Only an Expert Agent Can Give You an Accurate Value of Your Home

In today’s digital age, it’s tempting to rely on automated tools for everything — including figuring out how much your house is worth. But be careful. The automated estimates you’re seeing online often miss key details that affect the true market value of your home.

Before you toss a for sale sign in your yard and expect to bring in the number you saw for your house online, you need to understand why these tools generally aren’t spot-on and why working with an expert real estate agent is the best way to get an accurate picture of what your house is really worth.

The Myth: Online Home Value Estimates Are Accurate

Online home valuation tools give you an approximate value for your house based on the data that’s publicly available for your home. While this can give you a rough starting point, the keyword here is rough. As an article from Ramsey Solutions says:

“Online Home Value Estimators Aren’t 100% Accurate . . . The estimates are only as reliable as the amount of public record data the real estate websites can access. The less data gathered for your particular neighborhood, county and state, the less you can depend on this number.”

The Reality: Online Estimates Miss Key Factors

Here’s the biggest issue with online estimates: they don’t take into account the unique aspects of your home or your local market. And that’s why an agent’s expertise can make such a difference when figuring out what your house is really worth. Here’s an example. A real estate agent will also factor in:

- The Home’s Condition: Online tools can’t tell whether your home has been well-maintained or if it needs significant repairs. The condition of your house plays a huge role in its value, and only an in-person walk-through can account for that.

- The Latest Neighborhood Trends: Is your neighborhood up-and-coming? Are there new developments or amenities nearby that make your home more desirable? Automated tools often overlook local trends that can significantly affect the value of your home.

- Accurate Comparable Sales: While online estimates may use past sales data as a baseline, they don’t always reflect the most recent or most relevant comparable sales, or comps. Real estate agents, on the other hand, have access to up-to-date market data and can give you a much more accurate estimate based on real-time sales in your area.

Agents have a deep understanding of the local market, and they can provide insights that automated tools simply can’t match. As Bankrate explains:

“Online estimation tools determine pricing using algorithms that rely on publicly available information. These algorithms can vary widely from one tool to the next and typically don’t account for a home’s current condition or any upgrades or renovations that are not reflected in public records. So they are not as accurate as in-person methods, like a real estate agent’s comparative market analysis . . .”

While online home value estimates can be a helpful tool to get a rough idea of what your home is worth, they aren’t foolproof. The true value of your home depends on a range of factors that automated tools just can’t account for.

To get the most accurate estimate, let’s connect. That way you have expert guidance and up-to-date market insights to set the best possible price for your home.

Only an Expert Agent Can Give You an Accurate Value of Your Home

In the fast-paced world of real estate, understanding what your house is really worth is far more than a simple number. It’s the key to unlocking your next chapter, whether that involves upsizing, downsizing, or simply taking the next step in your financial journey. While online home value estimates may promise quick results, there’s one irrefutable truth: only an expert agent can give you an accurate value of your home.

The Myth of Online Estimates

If you’ve ever Googled for your house online to get a price, you’re not alone. The rise of online home valuation tools has made it easier than ever to get an approximate value for your house with just a few clicks. These tools use public record data and basic algorithms to determine your home’s worth. While this sounds convenient, they miss critical components that shape the true value of your property. Think of it this way: an automated tool can only see the bones of your home, but it doesn’t know the soul of it.

Your home’s condition, unique upgrades, and neighborhood nuances are invisible to even the most sophisticated online home value estimators.

Your home isn’t just a data point on a chart. It’s a living, breathing reflection of countless decisions, memories, and investments.

That’s where an expert real estate agent comes in. They’ll see past the numbers and into the details that add value where others miss it.

Why Online Tools Fall Short

Online tools might offer an approximate value for your house, but they aren’t equipped to provide the accurate home value you need to make informed decisions. Here’s why:

- Public Record Data Isn’t Always Accurate: These tools rely heavily on public record data — which can sometimes be outdated or incomplete. Renovations? Hidden gems like custom finishes or energy-efficient upgrades? These details rarely make it into public records.

- They Ignore Your Local Market: Real estate is inherently local. A recent surge in home sales in one West Palm Beach neighborhood might not apply to another area a mile away. Automated tools struggle to grasp these subtle yet crucial distinctions in your local market.

- They Don’t Consider the Human Factor: Is your street particularly quiet? Does your home have the best sunset view on the block? An automated system can’t measure the intangibles that buyers value.

The Power of An Agent’s Expertise

A real estate agent’s role isn’t just to list homes. It’s to analyze, interpret, and uncover value where a computer algorithm cannot. When you partner with an expert real estate agent, you gain more than just a listing price—you gain expert guidance that bridges the gap between market value and your home’s unique story.

The Comparative Market Analysis (CMA)

One of the most valuable tools in an expert agent’s arsenal is the comparative market analysis (CMA). Unlike automated systems, a CMA is crafted using:

- Real-time sales data from homes like yours.

- Up-to-the-minute insights about your specific neighborhood.

- A deep dive into your home’s condition and unique selling points.

In-person methods like walkthroughs ensure that every detail is accounted for—whether it’s the new kitchen countertops or the fully landscaped backyard.

Accurate home value isn’t about rough estimates. It’s about precision, expertise, and data-backed decisions.

Why Real-Time Data Matters

Real estate markets are constantly evolving. The price you saw for your house online last month might already be outdated. That’s why up-to-date market data and real-time sales comparisons are critical. Real estate agents have access to this information in ways that real estate websites simply can’t replicate.

When you’re deciding on the market value of your home, you need data that reflects today’s trends—not last quarter’s.

The Unique Factors Agents Consider

- Your Home’s Condition No two homes are identical, even in the same neighborhood. An expert agent will assess your home’s condition to see how well it compares to others on the market. A freshly painted home with modern finishes will naturally command a higher price than one in need of repairs.

- Renovations and Upgrades Have you recently upgraded your kitchen, added a pool, or finished your basement? These are factors that automated tools often miss. An agent’s expertise ensures your hard work is reflected in the final valuation.

- Neighborhood Trends Is the local park being revamped? Are trendy cafes or schools drawing new buyers? These micro-trends can have a big impact on your home’s desirability.

The West Palm Beach Advantage

If you’re selling in West Palm Beach, the stakes are even higher. The market is dynamic, and competition can be fierce. Whether you’re looking for affordable West Palm Beach home loans, seeking the best mortgage rates in West Palm Beach, or connecting with a West Palm Beach mortgage broker, partnering with local mortgage lenders in West Palm Beach and a knowledgeable agent will set you up for success.

For sellers considering their options, having the right valuation can also guide your next steps. Maybe you’re looking at first-time home buyer loans in West Palm Beach, exploring West Palm Beach refinancing options, or using a West Palm Beach mortgage calculator to plan for your next property. An expert real estate agent will ensure you’re not leaving money on the table.

The True Value of Expert Guidance

An accurate valuation is about much more than just numbers. It’s about understanding the unique factors that define your home’s place in the market. A commercial mortgage broker in West Palm Beach might help businesses determine value, but for residential sellers, an expert agent’s knowledge is indispensable.

Setting the Stage for Success

Before you list your home, consider this:

- Mortgage preapproval in West Palm Beach could help you get ready for your next purchase.

- Understanding property loan advice in West Palm Beach can help streamline your transition.

- Partnering with local mortgage lenders in West Palm Beach ensures your future moves are financially savvy.

But first, it all begins with knowing what your home is worth. Not approximately. Not roughly. Precisely.

Bottom Line

When you work with an expert real estate agent, you’re not just getting a price. You’re getting confidence. Confidence that your home’s true value will be recognized. Confidence that you’re making the right move in your local market. Confidence that every factor—from renovations to up-to-date market data—has been considered.

Don’t leave one of life’s biggest decisions to chance or algorithms. Trust an agent’s expertise to deliver the accurate home value you deserve. Because when it comes to the market value of your home, precision matters.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

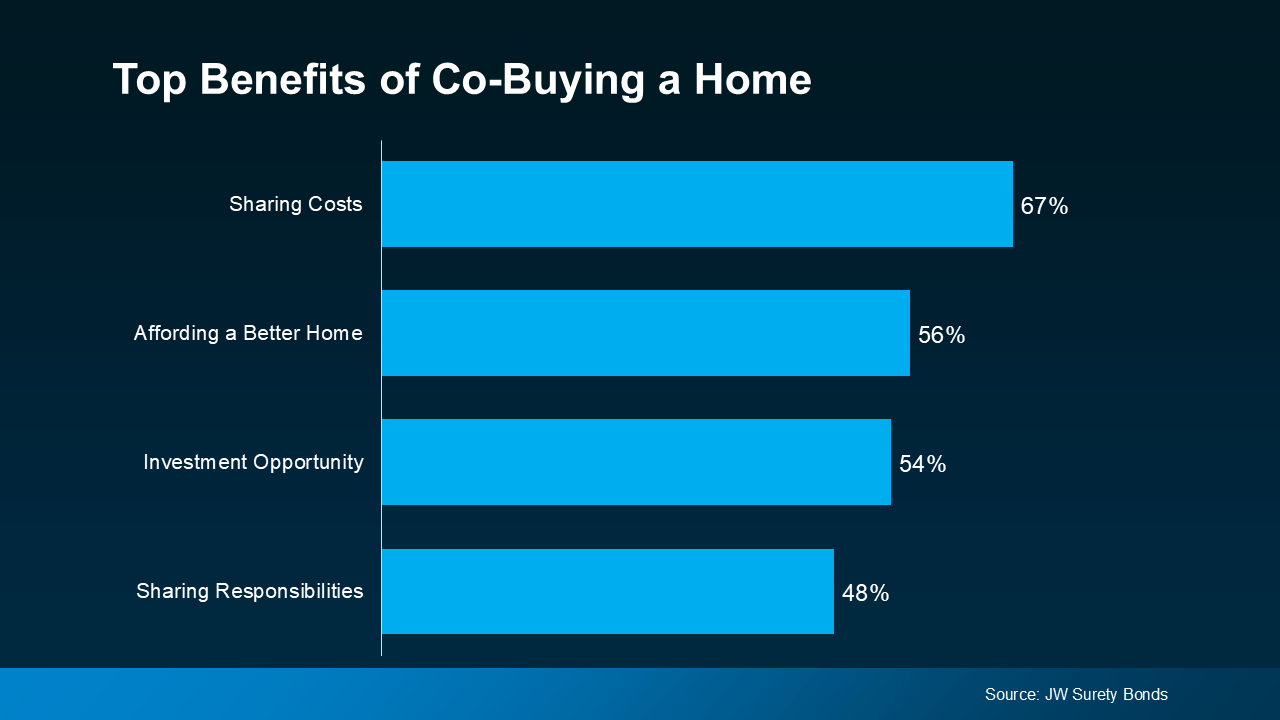

Sharing Costs (67%): From saving for a down payment to managing monthly payments,

Sharing Costs (67%): From saving for a down payment to managing monthly payments,