Townhomes: A Smart Solution for Today’s First-Time Buyers

Buying your first home in today’s market can feel tough. Between high home prices and mortgage rates, affordability is still a big challenge. And some buyers are making one simple trade-off that’s getting them in the door faster: square footage.

According to the National Association of Home Builders (NAHB), 35% of buyers are willing to purchase something smaller to make homeownership happen. And one place you can usually find a smaller footprint (and sometimes better affordability) is in townhomes.

Why Townhomes Are Gaining Popularity

Townhomes typically cost less than single-family homes due to their more limited size. And that’s a big plus for today’s budget-conscious buyer. As Realtor.com says:

“In today’s market, affordability remains a key priority for homebuyers, making townhomes an attractive option because they are often priced more reasonably than single-family homes. It makes them especially appealing to first-time homebuyers on a tighter budget . . .”

So, if you’re trying to buy but feeling stuck because of rising prices, shifting your focus to townhomes could be one way to get into homeownership without maxing out your budget.

Builders Are Responding to the Demand

Builders have seen buyers’ appetite shift to smaller homes, and they’re adjusting to meet the demand. As Joel Berner, Senior Economist at Realtor.com, explains:

“Builders are making a concerted effort to provide smaller, more affordable inventory to the market in a way that the existing-home market cannot. Townhomes are a significant portion of that effort.”

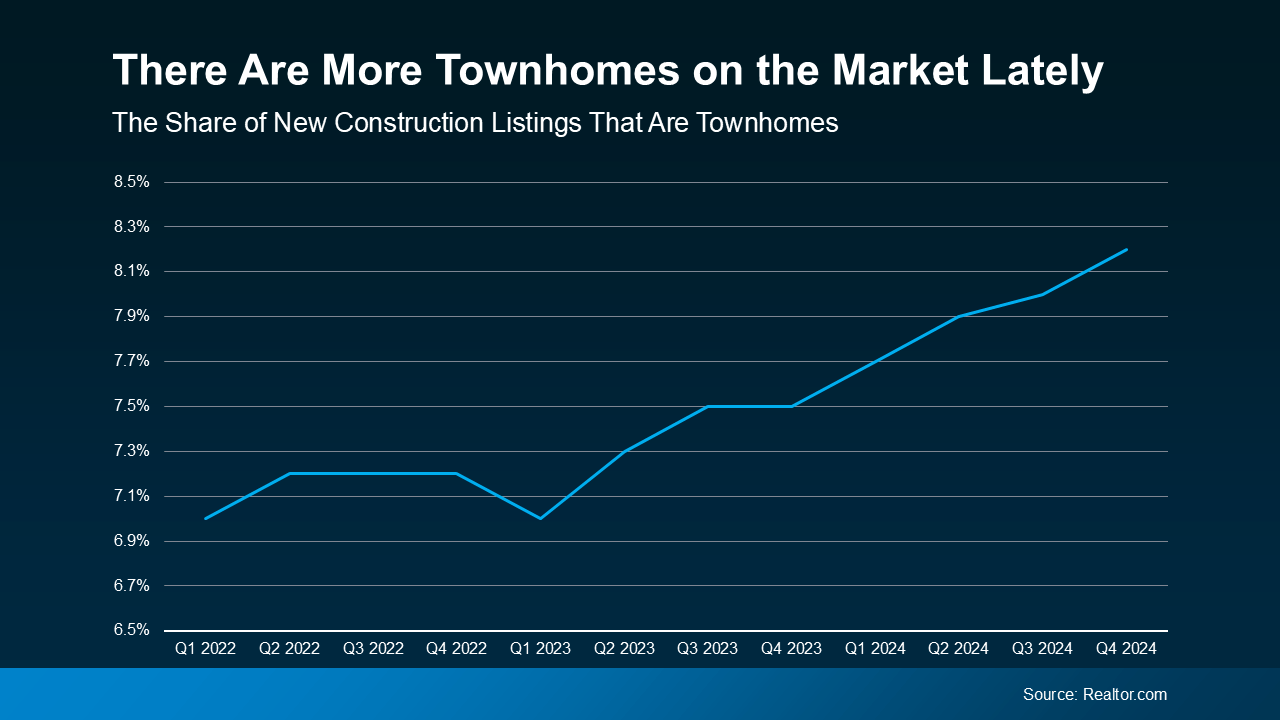

And the numbers back it up. According to data from Realtor.com, townhomes now make up a bigger share of new construction listings than they did just a couple of years ago (see graph below):

That means, if you’re interested in this type of house, you have more choices than you would have had over the last few years. And more options that are potentially more affordable are definitely a good thing. It should make your search for your first home a bit easier.

That means, if you’re interested in this type of house, you have more choices than you would have had over the last few years. And more options that are potentially more affordable are definitely a good thing. It should make your search for your first home a bit easier.

Is a Townhome Right for You?

If you’ve been focused only on more traditional homes with their own yards, an agent can help you explore whether a townhome could work for you. Who knows, you may find out you love the lifestyle. A lot of people do. As an article from the National Association of Realtors (NAR) explains:

“Townhomes tend to cost less than single-family detached homes and can be appealing to young professionals who may desire medium-density, walkable neighborhoods.”

That’s because they’re lower maintenance, they can provide a sense of community with other residents, and they have their own unique amenities. Not to mention, they give you the chance to start building wealth through homeownership without the upkeep that comes with having your own detached, single-family home. And that can be great for first-time buyers who are a bit worried about the maintenance anyway.

But they also come with some other considerations, like dealing with noise through shared walls. If you’re a renter right now, maybe you’re used to that already. But these are the types of things you’ll want to think about. And that’s where an agent’s expertise comes in. They’ll help you weigh the pros and cons, so you understand how a townhome fits into your lifestyle and long-term goals before making your decision.

If you’re struggling to find a home within your budget, it may be time to expand your search and consider options you haven’t before, like townhomes. Sometimes, compromising a little bit on space is worth it to get your foot in the door.

What matters most to you — space, location, or budget? Let’s figure out where you can flex to make homeownership happen.

Townhomes: A Smart Solution for Today’s First-Time Buyers

In today’s market, buying your first home can feel a bit like trying to solve a Rubik’s cube blindfolded. You’ve got one hand tied by rising home prices, the other constrained by unpredictable mortgage rates, and all the while, you’re just trying to find a home that doesn’t shatter your budget or dreams.

Enter the humble yet mighty townhome—a housing option often overlooked, but quickly rising in popularity, especially among first-time buyers. These residences strike a brilliant balance between lifestyle, location, and affordability, making them a standout choice in a market that demands agility and strategy.

The Appeal of Townhomes in Today’s Housing Market

Let’s start with the basics. Townhomes typically share one or two walls with neighboring properties but offer multiple stories of living space, often with a small yard or patio. They blend the benefits of apartment-style efficiency with the comfort of a detached single-family home. In other words, it’s the best of both worlds for budget-conscious buyers looking to step into the world of homeownership.

One of the biggest factors driving their popularity is—you guessed it—affordability. With home prices soaring in many regions, townhomes represent a practical and compelling option. According to the National Association of Home Builders (NAHB), a growing number of first-time homebuyers are opting for smaller homes with a smaller footprint in order to finally own something of their own.

A Numbers Game: Why Townhomes Make Financial Sense

The math is hard to ignore. Townhomes often come with a noticeably lower price tag than single-family homes, thanks in part to their compact design and shared structural components. Lower purchase prices translate into reduced mortgage rates and smaller down payments—especially important for those exploring first time home buyer loans in West Palm Beach.

But affordability isn’t the only financial benefit. These homes tend to offer:

-

Lower property taxes

-

Decreased utility bills

-

Shared maintenance costs (often covered by a modest HOA fee)

-

Increased wealth building potential over time

This is where real estate agent guidance becomes invaluable. An experienced pro can help you sift through the financial pros and cons, ensuring you make the right decision for your lifestyle and long-term goals.

Townhomes as a Response to Market Shifts

Builders have noticed the shifting tides. As more buyers adjust expectations and prioritize affordability over sprawling space, the construction industry is reacting with intention. According to data from Realtor.com, townhomes now account for a greater share of new construction projects than they have in years past.

This pivot isn’t random. Developers are seeing that the existing-home market simply can’t meet the demands of modern first-time buyers. And why would it? Many older homes are too large, too expensive, or too maintenance-heavy for young professionals, couples, or small families trying to plant roots.

So, what are developers doing? They’re delivering medium-density housing that caters directly to this need—townhomes that offer modern amenities, stylish finishes, and a lower maintenance lifestyle.

Let’s Talk Lifestyle: The Townhome Advantage

Beyond the numbers, townhomes speak to something deeper—how we want to live.

Imagine waking up on a quiet, tree-lined street in a walkable neighborhood. You’re steps away from a coffee shop, grocery store, or yoga studio. You don’t need a car for every errand, and there’s a sense that your neighbors are more than just people who live nearby—they’re part of a vibrant sense of community.

That’s the lifestyle townhomes offer. They’re not just a place to sleep—they’re a part of your daily rhythm. And for people transitioning from apartment living, they provide an easy, comfortable bridge to homeownership without diving headfirst into the complexities of detached single-family homes.

Navigating the Trade-Offs in Home Buying

Of course, every silver lining has its cloud. The decision to buy a townhome comes with a few considerations. Namely:

-

Shared walls may lead to occasional noise issues.

-

Smaller outdoor spaces may not be ideal for gardening enthusiasts.

-

Homeowners Association (HOA) rules might limit personalization.

But here’s the thing: trade-offs in home buying are inevitable. The goal isn’t to avoid them—it’s to navigate them wisely. That’s where an agent’s expertise really shines. They’ll help you evaluate each factor based on your needs and future plans, ensuring that your home aligns with your lifestyle—not the other way around.

The West Palm Beach Angle: Unlocking Local Opportunities

If you’re searching in Florida, West Palm Beach emerges as a shining beacon for first-time buyers. This sunny city blends culture, coastline, and a dynamic job market—all while offering a surprising range of housing options, including—you guessed it—townhomes.

Let’s explore why West Palm Beach is such a hotbed for smart homebuyers right now:

Financial Perks

Whether you’re looking for Affordable West Palm Beach home loans, need the best mortgage rates in West Palm Beach, or are exploring West Palm Beach refinancing options, there are a multitude of tools and professionals ready to assist. You can tap into:

-

Local mortgage lenders in West Palm Beach

-

Handy West Palm Beach mortgage calculators

-

Tailored property loan advice in West Palm Beach

-

Specialized help from a West Palm Beach mortgage broker

-

Expertise for businesses via a commercial mortgage broker in West Palm Beach

-

Quick and efficient mortgage preapproval in West Palm Beach

These resources are gold for first-time homebuyers navigating the maze of financial decisions. And when paired with the right real estate agent guidance, the process becomes far more manageable—and even exciting.

Building Equity Without Breaking the Bank

What if you could begin your journey to wealth building without spending years saving for a 20% down payment? That’s the promise of many first time home buyer loans in West Palm Beach, especially when applied toward townhomes.

Because they’re generally more affordable, townhomes allow you to start building equity sooner. Every mortgage payment contributes to your financial future—not your landlord’s. Over time, that adds up to real gains. It’s not just about having a place to live—it’s about investing in something that appreciates over time.

A Fresh Perspective for First-Time Buyers

Let’s face it: buying your first home can feel overwhelming. But it doesn’t have to be. Sometimes, all it takes is shifting your perspective.

Instead of fixating on a sprawling backyard or thousands of square feet, start asking: Where can I build a stable future? What spaces will support the way I live, work, and relax? And how can I get the most value for my money—now and over the next decade?

The answer, more often than not, leads back to townhomes.

They offer a path forward that’s both strategic and satisfying. They meet the needs of budget-conscious buyers, reflect the realities of today’s market, and open doors—literally and figuratively—that might otherwise remain closed.

Your Next Step: Making the Move Toward Homeownership

If your goal is to find a home that ticks the boxes of affordability, location, comfort, and long-term value, it’s time to take action. Reach out to a trusted real estate agent who understands your market. Tap into the insights of a savvy West Palm Beach mortgage broker. Use those West Palm Beach mortgage calculators to estimate your costs and explore West Palm Beach refinancing options if you’re already in the market and looking to upgrade or save.

Let the professionals guide you—because an agent’s expertise is more than just a convenience. It’s a competitive advantage.

Final Thoughts

The path to homeownership is no longer linear. It’s winding, competitive, and, yes, a little intimidating. But for those willing to consider alternatives—those open to the beauty and brilliance of townhomes—the path becomes a lot more approachable.

They’re not just a “starter home.” They’re a smart, strategic choice that reflects the changing rhythms of life in the 21st century.

So whether you’re walking through your first open house, researching the best mortgage rates in West Palm Beach, or chatting with a commercial mortgage broker in West Palm Beach for future investments—remember: townhomes aren’t just a backup plan.

They’re a bold and intelligent first move.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

To schedule a time to talk with me just click here:

To schedule a time to talk with me just click here:

Apply for a mortgage now at

Apply for a mortgage now at  561-861-3987 or

561-861-3987 or Call me directly

Call me directly  561-861-3987

561-861-3987

or to BUY

or to BUY  , SELL

, SELL  , LEASE

, LEASE  , INVEST

, INVEST  , or BUILD your DREAM HOME

, or BUILD your DREAM HOME  or OFFICE

or OFFICE  , we’ve got you covered! From residential properties

, we’ve got you covered! From residential properties  to commercial real estate & development

to commercial real estate & development  , we provide expert solutions tailored to your needs. Enhance your waterfront property with custom docks

, we provide expert solutions tailored to your needs. Enhance your waterfront property with custom docks  , seawalls

, seawalls

. Need disaster cleanup? Our heavy-duty grapple trucks

. Need disaster cleanup? Our heavy-duty grapple trucks

are ready for storm damage

are ready for storm damage

, fallen debris removal

, fallen debris removal

, and rapid response cleanup

, and rapid response cleanup

. We also specialize in luxury financing for yachts

. We also specialize in luxury financing for yachts  , aircrafts

, aircrafts  , RVs

, RVs  , and exotic cars

, and exotic cars  . Looking for insurance & financial solutions? We offer homeowners & commercial insurance, life insurance, estate planning, and access to top real estate attorneys, CPAs, and financial advisors

. Looking for insurance & financial solutions? We offer homeowners & commercial insurance, life insurance, estate planning, and access to top real estate attorneys, CPAs, and financial advisors  . Call us TODAY

. Call us TODAY

, no matter your NEED

, no matter your NEED  or GOAL

or GOAL  !

!

Christian Penner Personal Site:

Christian Penner Personal Site: Christian Penner’s LinkTree:

Christian Penner’s LinkTree: Helpful Resources & Websites:

Helpful Resources & Websites: Rate Ranges & Trends:

Rate Ranges & Trends: Service Level Agreement (SLA):

Service Level Agreement (SLA): HomeBot Dashboard:

HomeBot Dashboard: Search Homes on HomeBot:

Search Homes on HomeBot: HomeBot App:

HomeBot App: HomeBot Android App:

HomeBot Android App: KCM Video Blog – Market Updates:

KCM Video Blog – Market Updates: KCM Blog – Real Estate News & Trends:

KCM Blog – Real Estate News & Trends: Advanced Search:

Advanced Search: Off-Market Homes:

Off-Market Homes: AMS Google Review:

AMS Google Review:

Privacy Policy & Disclosures:

Privacy Policy & Disclosures: