Today’s Biggest Housing Market Myths

Have you ever heard the phrase: don’t believe everything you hear? That’s especially true if you’re thinking about buying or selling a home in today’s housing market. There’s a lot of misinformation out there. And right now, making sure you have someone you can go to for trustworthy information is extra important.

If you partner with a real estate agent, they can clear up some common misconceptions and reassure you by backing them up with research-driven facts. Here are just a few misconceptions they can help disprove.

1. I’ll Get a Better Deal Once Prices Crash

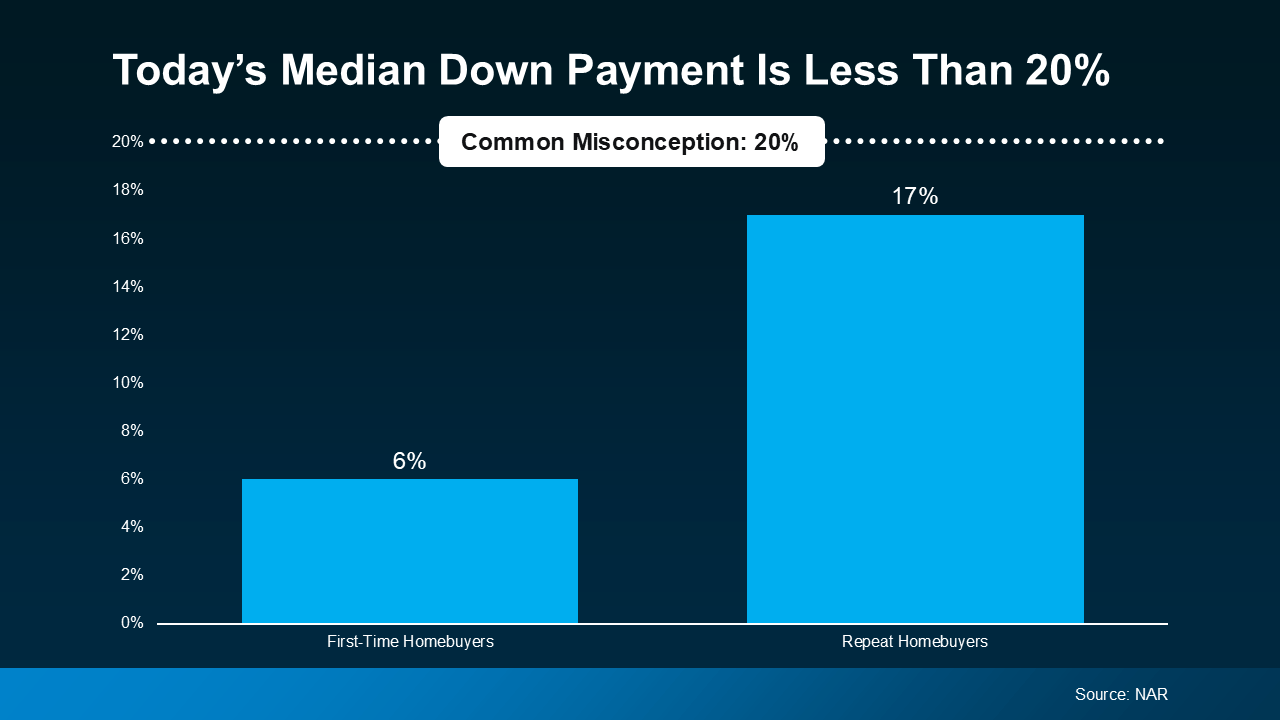

If you’ve heard home prices are going to come crashing down, it’s time to look at what’s actually happening. While prices vary by local market, there’s a lot of data out there from numerous sources that shows a crash is not going to happen. Back in 2008, there was a dramatic oversupply of homes that led to prices crashing. Across the board, there’s an undersupply of homes for sale today. That makes this market a whole different scenario (see chart below):

So, if you think waiting will score you a deal, know that data shows there’s not a crash on the horizon, and waiting isn’t going to pay off the way you’d hoped.

So, if you think waiting will score you a deal, know that data shows there’s not a crash on the horizon, and waiting isn’t going to pay off the way you’d hoped.

2. I Won’t Be Able To Find Anything To Buy

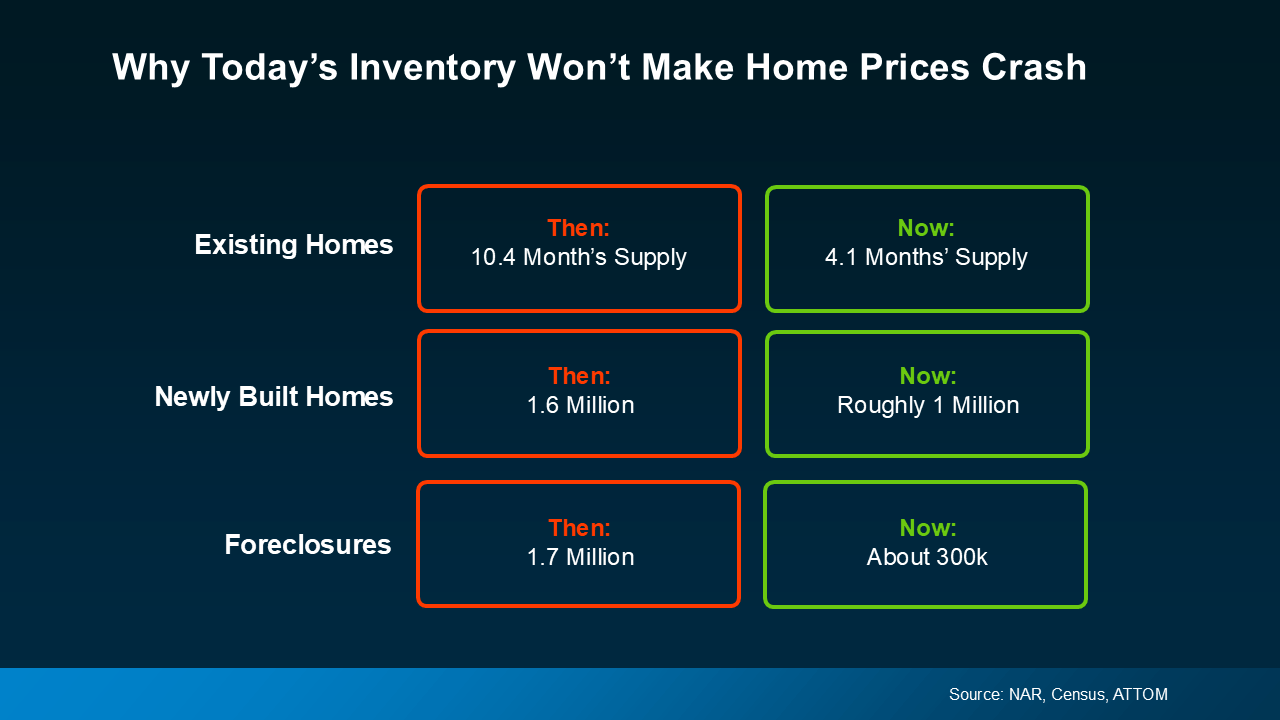

If this nagging fear about finding the right home if you move is still holding you back, you probably haven’t talked with an expert real estate agent lately. Throughout the year, the supply of homes for sale has grown. Data from Realtor.com helps put this into context. While there are still fewer homes on the market than in a more normal year like 2019, inventory is still above where it was at this time last year (see graph below):

So, if you’re remembering all that media coverage about record-low supply during the pandemic, you can rest a bit easier. While the market isn’t back to normal just yet, inventory is moving in a healthier direction. And that means as your options improve, you can let go of this now outdated myth because finding a home to buy won’t feel quite so impossible anymore.

So, if you’re remembering all that media coverage about record-low supply during the pandemic, you can rest a bit easier. While the market isn’t back to normal just yet, inventory is moving in a healthier direction. And that means as your options improve, you can let go of this now outdated myth because finding a home to buy won’t feel quite so impossible anymore.

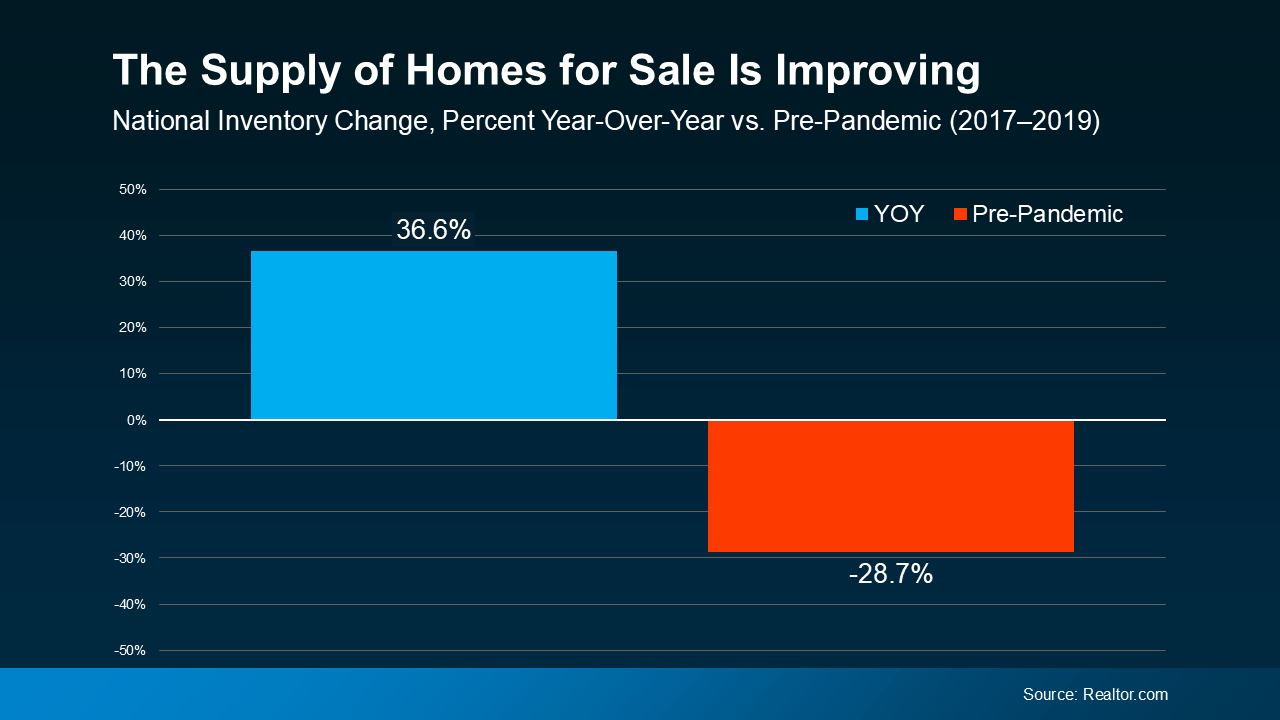

3. I Have To Wait Until I Have Enough for a 20% Down Payment

Many people still believe you need a 20% down payment to buy a home. To show just how widespread this myth is, Fannie Mae says:

“Approximately 90% of consumers overstate or don’t know the minimum required down payment for a typical mortgage.”

And if you look at the data from the National Association of Realtors (NAR), you can see the typical homeowner isn’t putting down as much as you might expect (see graph below):

First-time homebuyers are typically only putting down 6%. That’s far less than the 20% so many people think they need. And if you’re looking at that graph and you’re more focused on how the number for repeat buyers is closer to 20%, here’s what you need to realize. That’s only because they have so much equity built up in their current house that can be used to make a larger down payment for their next move.

This goes to show you don’t have to put 20% down, unless it’s specified by your loan type or lender. Many people put down a lot less. Not to mention, depending on the type of home loan you get, you may only need to put 3.5% or even 0% down. So, if you’re buying your first home, you likely don’t need nearly as much for your down payment as you may think.

An Agent’s Role in Fighting Misconceptions

If you put your move on pause because you heard one or more of these myths yourself, it’s time to talk to a trusted agent. An expert agent has more data and the facts, just like this, to reassure you and help break through any misconceptions that may be holding you back.

If you have questions about what you’re hearing or reading, let’s connect. You deserve to have someone you can trust to get the facts.

Today’s Biggest Housing Market Myths

The housing market can be a perplexing labyrinth of trends, jargon, and seemingly contradicting advice. Whether you’re a seasoned homeowner or buying your first home, you’ve probably come across more than a few confusing tales about the market. These tales, though, often veer away from reality, leaving potential buyers and sellers more apprehensive than informed. Let’s break down today’s biggest housing market myths to help you navigate this vital terrain with clarity and confidence.

Myth 1: You Don’t Need An Agent’s Role Anymore

With the wealth of information available online, many people think they can navigate the real estate market without an agent. However, the expertise of an expert real estate agent is invaluable. A good agent isn’t just a guide; they are a strategist, negotiator, and protector of your interests. Finding the right home goes far beyond scrolling through listings on a website. A trusted agent understands the nuances of neighborhoods, can anticipate market trends, and knows how to structure offers that are compelling yet protect your financial interests.

When buying or selling a home, having an expert agent in your corner is not just a convenience, it’s a competitive advantage. Their knowledge extends to helping you understand local dynamics, such as the supply of homes for sale in your area, and can assist in choosing the type of home loan that best fits your needs. Whether you are purchasing in a competitive market like West Palm Beach or a quieter neighborhood, an agent’s insights are critical.

Myth 2: You Need a 20% Down Payment for a Typical Mortgage

This myth has persisted for generations, but it’s far from reality. While a 20% down payment may be ideal to avoid private mortgage insurance (PMI), it’s not a hard and fast rule. In fact, many first-time homebuyers secure a mortgage with as little as 3% down. Options for first-time home buyer loans in West Palm Beach are numerous, and local lenders often provide flexible terms that can accommodate smaller down payments.

With various programs available through entities like Fannie Mae, buyers have more flexibility today than ever before. If you are a first-time buyer, or even if you’re considering West Palm Beach refinancing options, talk to local mortgage lenders in West Palm Beach. They will have access to affordable West Palm Beach home loans tailored to your situation. Whether it’s a property loan or a specialized mortgage for commercial purposes, you have options that don’t require draining your savings.

Myth 3: The Biggest Housing Market Crash is Coming

It’s easy to get swept up in fear, especially when you hear doomsday predictions about the housing market. But let’s take a step back and look at the bigger picture. Yes, home prices have surged in recent years, and the market can feel unpredictable, but that doesn’t mean we’re on the brink of another crash like in 2008.

The last major downturn was driven by risky lending practices, and today’s financial landscape is vastly different. Lending standards have become much stricter, and homeowners are in a far stronger equity position. So while there may be fluctuations, the idea that the entire housing market will crumble is one of the more misleading housing market myths. If you’re concerned, this is where consulting a West Palm Beach mortgage broker or an expert agent can help guide your decision-making based on real data, not fear-driven speculation.

Myth 4: Renting is Cheaper than Buying a Home

This one depends on your situation. Sure, in some cases, renting might seem cheaper month-to-month. But over time, buying your first home can provide substantial financial benefits that renting simply can’t offer. When you rent, you’re contributing to your landlord’s mortgage rather than building equity for yourself. Finding a home to buy may require some patience and compromise, but once you secure it, your payments are investments into your future.

Take into account the current best mortgage rates in West Palm Beach. With a variety of loan programs available, from adjustable rates to fixed terms, buyers can often find a mortgage that fits their budget. A simple use of West Palm Beach mortgage calculators can show you how owning compares to renting over time. Plus, with mortgage preapproval in West Palm Beach, you can know exactly what you’re able to afford and start building that equity sooner rather than later.

Myth 5: All Real Estate Agents Are the Same

Not all agents are created equal, and that’s not a knock on the profession. Just as you wouldn’t choose a doctor without doing your research, the same should go for selecting an expert real estate agent. When finding a home to buy or sell, you want someone who truly understands your needs, the market, and the intricacies of your transaction.

Whether you’re looking at homes for sale today in a competitive market or assessing your options for West Palm Beach refinancing, the right agent will make a world of difference. They can help you navigate the complexities of today’s housing market with precision, offer property loan advice in West Palm Beach, and can even connect you with reputable local mortgage lenders.

Myth 6: You Should Always Buy the Biggest and Best House You Can Afford

It’s tempting to stretch your budget to buy the most impressive home on the market, but that’s not always the best strategy. While it’s important to love the home you’re buying, overextending yourself financially can lead to significant stress down the road. Rather than aiming for the biggest, flashiest property, focus on finding the right home that fits your lifestyle, your family’s needs, and your financial reality.

Consulting with a West Palm Beach mortgage broker can help you understand what you can realistically afford. They’ll take into account your income, debt, and potential for future expenses, giving you a clear picture of what your mortgage payments will look like with different loan products. This way, you can confidently buy within your means and still achieve your homeownership goals.

Myth 7: The Housing Market Slows Down During the Holidays

While it’s true that fewer people list their homes in winter, this doesn’t mean the market grinds to a halt. In fact, serious buyers often use this time to strike a deal. With fewer homes on the market, you may find that the competition isn’t as fierce, and sellers are more willing to negotiate. If you’re on the fence about timing, talk to a trusted agent who can provide insights specific to your area and market.

In places like West Palm Beach, where the weather remains mild year-round, the housing market doesn’t follow the typical seasonal patterns. Whether you’re exploring West Palm Beach refinancing options or looking at the supply of homes for sale, the right moment to act is often dictated by personal circumstances rather than the time of year.

Myth 8: You Can’t Buy a Home with Bad Credit

It’s a common misconception that bad credit will automatically disqualify you from buying a home. While a good credit score does make the process smoother and more affordable, there are still options available for those with less-than-perfect credit. Programs for first-time homebuyers and government-backed loans can provide a path to homeownership, even if your credit isn’t stellar.

Working with a knowledgeable West Palm Beach mortgage broker can help you identify the right loan programs and guide you through improving your credit score, if needed. They can also show you options for affordable West Palm Beach home loans that may accommodate your financial situation. Even with bad credit, buying a home isn’t an impossibility.

Myth 9: You Can Skip the Home Inspection to Save Money

Saving a few hundred dollars by skipping the home inspection may seem like a savvy move, but this is one corner you don’t want to cut. The inspection process is your opportunity to uncover any hidden issues with the property before you commit to buying. From structural problems to electrical issues, a thorough inspection can save you from costly surprises down the road.

The upfront cost of a home inspection is a small price to pay for peace of mind. It ensures that you’re fully informed about the condition of the property before signing on the dotted line. And in many cases, a detailed inspection report can be a powerful negotiating tool, allowing you to request repairs or a lower purchase price based on the findings.

Myth 10: Once You’re Preapproved, You’re Guaranteed a Loan

Many buyers mistakenly believe that once they’ve received mortgage preapproval in West Palm Beach, they’re guaranteed financing. However, preapproval is just the first step in the mortgage process. It indicates that a lender is willing to loan you a certain amount based on your current financial situation. But that situation can change between the time you’re preapproved and when you close on the house.

It’s essential to keep your finances stable after receiving preapproval. Avoid taking on new debt, changing jobs, or making large purchases before closing. If your financial picture changes, it could affect your final loan approval, and you may find yourself scrambling to secure financing at the last minute.

Final Thoughts: Dispelling the Myths

The world of real estate is full of myths, but by separating fact from fiction, you can make better decisions when buying or selling a home. The housing market may seem daunting, but with the right knowledge and support, it doesn’t have to be. Working with an expert real estate agent, understanding the type of home loan that suits you best, and securing advice from local mortgage lenders in West Palm Beach are key steps to success.

Whether you’re purchasing your first home, refinancing, or investing in property, always take the time to gather real, accurate information. By avoiding these common myths, you can confidently navigate the housing market and find a home that meets your needs without unnecessary stress.

Myth 11: The Asking Price Is Non-Negotiable

One of the most persistent misconceptions in the real estate world is that the asking price of a home is set in stone. Many buyers believe that the listed price is the final word, especially in competitive markets where homes seem to fly off the shelves. However, this couldn’t be further from the truth. Negotiation is a critical part of the process, and it’s here where having an expert real estate agent truly shines.

An experienced agent can help you navigate the art of negotiation, knowing when and how to make an offer below asking, or when to go above and beyond to secure the home. They understand that homes for sale today often come with room for flexibility. Sellers may be motivated to close quickly or willing to make concessions, such as covering closing costs or making repairs, to expedite the deal. Whether you’re eyeing commercial mortgage broker deals in West Palm Beach or considering a cozy suburban home, don’t be afraid to negotiate with the seller.

Myth 12: You Should Always Wait for Interest Rates to Drop Before Buying

Interest rates can certainly influence your decision to buy a home, but waiting indefinitely for rates to drop can mean missing out on your dream home. The reality is, buying your first home or upgrading to a new property involves many factors beyond just the current mortgage rate. It’s important to consider your personal timeline, job stability, and family needs. Markets can shift, and trying to time the bottom can be a gamble.

Moreover, when you secure a home at today’s rate and talk to a trusted agent or lender about West Palm Beach refinancing options, you keep the door open for future opportunities. Rates might drop, and refinancing can help you lock in a lower rate later. But in the meantime, you’ll have already begun building equity and enjoying the benefits of homeownership.

Myth 13: Spring Is the Only Good Time to Buy a Home

The idea that spring is the optimal time to buy a home is one of the more seasonal housing market myths. While it’s true that spring often sees an influx of new listings, the reality is that great deals and opportunities can arise in any season. In areas like West Palm Beach, where the weather is consistently favorable, the market remains active year-round.

Buying a home during the fall or winter months may offer unique advantages, such as less competition from other buyers. Sellers during these off-peak times are often more motivated, which could lead to better deals. Working with local mortgage lenders in West Palm Beach can help you understand the seasonality of the market in your area and identify the best times to secure affordable West Palm Beach home loans.

Myth 14: You Should Always Choose the Lowest Mortgage Rate

While it might seem intuitive to go for the lowest interest rate available, this approach can be misleading. A low rate isn’t the only factor to consider when choosing a type of home loan. Different loan products come with varying terms, fees, and conditions that could impact your overall financial picture. For instance, a loan with a slightly higher interest rate but lower fees may be a better deal over the long term.

Additionally, the lowest rates are often reserved for buyers with stellar credit, and chasing that rate might mean overlooking other valuable options. West Palm Beach mortgage brokers can help you assess the full landscape, taking into account both interest rates and the overall cost of the loan. With their guidance, you can find the best mortgage product for your specific needs, whether it’s through West Palm Beach mortgage calculators or personal consultation.

Myth 15: You Should Only Buy a Home If You Plan to Stay for a Long Time

The conventional wisdom has always been that buying a home only makes sense if you plan to stay put for at least five to seven years. But in today’s market, this isn’t necessarily true. Home values in many areas, especially in high-demand markets, can appreciate quickly. This means that even a short-term investment in real estate can yield significant returns.

For those looking at homes on the market in rapidly growing areas like West Palm Beach, buying a home could be a smart move, even if you only plan to stay for a few years. With the right strategy and an understanding of the supply of homes for sale, you can position yourself for profit when the time comes to sell. And for those who do need to move sooner than expected, renting out the property is always an option to generate income while you wait for the right time to sell.

Myth 16: The Best Deals Are on Foreclosed Homes

Foreclosed homes are often marketed as a steal for buyers looking for a bargain, but they aren’t always the best deal. While it’s true that foreclosures can be priced below market value, these properties often come with significant risks and hidden costs. Many foreclosed homes have been neglected, requiring expensive repairs and renovations that can quickly eat into your savings.

Additionally, the process of buying a foreclosed home can be complicated and lengthy. There may be legal hurdles to clear, and the condition of the property may be uncertain until after you’ve committed to the purchase. Before diving into the foreclosure market, it’s essential to consult with an expert agent who can help you assess the risks and guide you toward better investment opportunities, such as well-maintained homes that might only need cosmetic updates.

Myth 17: It’s Always Best to Pay Off Your Mortgage as Quickly as Possible

While paying off your mortgage early might seem like a sound financial goal, it’s not always the best strategy for everyone. Depending on your financial situation, paying off your mortgage ahead of schedule could mean missing out on other investment opportunities. If your mortgage has a low interest rate, you might be better off investing that extra money elsewhere, where it could potentially yield a higher return.

Before making extra payments on your mortgage, it’s worth discussing your options with a financial advisor or a West Palm Beach mortgage broker. They can help you weigh the pros and cons of paying off your loan early versus using that money for other financial goals, such as retirement savings or investments in stocks or real estate.

Myth 18: Buying a Home Is Only for the Wealthy

The idea that homeownership is reserved for the wealthy is one of the most damaging myths in real estate. Homeownership is accessible to people from all walks of life, thanks to a variety of first-time homebuyer programs, low down payment options, and competitive mortgage rates. First-time home buyer loans in West Palm Beach, for example, are designed to help buyers with limited funds get into their first home.

There are also numerous loan products available that cater to different financial situations. Whether you’re looking for West Palm Beach mortgage calculators to help estimate your payments or seeking advice on affordable West Palm Beach home loans, there’s no need to assume that homeownership is out of reach. Talk to a trusted agent who can walk you through your options and help you determine the best path to owning your home.

Myth 19: You Should Always Start with a Fixer-Upper

The idea of buying a fixer-upper and transforming it into your dream home has been romanticized by countless TV shows and movies. While there are certainly benefits to purchasing a home that needs some work, it’s not the best option for everyone. Renovations can be costly, time-consuming, and stressful, especially for first-time buyers who may not fully understand the scope of the work required.

If you’re not prepared for the challenges of a fixer-upper, you may be better off looking at move-in ready homes. This is where consulting with an expert real estate agent can be invaluable. They can help you weigh the pros and cons of purchasing a home that needs work versus one that’s ready to go, and they can also provide access to local mortgage lenders in West Palm Beach who offer financing options for either scenario.

Final Thoughts: The Path to Informed Decisions

Navigating today’s housing market requires more than just surface-level knowledge—it demands a deep understanding of the nuances and realities that often get overshadowed by common myths. By dispelling these misconceptions, you empower yourself to make informed decisions that align with your goals and financial well-being.

From selecting the right mortgage to negotiating the best deal, every step of the home buying or selling process is an opportunity to leverage accurate information and professional expertise. Whether you’re purchasing your first home, considering a refinance, or investing in a new property, don’t let myths cloud your judgment. Seek guidance from expert real estate agents, reputable lenders, and West Palm Beach mortgage brokers to ensure you’re making the best decisions for your future.

Your dream home is out there, and with the right approach, you can confidently navigate the market and make that dream a reality.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice