A Record Percent of Buyers Are Planning To Move in 2025 – Are You?

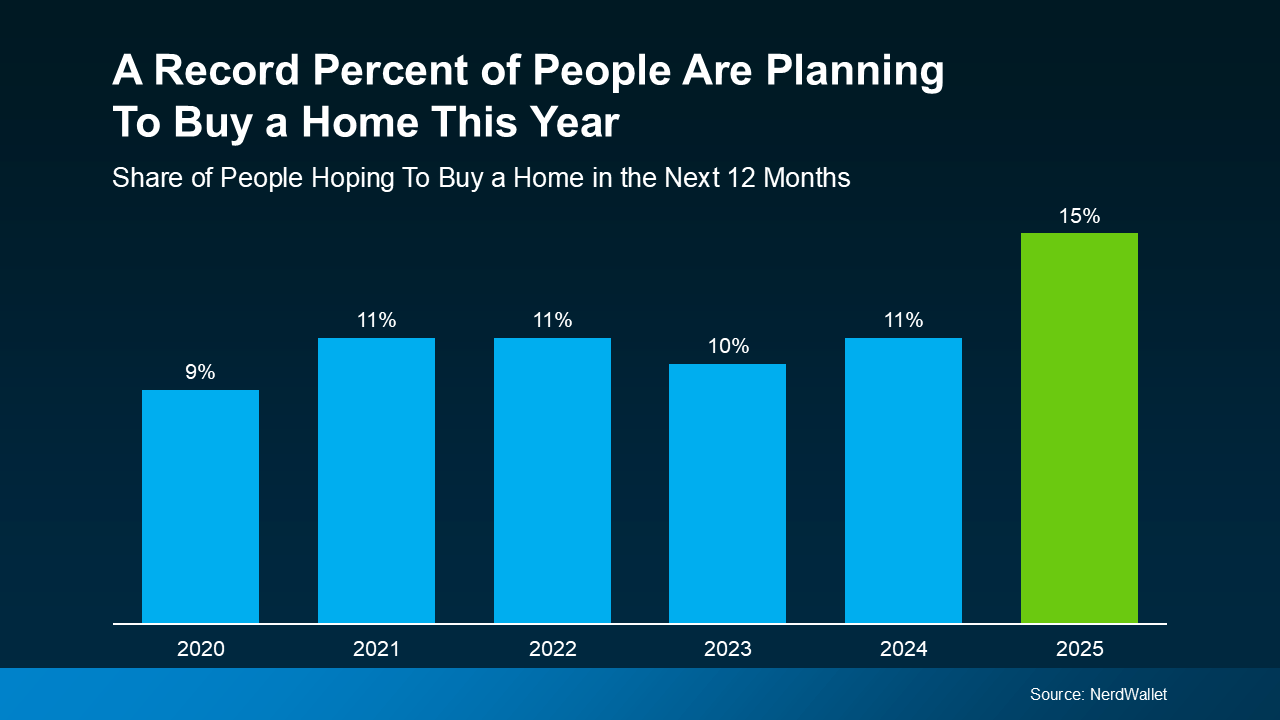

This could be the year to sell your house – and here’s why. According to a recent NerdWallet survey, 15% of people are planning to buy a home this year. That’s actually a record high for this survey (see graph below):

Here’s why this is such a big deal. The percentage has been hovering between 9-11% since 2020. This recent increase shows buyer demand hasn’t disappeared – if anything, it indicates there’s pent-up demand ready to come back to the market.

Here’s why this is such a big deal. The percentage has been hovering between 9-11% since 2020. This recent increase shows buyer demand hasn’t disappeared – if anything, it indicates there’s pent-up demand ready to come back to the market.

That doesn’t mean the floodgates are opening and that there’s going to be a huge wave of buyers like we saw a few years ago. But this does signal there’ll be more activity this year than last.

At least some of the buyers who put their plans on hold over the past few years will jump back in. Whether they’re feeling more confident about moving, they’ve finally saved up enough to buy, or they simply can’t wait any longer – this is the year they’re aiming to take the plunge.

And, according to that same NerdWallet survey, more than half (54%) of those potential buyers have already started looking at homes online.

That’s a good indicator that a number of these buyers will be looking during the peak homebuying season this spring. So, if you find the right agent to make sure your house is prepped, priced, and marketed well, you can get your house in front of them.

More people are going to move this year, and with the right strategy, you can make sure your house is one of the first they look at.

What do you think these buyers will love most about your house?

Let’s talk it over and make sure it’s front and center in your listing.

A Record Percent of Buyers Are Planning To Move in 2025 – Are You?

The Market is Heating Up: Why 2025 Could Be the Perfect Year for You

2025 is shaping up to be a landmark year for home buyers and sellers alike. According to a recent NerdWallet survey, a record-breaking percentage of Americans are planning to buy a home this year. This surge signals an electrified buyer demand, indicating a renewed confidence in the housing market. But what does this mean for you? If you’ve been considering selling a house, the stars may finally be aligning in your favor.

Understanding the Surge in Buyer Demand

Since 2020, the percentage of people planning to purchase homes has remained relatively steady, fluctuating between 9-11%. However, the latest data reflects a significant jump, revealing an untapped reservoir of pent-up demand. Buyers who postponed their purchases due to economic uncertainties, rising interest rates, or financial constraints are now eager to reenter the market.

Unlike the rapid, frenzied transactions of previous years, this year’s buyers are more strategic. Many have been meticulously saving, enhancing their credit scores, and researching financing options. This means they’re serious contenders, actively looking at homes online and getting their financials in order.

For sellers, this shift presents a golden opportunity. With more qualified buyers entering the fray, to sell your house at a favorable price, it’s crucial to position yourself strategically.

How To Attract Serious Buyers in 2025

1. Make Sure Your House Is Prepped and Market-Ready

First impressions matter. Before listing your property, take the time to ensure it’s visually appealing and structurally sound. Professional staging, minor renovations, and deep cleaning can make all the difference. A well-maintained home stands out in the sea of home listings, making it easier to attract buyers who are ready to make a competitive offer.

2. Find The Right Agent for the Job

Selling a home in a high-demand market requires more than just posting an online listing. Working with a seasoned real estate agent can significantly impact your selling experience. The right agent will have in-depth market knowledge, superior negotiation skills, and a comprehensive marketing strategy to position your listing in front of eager buyers.

3. Capitalizing on Homebuying Season This Spring

The peak homebuying season is typically spring, and 2025 is expected to follow this trend. More than half of prospective buyers have already begun looking at homes online, an indicator that they are preparing to make their move in the coming months. By listing your property early in the season, you increase your chances of attracting serious buyers and securing a favorable deal.

The Role of Mortgage Financing in 2025

For buyers, securing the right mortgage is often the most daunting part of the process. With affordability concerns lingering, many are turning to specialized mortgage solutions to make their homeownership dreams a reality. This is particularly relevant in competitive markets like West Palm Beach, where financing options play a critical role.

Affordable West Palm Beach Home Loans

With an increasing number of buyers entering the market, securing affordable West Palm Beach home loans is a top priority. Local lenders are offering tailored solutions to make homeownership more accessible. If you’re buying in the area, working with a West Palm Beach mortgage broker can provide customized loan options suited to your financial needs.

Best Mortgage Rates in West Palm Beach

Interest rates fluctuate, and securing the best mortgage rates in West Palm Beach requires research and strategic timing. A knowledgeable lender can help you lock in the most competitive rates and ensure you’re getting the best deal possible.

First Time Home Buyer Loans in West Palm Beach

For those entering the housing market for the first time, specialized programs such as first time home buyer loans in West Palm Beach can provide favorable terms, including lower down payments and reduced interest rates. These programs are designed to ease the financial burden of purchasing a home.

West Palm Beach Refinancing Options

If you already own a home but want to take advantage of better interest rates or improved terms, exploring West Palm Beach refinancing options can be a smart move. Refinancing can lower your monthly mortgage payments, free up cash for renovations, or shorten your loan term.

Local Mortgage Lenders in West Palm Beach

Working with local mortgage lenders in West Palm Beach can give buyers an edge. These lenders understand the nuances of the local market and can offer personalized service that big banks often can’t match.

West Palm Beach Mortgage Calculators

Before making a purchase, buyers should use West Palm Beach mortgage calculators to estimate monthly payments, interest rates, and loan affordability. These tools provide a clearer financial picture and help buyers make informed decisions.

Property Loan Advice in West Palm Beach

Navigating the mortgage process can be overwhelming. Seeking property loan advice in West Palm Beach from experts can clarify loan options, down payment requirements, and closing costs, ensuring a smoother buying experience.

Commercial Mortgage Broker in West Palm Beach

For those interested in investment properties or business real estate, a commercial mortgage broker in West Palm Beach can provide guidance on specialized loans tailored for commercial transactions.

Mortgage Preapproval in West Palm Beach

Buyers who obtain mortgage preapproval in West Palm Beach have a significant advantage in competitive markets. Preapproval signals to sellers that a buyer is financially capable of closing the deal, making their offers more attractive.

Final Thoughts: Is 2025 Your Year to Make a Move?

With buyer demand reaching record levels, a strong homebuying season, and favorable financing options, 2025 presents an unparalleled opportunity for both buyers and sellers. If you’ve been contemplating selling a house, the market conditions may be ideal to sell your house quickly and at a competitive price.

On the flip side, if you’re planning to buy a home this year, securing the right financing and working with a real estate agent can help you navigate the market with confidence. With so many buyers looking at homes online, ensuring your listing stands out is key to a successful sale.

So, are you ready to make your move? The market is primed, and the opportunities are abundant. Whether you’re buying or selling, 2025 could be the year that changes everything.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice