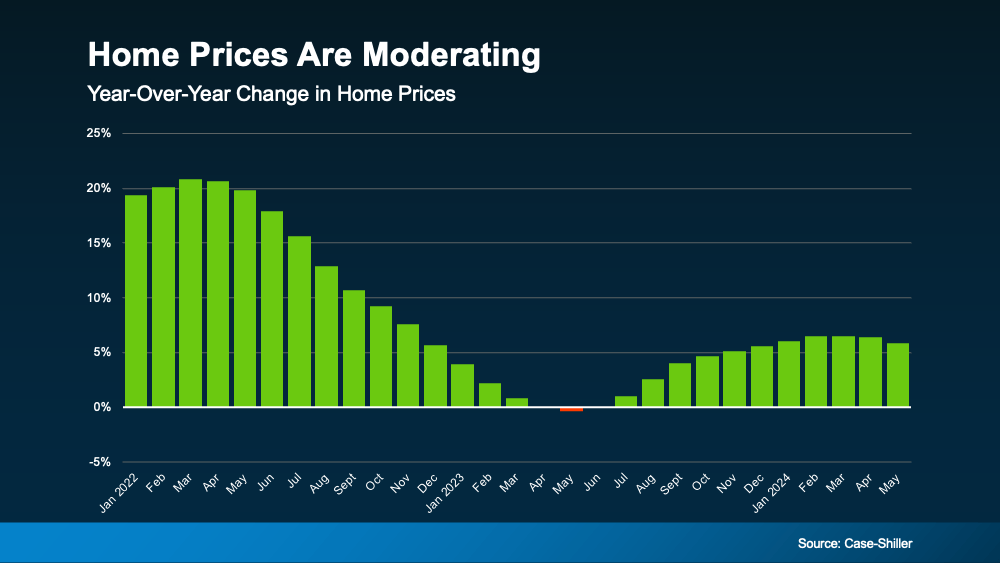

2. Home Prices

The second big thing to think about is home prices. Nationally, they’re still going up this year, but not as fast as they did a couple of years ago. The graph below uses home price data from Case-Shiller to illustrate that point:

If you’re thinking about buying a home, slower price growth is good news. Home prices went up a lot during the pandemic, making it hard for many people to buy. Now, with prices rising more slowly, buying a home may feel less out of reach. As Odeta Kushi, Deputy Chief Economist at First American, says:

If you’re thinking about buying a home, slower price growth is good news. Home prices went up a lot during the pandemic, making it hard for many people to buy. Now, with prices rising more slowly, buying a home may feel less out of reach. As Odeta Kushi, Deputy Chief Economist at First American, says:

“While housing affordability is low for potential first-time home buyers, slowing price appreciation and lower mortgage rates could help – so the dream of homeownership isn’t boarded up just yet.”

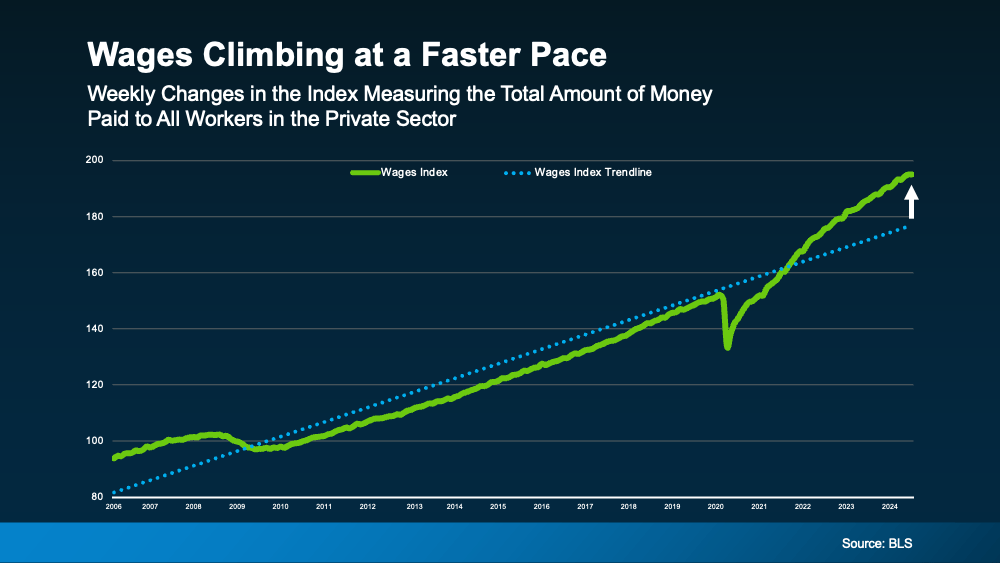

3. Wages

Another factor helping with affordability is rising wages. The graph below uses data from the Bureau of Labor Statistics (BLS) to show how wages have increased over time:

Look at the blue dotted line. It shows how wages usually go up in a typical year. On the right side of the graph, you’ll see wages are rising even faster than normal right now – that’s the green line.

Look at the blue dotted line. It shows how wages usually go up in a typical year. On the right side of the graph, you’ll see wages are rising even faster than normal right now – that’s the green line.

This helps you because if your income increases, it’s easier to afford a home. That’s because you won’t have to spend as much of your paycheck on your monthly mortgage payment.

When you put all these factors together, you see mortgage rates are trending down, home prices are rising more slowly, and wages are going up faster than usual. Though affordability is still a challenge, these trends are early signs things might be starting to improve.

Is Affordability Starting to Improve? A Glimpse into the Housing Market

Dreaming of Homeownership: For many, the vision of owning a home is a cornerstone of the American dream. It’s a place to build memories, invest in the future, and find a sense of belonging. However, in recent years, this dream has seemed increasingly elusive, as home prices have soared to unprecedented heights.

But is there a silver lining on the horizon? Are we witnessing a shift in the home affordability landscape? Let’s delve into the factors influencing this dynamic question.

The Impact of Mortgage Rates

One of the most significant determinants of home affordability is mortgage rates. When rates are low, your monthly payment is typically lower, making it easier to afford a home. Conversely, high rates can make homeownership seem out of reach for many.

In recent years, we’ve seen a rollercoaster ride of mortgage rates. Periods of historically low rates were followed by sharp increases, causing ripples throughout the housing market. However, there are indications that rates may be stabilizing or even trending downward, offering a glimmer of hope for potential homebuyers.

The State of Home Prices

Another critical factor affecting home affordability is the price of homes themselves. If home prices continue to rise at a rapid pace, it becomes increasingly difficult for buyers to keep up. However, there are signs that the rate of price appreciation may be slowing down, particularly in certain regions.

While it’s important to note that prices can vary significantly depending on location, factors such as economic conditions, inventory levels, and buyer demand can influence the overall trend.

A Balancing Act: Afford the Home You Want

The challenge for many prospective homebuyers is finding a balance between their financial capabilities and their desired lifestyle. While it’s tempting to pursue the dream home, it’s essential to be realistic about what you can afford.

Here are some key considerations:

- Down Payment: A larger down payment can reduce your monthly mortgage payment and potentially lower your overall interest costs.

- Income: Your income plays a crucial role in determining your home affordability. The higher your income, the more you can typically afford to borrow.

- Debt-to-Income Ratio: Lenders often consider your debt-to-income ratio when evaluating your loan application. A lower ratio generally improves your chances of approval.

Exploring West Palm Beach as a Case Study

West Palm Beach is a vibrant city with a growing population and a diverse housing market. If you’re thinking about buying a home in this area, it’s essential to understand the local market conditions.

West Palm Beach mortgage brokers can provide valuable insights into affordable West Palm Beach home loans, best mortgage rates in West Palm Beach, and first time home buyer loans in West Palm Beach. They can also help you navigate the homebuying process and ensure you get the best possible deal.

Additional Resources

- West Palm Beach refinancing options

- Local mortgage lenders in West Palm Beach

- West Palm Beach mortgage calculators

- Property loan advice in West Palm Beach

- Commercial mortgage broker in West Palm Beach

- Mortgage preapproval in West Palm Beach

By exploring these resources and working with a knowledgeable professional, you can increase your chances of finding a home that meets your needs and fits within your budget.

The Road Ahead

While the housing market is constantly evolving, there are reasons to be optimistic about home affordability. As mortgage rates potentially stabilize and home prices moderate, more people may find themselves in a position to afford the home they want.

However, it’s important to approach the homebuying process with a realistic mindset and to seek guidance from experts who can help you make informed decisions. By understanding the factors influencing home affordability and taking proactive steps, you can increase your chances of achieving your dream of homeownership.

Navigating the Shifting Landscape: Tips for Homebuyers

As the housing market continues to evolve, it’s essential for prospective homebuyers to stay informed and adapt their strategies accordingly. Here are some tips to help you navigate the shifting landscape:

1. Educate Yourself:

- Market Research: Stay up-to-date on home prices, mortgage rates, and other relevant market trends in your desired area.

- Understand the Buying Process: Familiarize yourself with the steps involved in buying a home, from finding a real estate agent to closing the deal.

2. Improve Your Credit Score:

- Pay Bills on Time: Consistent on-time payments can significantly boost your credit score.

- Reduce Debt: Pay down existing debts to improve your debt-to-income ratio.

- Dispute Errors: If you find any errors on your credit report, dispute them promptly.

3. Save for a Down Payment:

- Create a Budget: Develop a budget to track your income and expenses, and allocate funds towards your down payment.

- Consider Down Payment Assistance Programs: Research government-backed or private programs that may offer assistance with down payment costs.

4. Explore Alternative Financing Options:

- FHA Loans: Federal Housing Administration (FHA) loans often require lower down payments and have more lenient credit requirements.

- VA Loans: Veterans Affairs (VA) loans offer favorable terms for eligible veterans and active-duty military personnel.

- USDA Loans: The U.S. Department of Agriculture (USDA) offers loans in rural areas with low-to-moderate income levels.

5. Be Patient and Flexible:

- Don’t Rush: Take your time to find the right home that meets your needs and budget.

- Be Open to Compromise: Consider homes that may not be your ideal choice but offer good value and potential for future appreciation.

6. Work with a Trusted Real Estate Agent:

- Local Expertise: A knowledgeable real estate agent can provide valuable insights into the local market and help you find suitable properties.

- Negotiation Skills: A skilled agent can negotiate on your behalf to secure the best possible deal.

7. Consider Future Market Trends:

- Economic Outlook: Pay attention to economic indicators that could impact the housing market, such as interest rates and job growth.

- Long-Term Goals: Think about your long-term plans and how they align with your homeownership goals.

By following these tips and staying informed about the housing market, you can increase your chances of finding an affordable home that meets your needs and helps you achieve your dreams. Remember, the journey to homeownership may be challenging, but with patience, planning, and the right approach, it’s a rewarding endeavor.

The Future of Homeownership: A Glimpse into Tomorrow

While the current housing market offers both challenges and opportunities, it’s essential to consider the broader trends shaping the future of homeownership. Several factors are likely to influence the landscape in the coming years:

1. Technological Advancements:

- Smart Homes: Increasingly popular, smart homes offer energy efficiency, convenience, and security features, potentially driving up demand.

- Prefabricated Housing: Prefabricated homes can often be built more quickly and cost-effectively, providing an alternative to traditional construction methods.

2. Changing Demographics:

- Aging Population: As the population ages, there may be increased demand for age-restricted communities and accessible housing options.

- Millennials and Gen Z: These generations have different priorities and preferences compared to previous generations, which could impact housing trends.

3. Environmental Concerns:

- Sustainability: There is growing interest in sustainable and eco-friendly housing, leading to increased demand for energy-efficient homes and green building practices.

- Climate Change: The impacts of climate change, such as rising sea levels and extreme weather events, may influence housing preferences and locations.

4. Remote Work and Urbanization:

- Remote Work: The rise of remote work has led to increased flexibility in housing choices, as people can live further away from their workplaces.

- Urbanization: Continued urbanization may drive up housing prices in city centers, leading to increased demand for suburban and rural areas.

5. Government Policies:

- Housing Affordability Initiatives: Governments may implement policies to address housing affordability, such as increasing the supply of affordable housing or providing incentives for first-time homebuyers.

- Tax Reforms: Changes in tax laws can impact the affordability and attractiveness of homeownership.

As the housing market continues to evolve, it’s important to stay informed about these trends and adapt your strategies accordingly. By understanding the factors shaping the future of homeownership, you can make more informed decisions and increase your chances of achieving your long-term goals.

The Rise of Alternative Housing Models

As the traditional concept of homeownership continues to evolve, alternative housing models are gaining traction. These innovative approaches offer unique solutions to the challenges of affordability, flexibility, and sustainability.

1. Co-Living Spaces:

- Shared Living: Co-living spaces involve sharing common areas like kitchens, living rooms, and outdoor spaces while having private bedrooms or apartments.

- Benefits: Reduced costs, increased social interaction, and often located in desirable urban areas.

2. Tiny Homes:

- Downsizing: Tiny homes are typically less than 400 square feet and emphasize efficient use of space.

- Benefits: Lower costs, reduced environmental impact, and greater mobility.

3. Container Homes:

- Recycled Structures: Container homes are built using shipping containers as the primary structure, offering a sustainable and affordable option.

- Benefits: Durability, speed of construction, and potential for customization.

4. Rental Communities:

- Long-Term Rentals: Rental communities provide long-term rental options with amenities and services similar to traditional homeownership.

- Benefits: Flexibility, reduced maintenance responsibilities, and often located in desirable neighborhoods.

5. Home Sharing Platforms:

- Short-Term Rentals: Platforms like Airbnb allow homeowners to rent out their properties on a short-term basis.

- Benefits: Additional income, increased utilization of properties, and opportunities for cultural exchange.

These alternative housing models offer a diverse range of options for individuals and families seeking different lifestyles and financial arrangements. As the housing market continues to evolve, it’s likely that these models will play an increasingly significant role in meeting the diverse needs of the population.

Conclusion: A Dynamic Housing Market

The housing market is a complex and ever-evolving landscape, influenced by a myriad of factors. From economic conditions and interest rates to demographic shifts and technological advancements, the forces shaping the future of homeownership are constantly in flux.

As we’ve explored in this article, there are both challenges and opportunities for prospective homebuyers. While affordability remains a significant concern, there are signs of potential improvements in certain areas. By staying informed, being flexible, and exploring alternative housing options, individuals can navigate the market and find suitable living arrangements.

The future of homeownership is likely to be characterized by a greater diversity of housing options, increased emphasis on sustainability, and the integration of technology into our living spaces. As the housing market continues to evolve, it’s essential to stay informed and adapt to the changing landscape. By understanding the trends and making informed decisions, you can find a home that meets your needs and helps you build a fulfilling life.

The Future of Homeownership: A Call for Innovation

As we stand at the precipice of a new era in housing, it’s imperative to foster innovation and explore unconventional solutions. This could involve:

- Government Incentives: Encouraging the development of affordable housing through tax breaks, subsidies, and zoning reforms.

- Community-Based Initiatives: Supporting community-led housing projects that prioritize affordability and sustainability.

- Technological Advancements: Investing in research and development to explore new materials, construction methods, and energy-efficient technologies.

- Adaptive Reuse: Converting existing buildings into residential spaces to increase housing supply and preserve historic structures.

By embracing these approaches, we can create a more equitable, sustainable, and resilient housing market that meets the needs of diverse populations.

In conclusion, the future of homeownership is a dynamic and uncertain landscape. While challenges persist, there are also opportunities for innovation and progress. By understanding the trends, adapting to changing circumstances, and exploring alternative housing models, individuals can navigate the market and find suitable living arrangements. As we move forward, it’s essential to prioritize affordability, sustainability, and equity to ensure that the dream of homeownership remains accessible to all.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice