Buying a Home May Help Shield You from Inflation

It feels like everything is getting more expensive these days. That’s because inflation has remained higher than normal for longer than expected – and that’s impacting the costs of goods, services, and more. And with rising costs all around you, you’re probably questioning: is now really the right time to buy a home?

Here’s the good news. Owning a home is actually one of the best ways to protect yourself from the rising costs that come with inflation.

A Fixed Mortgage Protects You from Rising Housing Costs

One of the key benefits of homeownership is that when you buy a home with a fixed-rate mortgage, your biggest monthly expense — your mortgage payment — stabilizes. Sure, your payment could rise slightly as your homeowner’s insurance and property taxes shift. But no matter what happens with inflation, your principal and interest payments won’t change.

That’s not the case if you rent. Rent tends to rise over time, and it usually goes up even faster than the rate of inflation. Just look at the data from the Bureau of Economic Analysis (BEA) and the Census Bureau (see graph below):

So, while renters face higher costs year after year, homeowners with a fixed mortgage rate lock in their monthly payments, making it easier to budget no matter what happens with inflation.

So, while renters face higher costs year after year, homeowners with a fixed mortgage rate lock in their monthly payments, making it easier to budget no matter what happens with inflation.

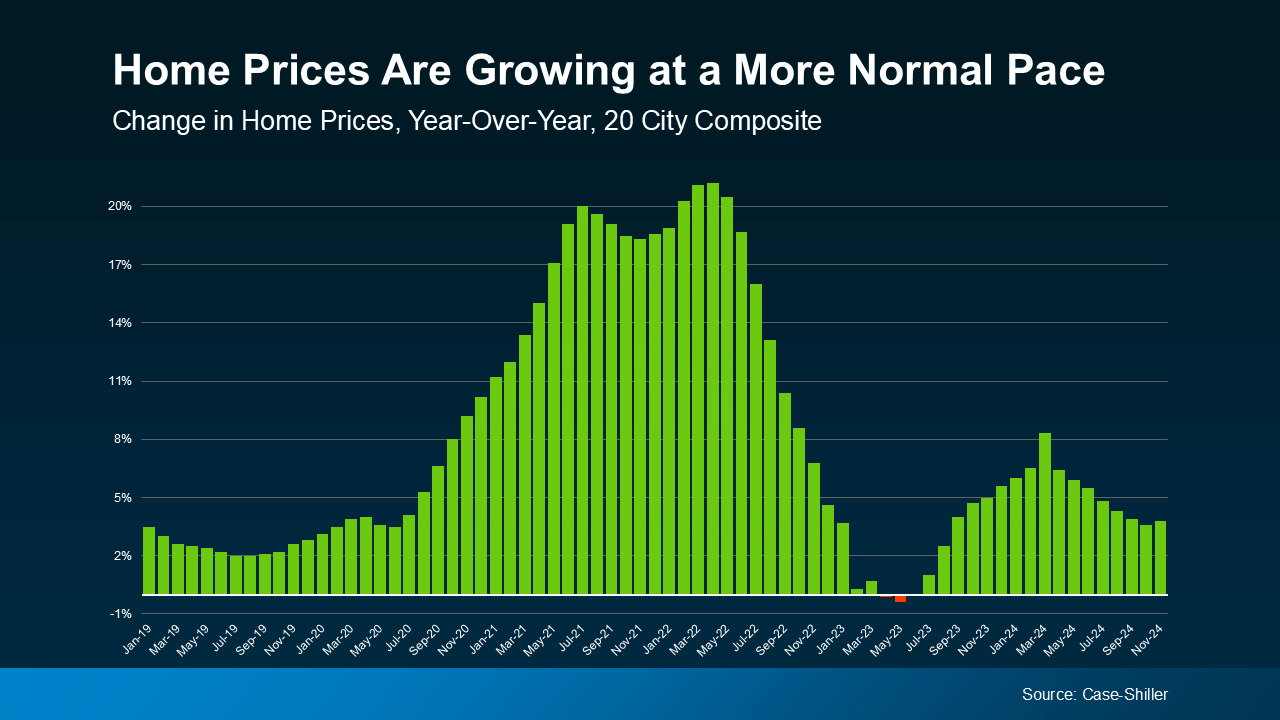

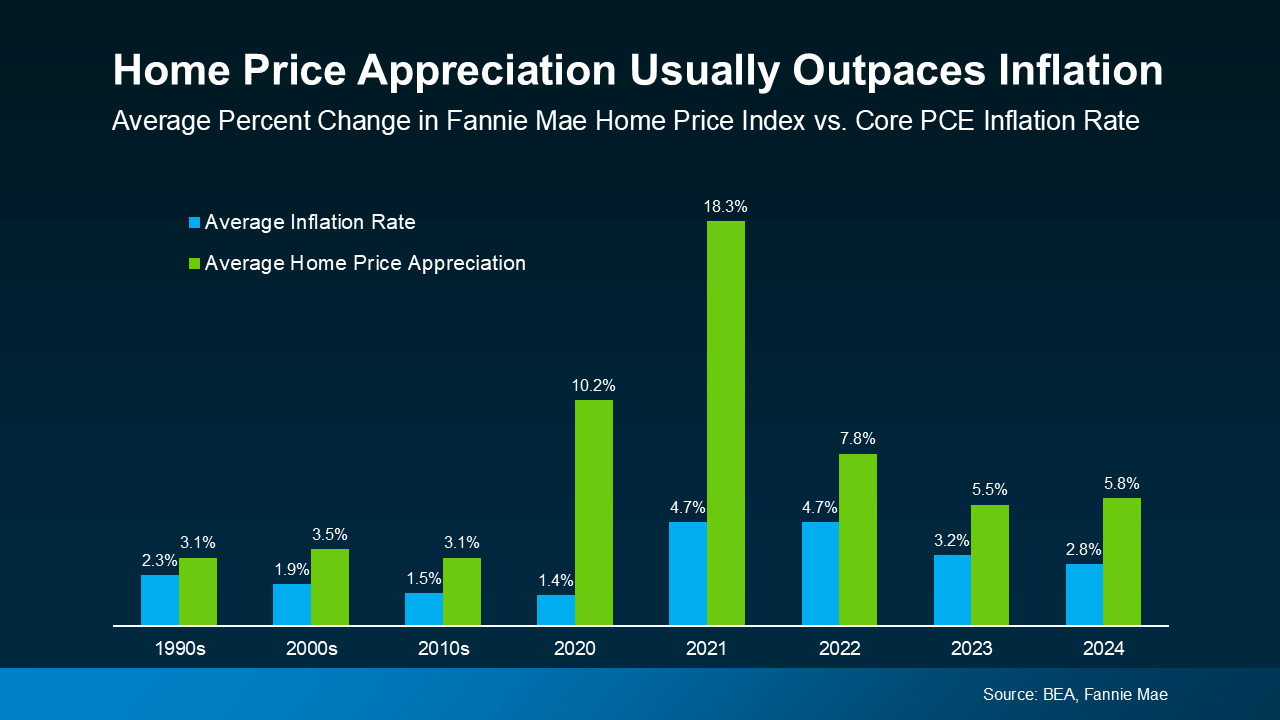

Home Prices Typically Rise Faster Than Inflation

Another big reason homeownership is a great hedge against inflation is that home values tend to appreciate over time — often at a higher rate than inflation, according to data from the BEA and Fannie Mae (see graph below):

That makes real estate one of the strongest long-term investments during times of rising prices. While inflation can chip away at the value of cash savings, real estate typically holds or grows in value, allowing you to build wealth.

That makes real estate one of the strongest long-term investments during times of rising prices. While inflation can chip away at the value of cash savings, real estate typically holds or grows in value, allowing you to build wealth.

On the other hand, renting offers no protection against inflation. In fact, it does the opposite — when inflation drives up costs, landlords often pass those increases onto tenants through higher rents.

That means as a renter, you’re continually paying more without gaining any financial benefit. But as a homeowner, rising prices work in your favor by increasing the value of your home and growing your equity over time.

And with experts forecasting continued home price growth, that means you’re making an investment that usually grows in value and should outperform inflation in the years ahead.

In short, a fixed-rate mortgage protects your budget, and home price appreciation grows your net worth. That’s why homeownership is a strong hedge against inflation.

Inflation can make everyday expenses unpredictable, but owning a home gives you stability. Unlike rent, your monthly mortgage payment stays pretty much the same over time. Plus, the value of your home is likely to increase after you buy.

How would having a fixed housing payment change the way you budget for the future?

Buying a Home May Help Shield You from Inflation

Why Inflation Makes Buying a Home a Smart Move

If you’ve been paying attention to the economy, you’ve likely noticed how inflation has been creeping into every corner of daily life. Groceries? More expensive. Gas? Prices keep fluctuating. Rent? Climbing at an unsettling pace. But there’s a way to secure your financial future despite these rising costs—and that’s buying a home.

Unlike other assets that may fluctuate in value or fail to keep up with inflation, real estate has historically been a resilient investment. The ability to lock in stable housing costs while simultaneously building home equity makes homeownership one of the most effective ways to hedge against the eroding power of inflation.

The Power of a Fixed-Rate Mortgage

When you buy a home, one of the biggest advantages you gain is locking in a fixed mortgage. Unlike rent, which can skyrocket unpredictably, a fixed-rate mortgage ensures that your monthly mortgage payment remains steady over time. Sure, there might be slight fluctuations in property taxes and insurance, but your principal and interest payments? Rock solid.

Now, compare that to renting. With rent increases becoming an annual ritual, tenants are constantly at the mercy of landlords and economic conditions. In contrast, owning a home with a fixed housing payment gives you budget stability and long-term financial security.

Additionally, having a fixed-rate mortgage allows you to plan your finances more efficiently. Instead of worrying about rent spikes, you can allocate your funds to other investments, savings, or lifestyle improvements. Predictable housing costs mean less financial stress and more control over your budget.

The Appreciation Factor: How Home Values Outpace Inflation

One of the strongest reasons why homeownership is a hedge against inflation is home price appreciation. Historically, home values tend to increase over time—often at a rate that surpasses inflation. According to Fannie Mae, real estate is among the strongest long-term investments you can make.

When inflation rises, the cost of goods and services climbs. But so do home prices. That means when you invest in real estate, you’re not just securing a place to live—you’re also growing your equity and safeguarding your wealth.

How Owning a Home Builds Wealth Over Time

Every mortgage payment you make chips away at your loan balance, increasing the value of your home through home equity. This is a powerful financial advantage. Instead of throwing money away on rent each month, you’re actually making payments that contribute to wealth building.

In contrast, renters face perpetual housing costs with no return on investment. They don’t benefit from home price appreciation, and they have no stake in the real estate market.

Beyond personal wealth, owning a home also provides financial flexibility. As your home equity grows, you can tap into it for renovations, education expenses, or even to start a business. It becomes a financial tool that renters simply do not have access to.

Additional Benefits of Homeownership

Besides financial security, owning a home provides stability in other ways. It allows you to personalize your space without restrictions, build roots in your community, and benefit from tax deductions associated with homeownership. Mortgage interest and property taxes are often tax-deductible, providing further financial advantages over renting.

Furthermore, paying a fixed mortgage over time while home values appreciate puts you in a position where your mortgage payment becomes an increasingly smaller percentage of your overall expenses, improving your financial situation in the long run.

West Palm Beach: A Prime Location for Homeownership

If you’re considering buying a home in Florida, West Palm Beach offers a fantastic market with excellent investment potential. And with so many financing options available, securing the best mortgage rates in West Palm Beach has never been easier.

West Palm Beach is known for its thriving economy, beautiful coastal scenery, and desirable quality of life. With a variety of housing options ranging from waterfront properties to family-friendly suburbs, it’s an ideal location for both first-time buyers and seasoned investors.

Financing Options in West Palm Beach

- First-time home buyer loans in West Palm Beach – Tailored to help new buyers enter the market.

- West Palm Beach refinancing options – Great for homeowners looking to lower their payments or tap into their equity.

- Affordable West Palm Beach home loans – Accessible lending options that fit different budgets.

- Local mortgage lenders in West Palm Beach – Work with experts who understand the area’s housing market.

- West Palm Beach mortgage broker – Find the right financing package to suit your needs.

- Commercial mortgage broker in West Palm Beach – Ideal for investors looking to expand into business properties.

Mortgage Tools and Advice

- West Palm Beach mortgage calculators – Estimate payments, interest rates, and affordability.

- Mortgage preapproval in West Palm Beach – Strengthen your buying power before house hunting.

- Property loan advice in West Palm Beach – Get professional insights to navigate the loan process smoothly.

Final Thoughts: Why Homeownership is the Smartest Hedge Against Inflation

Buying a home isn’t just about having a place to live—it’s about making a strategic financial move. A fixed-rate mortgage provides budget stability, home price appreciation grows your net worth, and owning a home shields you from the unpredictable nature of inflation.

If you’re in the market for a new home, especially in West Palm Beach, now is the time to explore your options. With expert guidance from a West Palm Beach mortgage broker and access to affordable West Palm Beach home loans, you can make a decision that protects your financial future.

Why keep paying rising costs when you could be growing your equity and securing a long-term financial asset? Make the move to homeownership today!

Next Steps to Secure Your Future

- Research available properties in West Palm Beach that fit your budget.

- Use a West Palm Beach mortgage calculator to estimate your potential payments.

- Get in touch with a local mortgage lender in West Palm Beach to discuss financing options.

- Apply for mortgage preapproval in West Palm Beach to streamline the home-buying process.

- Work with a West Palm Beach mortgage broker to find the best loan terms for your needs.

Owning a home isn’t just about stability—it’s about creating financial freedom and future prosperity. Take the first step today and invest in a brighter, more secure tomorrow.

Final Encouragement

Remember, the best time to invest in real estate is always now. Market conditions may fluctuate, but the long-term benefits of homeownership remain constant. Whether you’re looking to secure budget stability, build home equity, or make a long-term investment, buying a home will always be a smart financial move. Don’t wait—take control of your future today!

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice